Video game development is full of surprises! Sometimes, mistakes happen that actually change how players experience the game. In fact, many popular and enjoyable game features started as accidental bugs or problems with the technology. When developers see that a glitch makes the game better, they often decide to keep it! This article showcases some of the most famous examples of programming errors that became permanent and beloved parts of gaming.

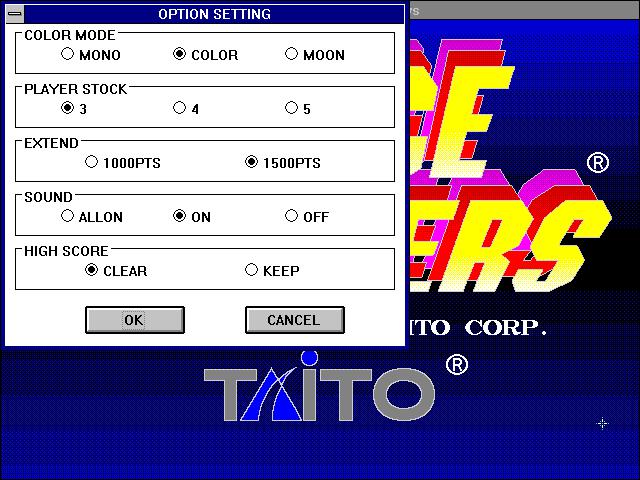

‘Space Invaders’ (1978)

The famously challenging difficulty in this classic game happened by accident. As players eliminated aliens, the game’s hardware could display the remaining ones more quickly. This caused the invaders to descend the screen at ever-increasing speeds. Instead of correcting this, the developer decided to leave it in, and it ultimately set the pattern for progressively harder levels in arcade games.

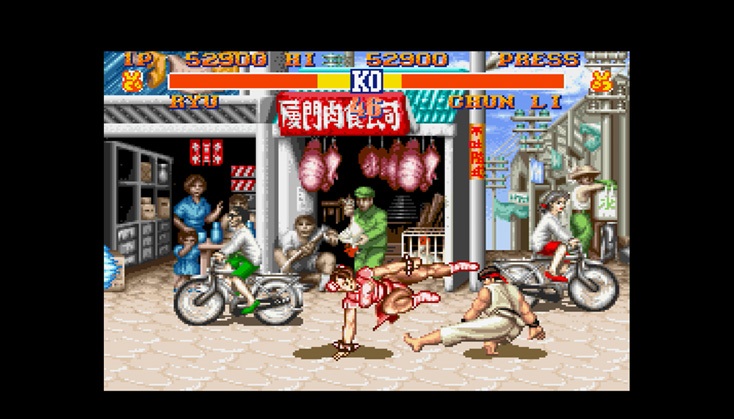

‘Street Fighter II’ (1991)

While making the game, a developer found that carefully timed attacks could be chained together. This happened because the game’s animations could be stopped mid-motion by another button press. Instead of fixing it, the team saw this as a way to make combat more complex and interesting. They kept the feature, and it eventually became the basis for how combos work in most modern fighting games. Now, almost every major fighting game uses this technique, which started as a happy accident.

‘Minecraft’ (2011)

The Creeper, Minecraft’s famous green, exploding monster, was actually created by accident. Its creator, Markus Persson, was trying to make a pig, but mistakenly switched the height and length settings during coding. This resulted in a bizarre, tall creature with short legs that looked creepy. Persson then decided to make it green and give it the ability to explode, and it unexpectedly became the most well-known symbol of the entire Minecraft series.

‘Quake’ (1996)

Players found a clever way to jump much higher in the game by shooting a rocket at their own feet. This trick used the game’s physics to gain a lot of upward speed, though it cost them some health. The game developers, id Software, saw players using this technique in online matches. Rather than fix it, they decided to build future levels and games around this new way of moving. Now, ‘rocket jumping’ is a key feature in many fast-paced arena shooter games.

‘Devil May Cry’ (2001)

This action game started as a prototype for ‘Resident Evil 4’. During development, a glitch let players endlessly launch enemies into the air with repeated shots. The game’s director loved how this looked and decided to design the whole combat system around it. This innovation helped establish a new style of action games focused on keeping enemies airborne. Eventually, the game became its own separate series.

‘Starsiege: Tribes’ (1998)

A quirk in the game’s physics let players build up speed by pressing the jump button while going downhill. This created a sliding or skiing effect, letting characters move incredibly fast across the game world. Players quickly learned to use this technique to get around the large maps much more quickly than the developers originally planned. Because it became so popular, the developers officially added this ‘skiing’ movement to all future games in the series. It has since become the signature feature of the ‘Tribes’ franchise.

