Many of Hollywood’s biggest stars never had formal acting training. They became famous thanks to their natural abilities and what they learned from life. Their success shows that you don’t need a degree to thrive in the entertainment industry. Whether they’re known for action or comedy, these performers built lasting careers through dedication and practical experience.

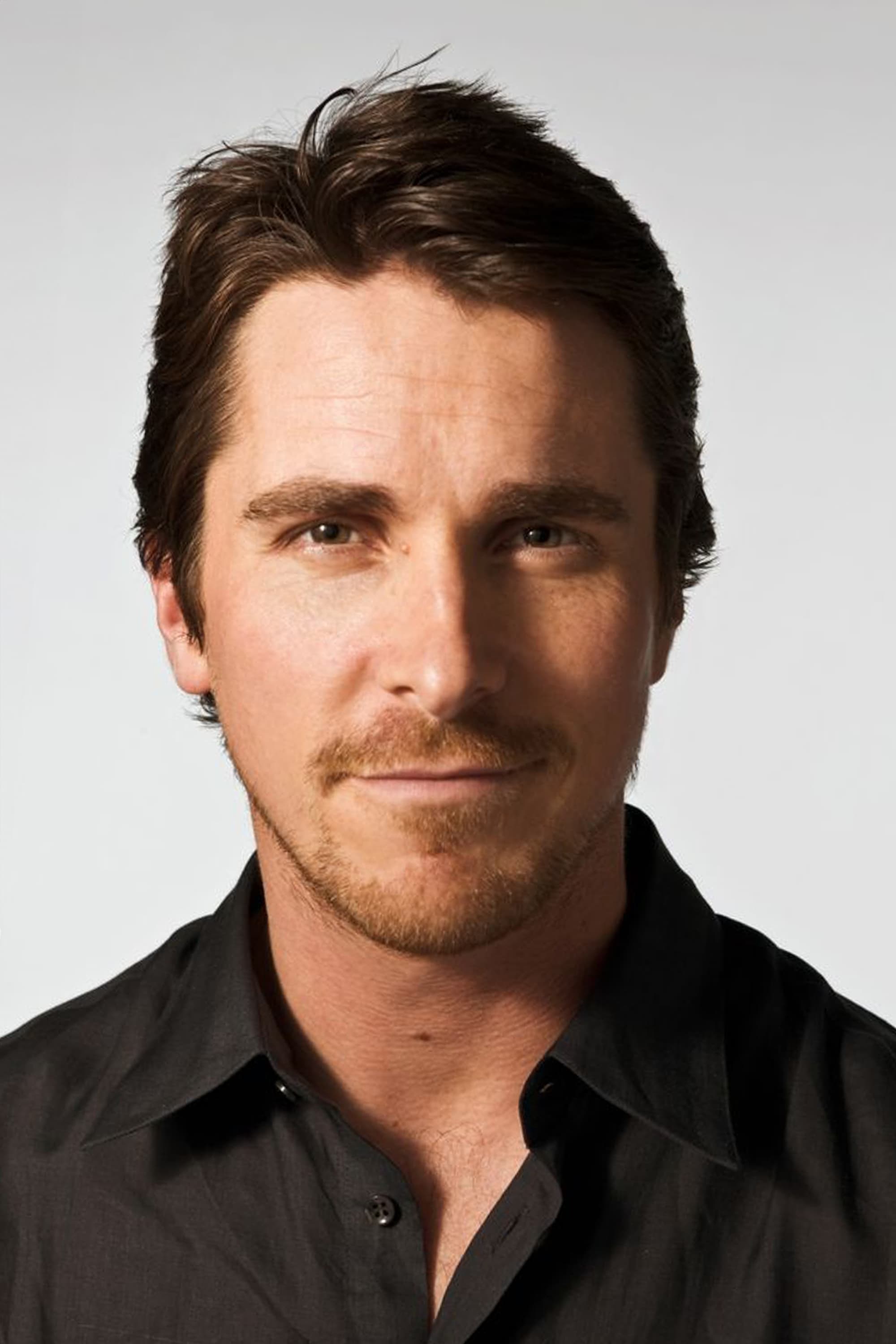

Christian Bale

Christian Bale is known as one of the most adaptable actors working today. Surprisingly, he never went to drama school – he’s entirely self-taught. He started acting as a child, appearing in commercials, and gained recognition for his performance in ‘Empire of the Sun’. Bale prepares for his varied roles by trusting his instincts and fully committing to each character. This unique approach has earned him an Academy Award and many other awards.

