Steam has a huge selection of great action games for all types of players. You can find everything from quick, exciting shooters to immersive role-playing games with complex fighting. The platform features both popular indie games and big-budget blockbusters. This list showcases some of the best and most popular action games you can buy digitally right now.

‘Elden Ring’ (2022)

In Elden Ring, players journey through a massive, open world called the Lands Between with the goal of repairing the Elden Ring and becoming the Elden Lord. The game features extensive exploration and difficult boss battles. Players can choose from a variety of classes and customize their characters to create unique playstyles. Developed by FromSoftware, Elden Ring blends immersive storytelling with demanding, action-packed combat.

‘Sekiro: Shadows Die Twice’ (2019)

In Sekiro: Shadows Die Twice, you play as a shinobi on a mission to save a young lord and avenge a samurai rival. Combat focuses on skillful blocking and breaking an enemy’s defenses rather than simply reducing a health bar. You can also use stealth to carefully plan your attacks in a beautifully recreated version of feudal Japan. The game is challenging, but it’s incredibly rewarding for players who can master its timing and learn enemy attack patterns.

‘Hades’ (2020)

In this action-packed game, Zagreus fights his way out of the Underworld, hoping to reach Mount Olympus. As a ‘rogue-like,’ each attempt is unique, filled with challenging combat and powerful abilities given by the Olympian gods. With every run, you’ll uncover more of the story and build stronger connections with the characters. The game’s beautiful hand-drawn art and dynamic music create a truly captivating experience.

‘Devil May Cry 5’ (2019)

I’m so hyped for the new Devil May Cry! Nero and Dante are back, and this time they’re fighting a huge demonic invasion in Red Grave City. What I’m really excited about is the combat – it’s all about pulling off crazy, stylish moves and mastering different weapons to climb the leaderboards. Plus, they’ve added a new character, V, who plays completely differently by controlling these awesome familiars to do his fighting for him. And from what I’ve seen, the graphics are incredible, and the heavy metal soundtrack actually reacts to what you’re doing in the game – it’s going to be epic!

‘God of War’ (2022)

Kratos and his son, Atreus, journey across the world of Midgard on a very personal mission. The fighting centers around Kratos’ powerful Leviathan Axe, which can be enhanced with different abilities as you progress. Throughout the game, you’ll battle famous monsters and gods from Norse legends in epic, visually stunning encounters. This game successfully reimagines the series with a new over-the-shoulder camera angle and a strong emphasis on storytelling.

‘DOOM Eternal’ (2020)

In DOOM Eternal, you play as the Doom Slayer, fighting demons on Earth and in other dimensions to save humanity from destruction. The fast-paced combat feels like a challenging puzzle, requiring players to strategically use different types of attacks to manage their resources. Enhanced movement abilities like dashing and a grappling hook add a new level of intensity and allow for more dynamic battles. The game provides a non-stop, action-packed experience, fueled by a powerful, industrial metal soundtrack.

‘Cyberpunk 2077’ (2020)

In Cyberpunk 2077, you play as V, navigating the gritty and dangerous streets of Night City while haunted by a digital ghost. You can approach challenges in various ways – whether through stealth and hacking, or with direct combat using advanced weaponry. The sprawling city is packed with missions and side quests that affect your character’s reputation. Expect a rich, immersive atmosphere filled with neon lights and the cutthroat world of corporate power struggles.

‘Monster Hunter: World’ (2018)

As a hunter, my whole deal is tracking down and fighting these huge monsters in all sorts of different environments. I need the stuff they drop to craft better gear, so it’s a constant cycle of learning each monster’s patterns and getting really good with one of the fourteen weapons they offer. The best part is teaming up with friends online – some of these monsters are seriously tough and way more fun to take down with a squad. This new version of the game really opened things up, making it easier to get into and looking absolutely gorgeous while doing it.

‘Resident Evil 4’ (2023)

In ‘Resident Evil 4,’ Leon S. Kennedy is sent to a secluded European village on a mission to save the President’s daughter. This updated version of the original game features improved controls and a more detailed story. Players will need to carefully manage their supplies as they battle waves of infected villagers and terrifying creatures. The game keeps the original’s suspenseful feeling while offering some of the best action combat in the ‘Resident Evil’ series.