‘Team Fortress’ (1996)

The Spy class in Team Fortress started as an accidental glitch in the original ‘Quake’ mod. Sometimes, players would briefly appear as the wrong color to the enemy team, leading to surprising and successful infiltrations. The game developers realized this unexpected deception was fun, so they intentionally created the Spy class – a character specifically designed to disguise themselves as other players. This ability to trick opponents quickly became a key part of what made Team Fortress unique and enjoyable.

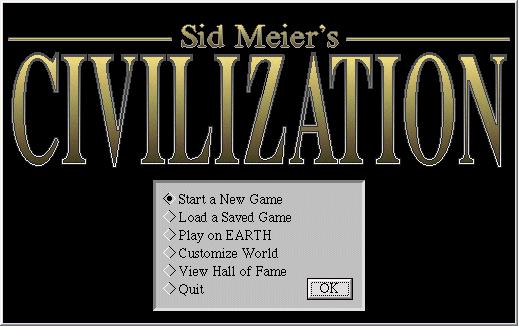

‘Civilization’ (1991)

Gandhi was originally designed to be the most peaceful leader in the game. However, a programming error occurred when he embraced democracy, causing his aggression level to drop below zero and unexpectedly reset to its highest possible value. This hilarious glitch transformed the peaceful Gandhi into a leader obsessed with nuclear weapons. The developers loved the unexpected result and kept it as an ongoing joke in subsequent versions of the game. ‘Nuclear Gandhi’ has since become a famous and beloved part of strategy game history.

‘Silent Hill’ (1999)

The original PlayStation couldn’t handle displaying faraway objects, so the game’s creators used a dense fog to mask the sudden appearance of things in the distance. Surprisingly, this technical workaround created a truly unsettling and lonely atmosphere, becoming a key part of what made the game scary. The fog became so well-known and beloved that it was kept in later games, even when the technology allowed for clearer views, and it’s now a signature part of the series’ look and feel.

‘The Elder Scrolls V: Skyrim’ (2011)

A glitch in the game ‘Skyrim’ caused players to be launched incredibly high into the air when killed by a giant’s ground slam attack. Players shared videos of this happening all over the internet and found it hilarious. Because it was so popular, the game developers, Bethesda, decided not to fix it for a long time. They eventually admitted the bug was actually a beloved feature, and it’s now remembered as a fun and unique part of the ‘Skyrim’ experience – often called the ‘giant space program’ by fans.

‘Mortal Kombat’ (1992)

A mysterious name, Ermac, started as a rumor among Mortal Kombat fans. It originally appeared as a result of a programming error – a glitch in the game’s code. Fans speculated it was a secret, playable character, and the developers eventually decided to make that speculation true. Ermac first appeared as a powerful, telekinetic ninja in ‘Ultimate Mortal Kombat 3’ and has been a popular character ever since.

‘Super Mario Bros.’ (1985)

Okay, so the multi-coin blocks? They actually started as a glitch! Apparently, sometimes blocks wouldn’t disappear after I hit them once. But the developers noticed players liked hitting them over and over for extra coins, so instead of fixing it, they leaned into it! Now they intentionally put these blocks in levels to encourage me to explore and find hidden stuff. It’s become a staple in pretty much every ‘Mario’ game since then – who doesn’t love finding a block you can hit a bunch of times?