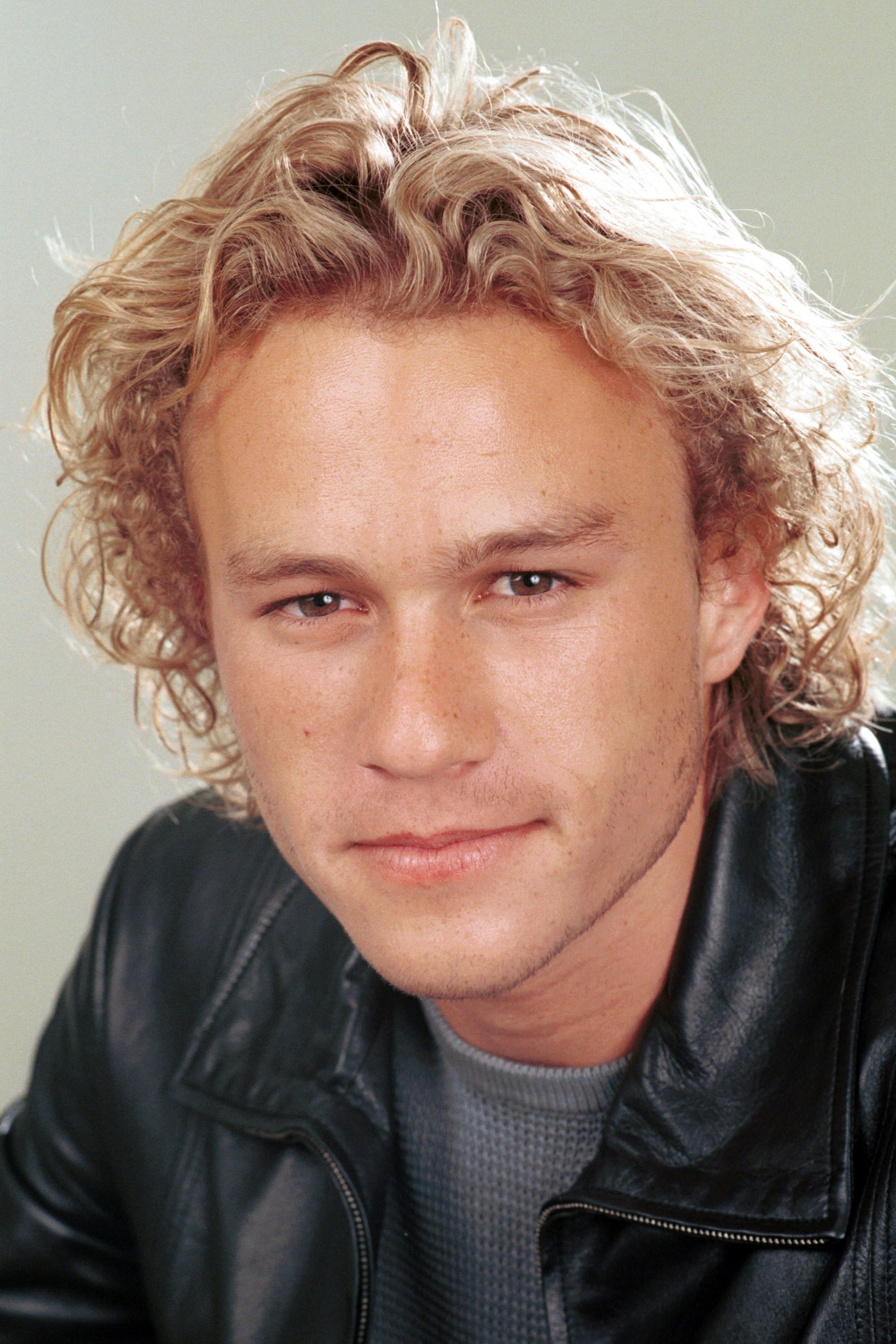

Heath Ledger

Heath Ledger was a remarkably gifted actor who became famous without formal training. He left school at sixteen and traveled across Australia to pursue his acting dreams. He first gained recognition in the film ’10 Things I Hate About You’ and later took on more challenging dramatic roles. His portrayal of the Joker in ‘The Dark Knight’ is considered one of the most memorable performances ever filmed. Ledger uniquely developed his characters by drawing on his own experiences and instincts, rather than relying on traditional acting techniques.

Joaquin Phoenix

I’ve always been fascinated by Joaquin Phoenix. He comes from a really artistic family, but surprisingly, he didn’t go to drama school! He started acting with his siblings when he was a kid, appearing in TV and movies right away. That’s where he really learned his craft – through doing. I think that’s why his performances feel so real and emotionally powerful. He’s famous for really becoming the characters he plays, like with his incredible performance in ‘Joker’. He’s said he actually prefers the energy of a spontaneous moment on set over being overly prepared, and I think that really comes across in his work.

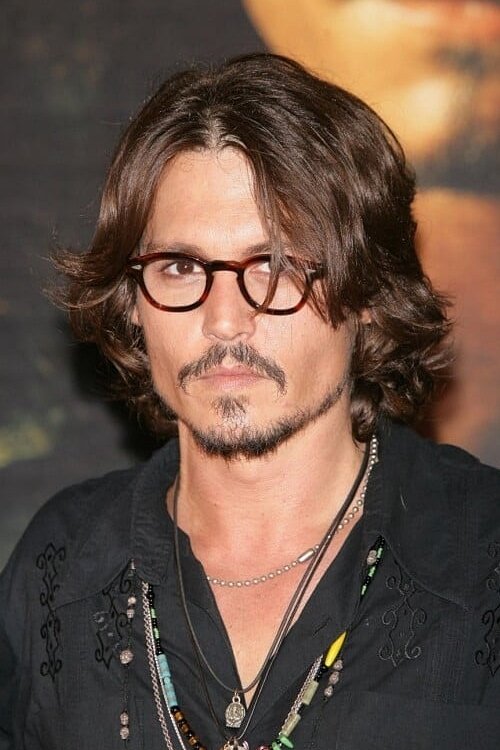

Johnny Depp

Johnny Depp first went to Los Angeles hoping to become a musician, but he stumbled into acting after meeting Nicolas Cage, who helped him get an audition for ‘A Nightmare on Elm Street.’ Surprisingly, Depp never had formal acting training; he learned by working on different TV shows and movies. He became well-known for his unique and unusual roles in films like ‘Edward Scissorhands’ and ‘Pirates of the Caribbean.’ Throughout his long career, he’s played some of the most memorable characters in recent film history.

