The Nasdaq-100, a collection of one hundred of the more substantial companies trading upon the Nasdaq exchange, possesses a character quite distinct from its peers. It is, one observes, remarkably concentrated in the pursuits of technology, a sector which presently commands upwards of sixty percent of its overall valuation. A circumstance which, while affording opportunities for considerable gain, does introduce a certain…specialty, shall we say, to its fortunes.

Last year witnessed a return of some twenty percent, exceeding, it must be noted, the performance of the broader S&P 500. The successes of companies such as Nvidia, Alphabet, and even Palantir Technologies were, of course, instrumental in this outcome. Though the present year has begun with a degree of volatility, the index remains, at the time of writing, only slightly below its previous peak – a situation which encourages, naturally, a degree of circumspection.

The Invesco QQQ Trust, a vehicle designed to mirror the performance of the Nasdaq-100 through a faithful replication of its holdings, presents a question worthy of consideration. Is this a propitious moment for investment? History, if one is willing to attend to its lessons, offers a reasonably clear indication.

The Essential Ingredients for Solid Returns

Certain emerging industries – artificial intelligence, cloud computing, robotics, and the more speculative realms of quantum computing and autonomous vehicles – have, of late, proven particularly generous to investors. Any portfolio exhibiting a significant exposure to these pursuits has, as a consequence, tended to outperform. One cannot but observe a certain fashionable enthusiasm for these ventures, though prudence dictates a measured approach.

Artificial intelligence currently occupies the foremost position in the minds of investors, having already created, it is said, trillions of dollars in value. Below is a comparison of five companies prominent in this field, and their respective weightings within the Invesco QQQ Trust and the S&P 500:

| Stock | Invesco ETF Weighting | S&P 500 Weighting |

|---|---|---|

| Nvidia | 8.32% | 7.18% |

| Alphabet (Google) | 7.41% | 6.22% |

| Meta Platforms | 3.92% | 2.67% |

| Broadcom | 2.92% | 2.51% |

| Palantir Technologies | 1.63% | 0.52% |

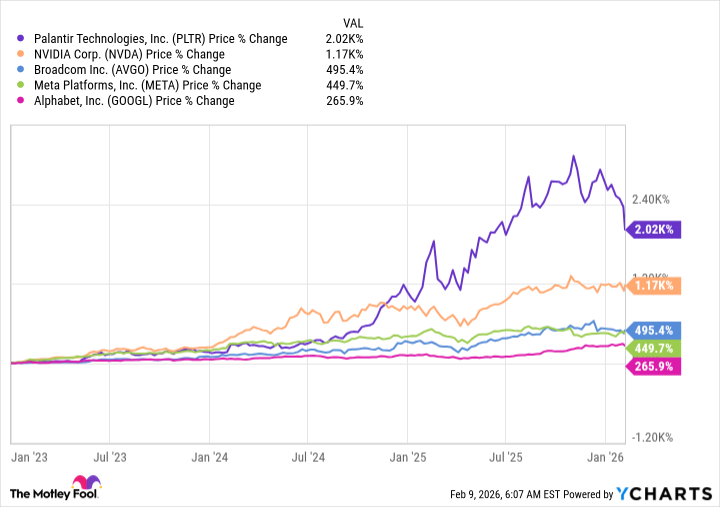

These five companies, it is claimed, have delivered an average return of no less than 880% since the beginning of 2023 – a circumstance which explains, in part, the superior performance of the Nasdaq-100 and, by extension, the Invesco ETF. The matter of position sizing, one notes, is of considerable importance.

While these five companies are likely to continue providing returns, other names within the Nasdaq-100 deserve attention:

- Tesla: A most expensive undertaking, certainly. However, should the company successfully transition from the production of electric vehicles to the more ambitious realm of humanoid robotics, it could prove a valuable addition to a portfolio.

- Micron Technology: A supplier of essential high-bandwidth memory solutions, particularly for Nvidia’s latest chips. The ongoing boom in AI infrastructure suggests a promising future.

- CrowdStrike: Data, one observes, is the very lifeblood of artificial intelligence. Protecting it will, therefore, become increasingly crucial. CrowdStrike’s comprehensive platform offers a degree of security that is most appealing.

A Prudent Investment for the Long Term

To attempt to time the market is, one suspects, a folly. No one possesses the ability to accurately foresee the future. However, we do know that the Invesco QQQ Trust has delivered a compound annual return of 10.4% since its inception in 1999, and an even more impressive 20.5% over the past decade. These gains, naturally, encompass every downturn, correction, and period of market distress. Indeed, the index has experienced declines exceeding twenty percent on no fewer than five occasions since the ETF’s establishment.

Therefore, while it may appear counterintuitive to invest during periods of market weakness, history suggests that it may, in fact, be the most opportune moment. Investors who purchased the Invesco QQQ Trust at any time since 1999, even at the height of previous market peaks, would have realized a profit had they maintained their holdings for the long term – even if the index subsequently experienced a decline.

Thus, provided one maintains a long-term perspective of at least five years, the present moment may not be an unsuitable time to invest in the Invesco QQQ Trust, even with the Nasdaq-100 approaching a new record high. It is, after all, a matter of aligning one’s investments with the inevitable currents of progress.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Monster Hunter Stories 3: Twisted Reflection launches on March 13, 2026 for PS5, Xbox Series, Switch 2, and PC

- Here Are the Best TV Shows to Stream this Weekend on Paramount+, Including ‘48 Hours’

- 🚨 Kiyosaki’s Doomsday Dance: Bitcoin, Bubbles, and the End of Fake Money? 🚨

- ‘The Substance’ Is HBO Max’s Most-Watched Movie of the Week: Here Are the Remaining Top 10 Movies

- First Details of the ‘Avengers: Doomsday’ Teaser Leak Online

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- The 11 Elden Ring: Nightreign DLC features that would surprise and delight the biggest FromSoftware fans

- 20 Films Where the Opening Credits Play Over a Single Continuous Shot

- Crypto’s Comeback? $5.5B Sell-Off Fails to Dampen Enthusiasm!

2026-02-12 20:54