As a film critic, I’ve always known Hollywood runs on who you know, but lately, something interesting has been happening. More and more actors are actually speaking out about what goes on behind the scenes. It’s unusual – there’s an unspoken rule to keep things quiet – but these performers are publicly airing grievances with the studios, from disagreements over casting and story choices to complaints about crazy work hours. It’s giving us a rare look at the tension that exists within the system. I’m going to focus on the male actors who’ve been brave enough to publicly critique the very companies that funded their careers.

Robert Pattinson

When the ‘Twilight’ movies were most popular, Robert Pattinson often openly criticized them and the way the studio promoted the series. He frequently made jokes in interviews about the plot’s confusing parts and the extreme level of fame the films created. Even though he was the star of the franchise, he didn’t hide his disagreements with the creative direction. This honesty became a signature part of his interviews for the later ‘Twilight’ films, and it was a surprising contrast to the carefully crafted image usually presented by leading actors in big-budget movies.

Ray Fisher

After his time working on ‘Justice League’, the actor publicly criticized Warner Bros., focusing his accusations of inappropriate and unprofessional conduct towards the studio’s leaders and director Joss Whedon. His decision to speak out sparked an internal investigation and a continuing public debate about the company’s work environment. He consistently voiced his concerns, frequently using social media to call out executives for past behavior. Ultimately, this led to his dismissal from his part in ‘The Flash’.

John Boyega

Following the end of the latest ‘Star Wars’ trilogy, John Boyega publicly criticized Disney and Lucasfilm for not giving enough attention to the characters played by actors of color. He felt the studio didn’t have a clear plan for his character, Finn, after initially presenting him as a key player in ‘The Force Awakens’. Boyega pointed out that characters of color often seemed to be moved to the background while white characters took center stage. His statements led to a broader discussion about diversity and representation in big Hollywood franchises, and he later explained that these experiences influenced his choices for future projects outside of Disney and Lucasfilm.

