Steam has a lot of exciting survival games where you try to stay alive in tough conditions and with limited supplies. These games usually combine building, exploring, and fighting to keep you hooked. You can find yourself anywhere from underwater alien planets to cities overrun by zombies, and play by yourself or with friends. To win, you’ll need to think ahead and be ready for anything. Here are some of the best survival games Steam has to offer.

‘The Forest’ (2018)

After a plane crash, players find themselves stranded on a peninsula overrun by cannibalistic mutants. The game focuses on building and crafting to create a safe haven against nightly attacks. As players explore extensive cave systems, they uncover a disturbing story about the main character and his lost son. Staying alive means constantly managing hunger and thirst while scavenging for resources like wood and stone. This game uniquely combines the tension of horror with classic survival gameplay.

‘Sons of the Forest’ (2024)

This game is a follow-up to a well-loved survival adventure, tasking players with finding a billionaire who’s disappeared on a distant island. It features enhanced building options and smarter AI for both allies and opponents. The game’s dynamic seasons create challenges – you’ll need to gather supplies and prepare for harsh weather. A huge map awaits, packed with secret bunkers and dangerous mysteries. You can also team up with friends for a shared experience in this richly detailed world.

‘Subnautica’ (2018)

After a spaceship crashes on a distant planet, players find themselves exploring a vast alien ocean. The game centers around collecting resources to construct underwater bases and high-tech submarines. To survive, you’ll need to keep track of your oxygen supply as you navigate glowing reefs and deep, dark trenches. Be careful – dangerous sea creatures lurk in the darker areas where the most valuable resources are hidden. The story unfolds as you discover data logs and radio messages scattered throughout the world.

‘Subnautica: Below Zero’ (2021)

This new game continues the underwater adventure, but this time it’s set in a frozen area of the same planet. As players explore icy landscapes, they’ll need to watch their body temperature, along with oxygen and hunger levels. New vehicles, including the Seatruck and Snowfox, help with getting around. The story revolves around a central mystery involving an alien presence and the search for a missing sister. Players will encounter a variety of creatures, from friendly sea monkeys to massive leviathans.

‘Valheim’ (2021)

In this Viking survival game, you’ll need to prove yourself to Odin in a constantly changing afterlife. You begin with absolutely nothing and must build up your resources by crafting tools, constructing buildings, and exploring the seas. Fighting is a key part of the game, as you hunt for materials to summon and overcome formidable ancient bosses. The building system is realistic, allowing for strong and intricate structures. You’ll progress by defeating these powerful bosses, which unlocks better technology and resources.

‘Rust’ (2018)

I’m totally hooked on this game! It’s all about trying to survive – you’ve gotta manage your hunger and thirst, and watch out for other players who are just as desperate as you are. It’s seriously intense because you can lose everything if someone raids your base. Building a solid base and then raiding other people’s is pretty much the whole point for most of us. A lot of players team up in clans to defend what they’ve built or to go on the offensive. And the best part is, the developers are constantly updating it with new stuff, so it never gets stale!

‘Project Zomboid’ (2013)

This survival game puts you in a realistic zombie apocalypse happening in Kentucky. You’ll need to find food and medicine, but you’ll also have to manage your character’s mental and physical health, including things like depression and exhaustion. The game closely tracks everything about your character, from their weight to how they’re feeling. Because even a single zombie bite can be fatal, every encounter is incredibly stressful. Ultimately, the game tells the story of how your character meets their end.

‘7 Days to Die’ (2024)

This game blends the action of first-person shooting with the strategy of tower defense and the challenge of surviving in a world after a disaster. Every week, players face a huge wave of zombies that will push their defenses to the limit. In between attacks, you’ll need to collect supplies and improve your base. The environment can be completely destroyed, letting you find unique ways to gather resources and build defenses. You can also develop your character with a detailed skill tree, letting you customize how you play and specialize in different abilities.

‘Don’t Starve’ (2013)

This game features a distinctive hand-drawn art style and puts you in the role of a scientist stranded in a strange, dark world. You’ll need to collect materials to build tools and stay mentally stable while facing long, challenging nights. Using both science and magic, you’ll fight off unusual creatures and adapt to tough weather conditions. The world gets more dangerous as time goes on, so staying alive requires constant effort. The core of the game is about exploring and trying out different approaches to find the best way to survive.

