Alright, settle in, folks! You’re about to get a stock analysis. And not just any stock analysis—a hilarious stock analysis! (Or at least, I’m hoping. My agent said I needed to diversify. Apparently, writing historical spoofs doesn’t pay the bills. Who knew?) We’re talking NextEra Energy (NEE +0.67%). Now, for the last five years, this Florida-based utility has been about as exciting as watching paint dry…in a dimly lit room…while listening to polka music. Compared to the S&P 500’s dazzling 77.5% return, NextEra limped along with a measly 8.3%. A tragedy! A farce! A…well, a slightly disappointing investment.

But hold on to your hats, because things are about to get interesting. You see, utility stocks are, by nature, defensive. They’re the financial equivalent of a heavily armored turtle. Safe, reliable…and not exactly built for speed. They compete with bonds for the affection of investors who’d rather count their pennies than risk a wild ride. And with interest rates soaring, these “widow and orphan stocks” – as The New York Times so charmingly called them back in 2000 – have been feeling a bit… neglected. (Honestly, it’s a terrible nickname. Makes them sound like they need a good home and a warm blanket.)

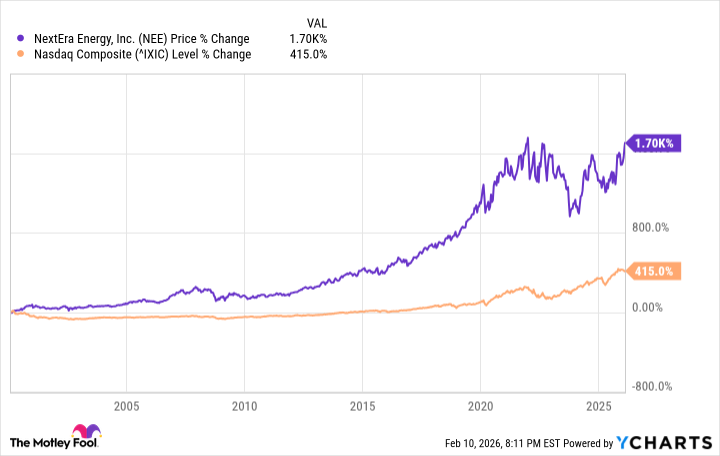

But here’s the kicker: since 2000, NextEra hasn’t just been a safe haven. It’s been a surprisingly good investment! A whopping 1,700% return! The Nasdaq Composite? A mere 415%. (Take that, tech bros!) And the dividend? Up 737%! That’s enough to buy a small island…or at least a really nice inflatable pool.)

Now, let’s talk long-term. NextEra has managed to be both a defensive, income-generating play and a high-growth tech stock. (It’s like a financial unicorn…wearing sensible shoes.) And there are three reasons why that old identity is starting to reassert itself. So, listen up! (Or don’t. I’m just a humble equity researcher…with a penchant for theatricality.)

1. A “Unique Moment” (Or, Why Your Electric Bill is Scaring You)

Have you noticed your electricity bill lately? It’s enough to make a grown man weep! Well, you’re not alone. In their Q2 2025 earnings call (nine months ago, folks, time flies when you’re analyzing stocks!), NextEra’s CEO, John Ketchum, pointed to the surging demand for electricity. And what’s driving that demand? Artificial intelligence! (Those data centers are hungry, let me tell you.)

Ketchum called it a “unique moment,” and he’s right. For decades, electricity demand was pretty much flat. But now, with data centers projected to consume as much electricity as Japan (a nation of 125 million people!), things are changing. It’s like the electric grid is suddenly trying to bench press a Buick.

Utility companies are regulated, of course. They can’t just charge whatever they want. But they can grow earnings by selling a lot more of their product. And NextEra has a 95-gigawatt pipeline of new energy capacity! That’s enough to power over 83 million homes! (They currently serve 6 million. It’s like going from a bicycle to a rocket ship!)

2. NextEra Could Claim the Lion’s Share of Lucrative Tax Credits (Or, The Great Wind & Solar Rush of ’26)

Last July, Congress passed a bill with what they called “big, beautiful” tax credits for wind and solar projects. But there was a catch: you had to start construction by July 1, 2026. (It’s like a financial cliff! A very green, sustainable cliff.)

In NextEra’s earnings call, Ketchum called the rules “tough, but constructive.” (That’s politician-speak for “we’re already way ahead of the game.”) They were already “constantly in a state of construction,” with a huge pipeline of projects well underway. (They’re like the Energizer Bunny of renewable energy!)

BloombergNEF forecasts that record clean energy capacity could be added in 2026 and 2027. And since NextEra is already the largest provider of clean power in North America, they’re perfectly positioned to capitalize on this rush. (It’s like being the first to the buffet!)

3. Dividend Champions Should Thrive From Lower Rates (Or, The Return of the Income Investor)

The Federal Reserve is expected to lower interest rates by April or June. (Maybe by as much as 75 basis points! It’s like giving the economy a little shot of adrenaline!) This would make dividend yields much more attractive to income investors. And NextEra is a Dividend Champion – they’ve raised payouts for 25 years or more!

Their dividend-hiking streak goes back 31 years to 1994! (That’s longer than some marriages!) And the current yield is 2.5%. Management is guiding for 10% growth this year, with 6% hikes in 2027 and 2028. (They’re practically printing money!)

So, thanks to the shift to income stocks, the supercharged demand from the AI revolution, and their unique positioning to claim lucrative tax credits, I believe this company is about to surprise a lot of people. NextEra’s 11% rally so far this year could be just the beginning of a multiyear or even multi-decade surge like the one seen in 2000. Whether you prioritize growth or income, this company belongs on just about everyone’s buy list. (Unless you’re a contrarian…in which case, good luck with that!)

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- 🚨 Kiyosaki’s Doomsday Dance: Bitcoin, Bubbles, and the End of Fake Money? 🚨

- Monster Hunter Stories 3: Twisted Reflection launches on March 13, 2026 for PS5, Xbox Series, Switch 2, and PC

- Here Are the Best TV Shows to Stream this Weekend on Paramount+, Including ‘48 Hours’

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- 20 Films Where the Opening Credits Play Over a Single Continuous Shot

- Crypto’s Comeback? $5.5B Sell-Off Fails to Dampen Enthusiasm!

- 39th Developer Notes: 2.5th Anniversary Update

- 10 Hulu Originals You’re Missing Out On

- 10 Underrated Films by Ben Mendelsohn You Must See

2026-02-12 17:33