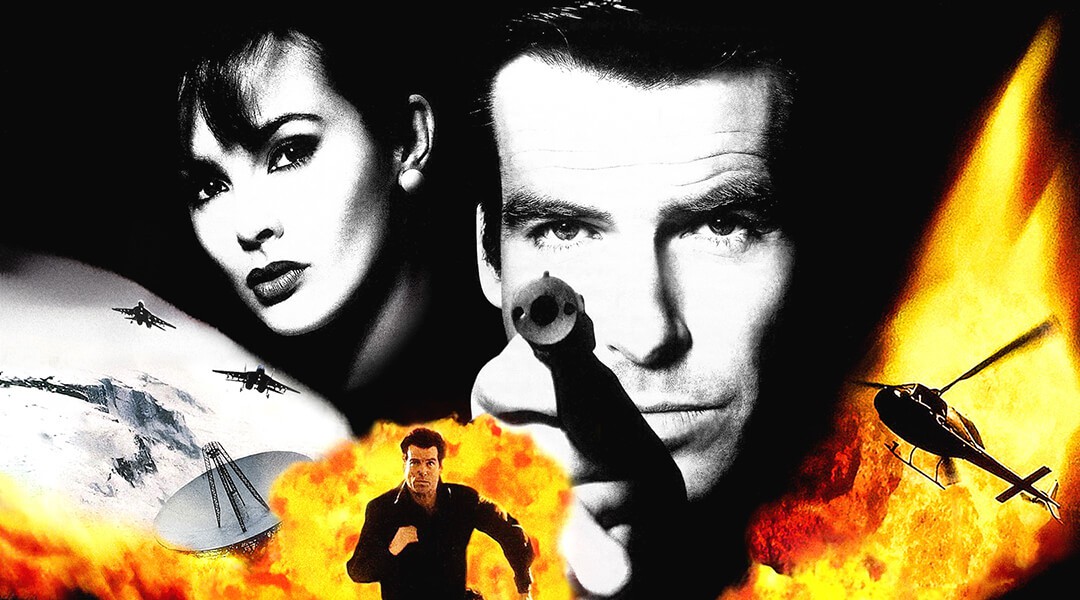

‘GoldenEye 007’ (1997)

Big Head Mode started as a simple tool for game developers to test how accurately headshots registered. They jokingly found the oversized heads on small bodies hilarious during testing. Instead of removing the feature, they cleverly hid it in the game as a fun cheat code. This inspired other shooting games to include similar, lighthearted visual effects. To this day, Big Head Mode is still a fondly remembered part of the classic Nintendo 64 game.

‘Tomb Raider’ (1996)

Lara Croft’s famously exaggerated proportions weren’t intentional. Lead designer Toby Gard accidentally made her breast size fifty percent larger while working on the character model. The rest of the team actually liked the change, believing it would help sell the game. This accidental design choice went on to define Lara Croft’s appearance for more than ten years and became a major topic of discussion surrounding the Tomb Raider series.

‘Metal Gear’ (1987)

I remember reading that Hideo Kojima initially set out to make a straightforward action game for the MSX2. But the system just couldn’t handle a lot of enemies appearing on screen at the same time without slowing to a crawl. So, he cleverly changed things up and focused on avoiding enemies instead of fighting them. It’s amazing to think that this limitation actually led to the birth of stealth action games! The series really pioneered the whole idea of sneaking around and using tactics – it truly defined the genre.

‘Sonic the Hedgehog’ (1991)

At first, the main character’s incredible speed caused problems for the game developers. The game’s graphics couldn’t always keep up, leading to visual errors. However, the team worked hard to improve the game engine, and eventually, the character’s speed became the game’s biggest strength. This challenge even led to the creation of Sonic the Hedgehog, who became well-known for the fast-paced gameplay that started as a technical fix.

‘DotA’ (2003)

Denying lets players intentionally kill their own units, stopping the enemy team from getting gold and experience. This started as a glitch in the original ‘Warcraft III’ game engine – players found they could damage their own units when they were almost defeated. Competitive players quickly realized this could be a useful tactic to control areas of the map, and it was later turned into an official feature in games like ‘Dota 2’.

‘Counter-Strike’ (2000)

Bunny hopping is a technique where players repeatedly jump to build up and keep their speed. It started as an unintended quirk in older game engines that didn’t limit how fast players could move in the air. Competitive players quickly learned to use this to move much faster than the game designers intended. Though it’s been adjusted in newer versions, bunny hopping is still a well-known skill among players. Many modern shooting games let developers choose whether or not to allow this fast movement.

‘Super Smash Bros. Melee’ (2001)

Wavedashing is a move where players quickly slide across the stage by air dodging diagonally downwards. The game developers noticed this technique during the final months of development but decided to leave it in. It ultimately became a key part of the game’s competitive community, allowing players to move around rapidly without losing access to their normal attacks. Many believe wavedashing is the main reason the game remained popular in the competitive scene for so long.

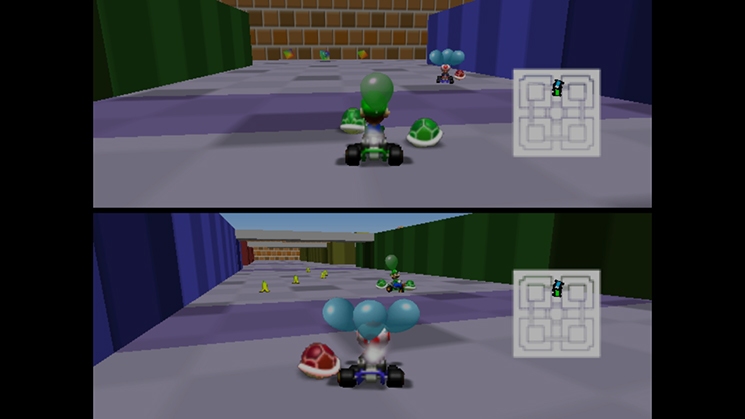

‘Mario Kart 64’ (1996)

Mini turbos are speed boosts players earn by drifting. Originally, this happened by accident due to how the game calculated friction when turning. Clever players discovered they could use this to go faster. The game developers then improved the visual cues and turned it into a key feature. Now, drifting and using mini turbos are the most important skills to master in the game.