‘Don’t Starve Together’ (2016)

Okay, so this expansion is awesome because you can finally play the whole game with your friends! It’s not just the original game though – there’s a bunch of new stuff, like totally unique bosses and areas built specifically for playing together. Seriously, you need to work as a team to build up huge farms and fight these massive, seasonal monsters that show up. We all get to pick a character, and each one is different – they have their own strengths and weaknesses, so you really have to coordinate. And the best part? The developers are constantly adding new stuff – more story, and some seriously challenging endgame content to keep us busy for ages.

‘Raft’ (2022)

You begin on a tiny wooden raft in the middle of the ocean, equipped with just a plastic hook. Your aim is to build a massive floating base by collecting anything that drifts by. As you explore, you’ll discover islands and abandoned ships filled with valuable resources and plans. But beware – a relentless shark constantly circles, trying to tear your raft apart! Working together with other players makes sailing and finding food much easier.

‘Stranded Deep’ (2022)

After a plane crashes into the Pacific, you’re left stranded on a chain of tropical islands. To survive, you’ll need to gather resources to build a raft and explore the ocean. Finding food and water is essential, but watch out for dangerous sharks! The game changes with the weather and time of day, and building tools and shelters is your only way to escape the islands.

‘Terraria’ (2011)

This game is a 2D adventure where you explore, survive, and fight. You’ll dig underground to find valuable resources and use them to create strong weapons and armor. The world is diverse, with many different environments and enemies. Beating powerful bosses changes the world, making it more difficult but also rewarding you with better items. While crafting is important, the game really focuses on challenging boss fights and improving your equipment.

‘No Man’s Sky’ (2016)

Explore a vast, ever-changing universe with billions of unique planets. To survive, you’ll need to manage your life support and protect yourself from dangerous alien environments. Gather resources to improve your starship, tools, and bases. Enjoy space battles, trading, and the thrill of discovering new worlds in an endless galaxy. The game has been continually expanded with free updates, adding features like building bases, playing with others, and engaging in story-driven missions.

‘V Rising’ (2024)

In this game, you play as a vampire who’s just woken up after a long sleep and is initially very weak. To survive, you need to hunt for blood to get stronger and stay hidden from the sun. You’ll build a grand, gothic castle as your home base, where you can gather resources and improve your powers. You can also control humans, turning them into loyal servants to help protect your territory. The game takes place in a large, open world filled with powerful bosses that, when defeated, grant you new magical abilities.

‘Enshrouded’ (2024)

In this survival game, you’ll explore a world covered in a dangerous, corrupting fog. You’ll need to build strong bases and craft equipment to defend against the creatures lurking in the mist. The game features a world made of blocks that you can completely destroy and rebuild however you like, letting you get creative with building. Discovering ancient ruins and powerful items is a key part of the experience, and you can team up with many other players to fight back against the fog and reclaim the kingdom.

‘Palworld’ (2024)

This open world game lets you capture and train creatures called Pals, who help you survive. You can use Pals to fight, farm, or even run automated factories. You’ll need to take care of your own needs – like staying fed and healthy – while also looking after your Pals. It’s a unique mix of survival gameplay and monster collecting, with a big focus on building and designing your own industrial base.

‘Scum’ (2018)

This game puts you in a realistic and intense prison riot, challenging you to survive. You’ll need to manage everything from your vitamin levels and muscle mass to even your dental health! You’ll explore a large island, fighting off both other prisoners and robotic security. The game offers a lot of options to customize your character and abilities, and success depends on both smart fighting and carefully managing your limited supplies.

‘This War of Mine’ (2014)

This survival game is different because it puts you in the shoes of ordinary people trying to live through a city under attack. You’ll face tough decisions about how to share limited food and medicine to keep your group alive. During the day, it’s too dangerous to go outside because of snipers, so you focus on repairing and building things. At night, you risk venturing out into dangerous parts of the city to find the supplies you need. The game offers a bleak and realistic view of what war does to people.

‘Kenshi’ (2018)

This game lets you explore a vast, open world and become anyone you choose. It’s a tough place to survive, filled with dangerous cannibals, slave traders, and wild animals. You aren’t a pre-defined hero – you can play as a lone wanderer or build up a powerful group. The game focuses on teamwork, letting you create bases and fight large-scale battles. Your character gets better by doing things, so even if you fail, you’ll still improve their skills.