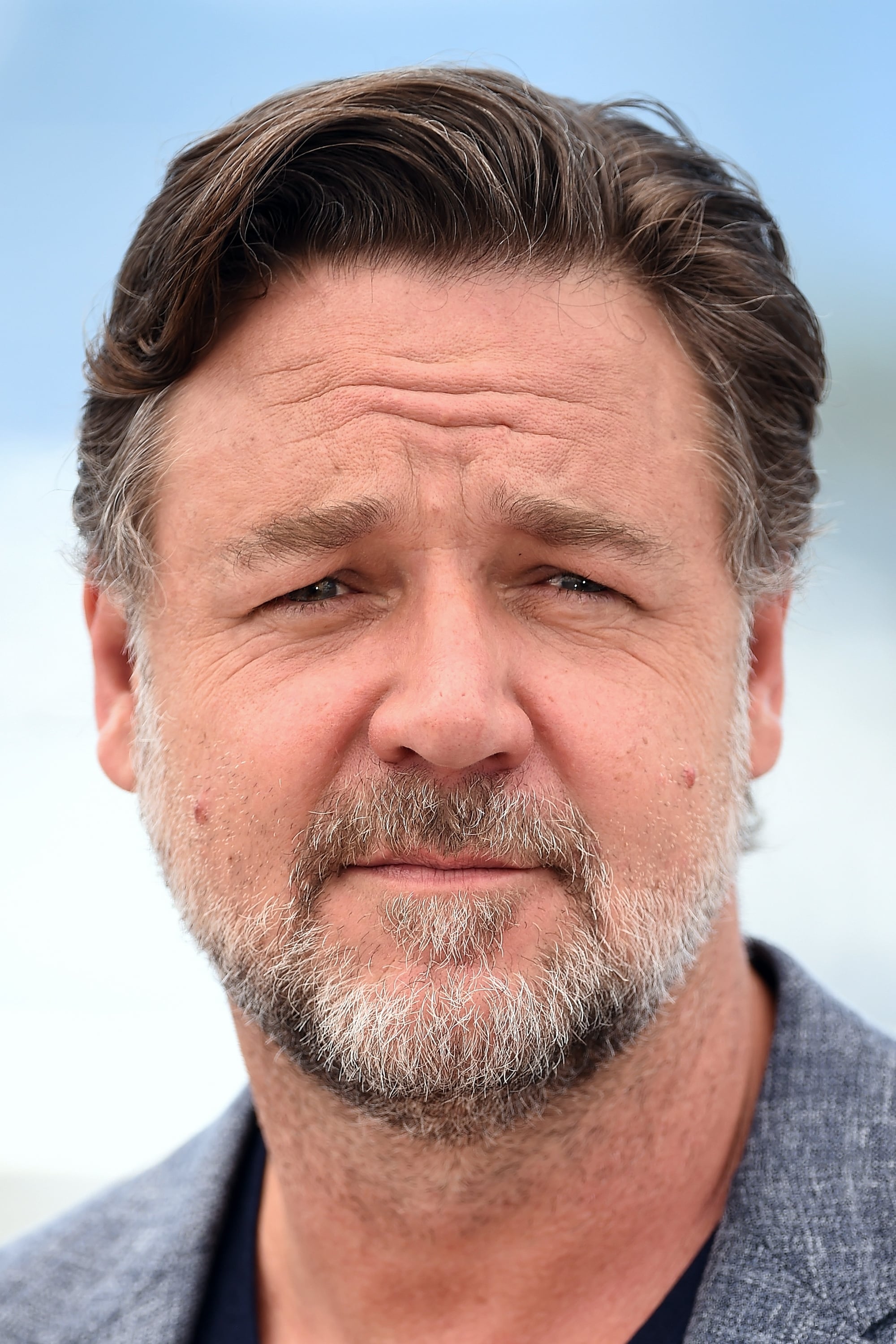

Russell Crowe

Russell Crowe began his acting career as a child in Australia. Rather than going to drama school, he developed his talent by performing live and taking on early film parts. He became a global star with his strong performance in ‘Gladiator,’ and is known for his captivating presence and ability to convincingly portray both physically and emotionally challenging characters. His story shows how hands-on experience can lead to significant professional achievement.

Jim Carrey

Jim Carrey started his career doing stand-up comedy in Toronto and eventually moved to Hollywood. He taught himself to act, developing his signature physical comedy through performing live. He then moved into television and achieved huge success in films like ‘Ace Ventura: Pet Detective’. Though known for his energetic and funny roles, he also showed he could handle serious acting with ‘The Truman Show’. His incredible comedic timing and expressive face are all skills he developed on his own.

Eddie Murphy

Eddie Murphy became famous very young, starting with stand-up comedy and then on ‘Saturday Night Live.’ Surprisingly, he didn’t have any formal acting training when he became a huge movie star in the 1980s. Films like ‘Beverly Hills Cop’ and ‘48 Hrs.’ proved he was a true Hollywood icon. Murphy is known for playing many different characters in one movie, demonstrating his natural talent for impressions. He mostly uses his own sense of humor and perfect timing, rather than relying on acting techniques he learned in school.

Jason Statham

Before becoming an actor, Jason Statham was a professional diver and even worked as a fashion model. He caught the eye of director Guy Ritchie, who cast him in ‘Lock, Stock and Two Smoking Barrels’ because of his genuine personality and unique experiences. Statham never had formal acting training, and he’s become known for starring in action movies, often performing his own stunts – as seen in films like ‘The Transporter’. His tough look and athleticism have made him a popular star in big-budget films around the world.

Channing Tatum

Channing Tatum began his career as a dancer and model before becoming a film actor. He surprisingly landed a leading role in the dance movie ‘Step Up’ without any formal acting training. He then showed his range as an actor, succeeding in both funny roles like those in ‘21 Jump Street’ and more serious roles in ‘Foxcatcher’. Tatum has often talked about learning how movies are made simply by being on set. His appeal and hard work have been key to his success.

Mark Wahlberg

Mark Wahlberg started his career as a popular rapper before becoming a major movie star. He didn’t go to acting school, instead using his own life experiences to make his characters feel real. He first gained recognition for his dramatic skills in the film ‘Boogie Nights’ and has since starred in many different types of movies, from action films to comedies. On top of acting, Wahlberg is also a successful producer.

Ryan Gosling

Ryan Gosling started his acting career as a child on ‘The Mickey Mouse Club,’ alongside other performers who later became famous. Instead of going to drama school, he honed his skills by working consistently in television and independent films. He first gained significant recognition for his role in ‘The Believer,’ which opened doors to leading parts in films like ‘The Notebook’ and ‘Drive.’ Gosling is known for his subtle and natural acting, often communicating complex emotions without saying much. Throughout his career, he’s consistently chosen roles in projects that are both challenging and creatively fulfilling.

Seth Rogen

Seth Rogen began his comedy career as a teenager doing stand-up in Vancouver. He landed a role on the TV show ‘Freaks and Geeks’ with no formal acting training. Rogen frequently writes and produces the movies he appears in, like the popular comedy ‘Superbad’. His easygoing and spontaneous comedic approach has become well-known in recent films. He remains a significant creative talent in the industry, working as both an actor and a filmmaker.

Jonah Hill

Jonah Hill started his career creating and performing his own plays in New York City. He learned to act by performing in alternative comedy shows, rather than through formal classes. The movie ‘Superbad’ launched him to fame, and he followed that success with a series of popular comedies. Later, Hill impressed viewers by showing his ability to play more serious roles in films like ‘Moneyball’ and ‘The Wolf of Wall Street,’ earning him several Academy Award nominations for these challenging supporting performances.

Chris Pratt

You know, it’s always fascinating to hear how actors get their start. Chris Pratt was actually waiting tables in Hawaii when someone in the industry spotted him! He took a chance and moved to Los Angeles, and slowly started getting roles on shows like ‘Everwood’ and then, of course, ‘Parks and Recreation’ – that’s where I really started noticing him. What’s cool is he didn’t go to acting school; he really built his comedic timing just by doing the work. Then, he completely surprised everyone by becoming this huge action star with ‘Guardians of the Galaxy’ and ‘Jurassic World’! It’s just a really classic Hollywood story – a total underdog who made it big.

Vin Diesel

Vin Diesel started his career working as a bouncer in New York City while pursuing his dream of becoming a filmmaker. He taught himself the ropes, creating short films instead of taking acting classes. This independent work caught the eye of Steven Spielberg, who cast him in ‘Saving Private Ryan’. Diesel later became internationally famous for playing Dominic Toretto in the ‘Fast & Furious’ movies, building a successful career on his distinctive voice and strong on-screen image.

Dwayne Johnson

Dwayne Johnson first became famous as a professional wrestler, and then successfully became a full-time actor. He didn’t have formal acting training; instead, he learned to connect with audiences through his wrestling performances. After appearing in films like ‘The Mummy Returns,’ he landed leading roles in many action and family movies. Now, Johnson is one of the world’s highest-paid actors, known for his incredible charm and ability to draw people in. He’s made a remarkably smooth transition from the world of wrestling to becoming a global movie star.

Adam Sandler

Adam Sandler started his career as a stand-up comedian and was later hired as a cast member on ‘Saturday Night Live’. He didn’t have any formal acting lessons, instead relying on his distinctive comedic style and ability to create characters people could connect with. He became a movie star with popular comedies like ‘Billy Madison’ and ‘Happy Gilmore’, which have become beloved by fans. Though mostly known for making people laugh, Sandler has also earned praise for his serious acting in films like ‘Punch-Drunk Love’. He continues to be a consistent presence in Hollywood thanks to his own production company.

Will Smith

Will Smith initially rose to prominence as a successful rapper, winning a Grammy Award before landing his breakout role in the TV show ‘The Fresh Prince of Bel-Air’. He began acting without any formal training, learning the skills on the job over the show’s six seasons. Smith then transitioned to movies, becoming a major box office draw with hits like ‘Independence Day’ and ‘Men in Black’. He’s received several Academy Award nominations for his powerful performances in biographical films, proving his career is built on his charisma and ability to connect with viewers.

