We often put celebrities on a high pedestal, but some well-known male actors have gained reputations for being unpleasant in person. While fans hope for a positive experience, reports suggest these actors can be dismissive, cold, or even rude. These accounts come from people who’ve interacted with them – former coworkers, fellow actors, and members of the public – not during filming, but in real life. Recognizing this contrast helps us see the person behind the public image.

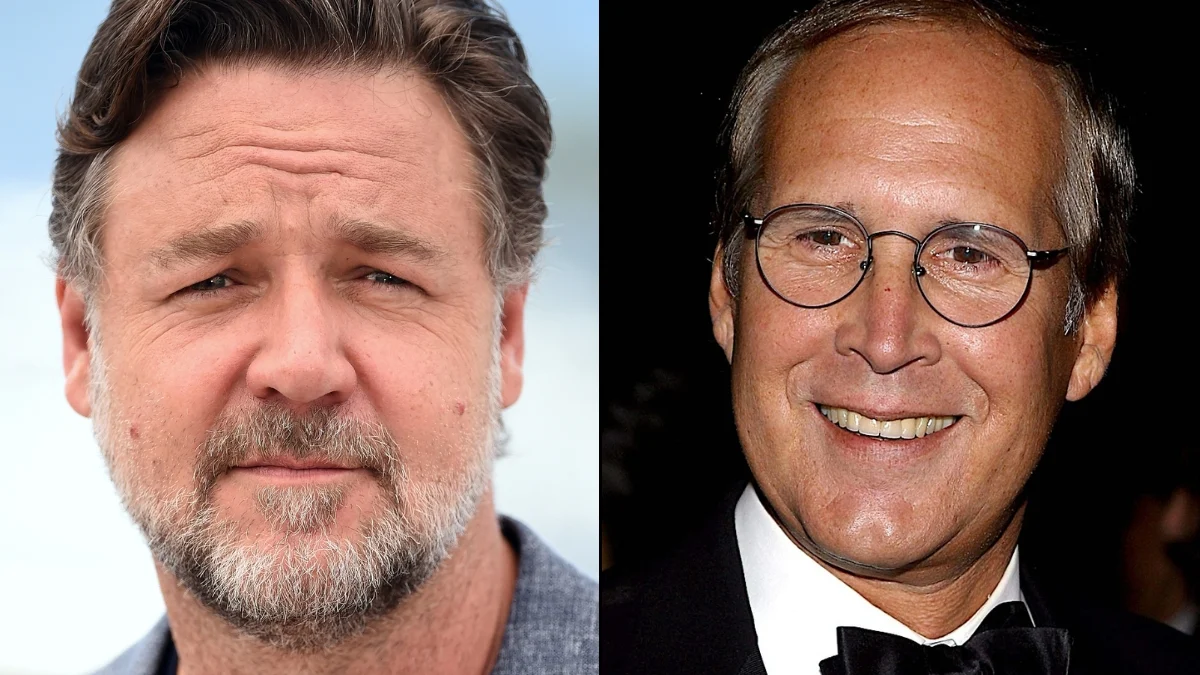

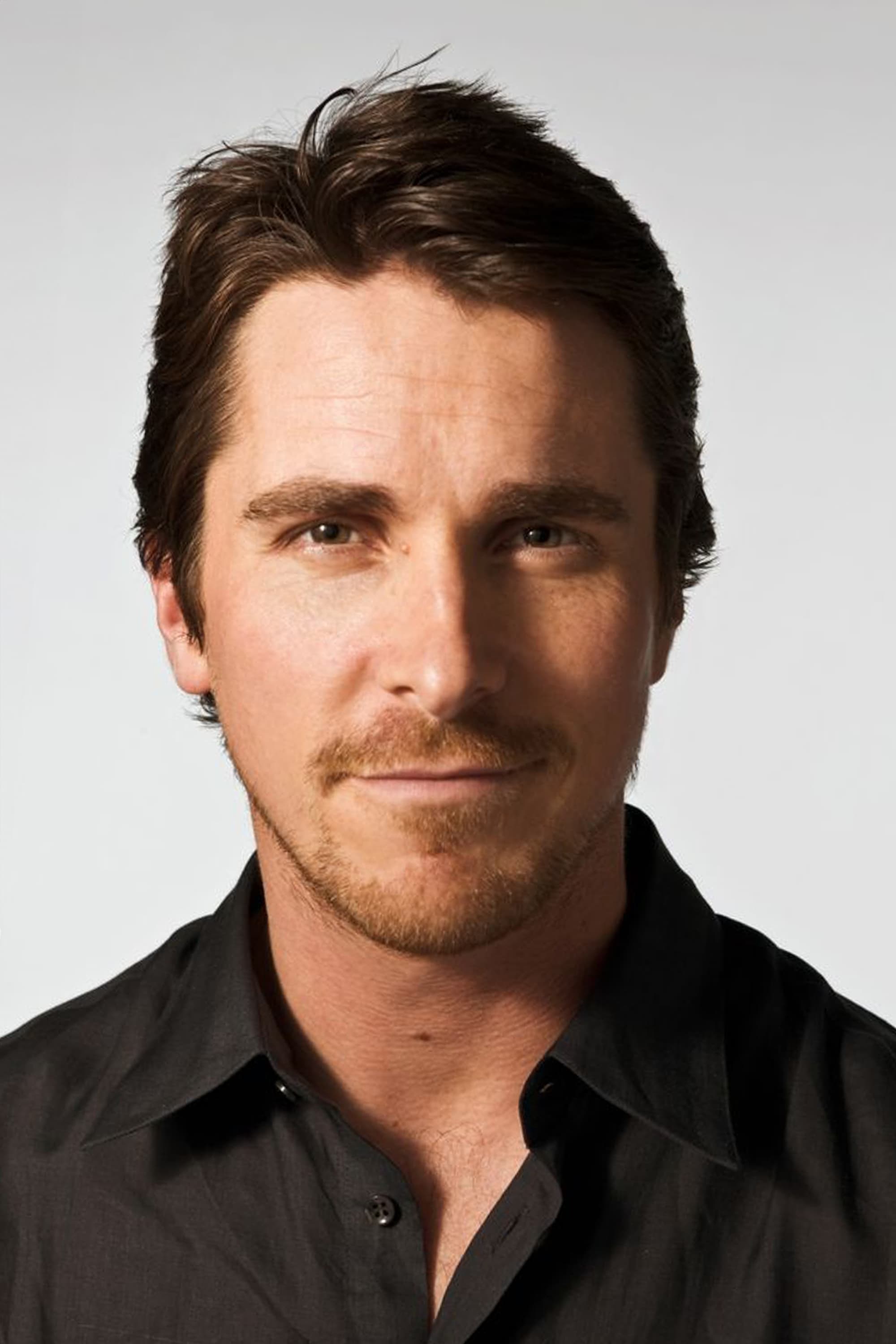

Christian Bale

Christian Bale, the actor famous for his role in ‘American Psycho,’ has often been described as demanding and difficult to work with. Stories from former staff and fans detail instances where he seemed dismissive or impatient, particularly when approached for autographs or during public appearances. A recording from the set of ‘Terminator Salvation’ revealed a heated argument, further solidifying his reputation. Although widely praised for his commitment to acting, he’s often seen as having little patience with fans and the public.

