One does rather fret about Boeing (BA +1.31%). Not that I’m given to emotional displays, naturally, but a company needing to fund a new aircraft and simultaneously settle a rather substantial tab accumulated during recent unpleasantness… well, it’s hardly a recipe for a quiet life, is it? The current cash flow situation appears… precarious. And President Trump’s insistence on timely deliveries? A touch theatrical, perhaps, but undeniably focused.

A Spot of Bother with the Balance Sheet

The figures, as ever, tell a tale. Consolidated debt stands at $54.1 billion, offset by a mere $29.4 billion in cash and marketable securities – a net debt of $24.7 billion. And a further $1.9 billion evaporated last year. Then, one hears whispers of a new narrowbody aircraft requiring a cool $50 billion to develop. One begins to suspect the accountants are having a rather trying time.

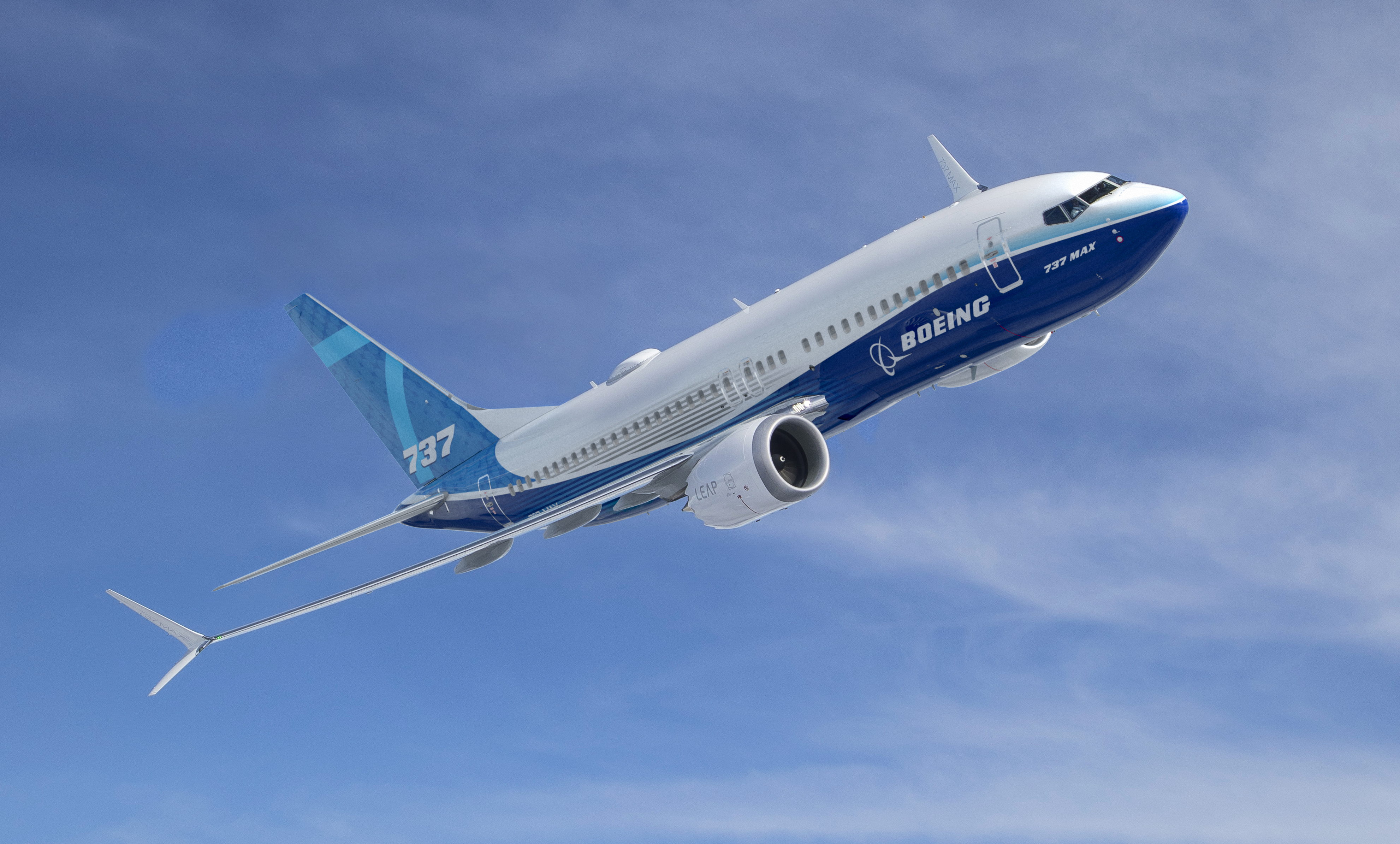

Add to that the recent acquisition of Spirit AeroSystems, a flirtation with electric vertical take-off and landing devices (Wisk, I believe it’s called – terribly modern), the ongoing 737 production ramp-up, and the delays surrounding the 777X… it all adds up to a rather insistent drain on resources. Management, it seems, anticipates a mere $1 to $3 billion in free cash flow next year. One shudders to think what the auditors will say.

A Glimmer of Hope, Tempered by Reality

The good news, if one can call it that, is that without the 777X issues, the Spirit investment, and a few departmental settlements, the underlying free cash flow might be in the high single-digit billions. And, naturally, increasing 737 production will eventually improve earnings. Margins, as everyone knows, tend to expand when one actually manages to produce something.

The less agreeable news is that capital spending has surged to $4 billion, up from a comparatively modest $2.9 billion and $2.2 billion in the preceding years. Part of that is, of course, due to the aforementioned difficulties, but another portion stems from a determined effort to ensure deliveries on some rather problematic fixed-price development programs.

These programs, it appears, cost Boeing $5 billion last year and $802 million the year before. The most troublesome of all, I gather, is the KC-46 refueling tanker. A most unfortunate affair.

When questioned about the KC-46, CEO Kelly Ortberg remarked – and I quote – “We made the conscious decision that we needed to keep resources at a higher level to assure that we make those deliveries on time. As you know, the Department of War is super focused on us.” One detects a certain… urgency in that statement. Or perhaps it’s merely the inherent absurdity of the situation.

What It Means for the Discerning Investor

All told, the Trump administration is, as intended, influencing Boeing’s decision-making – and, notably, its cash flow – in its defense business. A factor to consider, naturally, when contemplating an investment. The 737 MAX production ramp-up remains encouraging, and likely the key driver for the stock in the near term.

The stock remains… attractive, shall we say? Though perhaps a trifle less so, given the added pressure on cash flow. One mustn’t be greedy, after all. A modest return is often preferable to a spectacular collapse.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Monster Hunter Stories 3: Twisted Reflection launches on March 13, 2026 for PS5, Xbox Series, Switch 2, and PC

- Here Are the Best TV Shows to Stream this Weekend on Paramount+, Including ‘48 Hours’

- 🚨 Kiyosaki’s Doomsday Dance: Bitcoin, Bubbles, and the End of Fake Money? 🚨

- ‘The Substance’ Is HBO Max’s Most-Watched Movie of the Week: Here Are the Remaining Top 10 Movies

- First Details of the ‘Avengers: Doomsday’ Teaser Leak Online

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- The 11 Elden Ring: Nightreign DLC features that would surprise and delight the biggest FromSoftware fans

- 20 Films Where the Opening Credits Play Over a Single Continuous Shot

2026-02-13 01:12