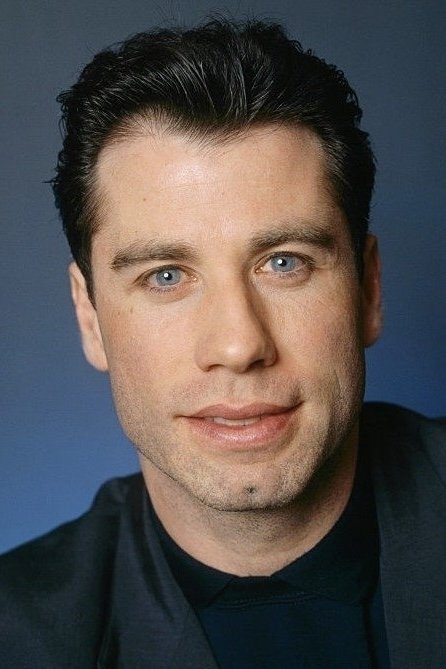

John Travolta

John Travolta left high school to chase his dream of becoming an entertainer in New York City. He didn’t go to drama school, choosing instead to gain experience through commercials and stage work. He first became famous on the TV show ‘Welcome Back, Kotter’, which then opened doors to leading roles in hit movies like ‘Saturday Night Fever’ and ‘Grease’. Though his career had a slow period, he made a huge comeback with the film ‘Pulp Fiction’. Travolta has remained a well-known actor in Hollywood for over forty years.

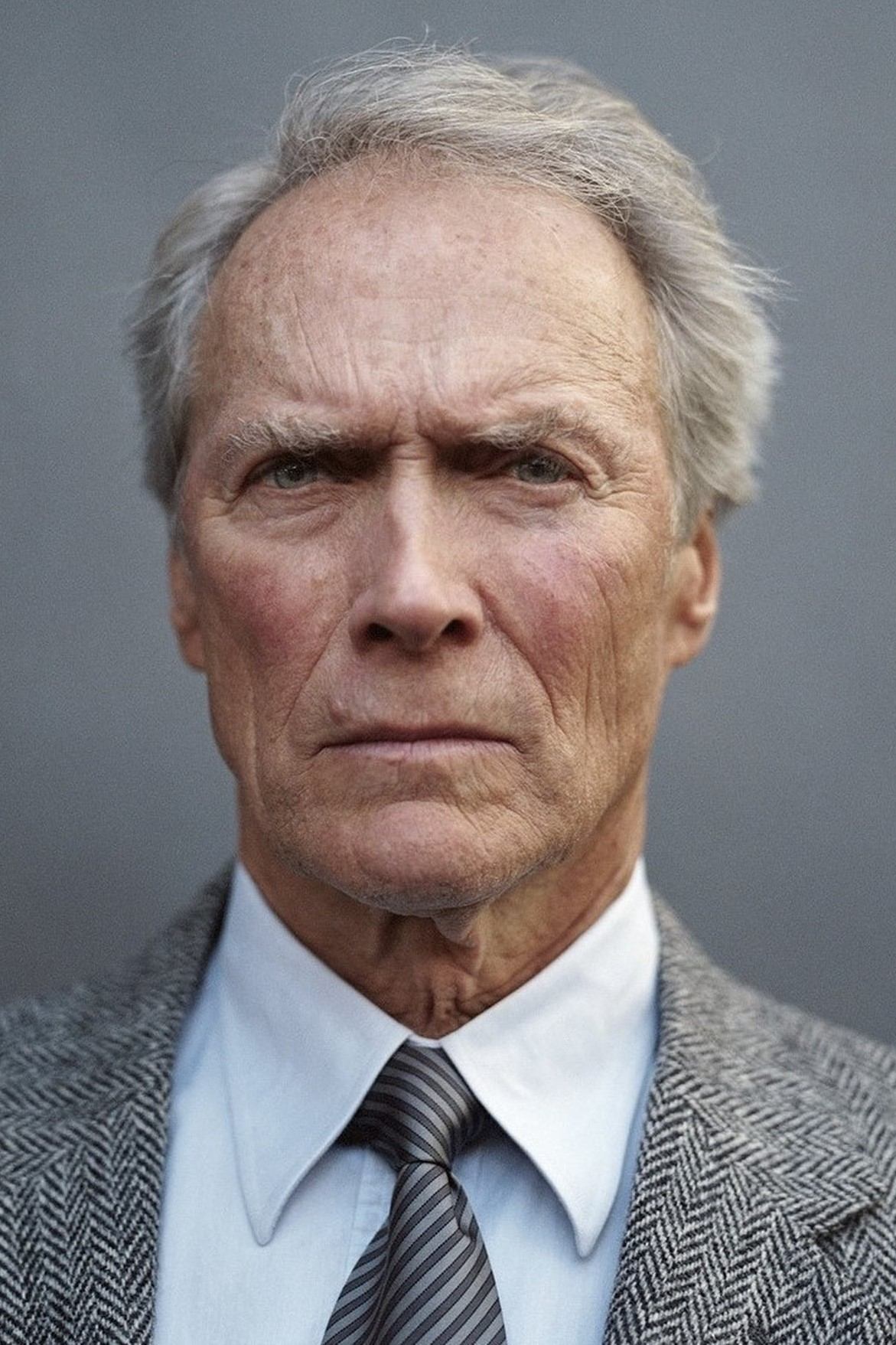

Clint Eastwood

Clint Eastwood started his acting career in the 1950s with a contract at Universal Pictures. He wasn’t formally trained, learning on the job while filming westerns such as ‘Rawhide’. He became a global star through his work with director Sergio Leone on the ‘Man with No Name’ films. Later, Eastwood moved into directing, earning several Academy Awards for his directing achievements. His simple, understated acting has had a lasting impact on actors in action and western movies.

Cary Grant

Cary Grant began his career performing acrobatics and walking on stilts with a traveling show. He didn’t have formal acting training, but instead honed his elegant style while working in vaudeville. Moving to Hollywood, he became a quintessential leading man during cinema’s Golden Age, known for his cleverness and charisma in films like ‘North by Northwest’ and ‘The Philadelphia Story’. His journey from a circus performer to a Hollywood icon is a truly inspiring story.

James Cagney

Before becoming a famous movie star, James Cagney trained as a dancer and performed in vaudeville shows. He didn’t have formal acting lessons, but he brought a lot of energy and physicality to his roles. Cagney is best known for playing tough characters and gangsters, like in the film ‘The Public Enemy’. However, he also surprised audiences with his dancing ability in the musical ‘Yankee Doodle Dandy’. He was a popular leading man at Warner Bros. for a long time.

Humphrey Bogart

Humphrey Bogart started acting without any formal training, working his way up through small parts. He eventually became a major star with films like ‘The Maltese Falcon’ and ‘Casablanca.’ Bogart became known as the classic tough guy of the 1940s, and his realistic acting style and distinctive voice made him unforgettable. Later in his career, he won an Academy Award for his performance in ‘The African Queen’.