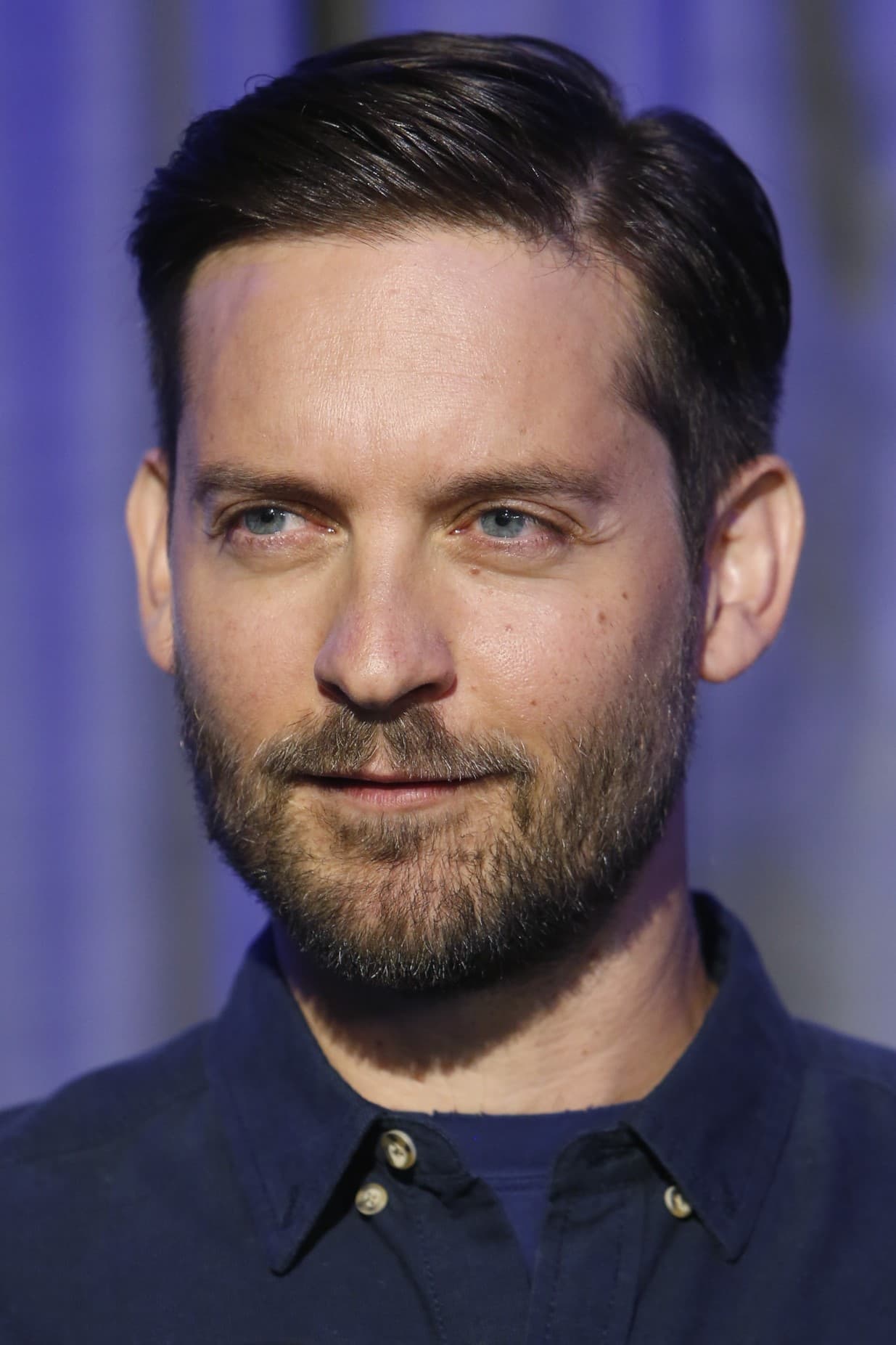

Tobey Maguire

Tobey Maguire, who played Spider-Man in the early 2000s, has a reputation among fans for being distant and unfriendly. Many people have shared stories about him refusing to acknowledge or interact with fans, sometimes responding rudely to requests for photos. His behavior even reportedly inspired a villainous character in the movie ‘Molly’s Game,’ which was based on poker games he participated in. Generally, those who have met him describe him as cold and uninterested in connecting with his fans.

Bruce Willis

Bruce Willis has a reputation for being challenging to work with and often appears distant with fans and the media. Director Kevin Smith described a particularly negative experience working with him, and many fans have shared stories of similar encounters, noting his lack of enthusiasm or even dismissive behavior. This cool and detached public image has been a consistent part of his persona for years.

Mike Myers

The creator of popular comedies like ‘Shrek’ and ‘Wayne’s World’ is known for being a perfectionist, and can be hard to satisfy. People who have met him often say he seems withdrawn and doesn’t make much eye contact, especially with fans. Those who’ve worked with him describe him as very demanding, both on set and in his personal life. Though his movies are funny and endearing, he’s often seen as reserved and difficult in person.