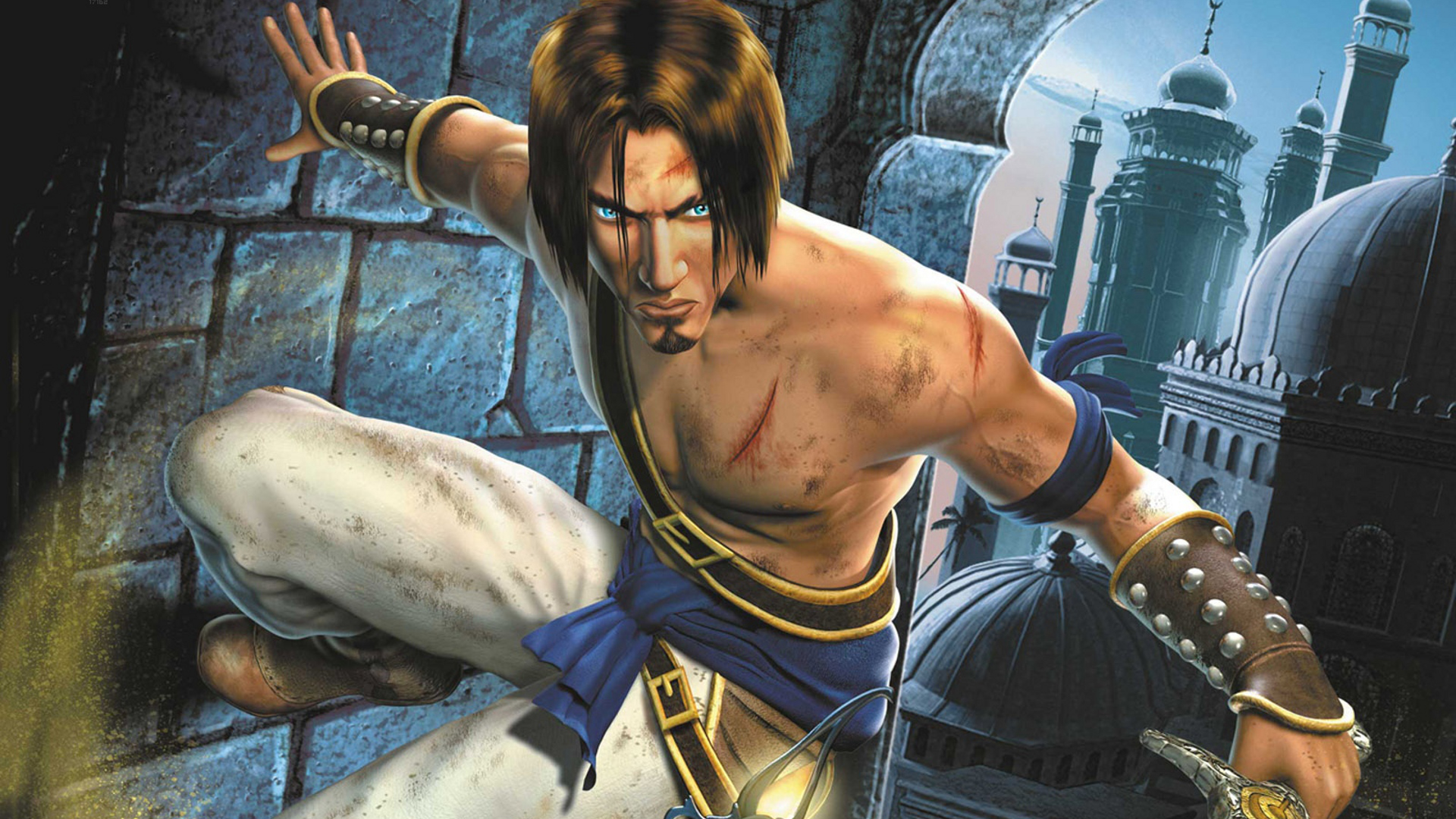

‘Prince of Persia: The Sands of Time’ (2003)

The game’s time rewind feature started as a solution to the often-frustrating instant deaths common in platforming games. While testing, developers had a tool to roll back the game to fix bugs. They quickly realized that letting players use this tool could make the game experience both unique and more enjoyable. This idea eventually became the core of the game, embodied by the Dagger of Time, and helped turn a standard platformer into a fresh puzzle-action game.

