The market, that ravenous beast, has been chewing on Palantir (PLTR 2.66%). Down nearly 34% from its recent high? A temporary inconvenience, I assure you. A little turbulence before the REALLY weird stuff starts happening. The Q4 results – a jump of nearly 7% in the next session – weren’t just numbers, they were a flashing neon sign in the digital wilderness. A warning, perhaps. Or an invitation. Either way, the vultures are circling, but they’re going to get a mouthful of something they didn’t expect.

Valuation? Oh, they whine about valuation. As if numbers on a screen can contain the sheer, unadulterated potential of this company. It’s not about what it is, it’s about what it’s becoming. A digital panopticon, maybe. A key to unlocking… well, let’s just say a lot of doors you probably didn’t want opened in the first place. The numbers, frankly, are just a smokescreen. A distraction from the REAL story unfolding in the data streams.

A bull run? Please. We’re talking about a full-scale stampede. This isn’t some incremental growth play, it’s a tectonic shift. Especially when you consider what they’re doing with Artificial Intelligence. AI isn’t just a buzzword, it’s the engine driving this beast, and Palantir is building the goddamn chassis. They’re not just participating in the AI revolution, they’re actively shaping it. And that, my friends, is a VERY dangerous thing.

Let’s dissect the beast, shall we? Peel back the layers of hype and see what’s REALLY ticking inside.

Palantir’s AI Ascension: From Data Swamp to Digital Fortress

70% revenue increase in Q4? That’s not growth, that’s acceleration. The AI tools aren’t just boosting productivity, they’re fundamentally changing the way clients operate. It’s a digital lobotomy, in the best possible way. They’re not selling software, they’re selling foresight. And in this increasingly chaotic world, foresight is a commodity more valuable than gold. New customers aren’t just adopting the software, they’re becoming utterly DEPENDENT on it. A digital addiction, if you will.

Margins jumping 12 percentage points to 57%? That’s not just good business, that’s a sign of something… efficient. Ruthlessly efficient. They’re squeezing every drop of value out of the data, leaving nothing to waste. It’s a beautiful, terrifying sight. 2025 was a good year, a REALLY good year. A prelude, perhaps, to something far more… substantial.

| Period | Revenue | Growth (YOY) | Earnings Per Share | Growth (YOY) |

|---|---|---|---|---|

| Q1 2025 | $884 million | 39% | $0.13 | 62.5% |

| Q2 2025 | $1.004 billion | 48% | $0.16 | 78% |

| Q3 2025 | $1.181 billion | 63% | $0.21 | 110% |

| Q4 2025 | $1.407 billion | 70% | $0.25 | 79% |

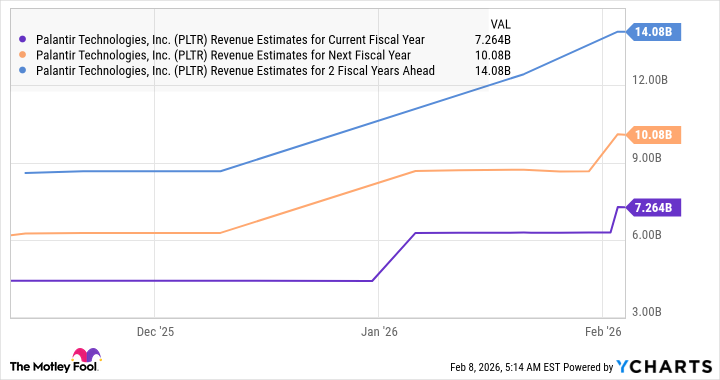

Almost $7.2 billion in revenue for 2026? A conservative estimate, I assure you. The remaining deal value of $11.2 billion is a ticking time bomb of future revenue. A digital hoard, waiting to be unleashed. And with a 34% increase in overall customer count to 954, the pipeline is overflowing. This isn’t just growth, it’s an AVALANCHE.

The AI software platform market growing over 400% between 2025 and 2030? Palantir controlling about a quarter of that space? These numbers are… intoxicating. They’re not just projecting growth, they’re predicting DOMINANCE. And if Palantir can maintain its outperformance, if it can continue to defy the odds… well, let’s just say the sky isn’t the limit.

The Next Five Years: A Descent Into the Data Abyss

Analysts expecting 40% revenue growth in 2028? A pathetic underestimate. 50%? Closer, but still… insufficient. This isn’t just a company, it’s a force of nature. A digital leviathan, rising from the depths. And by 2030, with revenue potentially jumping to almost $37 billion… that’s when things get REALLY interesting.

A market cap of $740 billion based on 20 times sales? A bargain, I tell you. A STEAL. The current price-to-sales ratio of 78 is an anomaly, a temporary distortion. This stock could deliver robust gains even if the valuation declines significantly. It’s a self-fulfilling prophecy, a digital vortex pulling everything in its path.

By 2030, $300 a share isn’t just possible, it’s… inevitable. Buckle up, folks. This isn’t just an investment, it’s a descent into the data abyss. And trust me, you don’t want to be left behind.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- 🚨 Kiyosaki’s Doomsday Dance: Bitcoin, Bubbles, and the End of Fake Money? 🚨

- Monster Hunter Stories 3: Twisted Reflection launches on March 13, 2026 for PS5, Xbox Series, Switch 2, and PC

- Here Are the Best TV Shows to Stream this Weekend on Paramount+, Including ‘48 Hours’

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- 20 Films Where the Opening Credits Play Over a Single Continuous Shot

- Crypto’s Comeback? $5.5B Sell-Off Fails to Dampen Enthusiasm!

- 39th Developer Notes: 2.5th Anniversary Update

- 10 Hulu Originals You’re Missing Out On

- 10 Underrated Films by Ben Mendelsohn You Must See

2026-02-12 15:22