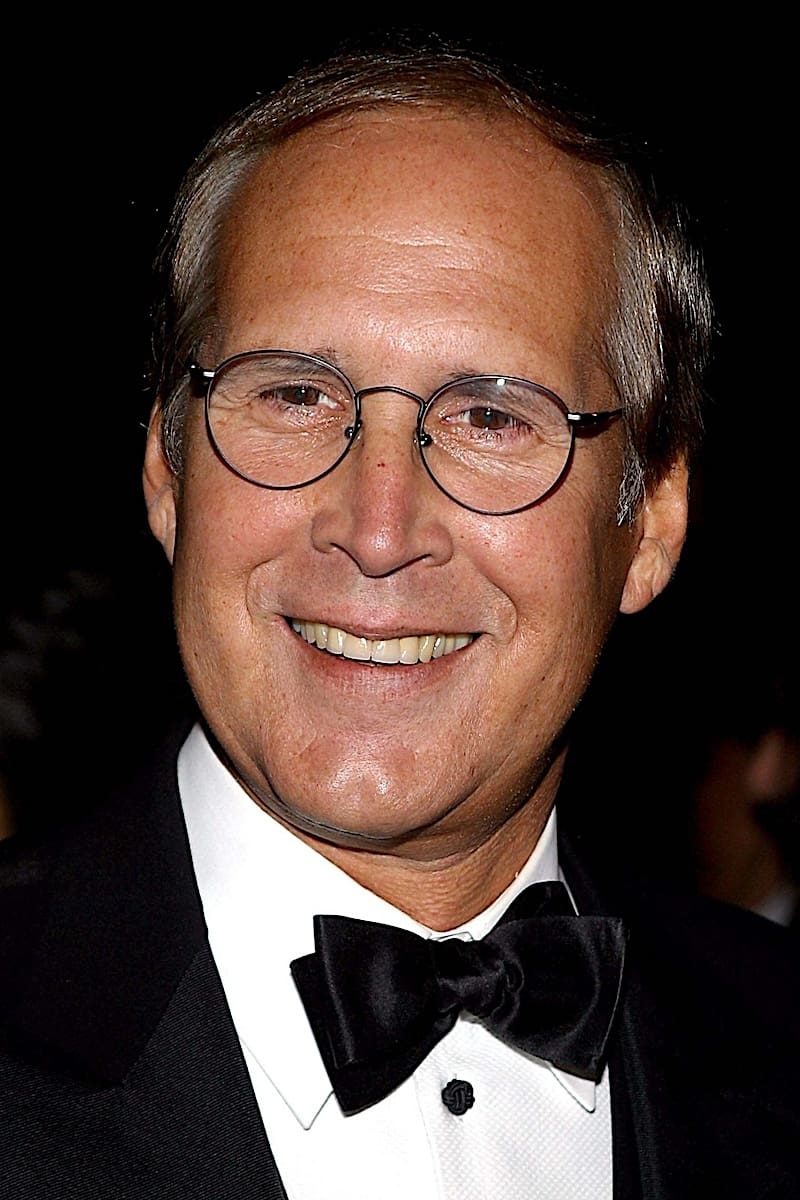

Chevy Chase

The actor known for his role in ‘Caddyshack’ has gained a reputation for being difficult due to numerous disagreements and clashes with others, both professionally and personally. He’s publicly feuded with former colleagues from ‘Saturday Night Live’ and ‘Community’, and fans often describe him as condescending and sarcastic at public appearances. This consistently abrasive behavior has led many to consider him one of the most challenging personalities in Hollywood.