‘Grounded’ (2022)

In this game, you’re magically reduced to the size of an ant and have to survive in an ordinary backyard! Everything feels huge, and you’ll encounter giant insects – some friendly, others a serious threat. You’ll need to collect things like blades of grass and soda cans to create tools and armor. As you explore, you’ll discover a network of secret labs that hold the key to returning to normal size. You can also team up with friends to build impressive bases amongst the grass and trees!

‘Pacific Drive’ (2024)

This game puts you in a survival situation where your station wagon is key to staying alive in a strange and dangerous area. You’ll need to keep your car in good shape and upgrade it to handle weird events and bad weather. Every trip you take into the zone helps you find what you need to fix and improve your vehicle. Your garage is a safe place to plan your next risky journey into the Olympic Exclusion Zone, and managing things like gas and tires is just as crucial as keeping yourself fed.

‘Abiotic Factor’ (2024)

Players find themselves trapped in an underground research facility after a major disaster. The game combines the challenge of survival with a sci-fi world that feels like a familiar office space. You’ll need to use everything around you – from scientific tools to everyday office supplies – to build weapons and defenses. As you explore the facility, you’ll uncover supernatural dangers and bizarre alternate dimensions. Working together with your team is key to escaping the massive laboratory.

‘Sunkenland’ (2023)

This survival game takes place in a world mostly covered by water. Players explore underwater ruins to find supplies and lost technology. You can build a base on the surface or on small islands to protect yourself from attacking groups. When enemies raid, you’ll defend your territory with guns and other weapons. Jet skis and helicopters help you travel across the huge ocean map.

‘State of Decay 2’ (2020)

Okay, so in this game, you’re basically in charge of a group of people trying to survive a zombie apocalypse. Everyone in your community is different – they have their own strengths and weaknesses, which really changes how things play out. A big part of it is building up your base – you’ve got to create things like hospitals, gardens, and workshops to keep everyone alive and happy. You’ll also be sending people out on missions to scavenge for supplies or help other settlements. But be warned – if someone dies on a mission, they’re gone for good, and losing a good character really hurts!

‘Astroneer’ (2019)

This game lets you explore and build bases on different planets. You can even change the landscape using a special tool to find valuable minerals. To survive, you’ll need to create a system to keep a steady supply of oxygen. It’s a visually bright and colorful game that focuses on working together instead of fighting. Players can build complicated, automated systems to gather resources and travel through space more easily.

‘Satisfactory’ (2024)

This game combines factory building with survival in an alien world. You’ll explore a planet to gather resources while fighting off dangerous creatures. The main objective is to build huge, automated factories to construct different parts of a space elevator. Played from a first-person view, the machines feel incredibly large. Careful planning is key to creating efficient production lines and keeping your power supply stable.