‘Halo 2’ (2004)

Sword flying was a popular glitch in the game that let players travel long distances quickly. It worked by quickly switching between a sword attack and another weapon, which messed with the game’s targeting and allowed for incredibly fast movement. Players who speedrun the game used this to skip large parts of it and avoid tough enemies. The game developers at Bungie later recognized these kinds of movement techniques and even added official tools to help players get around the game world. Sword flying is still remembered as one of the most well-known glitches in the game’s history.

‘Apex Legends’ (2019)

Tap strafing is a technique players use to quickly change direction while airborne without slowing down. It works because of how the game processes fast-paced movement commands. The game developers, Respawn Entertainment, originally thought it was a bug and planned to remove it, but strong feedback from players convinced them to keep a slightly altered version. Now, it’s seen as an advanced skill used by competitive players on some platforms.

‘Fortnite’ (2017)

Players discovered a fun and unexpected way to move around the game: by standing on top of a rocket-propelled grenade as it flew through the air. While this wasn’t what the game developers, Epic Games, originally planned, they were impressed by the creative videos and gameplay it created. Instead of fixing it, they decided to keep ‘rocket riding’ in the game and even improved how it looked with special animations. Now, it’s become a popular and exciting part of the game’s fast-paced battles.

‘Destiny’ (2014)

Man, I remember the Loot Cave! It was this crazy spot where you could just endlessly kill the same enemies over and over to get tons of loot because they respawned so quickly. Bungie eventually fixed it, of course, but they actually acknowledged how much fun everyone had with it. They put a little pile of bones in the cave that makes a sound when you walk over it – it’s like a memorial to the glitch and all of us who took advantage of it! It’s cool to see they’ve done similar things in later updates, remembering the game’s history and little moments like that.

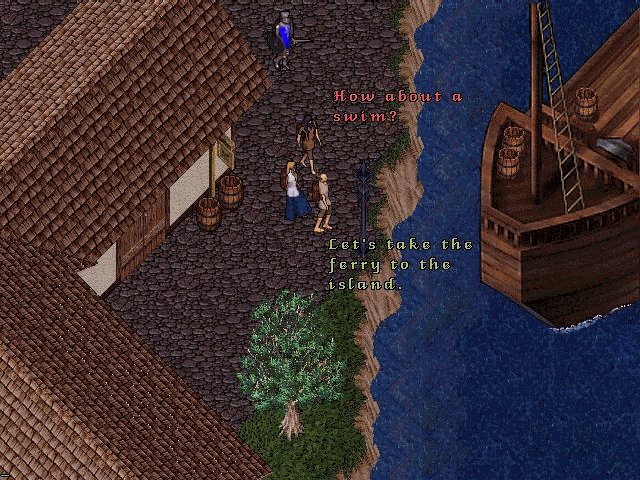

‘Ultima Online’ (1997)

The game’s economy was initially shaped by unexpected problems with item management. Players discovered ways to unfairly create extra gold and valuable items, forcing the game creators to reconsider how they controlled scarcity. These economic issues prompted them to build better trading systems and ways to remove gold from circulation. The mistakes made early on ultimately helped lay the groundwork for how many large online games are designed today, and it’s still used as an example for developers managing virtual economies.

‘Warcraft III’ (2002)

Initially, hero characters weren’t very influential in gameplay. Problems discovered during testing led the developers to redesign them, focusing on the concept of characters that could grow stronger and gain new abilities. This change dramatically altered the traditional real-time strategy experience and, importantly, laid the groundwork for the popular multiplayer online battle arena (MOBA) genre.

‘Borderlands’ (2009)

Loot midgets are small enemies that jump out of containers to startle and attack players. They originally appeared due to a glitch where enemies would sometimes appear very small inside loot crates. The developers liked how surprising this was and decided to make it a deliberate part of the game. Now, these little enemies are a popular feature in every game, and they even have a higher chance of dropping rare items!

‘Gears of War’ (2006)

The game features an ‘active reload’ system where players can reload their weapons faster by pressing a button at just the right moment. This was originally created to fix some timing issues the developers noticed during testing. It turns a normally automatic process into something that requires skill, and successfully timing the reload even gives the bullets a temporary damage boost. This active reload has become a signature feature of the game series since it first appeared.

‘Super Mario 64’ (1996)

Originally, a glitch in the game allowed Mario to bounce off walls and reach higher areas. The developers realized this could be useful, so they improved the animation and made it an intentional move. This technique changed 3D platforming games by adding a new way to move upwards and remains a beloved part of the Mario series.