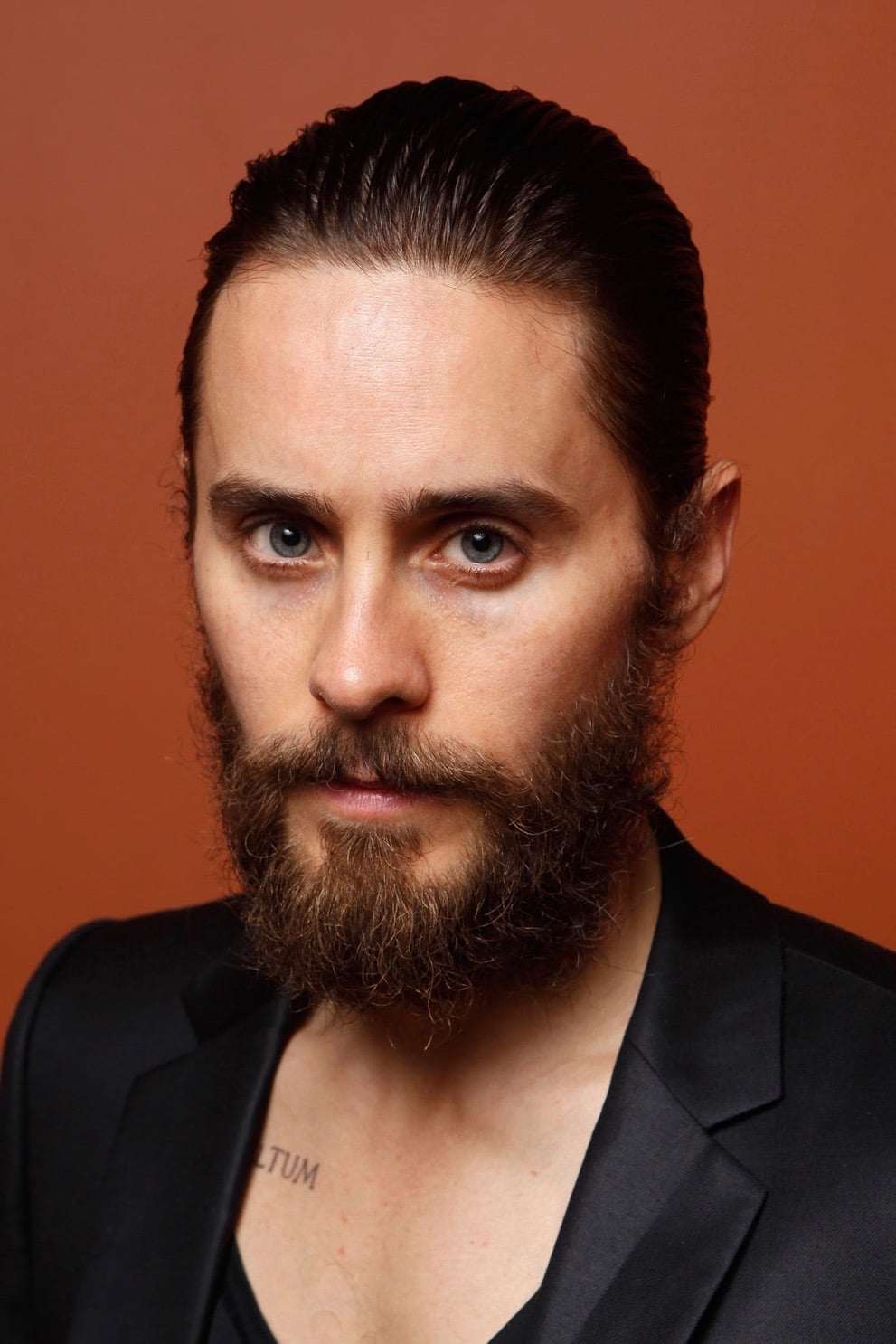

Jared Leto

Jared Leto, known for his acting and music, has faced criticism for how he interacts with people. While promoting ‘Suicide Squad,’ his dedication to his role reportedly made both his co-stars and fans uncomfortable. Concert attendees have described instances where he seemed dismissive or talked down to the audience, and he’s often been labeled as self-centered in accounts of his interactions with fans.

