It has been observed, with a degree of satisfaction, that Advanced Micro Devices, or AMD as it is more commonly known, has presented a most agreeable performance since the year 2025. Indeed, its fortunes have risen by approximately sixty per cent, surpassing even the estimable Nvidia in that regard. A recent adjustment in valuation, however, following the announcement of quarterly results, has caused a flutter amongst investors, a reaction which, upon closer inspection, appears not entirely unwarranted.

One might be tempted to question the cause of this diminution, given the numbers presented; yet a careful consideration suggests that AMD is, at last, demonstrating the progress long anticipated by those acquainted with its affairs. The question, therefore, is whether this presents a suitable opportunity for investment, or whether a more patient course might prove more advantageous.

AMD’s Advancement in the Data Center

The pursuit of artificial intelligence has, of late, become the object of considerable speculation, and AMD, it must be admitted, has been somewhat tardy in securing its place within this fashionable circle. Unlike Nvidia, which derives the greater part of its revenue from sales to data centers, AMD’s interests are more broadly distributed. In the last quarter of 2025, fifty-two per cent of its income stemmed from this source, whilst thirty-eight per cent arose from its client and gaming division, and a further nine per cent from embedded processes. Thus, AMD has not, until recently, fully participated in the substantial gains attendant upon this technological shift.

However, it is becoming increasingly apparent that AMD is exerting itself to rectify this oversight. The growth of its data center revenue, in the aforementioned quarter, reached a respectable thirty-nine per cent, a considerable improvement upon the previous quarter’s twenty-two per cent. One might venture to suggest that this quarter marks a turning point, though prudence dictates a degree of caution in such pronouncements. Moreover, the resumption of sales to China, following certain adjustments in trade relations, is expected to provide a further boost to its fortunes in the coming years.

In November past, AMD issued a five-year forecast, predicting a compound annual growth rate of sixty per cent within its data center division, and a more modest ten per cent for its remaining enterprises. This would, if achieved, result in an overall growth rate of thirty-five per cent through 2030. While recent results fell somewhat short of these ambitious projections, the progress demonstrated is nonetheless encouraging.

A Question of Valuation

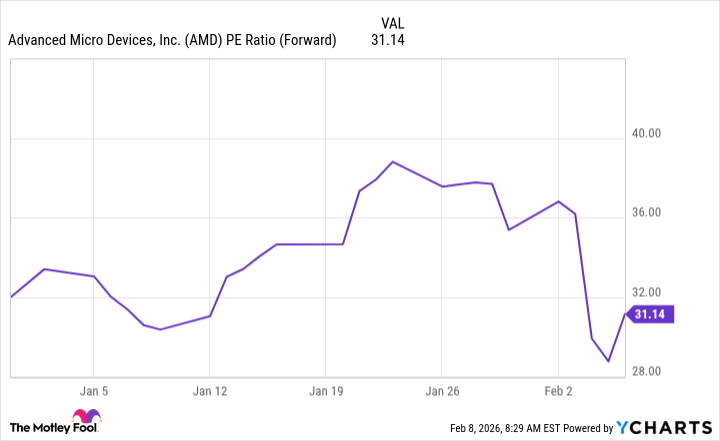

The recent adjustment in AMD’s valuation, it must be observed, was not entirely unexpected. Prior to the aforementioned announcement, its shares were valued at nearly forty times forward earnings – a figure which, to a discerning eye, appeared somewhat excessive. The current valuation of approximately thirty-one times earnings is, therefore, a more reasonable assessment, though a comparison with Nvidia, which trades at a mere twenty-four times earnings despite its greater market share and stronger growth rate, reveals that caution is still warranted.

Thus, to declare AMD’s shares inexpensive at this juncture would be, in my estimation, a misjudgment. Nevertheless, I anticipate continued growth, particularly should its data center division achieve the projected sixty per cent growth rate. Wall Street analysts, it is worth noting, foresee revenue growth of thirty-four per cent in 2026, rising to thirty-seven per cent in 2027 – figures which align with the company’s overall projections. This suggests a degree of confidence within the financial community that AMD can, indeed, deliver upon its promises.

While I maintain a more favorable view of Nvidia, I believe AMD presents a worthy alternative for those seeking exposure to the burgeoning field of artificial intelligence. The development of this technology is far from complete, and AMD, despite a somewhat belated entry, may yet achieve considerable success.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Monster Hunter Stories 3: Twisted Reflection launches on March 13, 2026 for PS5, Xbox Series, Switch 2, and PC

- Here Are the Best TV Shows to Stream this Weekend on Paramount+, Including ‘48 Hours’

- 🚨 Kiyosaki’s Doomsday Dance: Bitcoin, Bubbles, and the End of Fake Money? 🚨

- ‘The Substance’ Is HBO Max’s Most-Watched Movie of the Week: Here Are the Remaining Top 10 Movies

- First Details of the ‘Avengers: Doomsday’ Teaser Leak Online

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- The 11 Elden Ring: Nightreign DLC features that would surprise and delight the biggest FromSoftware fans

- Noble’s Slide and a Fund’s Quiet Recalibration

2026-02-13 05:02