Nvidia, that currently incandescent name in the pantheon of artificial intelligence, presents a curious case. Its recent performance, a dazzling ascent followed by a rather pedestrian consolidation, reminds one of a firefly—brilliant, yes, but possessed of a distinctly limited lifespan. While a five-year gain of 1,220% would certainly gild the portfolios of many, the past six months—a mere 3% increment—suggests a cooling of the fever. Not a collapse, mind you, merely a settling, like dust motes after a particularly enthusiastic waltz. To dismiss it entirely would be imprudent, a touch of the philistine, but to stake one’s entire fortune upon its continued trajectory… well, that would be a gamble of a distinctly theatrical nature.

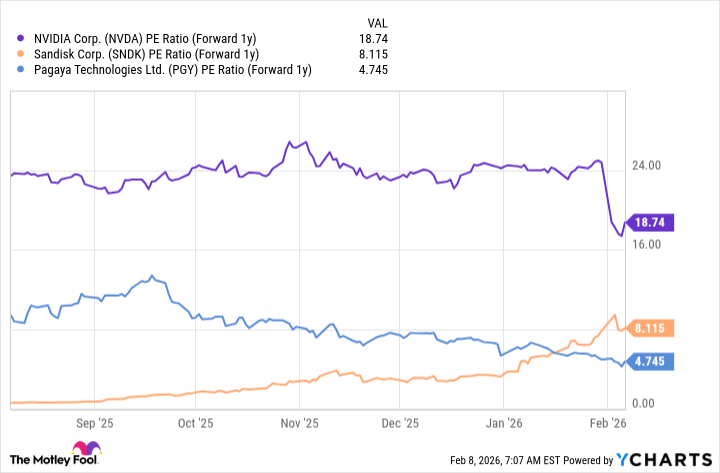

The discerning investor, one who favors the quiet accumulation of value over the fleeting spectacle of hype, might instead cast an eye towards less celebrated, yet potentially more fertile, ground. Sandisk and Pagaya Technologies, names that lack the immediate resonance of Nvidia, offer a different sort of allure—a promise not of instantaneous elevation, but of sustained, perhaps even glacial, growth. Their valuations, presently more… tractable, suggest a degree of headroom that Nvidia, having already scaled such dizzying heights, can only dream of.

Sandisk: A Repository of Potential

Sandisk, a name that once conjured images of memory cards and flash drives, has undergone a metamorphosis. Its recent performance—a 1,410% ascent over the past year—is not merely impressive; it’s almost… impertinent. Yet, this is not a case of mere ephemeral enthusiasm. The underlying engine of growth—the insatiable demand for data storage, particularly within the burgeoning ecosystem of data centers—is remarkably robust. The company’s second fiscal quarter (ended January 2nd) witnessed a 61% year-over-year revenue increase, fueled by a particularly vigorous 64% quarter-over-quarter surge in data center revenue. Their commercial and personal storage solutions, too, continue to flourish, like hardy perennials in a well-tended garden.

Management, with a commendable degree of pragmatism, anticipates continued growth, fueled by collaborations with several “hyperscalers”—a rather charmingly clumsy term, isn’t it?—and a demand that currently outstrips supply. Sandisk is, undeniably, benefiting from the current AI frenzy, but its foundations are far more solid—a bedrock of established consumer businesses that provide a reassuringly low-risk trajectory. A tortoise, perhaps, but one with a remarkably efficient shell.

Pagaya: The Algorithm and the Ascent

Pagaya, a name that trips rather elegantly off the tongue, operates in the intriguing realm of AI-driven credit. It identifies promising borrowers—those overlooked by more conventional institutions—through a sophisticated machine learning platform, bundling these loans into asset-backed securities (ABS) and offering them to institutional funders. Their recent announcement of an $800 billion loan securitization, funded by a rather impressive 32 investors, solidifies their position as the largest U.S. personal loan ABS issuer. A rather significant achievement, wouldn’t you agree?

Their clientele is a roster of familiar names—U.S. Bank, Visa, SoFi Technologies—and they boast 31 lending partners across a diverse range of products—personal loans, credit cards, auto loans. Pagaya’s contribution is to augment the approval rates of these partners, leveraging AI to assess applications and transferring the risk to institutional funders. They claim an application evaluation time of less than one second—a feat of algorithmic efficiency that would surely impress even the most jaded clockmaker—and seamlessly integrate their models into partner platforms.

Pagaya, one suspects, represents a glimpse into the future of financial services—a future where algorithms and data reign supreme. And, judging by their current trajectory, they are only just beginning to unfold their potential.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- 🚨 Kiyosaki’s Doomsday Dance: Bitcoin, Bubbles, and the End of Fake Money? 🚨

- Monster Hunter Stories 3: Twisted Reflection launches on March 13, 2026 for PS5, Xbox Series, Switch 2, and PC

- Here Are the Best TV Shows to Stream this Weekend on Paramount+, Including ‘48 Hours’

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- 20 Films Where the Opening Credits Play Over a Single Continuous Shot

- Crypto’s Comeback? $5.5B Sell-Off Fails to Dampen Enthusiasm!

- 39th Developer Notes: 2.5th Anniversary Update

- 10 Hulu Originals You’re Missing Out On

- 10 Underrated Films by Ben Mendelsohn You Must See

2026-02-12 14:52