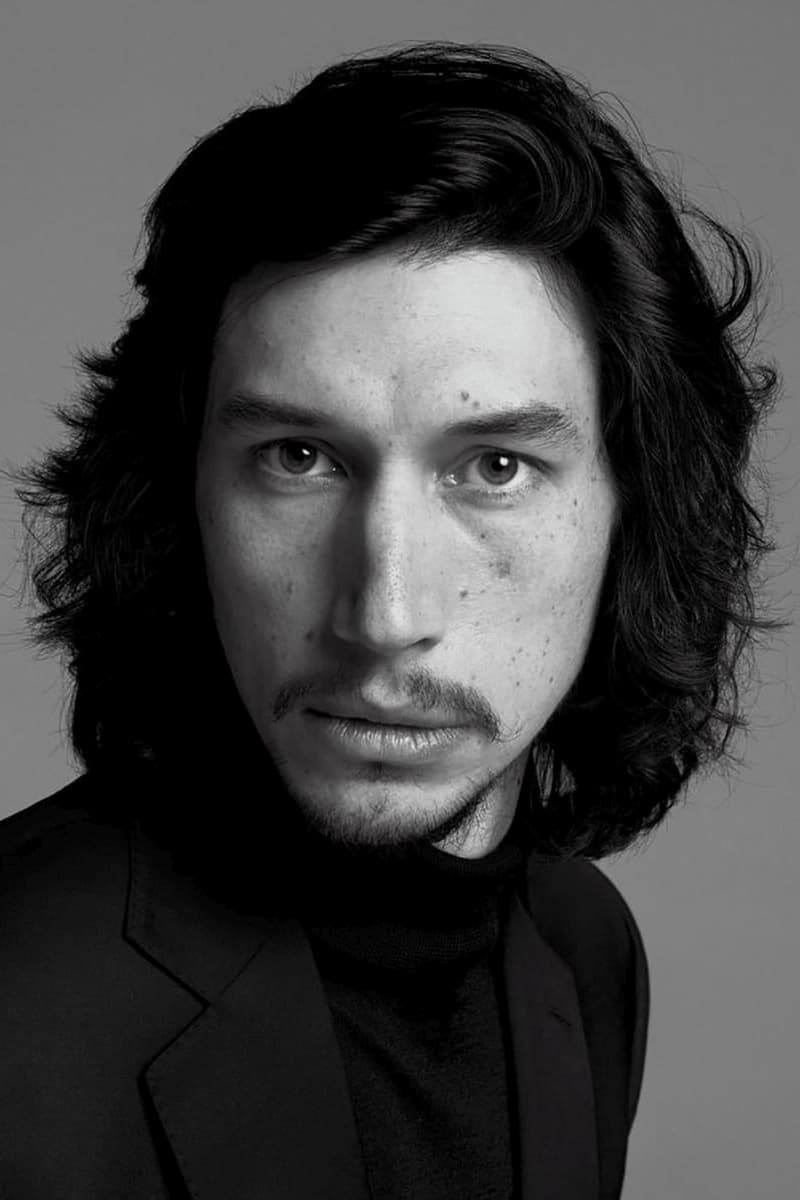

Adam Driver

During film festivals in 2023, Adam Driver publicly criticized major streaming services like Netflix and Amazon. He pointed out that smaller, independent production companies were able to meet the demands of the actors’ union (SAG-AFTRA), while the large studios claimed they couldn’t. He used the ‘Ferrari’ movie promotion to draw attention to the difference between the high profits of these companies and the pay actors receive. This made him a leading advocate for actors’ rights and fair labor practices.

Edward Norton

Edward Norton is known for being very involved in the creative process, and this led to disagreements with Marvel Studios while finishing ‘The Incredible Hulk’. He wanted a longer version of the film that focused more on character development, but the studio didn’t agree. After the movie came out, Norton stepped away from the project and the wider Marvel Cinematic Universe. Marvel publicly stated they needed an actor who was more of a team player, which confirmed the strained relationship. This disagreement remains a well-known example of a leading actor having a public conflict with a major movie studio.

Shia LaBeouf

After ‘Indiana Jones and the Kingdom of the Crystal Skull’ came out, Shia LaBeouf said he felt he hadn’t lived up to the standards of the Indiana Jones movies. He believed the film’s problems were partly due to decisions made by Paramount and director Steven Spielberg, specifically that they prioritized flashy effects over a good story. His frankness about this reportedly caused tension with the studio and other people he worked with for a long time. Later, he explained that he felt pressured by the studio to fit a certain image, which he found creatively limiting.

Channing Tatum

As a film fan, I’ve always been fascinated by what goes on behind the scenes, and Channing Tatum’s honesty about ‘G.I. Joe: The Rise of Cobra’ is pretty telling. He’s been really upfront about how much he disliked making it – he was basically forced to do it as part of a deal with Paramount. Apparently, the studio threatened to sue him if he didn’t honor his contract. He didn’t hold back when talking about how bad the script was and how the studio pushed ahead with the movie even though he really wasn’t into the project. He even admitted he was relieved when his character got killed off in the sequel! It really shows how tough it can be for actors, especially those on the rise, when they’re locked into long-term contracts with studios.