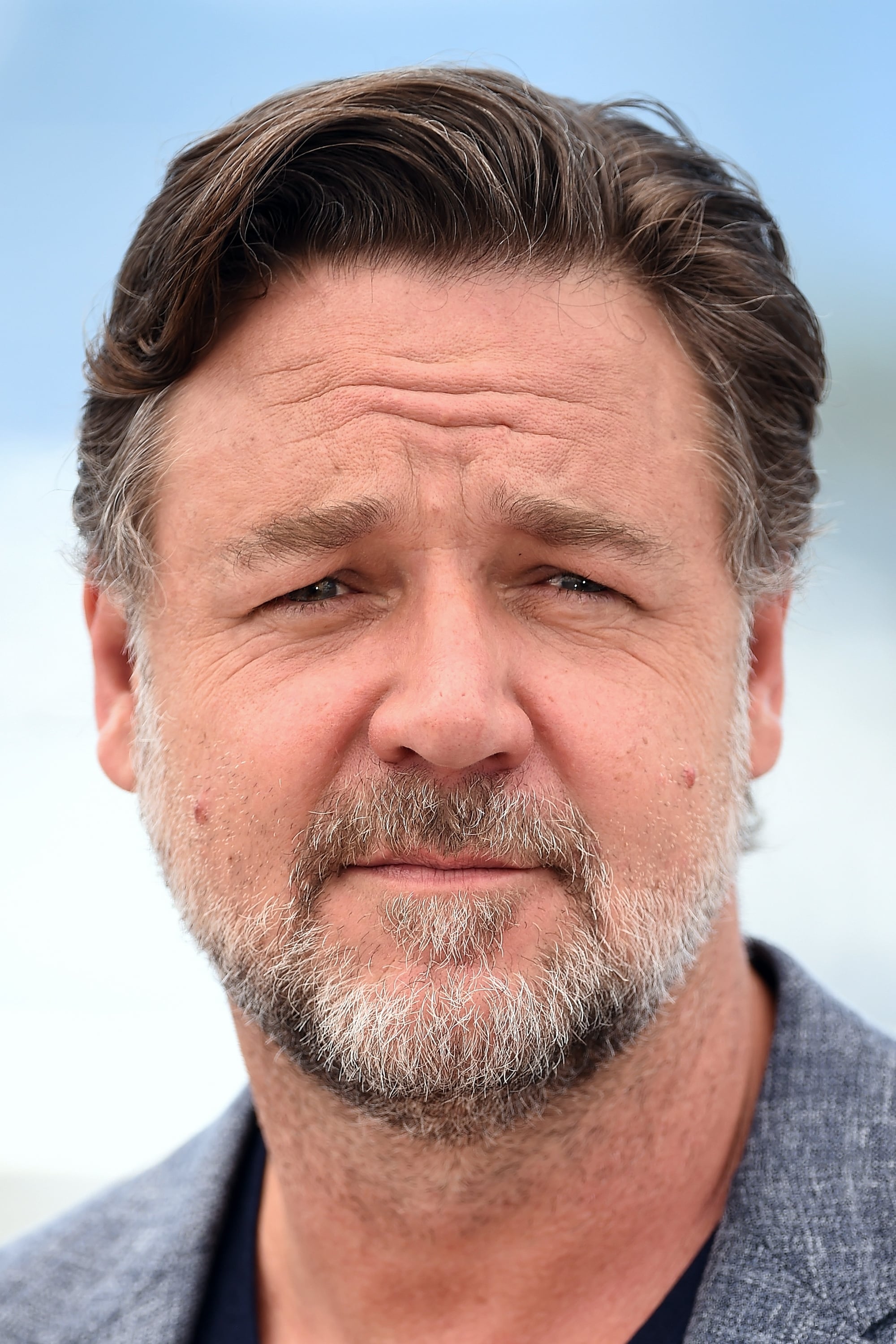

Russell Crowe

Russell Crowe, the star of ‘Gladiator,’ is known for having a quick temper and has sometimes gotten into arguments with people in public. There have been several reported incidents of him being physically and verbally confrontational. Fans often say he can be impatient and dismissive when approached outside of work. Despite his success as an actor, these outbursts have made him a somewhat controversial figure when it comes to interacting with fans.

William Shatner

William Shatner, famous for playing Captain Kirk in ‘Star Trek,’ has a challenging relationship with his fans. Many have said he seems uninterested or even unfriendly when meeting them at conventions. Some colleagues have also spoken out about his ego and how he’s treated people both on and off set. Despite being a beloved figure, stories about his dismissive attitude towards his devoted fans keep surfacing.

Val Kilmer

Val Kilmer quickly became known as a challenging actor to work with, even early in his career, as seen on films like ‘The Island of Dr. Moreau’. Directors and crew often described him as uncooperative, a trait that extended to how he interacted with fans. During his most famous period, many found him arrogant and unwilling to be friendly or chat. His deep dedication to roles, such as his portrayal in ‘The Doors’, sometimes made him seem distant and unapproachable.

Tell us about your own experiences meeting famous actors in the comments.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Monster Hunter Stories 3: Twisted Reflection launches on March 13, 2026 for PS5, Xbox Series, Switch 2, and PC

- Here Are the Best TV Shows to Stream this Weekend on Paramount+, Including ‘48 Hours’

- 🚨 Kiyosaki’s Doomsday Dance: Bitcoin, Bubbles, and the End of Fake Money? 🚨

- ‘The Substance’ Is HBO Max’s Most-Watched Movie of the Week: Here Are the Remaining Top 10 Movies

- First Details of the ‘Avengers: Doomsday’ Teaser Leak Online

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- The 11 Elden Ring: Nightreign DLC features that would surprise and delight the biggest FromSoftware fans

- 20 Films Where the Opening Credits Play Over a Single Continuous Shot

2026-02-12 21:15