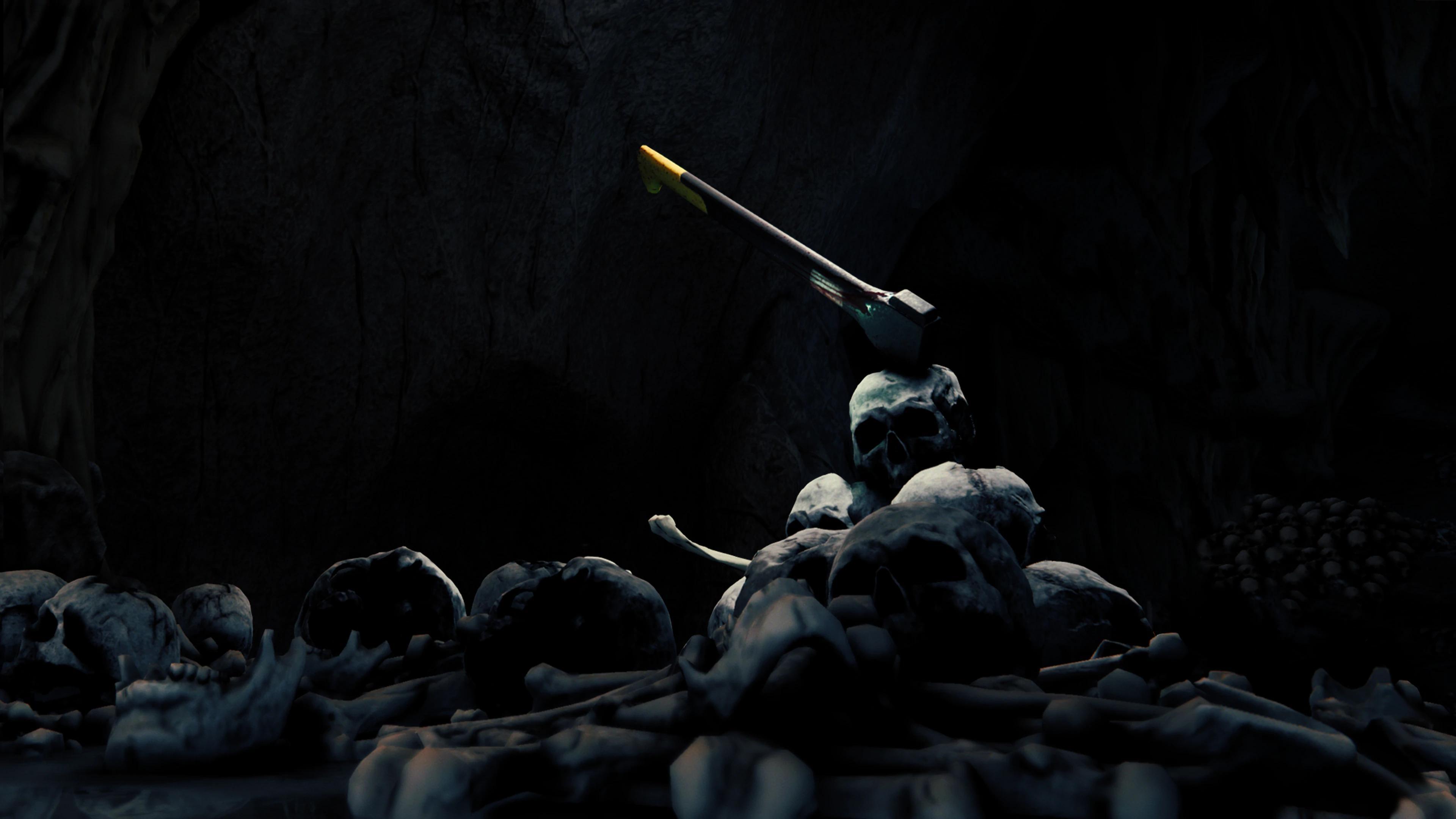

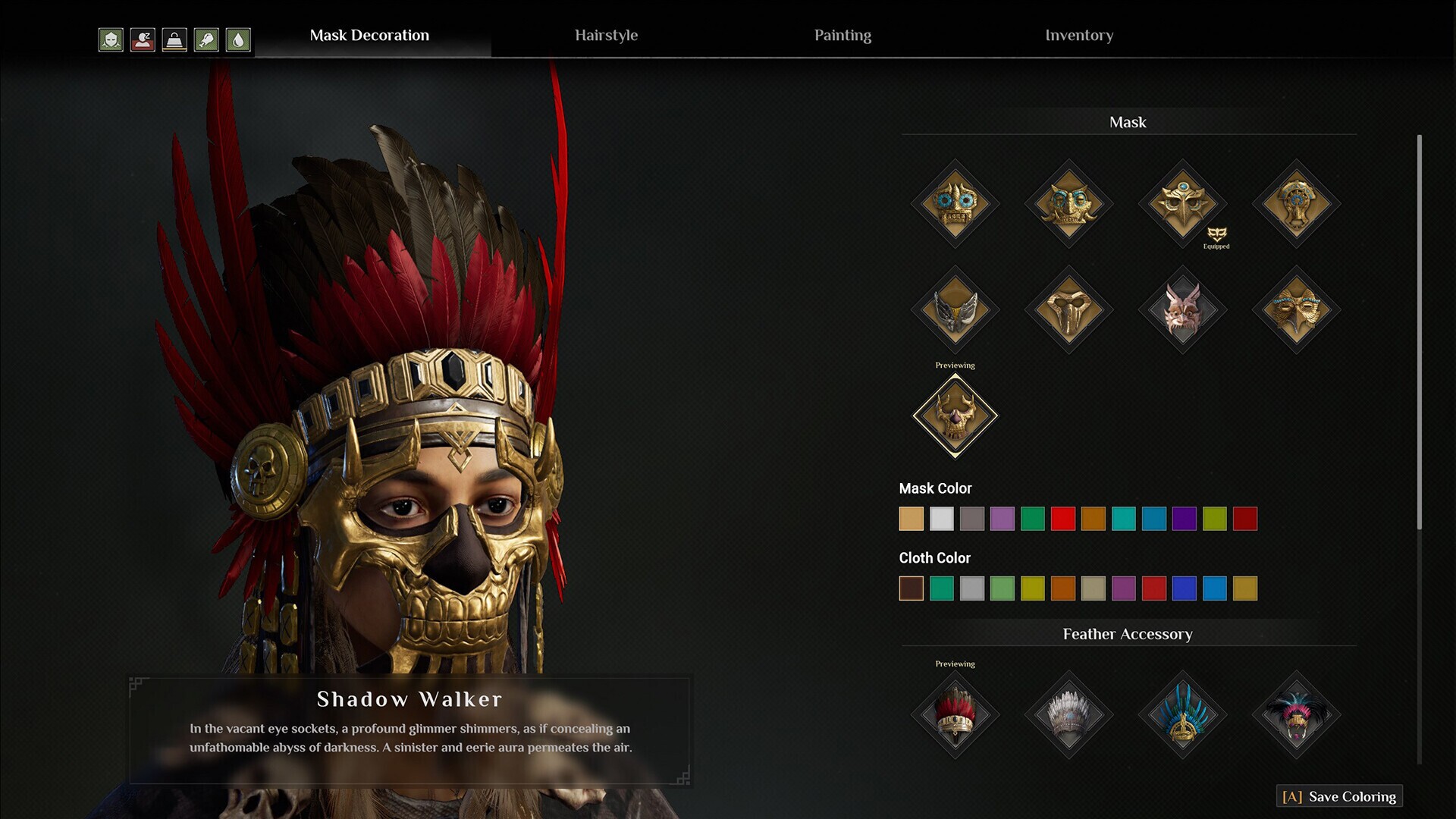

‘Soulmask’ (2024)

In this survival game, you play as a character who discovers a magical mask with special powers. You’ll explore a huge world, build and expand your base, and gather followers to create a strong tribe. Expect challenging combat, a mystery surrounding ancient lore, and the constant need to manage resources and protect yourself from other tribes. The unique mask allows you to control different characters, each with their own abilities, adding a strategic layer to gameplay.

‘Frostpunk’ (2018)

This game takes place in a world gripped by an endless winter. You lead the last remaining city and must work tirelessly to keep your citizens alive. Managing the city’s massive heater is crucial, and you’ll need to make tough decisions about things like healthcare and whether or not to allow child labor. You’ll gather resources – coal, wood, and food – to prevent your people from freezing or going hungry. It’s a challenging game where you’ll often have to make difficult choices, and sometimes the needs of the many will outweigh the needs of the few.

‘Unturned’ (2017)

This free survival game has a distinctive blocky look and challenges you to survive in a world overrun by zombies. You’ll need to find resources and build a secure base to defend against both the undead and other players. Explore diverse maps around the globe, each offering unique vehicles and weapons. Customize your character with skill trees, focusing on areas like farming or fighting. Play alone or join massive multiplayer servers.

‘Dying Light’ (2015)

This game blends the fast-paced action of parkour with the challenge of surviving a zombie apocalypse. Players explore a city during the day, scavenging for resources and assisting other survivors. But nighttime brings increased danger, as zombies become more ferocious and new, deadly creatures appear. The game’s smooth movement system lets you creatively traverse the environment and evade fights, and crafting powerful melee weapons is key to defending yourself against the overwhelming undead.

‘Medieval Dynasty’ (2021)

I’m really excited about this game where you play as someone escaping a war and trying to start over in a quiet valley. It’s a cool mix of things – you’ve got to survive by hunting and farming, build yourself a home, and take care of your family. But it’s not just survival! You can slowly build up a community, inviting other people to join you and turning your little place into a real village. The best part is you get to continue your family’s story through generations, passing down everything you’ve built to your heir. It sounds amazing!

Tell us which of these survival games is your favorite in the comments.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Banks & Shadows: A 2026 Outlook

- ETH PREDICTION. ETH cryptocurrency

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- 9 Video Games That Reshaped Our Moral Lens

- Gay Actors Who Are Notoriously Private About Their Lives

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

2026-02-12 19:55