Kiefer Sutherland

Kiefer Sutherland started acting in Canada and the U.S. instead of finishing school. He learned on the job, gaining experience through various film roles rather than attending acting school. He became well-known in the 1980s with movies like ‘The Lost Boys’ and ‘Stand by Me,’ and later achieved huge popularity on television starring in the series ‘24’. He’s consistently worked in both film and television for many years.

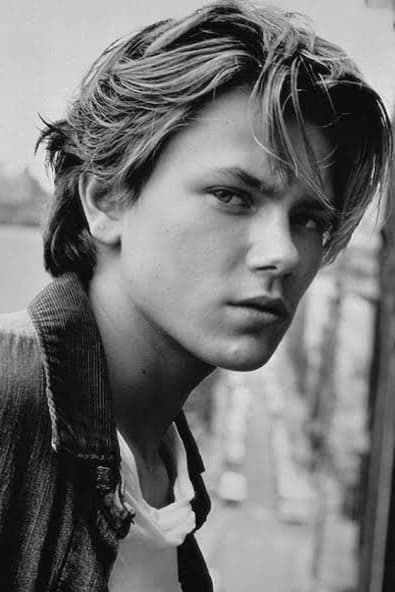

River Phoenix

River Phoenix was a remarkably talented actor who achieved success without ever taking acting classes. He was first noticed by a talent scout while busking with his family to earn money. He became internationally known for his roles in films like ‘Stand by Me’ and ‘Running on Empty’. Audiences and critics alike praised his powerful and realistic performances, and he remains an inspiration to actors today.

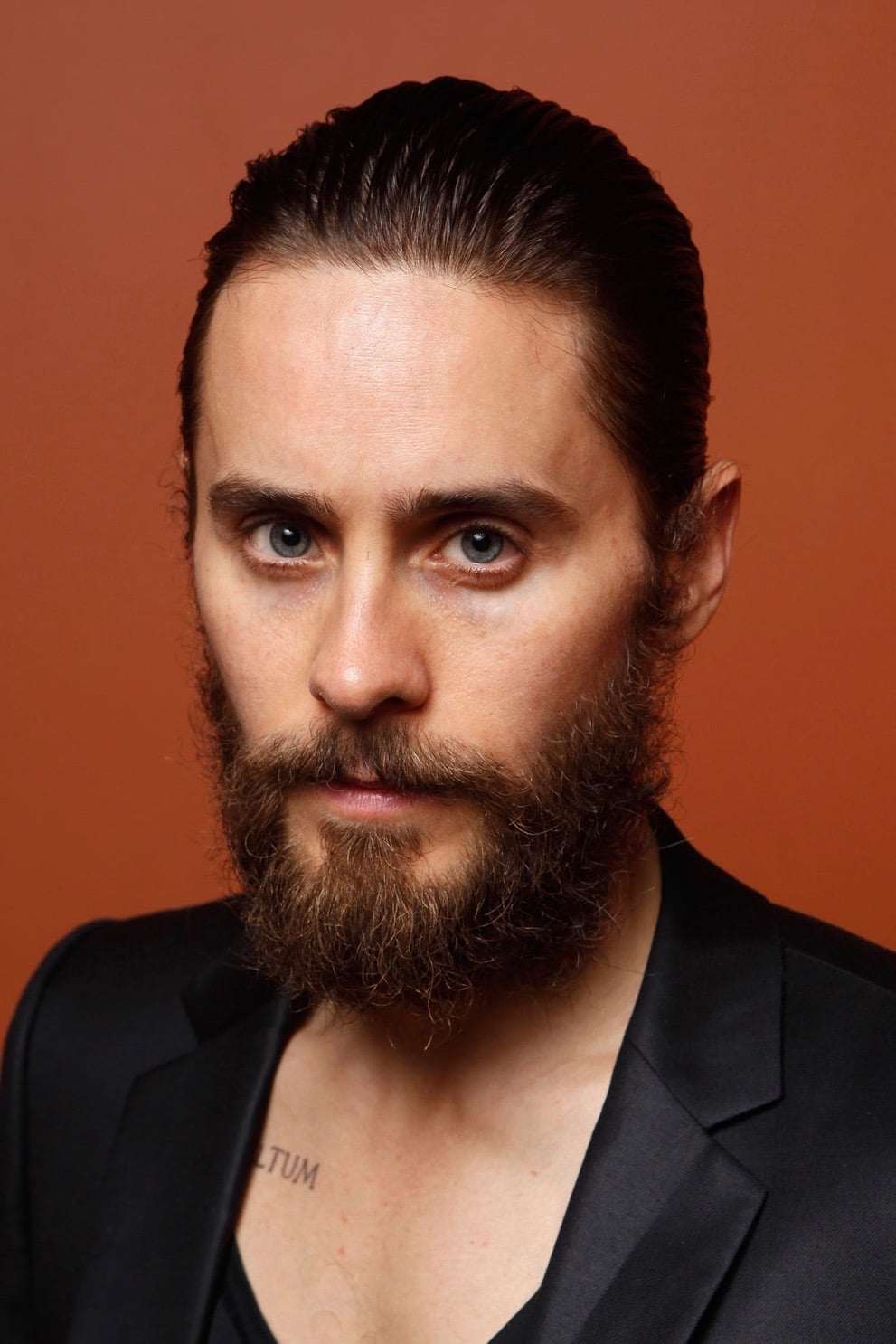

Jared Leto

Jared Leto first studied art in college and then moved to Los Angeles to become a musician and actor. He learned to act not through formal classes, but by taking on small parts in TV and movies. Leto is famous for completely immersing himself in his roles and fully becoming his characters. After a break from acting, he won an Academy Award for his performance in ‘Dallas Buyers Club’. He successfully balances a career in both music and acting, showing his wide range of creative talents.

Christopher Walken

Before becoming a celebrated dramatic actor, Christopher Walken trained as a dancer in musical theater. He developed his distinctive speaking style and mannerisms not through formal acting classes, but through performing on stage. He famously won an Oscar for his powerful role in ‘The Deer Hunter’ and has since become a beloved, unconventional figure in film, often playing unforgettable supporting characters. His dance training still subtly shapes his movements and presence when he’s on screen.

Christian Slater

I’ve always been fascinated by Christian Slater. It’s amazing to me that he started acting so young, even appearing on Broadway as a child! What’s even more impressive is that he didn’t have any formal training – he just learned by working with seasoned professionals. I first really noticed him in ‘Heathers,’ which is still a favorite of mine, and he’s consistently delivered great performances in both movies and TV ever since. Seeing him recently in ‘Mr. Robot’ reminded me what a talented actor he is, and it’s clear that getting that early start really helped him hone his craft.

