Joby Aviation (JOBY 1.42%). The name conjures images of sleek, vertical contraptions whisking discerning citizens above the common traffic, a vision that’s either the future of personal transport or a particularly ambitious scheme to relieve investors of their capital. It’s a company attempting to build and operate what the Guild of Aeronautical Alchemists1 insists on calling ‘eVTOLs’ – electric vertical takeoff and landing aircraft. Essentially, airborne carriages. A promising concept, certainly, but one that requires defying both gravity and the fundamental laws of venture capital. The problem, as always, isn’t the dream of flight; it’s the landing.

How Does One Measure Progress in the Sky?

Joby is, to give them credit, making noises that suggest forward momentum. Hundreds of test flights have been conducted, which is good, assuming they haven’t simply been circling the same field repeatedly to impress onlookers. They’re now investing in simulators to train pilots, a sensible precaution considering that handing the controls to an untrained individual in a flying machine is generally frowned upon by insurance adjusters. This is all progress, of a sort, though it feels rather like measuring the distance travelled by a snail attempting to cross the Atlantic.

However, let’s talk numbers, shall we? Through the first nine months of this year, Joby managed to lose the equivalent of $1.01 per share. A substantial sum, even by the inflated standards of the Unseen University of Startup Funding.2 This represents an increase from the $0.53 loss in the same period last year, which, if projected forward, suggests a trajectory that could eventually lead to the company achieving negative wealth. A remarkable feat, if somewhat undesirable.

The Dream is Sound, But the Fuel is Expensive

The core idea – bypassing ground-based congestion – isn’t flawed. In fact, it’s rather brilliant. The problem isn’t the concept of eVTOLs, but the sheer logistical and financial hurdles involved in turning it into a sustainable business. Imagine, if you will, a network of airborne carriages navigating the skies, potentially controlled by artificial intelligence. A truly remarkable vision…assuming you can ignore the potential for rogue AI, mid-air collisions, and the inevitable lawsuits. But that’s just the price of progress, isn’t it?

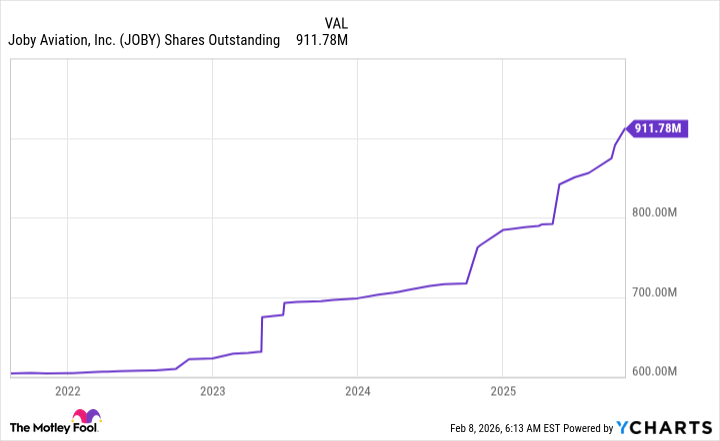

Getting from here to profitability, however, will require more than just optimism and a powerful electric motor. Investors seem to be realizing this, as the stock price has fallen nearly 50% from its 52-week high. A clear signal that even the most ardent believers are starting to question the long-term viability of the enterprise. And then there’s the dilution. Joby recently announced a sale of $600 million worth of convertible notes and 52,863,437 shares of common stock. Which is a polite way of saying they’re asking investors for more money, in exchange for a smaller piece of the pie.

Issuing equity and debt is a common practice for startups, of course. In fact, Joby went public precisely to tap into the capital markets. But each new share issued diminishes the ownership stake of existing shareholders. It’s a bit like trying to fill a leaky bucket with gold coins – a noble effort, perhaps, but ultimately futile.

A Waiting Game, Perhaps?

Wall Street, it appears, has adopted a “show me” attitude. Which is to say, they want to see more concrete evidence of progress before getting overly excited. And frankly, that’s a perfectly reasonable position. For most investors, it’s probably best to wait until Joby achieves sustainable profitability before jumping on board. If the company’s air taxis do take off, the opportunity is likely to be long-term, and not a fleeting moment of speculative frenzy.

In conclusion, Joby Aviation is a fascinating, if somewhat precarious, enterprise. It’s a bold attempt to redefine personal transportation, but it’s also a high-risk investment. Whether it will soar to new heights or crash and burn remains to be seen. But one thing is certain: the journey will be…interesting.

- 1 The Guild of Aeronautical Alchemists is, naturally, fiercely protective of its terminology. They insist that ‘eVTOL’ is a far more sophisticated term than ‘flying carriage,’ despite the fact that the latter is considerably more descriptive.

- 2 The Unseen University of Startup Funding specializes in the art of turning thin air into valuations. Its methods are…unconventional, but remarkably effective.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- 🚨 Kiyosaki’s Doomsday Dance: Bitcoin, Bubbles, and the End of Fake Money? 🚨

- Monster Hunter Stories 3: Twisted Reflection launches on March 13, 2026 for PS5, Xbox Series, Switch 2, and PC

- Here Are the Best TV Shows to Stream this Weekend on Paramount+, Including ‘48 Hours’

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- 20 Films Where the Opening Credits Play Over a Single Continuous Shot

- Crypto’s Comeback? $5.5B Sell-Off Fails to Dampen Enthusiasm!

- 39th Developer Notes: 2.5th Anniversary Update

- 10 Hulu Originals You’re Missing Out On

- 10 Underrated Films by Ben Mendelsohn You Must See

2026-02-12 14:32