‘Metroid’ (1986)

Bomb jumping is a technique in the Metroid series where players use Samus’s bombs to launch her Morph Ball form into the air. It started as a glitch – an unexpected result of how the game calculated bomb explosions and Samus’s movements. Players quickly discovered they could string together these jumps to reach areas much earlier than intended. Instead of fixing it, Nintendo embraced the technique, even building later levels around it to encourage skilled players. Bomb jumping has since become a well-known example of ‘sequence breaking’ – completing a game out of the intended order – in video games.

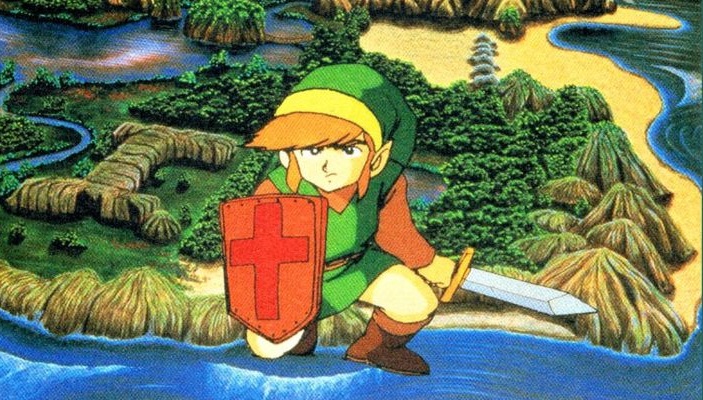

‘The Legend of Zelda’ (1986)

Players were able to explore dungeons in any order because the original game code wasn’t overly restrictive. Clever players discovered ways to overcome obstacles using items in unexpected ways. Shigeru Miyamoto and his team noticed this freedom was actually more fun than forcing players down a single path. They decided to lean into this open-ended exploration, which became a defining feature of the series, ultimately leading to the vast freedom found in the latest games.

‘World of Warcraft’ (2004)

The ‘Corrupted Blood’ incident was a virtual plague that started with a mistake in a difficult boss battle. A negative effect from the boss was supposed to be limited to the battle area, but players managed to spread it to cities within the game. This caused a widespread epidemic, killing off many lower-level characters. Interestingly, researchers studied the way the virtual plague spread to better understand how real-world diseases are transmitted. Later, the game developers, Blizzard, created a memorial for the event and began including similar large-scale events in the game.

‘Rocket League’ (2015)

Originally, the game wasn’t designed around players flying with their cars. However, the game’s physics allowed for it – if players used a boost while angled upwards, their car could take to the air. Players rapidly learned to control this and started making impressive aerial shots. The developers were amazed by how skilled the community became and responded by improving the camera and controls to fully support this new style of play, which has now become the foundation of competitive matches.

‘Tekken’ (1994)

Wave dashing is a tricky move in the game that lets players quickly move forward by canceling their crouch. It can throw opponents off balance and allows for fast changes in position. The game developers at Namco chose to keep this move, even though it was originally a glitch, because it added a lot of depth to the game’s movement. It’s become a trademark move for characters like the Mishima family, and competitive players often spend hundreds of hours perfecting it.

‘Street Fighter’ (1987)

The original game in this series had a flaw that made it surprisingly easy to pull off special moves. The timing for these moves wasn’t consistent, often leading to moves happening too early or too late. While the developers fixed this inconsistency in the next game, they kept the idea of needing to perform precise, complex motions. Surprisingly, this accidental complexity became the standard way special attacks are done in most fighting games today. It means there’s a skill gap – players need good hand-eye coordination and fast reflexes to master them.