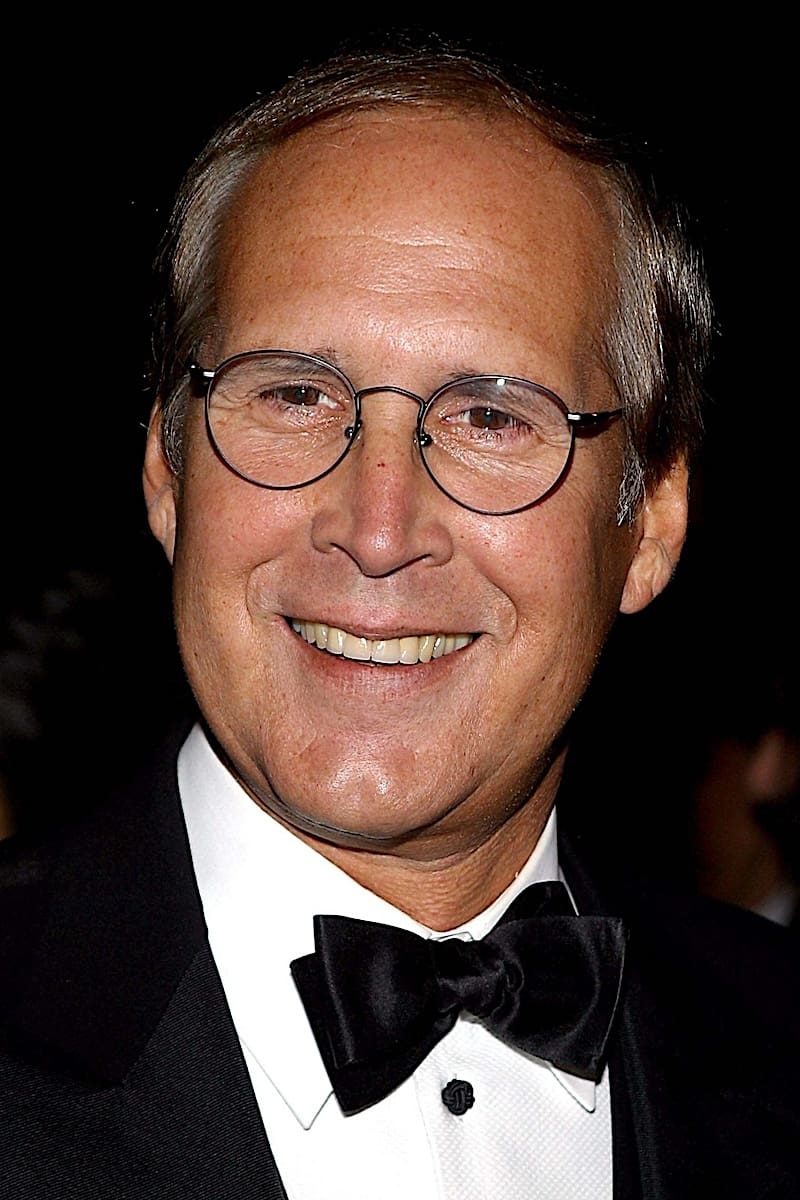

Chevy Chase

Before becoming famous on the first season of ‘Saturday Night Live’, Chevy Chase honed his skills as a comedian in smaller, more experimental shows. He didn’t have traditional acting lessons, instead relying on his talent for physical humor and a dry, understated delivery. In the 1980s, Chase became a major movie star, appearing in popular films like ‘Caddyshack’ and ‘National Lampoon’s Vacation’. He’s known for being quick on his feet and having a natural charisma on screen, and his unique style of comedy continues to influence filmmakers today.

Burt Reynolds

Burt Reynolds was a gifted athlete whose acting career began after a football injury forced him to retire. He learned the craft on the job, starting with TV westerns and small film parts. In the 1970s, Reynolds became the most popular movie star in the world, thanks to hits like ‘Smokey and the Bandit.’ He was known for his charming personality and his knack for mixing action and humor. Later in life, he earned praise from critics and an Academy Award nomination for his role in ‘Boogie Nights.’

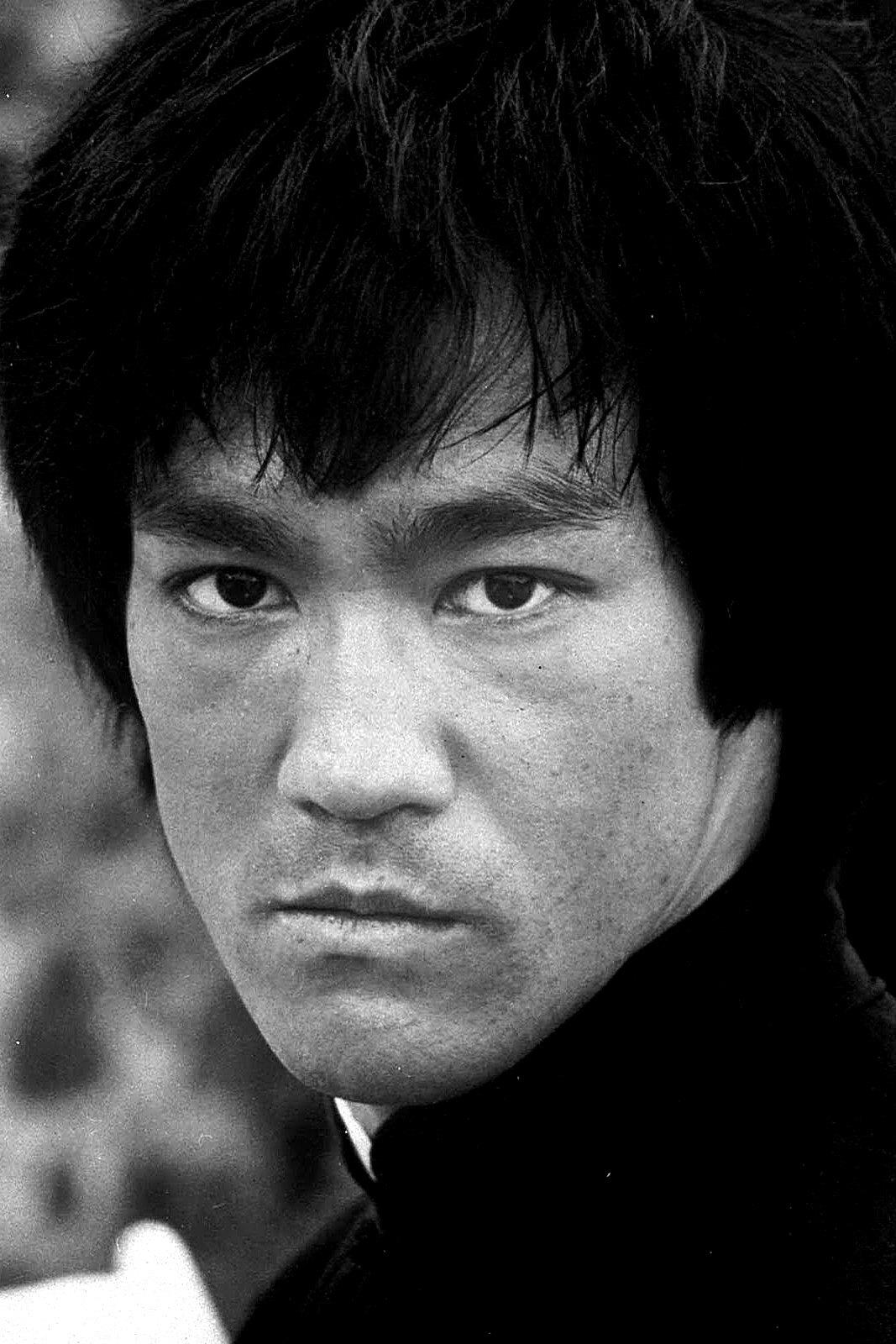

Bruce Lee

Bruce Lee began his career as a child actor in Hong Kong, but he wasn’t formally trained in Western acting techniques. Instead, he dedicated himself to martial arts and philosophy, which helped him create a unique on-screen image. After returning to the United States, he revolutionized the action movie genre with the film ‘Enter the Dragon.’ Lee’s incredible physical fitness and speed led to a completely new style of fighting on film. He remains a globally recognized icon and a groundbreaking figure for Asian representation in acting.

