So, Amazon. A company so vast, it’s frankly a little unnerving. They deliver almost everything to almost everyone, and now they’re determined to be at the forefront of artificial intelligence. Predictably, Wall Street had a bit of a wobble when Amazon announced it’s planning to spend a rather eye-watering $200 billion on capital expenditures by 2026. That’s a jump, let me tell you, from the $128 billion they splashed out last year. The concern, naturally, is whether all this spending will actually, you know, pay off. It’s a fair question, really. Spending that kind of money could probably solve a lot of problems, if only one knew which problems to solve.

The AI Infrastructure Question

Let’s consider the cloud. Specifically, Amazon Web Services, or AWS. It’s the bit of Amazon that rents computing power to other companies, and it’s booming. Why? Artificial intelligence, naturally. AI isn’t magic; it’s just a lot of very complicated calculations requiring a frankly obscene amount of computing power. AWS provides that power. It’s like being the owner of all the electrical outlets in a rapidly expanding city. Demand is… robust. And Amazon, sensibly, wants to be the one supplying the electricity.

AMZN“>

Amazon’s Own AI Ambitions

But it’s not just about renting power to others. Amazon is building AI into pretty much everything it does. Take Amazon Connect, their customer service platform. It now uses AI to anticipate and prevent problems before customers even realize they have them. It’s a bit like having a mind-reading receptionist. It’s growing at 30% a year, with a $1 billion annualized run rate. That’s a lot of proactive problem-solving.

Then there are the robots. Over a million of them, whizzing around Amazon’s warehouses. They’re speeding up deliveries, reducing costs, and generally making the whole operation more efficient. The result? A 70% increase in the number of items available for same-day delivery. It’s a logistical marvel, really. Although I do occasionally wonder what the robots think of us.

And let’s not forget Zoox, Amazon’s foray into autonomous vehicles. They’re currently testing robotaxis in San Francisco and Las Vegas. It’s a bold move, admittedly. But if it works, it could revolutionize transportation. Or at least provide a very amusing spectacle.

AI and the Bottom Line

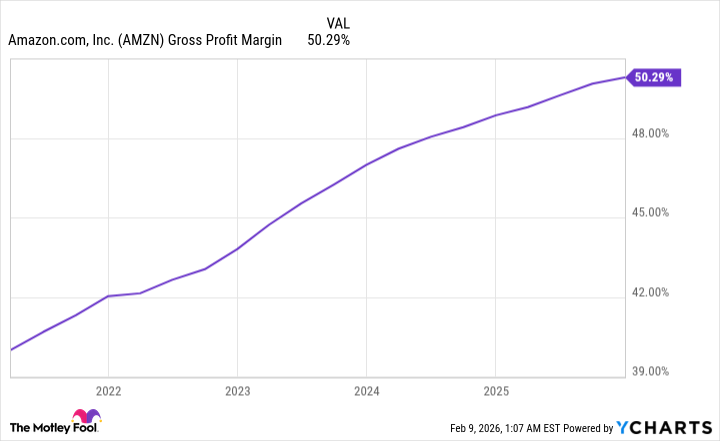

The key takeaway, though, is that all this AI investment is already starting to pay off. Amazon’s gross profit margins have been steadily increasing in recent years, thanks to AI-enabled cost optimizations. Operating income jumped to $80 billion last year, up from $68.6 billion the year before. That’s a substantial improvement, and it suggests that Amazon is on the right track.

So, while Wall Street may be fretting about Amazon’s spending, I’d argue that this is a calculated gamble. Amazon is investing heavily in the future, and it’s positioning itself to be a leader in the age of artificial intelligence. For long-term investors, the recent dip in Amazon’s stock price presents a rather attractive opportunity. It’s a bit like finding a perfectly good map to a treasure island just when everyone else has given up looking.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Monster Hunter Stories 3: Twisted Reflection launches on March 13, 2026 for PS5, Xbox Series, Switch 2, and PC

- Here Are the Best TV Shows to Stream this Weekend on Paramount+, Including ‘48 Hours’

- 🚨 Kiyosaki’s Doomsday Dance: Bitcoin, Bubbles, and the End of Fake Money? 🚨

- ‘The Substance’ Is HBO Max’s Most-Watched Movie of the Week: Here Are the Remaining Top 10 Movies

- First Details of the ‘Avengers: Doomsday’ Teaser Leak Online

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- The 11 Elden Ring: Nightreign DLC features that would surprise and delight the biggest FromSoftware fans

- 20 Films Where the Opening Credits Play Over a Single Continuous Shot

- Crypto’s Comeback? $5.5B Sell-Off Fails to Dampen Enthusiasm!

2026-02-12 18:55