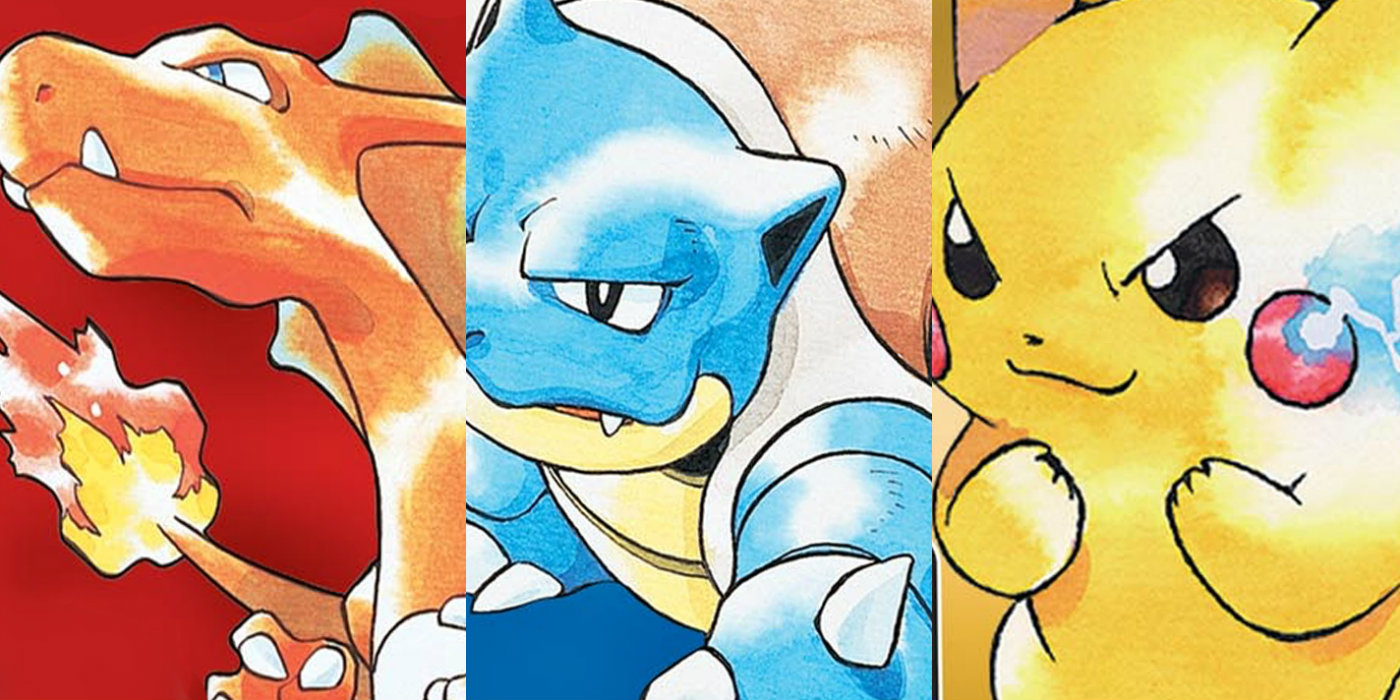

‘Pokémon Red’ (1996)

MissingNo was a glitch in the original Pokémon games caused by the game trying to load Pokémon data that didn’t exist in certain areas. Players quickly found out that encountering MissingNo would duplicate an item they were holding in their inventory. Though it was just a programming error, it became a beloved legend within the Pokémon community and even inspired how later games included hidden secrets. Nintendo officially documented the glitch, and it’s now considered one of the most well-known accidental creations in video game history.

‘Bloodborne’ (2015)

As a big fan of this game, I’ve been amazed by how much you can skip using some really clever jumps – we call them ‘glitches’. It’s kind of a tradition with FromSoftware; they often leave in these tricky shortcuts if you’re skilled enough to find them. These glitches have become huge in the speedrunning scene, and it’s awesome because the developers sometimes even hide rewards in the areas you can only reach by glitching! It’s like there’s a whole other layer to the game, where everyone’s trying to find new ways to break it and discover secrets. It’s really cool that they acknowledge and even encourage it!

‘Left 4 Dead’ (2008)

The AI Director controls how quickly the game’s action unfolds by generating enemies based on how well the player is doing. Initially, there were problems with the system causing too many enemies to appear at once and in unexpected ways. Surprisingly, testers loved these intense, chaotic moments. The developers then adjusted the system on purpose to create these peaks of excitement, leading to a horror game that feels fresh and unpredictable with each playthrough.