Jet Li

Before becoming a famous actor, Jet Li was a wushu champion in China. He learned to act on the job, while filming action movies. He first became a big star in Asia with the ‘Once Upon a Time in China’ films, and then successfully moved to Hollywood. He’s famous for his fast and precise fighting skills, and his career helped connect action movies from both Eastern and Western cultures.

Chuck Norris

Before becoming an actor, Chuck Norris was a skilled martial artist – a world karate champion – and served in the military. He didn’t have any formal acting training, but got his start in the film industry through his friendship with Bruce Lee. Norris became a popular action movie star in the 1980s and later gained even wider recognition as the lead in the television series ‘Walker, Texas Ranger’. He’s well-known for playing tough characters and showcasing his impressive martial arts abilities, and his journey from fighting professionally to becoming a TV star made him a familiar face in many homes.

Jean-Claude Van Damme

Before becoming a Hollywood star, Jean-Claude Van Damme was a successful kickboxer and bodybuilder in Belgium. He taught himself to act and worked various jobs while trying to get his start in the film industry. His incredible physical skills ultimately landed him roles in popular martial arts movies like ‘Bloodsport’ and ‘Kickboxer’. Combining his fighting talent with a strong personality, Van Damme became a major action star in the 1990s. He’s continued to appear in numerous action films, and even playfully poked fun at his own persona in the movie ‘JCVD’.

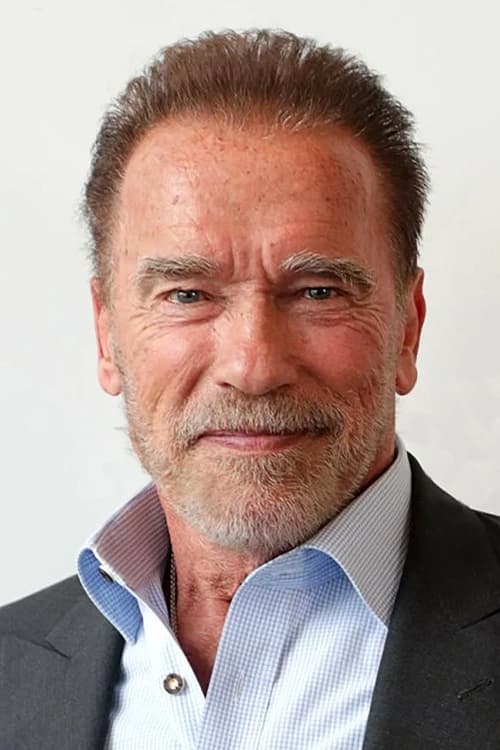

Arnold Schwarzenegger

Arnold Schwarzenegger first gained fame as a top bodybuilder before becoming a movie star. Despite having no prior acting experience, and facing doubts because of his accent and build, he proved his leading man potential with the film ‘Conan the Barbarian’. He then became a worldwide icon thanks to the ‘Terminator’ films and many other popular action and comedy movies. Later, he entered politics and served as Governor of California, taking a break from acting.

Steven Seagal

Steven Seagal started as an aikido teacher with a dojo in Japan. A talent agent noticed him, and despite having no acting background, he landed the main role in ‘Above the Law’. He quickly became a popular action movie star in the late 80s and early 90s, known for films like ‘Under Siege’. His movies are recognizable for his distinctive martial arts skills and his cool, calm demeanor. He’s continued making action films for many years.

Michael J. Fox

Michael J. Fox started acting as a teen in Canada with the TV show ‘Leo and Me’. He didn’t go to drama school, learning the craft directly on set. Moving to Los Angeles, he quickly became famous with ‘Family Ties’ and the ‘Back to the Future’ movies. Known for his great comedic skills and ability to play characters people could connect with, Fox has maintained a strong reputation in the industry, even while dedicating himself to raising awareness and funding for Parkinson’s disease research.

