Now, listen closely, because this is a tale of enormous sums of money, whizzpopping technology, and a rather peculiar wobble in the stock market. It seems the grown-ups are in a frightful fluster over something they call “AI,” which, as far as I can gather, is a sort of electronic brain that’s supposed to do all the thinking for them. A lazy invention, if you ask me.

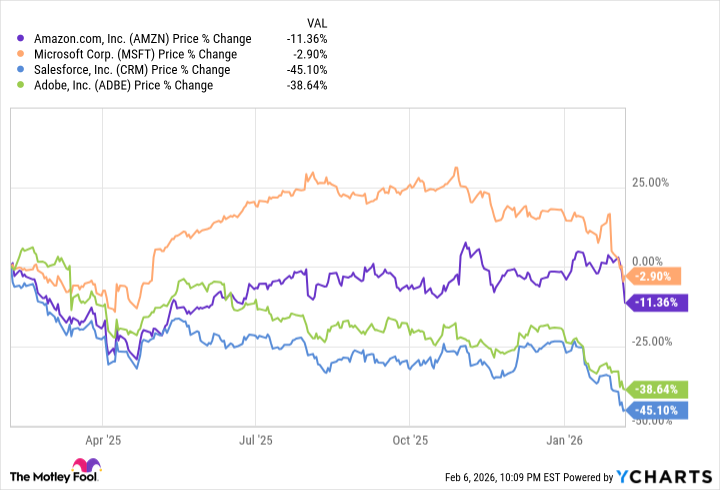

The big chaps at companies like Amazon and Microsoft are spending fortunes – absolutely mountains of money – building these electronic brains. They’re erecting these enormous “data centers,” which sound suspiciously like dungeons for numbers, and everyone’s getting a bit twitchy. Amazon, you see, announced plans to splurge two hundred billion dollars by 2026. A truly ghastly amount! The stock price promptly did a little jig downwards, tumbling about nine percent this year. Microsoft isn’t faring much better, despite all their bluster. They’re spending a similar sum, and their stock has also taken a bit of a knock.

But the real bother, the truly peculiar part, is what’s happening to the software companies. Firms like Salesforce and Adobe – purveyors of digital doohickeys and fancy spreadsheets – are suddenly looking rather pale. The grown-ups are whispering about a “SaaSpocalypse” – a frightful name, isn’t it? – suggesting that these clever electronic brains will make all their software utterly useless.

The idea, you see, is that these AI contraptions will become so astonishingly capable, so frightfully efficient, that companies won’t need to buy software anymore. They’ll simply have the brains do everything for them. A rather bleak prospect for those who sell the software, wouldn’t you say? It’s a bit like inventing a machine that makes shoelaces unnecessary – all those shoelace makers would be in a pickle.

Now, history tells us that these sorts of panics are rarely sensible. Is this AI really so all-powerful that it’s going to wipe out an entire industry? Or is it all a bit of hot air, a puffed-up exaggeration? Some wise old chap at Nvidia, a fellow named Jensen Huang, has called this “SaaSpocalypse” nonsense – rather bluntly, I thought. He points out that software isn’t just about simple tasks; it’s about specialized knowledge, industry secrets, and all sorts of fiddly bits that a general-purpose brain can’t easily replicate.

More likely, he suggests, is that these AI brains will work with the software, making it even better. A bit like a clever assistant helping a master craftsman. If you believe that, then this software sell-off is a rather splendid opportunity to snap up some bargains. And that’s where this “iShares Extended Tech-Software ETF” comes in. It’s a bit like a treasure chest filled with shares in all sorts of software companies.

A Dip in the Digital Pond

This “iShares” thing – a rather clumsy name, if you ask me – is a collection of 114 North American software companies. It’s stuffed with big names like Microsoft, Palantir (a rather mysterious firm, that one), Salesforce, Oracle, and Intuit. It’s been doing rather well for itself over the years, delivering an average annual return of 10.4% since 2001. Not bad, not bad at all.

It does cost a tiny bit to own – a fee of 0.39% – but that’s a small price to pay for a piece of the digital pie. It’s currently trading at a price-to-earnings ratio of 35.2, which is a little bit higher than the tech-heavy Nasdaq-100 index (32.4). But if you think the software sell-off is overdone, it’s a rather clever way to bet against the “SaaSpocalypse.”

Of course, investing always carries a risk. The market is a fickle beast, and things can change in a flash. But if you’re a sensible sort, and you believe in the power of good software, this little treasure chest might just be worth a look.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Monster Hunter Stories 3: Twisted Reflection launches on March 13, 2026 for PS5, Xbox Series, Switch 2, and PC

- Here Are the Best TV Shows to Stream this Weekend on Paramount+, Including ‘48 Hours’

- 🚨 Kiyosaki’s Doomsday Dance: Bitcoin, Bubbles, and the End of Fake Money? 🚨

- Gold Rate Forecast

- ‘The Substance’ Is HBO Max’s Most-Watched Movie of the Week: Here Are the Remaining Top 10 Movies

- First Details of the ‘Avengers: Doomsday’ Teaser Leak Online

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- The 11 Elden Ring: Nightreign DLC features that would surprise and delight the biggest FromSoftware fans

- 20 Films Where the Opening Credits Play Over a Single Continuous Shot

2026-02-12 22:34