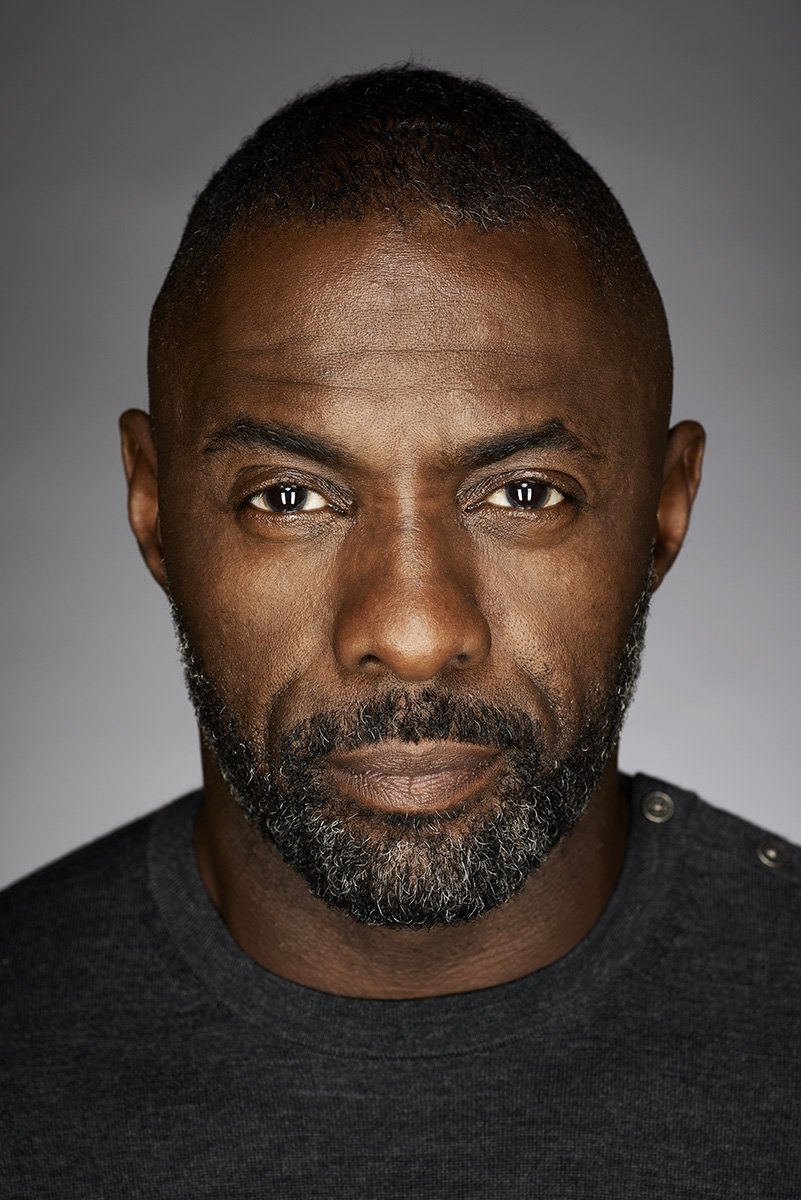

Idris Elba

As a fan, it was really surprising to hear Idris Elba talk about his experience going back to film more scenes for ‘Thor: The Dark World.’ He said it was honestly a tough and painful experience, especially because of how strict the schedule was and all the things Marvel wanted him to do contractually. He even pointed out how weird it was to go from playing Nelson Mandela in a serious biopic to then being hung up on wires in front of a green screen! It really showed how demanding the whole process of making these big Marvel movies can be. Even though he felt that way, he still loved Heimdall enough to come back for more films, which is awesome to see.

George Clooney

George Clooney has consistently spoken out against big movie studios, especially their behavior during labor disagreements. He publicly criticized the group representing studios like Warner Bros. and Sony for their position on how streaming revenue is shared. He also voiced his disappointment with Warner Bros. regarding how they promoted and handled his appearance in ‘The Flash’. Clooney frequently uses his influence to support fairer treatment for film crews and background actors. Because he’s willing to challenge powerful industry figures, he’s become a key voice in the fight for better working conditions in Hollywood.

Matt Damon

Matt Damon publicly criticized Universal Pictures for how they made ‘The Bourne Ultimatum,’ particularly the poor quality of the script. He explained that the studio rushed the film into production without a finished, understandable screenplay. Damon felt this pressure to meet a deadline hurt the creative process and negatively impacted his character. Although he continued with the series, his criticism of the studio’s handling of the franchise is well known. He’s since spoken out more often about how studios relying on existing ideas can harm good storytelling.

Terrence Howard

Terrence Howard was the first well-known actor to publicly disagree with Marvel Studios, after being replaced in ‘Iron Man 2’. He stated that Marvel didn’t honor their original agreement for multiple films and tried to significantly lower his pay for the sequel. Howard claimed the studio redirected funds originally intended for him to other actors. His public complaints about Marvel’s business dealings sparked a lot of discussion about how the studio handled its contracts with performers at the time. This disagreement ended his role in the franchise and created lasting resentment.

Hugo Weaving

Hugo Weaving, who provided the voice for Megatron in the ‘Transformers’ movies, didn’t hold back about his negative experience working with Paramount and director Michael Bay. He felt the work lacked substance and confessed he wasn’t interested in the story or characters. Weaving explained he never even met Bay and simply recorded his lines in a studio without much guidance. His honest criticism highlighted a clash between creative talent and the studio’s approach to making big-budget films, and it famously led to a public rebuttal from the director.

Jim Carrey

Jim Carrey famously distanced himself from ‘Kick-Ass 2’ shortly before it came out, explaining he was uncomfortable with the film’s intense violence. He used social media to share that a recent tragic event had made him reconsider what kind of content he wanted to promote. Carrey stated he couldn’t ethically support the film’s violent scenes. Although he didn’t give back his salary, his decision not to participate in promoting the movie hurt the film’s marketing efforts. This situation demonstrated the conflict that can arise between an actor’s personal beliefs and their work obligations to a studio.

Share which of these actor critiques surprised you the most in the comments.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Banks & Shadows: A 2026 Outlook

- ETH PREDICTION. ETH cryptocurrency

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- Gay Actors Who Are Notoriously Private About Their Lives

- The Weight of Choice: Chipotle and Dutch Bros

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

2026-02-12 20:47