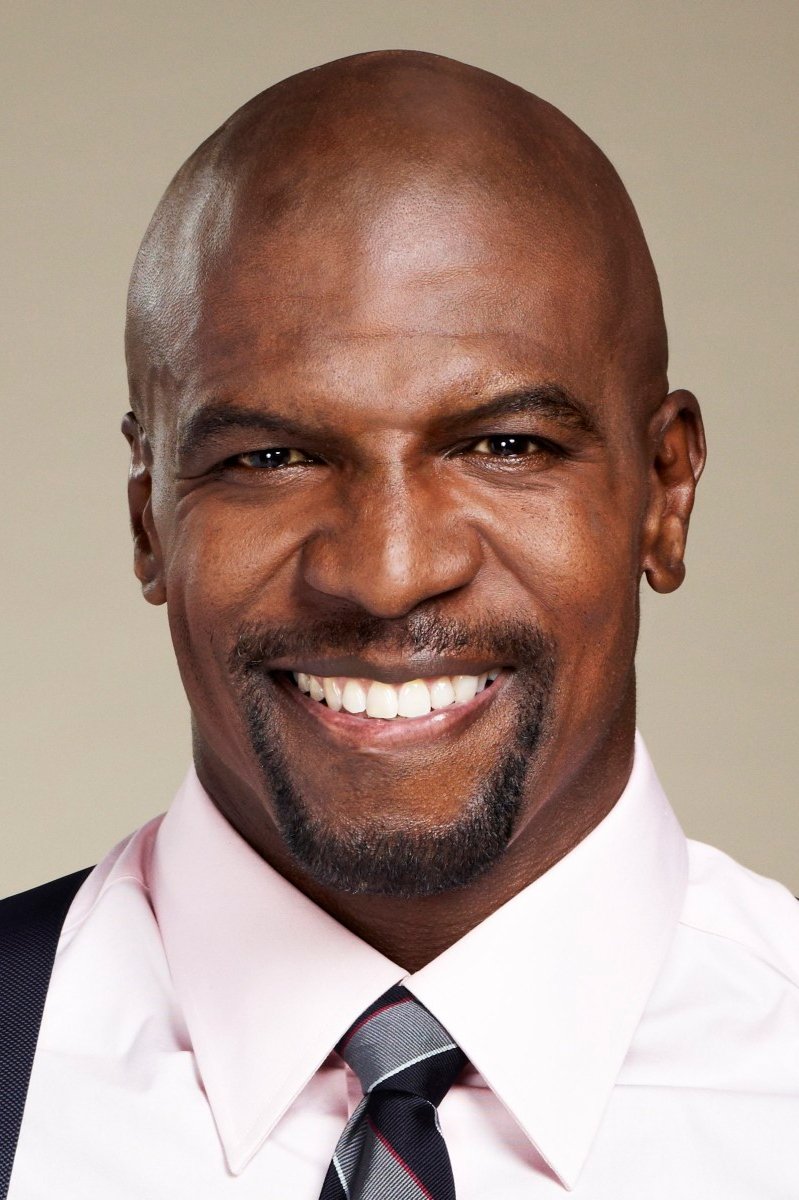

Terry Crews

Terry Crews started his career as a professional football player, but later moved into acting and television. Surprisingly, he didn’t have any formal acting training, and first worked as a security guard on movie sets. His strong build and funny personality eventually landed him roles in popular comedies like ‘Friday After Next’ and ‘White Chicks’. He went on to become a familiar face on the TV show ‘Brooklyn Nine-Nine’ and has hosted several big reality shows, creating a successful and varied career in the entertainment industry.

Ice Cube

Ice Cube first became famous as part of the groundbreaking rap group N.W.A. He then transitioned to acting, landing a role in the highly praised film ‘Boyz n the Hood’ without any formal training. He later showcased his comedic skills in the popular ‘Friday’ movies, proving his talent as both an actor and writer. Since then, Ice Cube has become a successful producer and continues to appear in a variety of films, from action movies to family comedies. His career is a great example of how a musician can build a lasting career in Hollywood.

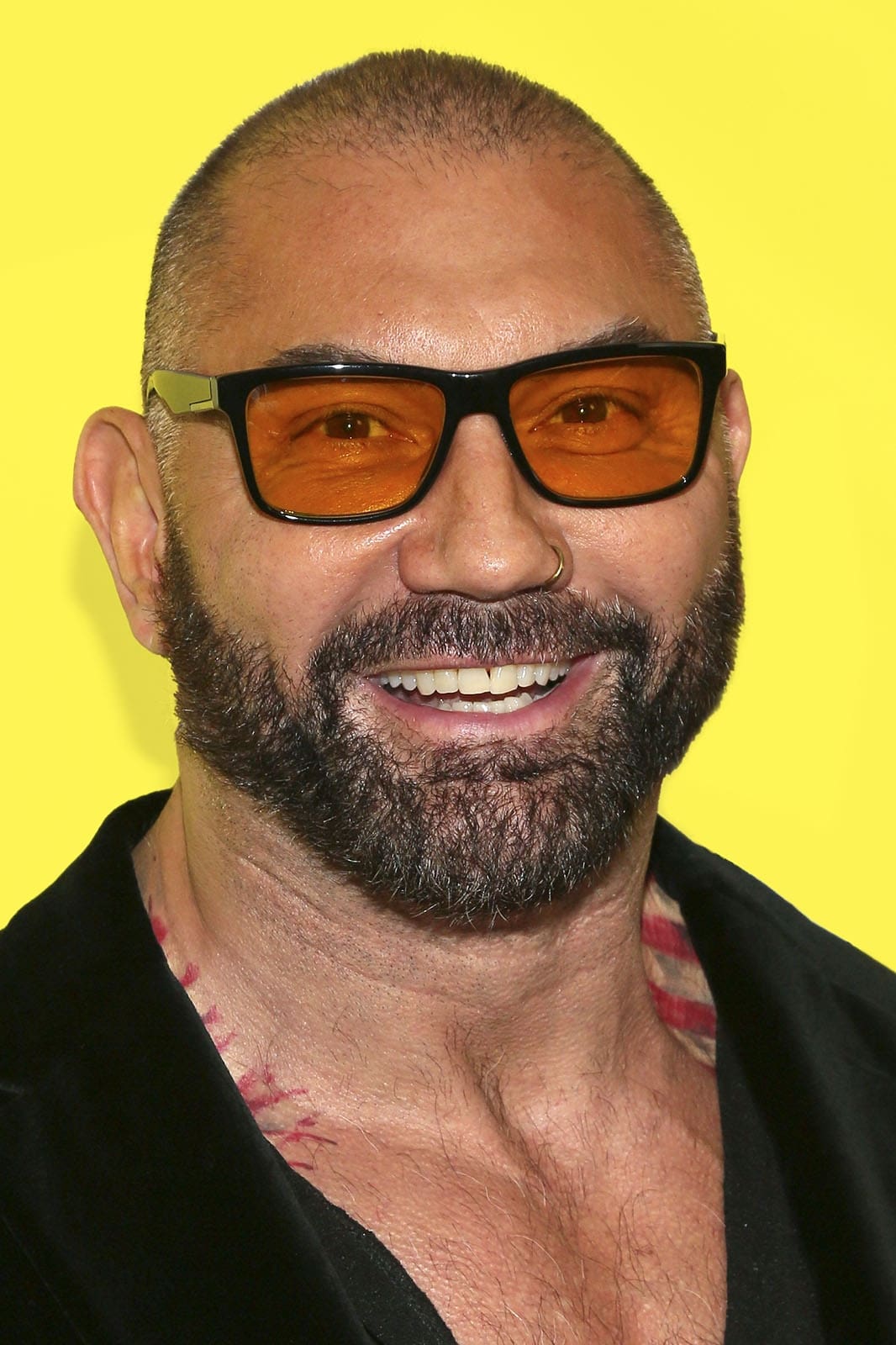

Dave Bautista

Dave Bautista first became famous as a professional wrestler, but later decided to try acting. With no formal acting training, he faced challenges finding substantial roles at first. He gained recognition with his role as Drax in ‘Guardians of the Galaxy,’ which highlighted his ability to act and his comedic talent. Since then, he’s taken on more serious roles in films like ‘Blade Runner 2049’ and ‘Glass Onion.’ Bautista is dedicated to improving his skills and enjoys collaborating with highly respected directors.

Share your favorite self-taught actor in the comments.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Monster Hunter Stories 3: Twisted Reflection launches on March 13, 2026 for PS5, Xbox Series, Switch 2, and PC

- Here Are the Best TV Shows to Stream this Weekend on Paramount+, Including ‘48 Hours’

- 🚨 Kiyosaki’s Doomsday Dance: Bitcoin, Bubbles, and the End of Fake Money? 🚨

- ‘The Substance’ Is HBO Max’s Most-Watched Movie of the Week: Here Are the Remaining Top 10 Movies

- First Details of the ‘Avengers: Doomsday’ Teaser Leak Online

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- The 11 Elden Ring: Nightreign DLC features that would surprise and delight the biggest FromSoftware fans

- Noble’s Slide and a Fund’s Quiet Recalibration

2026-02-13 02:27