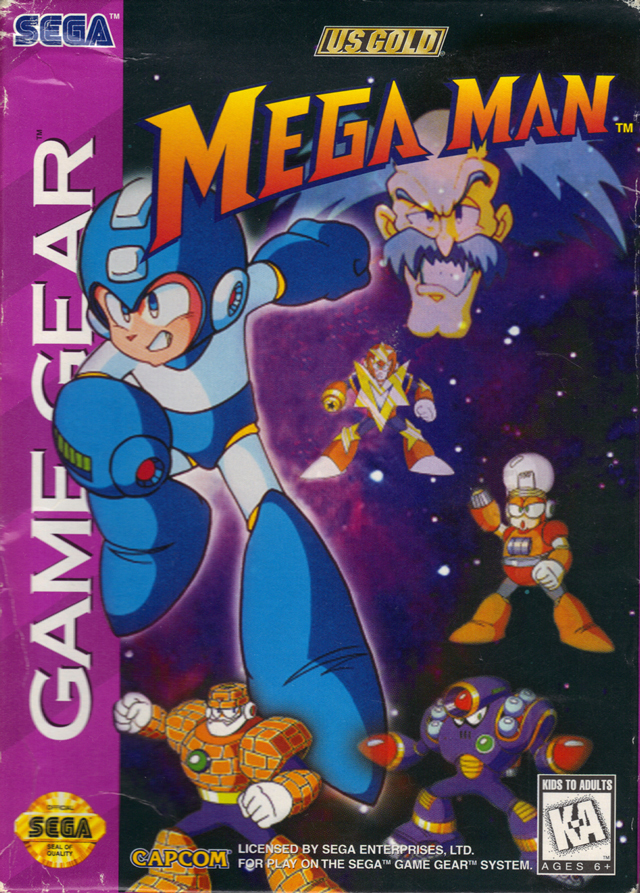

‘Mega Man’ (1987)

A glitch in the game allowed players to repeatedly hit bosses with just one attack by quickly pausing and unpausing. This happened because the area where the attack connected stayed active even when the game was frozen. It became a well-known strategy for defeating tough bosses like the Yellow Devil. Though it was a bug, it’s become a memorable part of the game’s history and is still talked about by fans. Some newer games inspired by this one even include similar features as a tribute.

‘Spyro the Dragon’ (1998)

A glitch called ‘double jump gliding’ let players jump much higher than originally intended in Spyro, letting them reach faraway areas and collect items before they were supposed to. The developers noticed this actually made the game more enjoyable, so instead of fixing it, they tweaked the levels to make sure it didn’t ruin the game’s overall flow. This unexpected feature ultimately helped establish Spyro as a platformer known for its open-ended exploration and emphasis on jumping.

‘Diablo’ (1996)

Early online play in this action role-playing game was heavily affected by a bug that allowed players to duplicate items. If two actions happened at the same moment as picking up an item, it would be copied. This caused problems for the game’s economy, but ultimately led to the creation of much safer, server-based inventory systems. Blizzard used the knowledge gained from these exploits to build the reliable infrastructure for ‘Diablo II’. It also fostered a black market that older players still talk about today.

‘Castlevania: Symphony of the Night’ (1997)

Shield dashing is a technique in Castlevania: Symphony of the Night where players can quickly move forward by cleverly using Alucard’s shield during a backdash. This allowed for fast travel around the castle and skipping difficult jumps. The game developers knew about this and other similar glitches, but intentionally left them in the game to support the speedrunning community. This decision proved successful, helping the game build a loyal fanbase that continues to this day, and shield dashing is now considered a key skill for advanced players.

‘Battlefield 1942’ (2002)

A surprising discovery in the game allowed players to stand on the wings of airplanes mid-flight without falling. Players quickly began performing impressive stunts and even using this to help teammates move around. The game developers loved the creative videos the community shared and decided to keep this unexpected feature. It became a signature element of the game, known for its unpredictable and fun moments. The latest games in the series continue to include similar ways for players to interact with vehicles.

‘Titanfall 2’ (2016)

Slide hopping is a technique where players chain slides and jumps together to keep up their speed. It happened because of how the game calculates friction during slides, and players quickly discovered they could use it to move incredibly fast around the maps. The developers liked how it added to the game’s quick action, so they kept it in. Now, mastering slide hopping is essential for competitive players.

‘Hollow Knight’ (2017)

Pogo jumping lets players bounce off enemies and spikes by hitting down with their weapon. It started as a way to attack, but players quickly discovered they could use it to get over tricky parts of the game. The developers then created hidden areas specifically designed around this technique, making it a well-known way to move around. It’s a feature that encourages players to be accurate and skilled with the game’s combat system.

Tell us which of these accidental game mechanics is your favorite in the comments.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Monster Hunter Stories 3: Twisted Reflection launches on March 13, 2026 for PS5, Xbox Series, Switch 2, and PC

- Here Are the Best TV Shows to Stream this Weekend on Paramount+, Including ‘48 Hours’

- 🚨 Kiyosaki’s Doomsday Dance: Bitcoin, Bubbles, and the End of Fake Money? 🚨

- ‘The Substance’ Is HBO Max’s Most-Watched Movie of the Week: Here Are the Remaining Top 10 Movies

- First Details of the ‘Avengers: Doomsday’ Teaser Leak Online

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- The 11 Elden Ring: Nightreign DLC features that would surprise and delight the biggest FromSoftware fans

- Noble’s Slide and a Fund’s Quiet Recalibration

2026-02-13 00:50