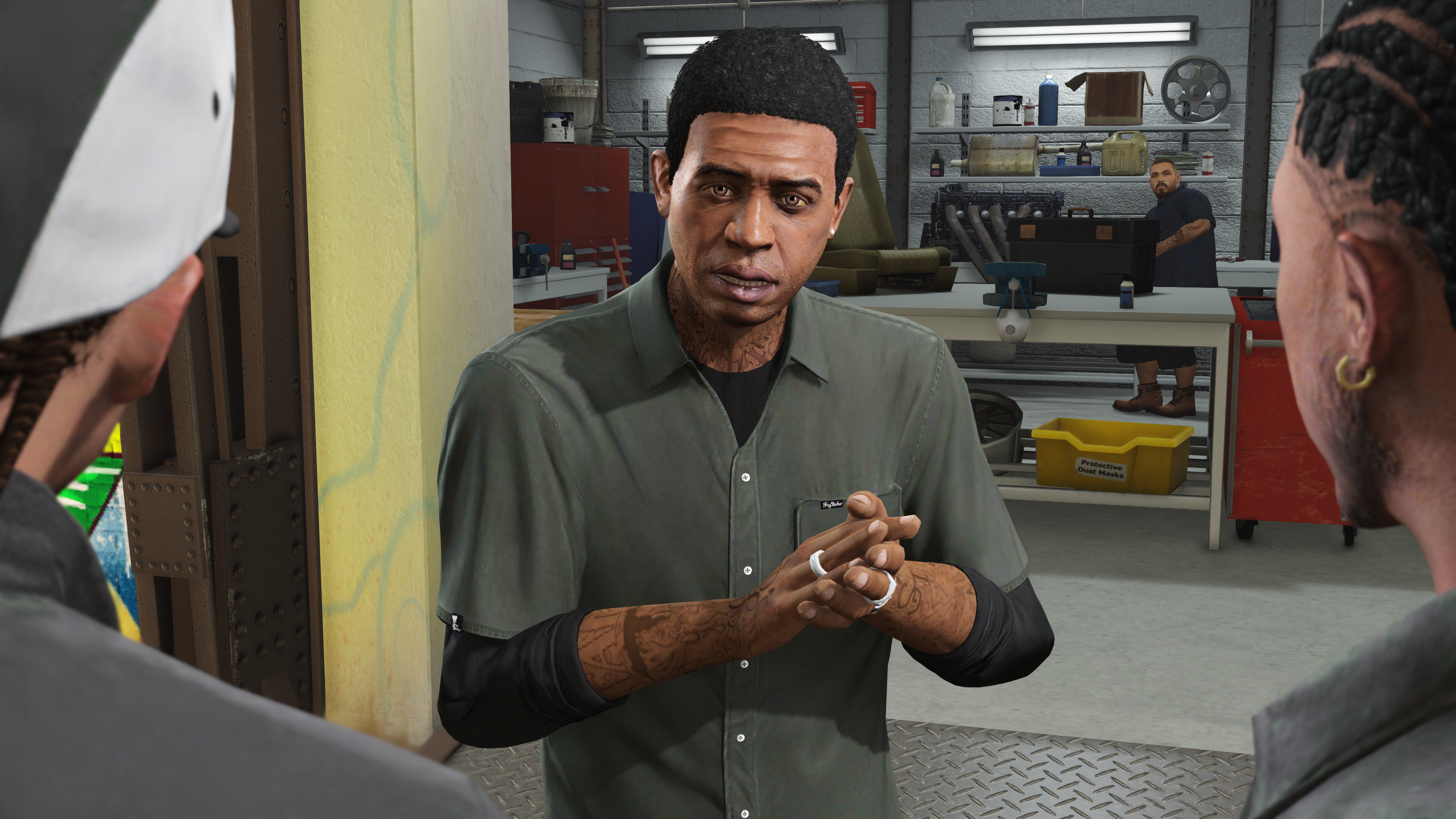

‘Grand Theft Auto V’ (2015)

In ‘Grand Theft Auto V,’ players follow three criminals as they pull off a series of bold robberies throughout the city of Los Santos. You can instantly switch between playing as each character, offering unique gameplay experiences and skills. The game also features a huge online world where players can create and manage their own criminal organizations. Its lasting popularity on Steam is thanks to its incredible variety and smooth gameplay.

‘Apex Legends’ (2020)

In Apex Legends, three-player squads fight to be the last team standing in a fast-paced arena. Each character has special abilities that can turn the battle around if used well. Players can move quickly and skillfully by sliding and climbing. The game is constantly updated with new characters and map adjustments each season.

‘Ultrakill’ (2020)

Okay, so I’ve been playing this game called ‘Ultrakill’, and it’s seriously awesome. It’s a throwback to those old-school first-person shooters, but with a super-fast pace. What’s really different is how healing works – you actually have to be aggressive and deal damage to get your health back! The levels are all themed around Hell, which is pretty cool, and it really pushes you to try out different weapon combinations and move in a really stylish way. It’s definitely a challenging game, but if you’re a fan of classic shooters, you’ll probably love how frantic and intense it is.

‘Risk of Rain 2’ (2020)

Players fight their way through alien landscapes, trying to escape a dangerous planet while gathering powerful, endlessly stacking items. The game gets harder as time goes on, pushing players to act fast and make smart choices about how they improve their abilities. Each attempt is unique thanks to randomly generated loot and level designs. This game successfully updated the series, moving it from a 2D style to a full 3D world.

‘Sifu’ (2022)

In ‘Sifu,’ you play as a young martial arts student driven to avenge their family’s killers. The game has a special twist: every time you fall in battle and come back to life, your character ages. Success depends on learning a difficult but rewarding combat system that focuses on smart positioning and using your surroundings. ‘Sifu’ is a tough game that requires patience and skill to beat its challenging enemies and complex stages.

‘Metal Gear Rising: Revengeance’ (2014)

As a huge fan, I can tell you Raiden is amazing! He uses this super-fast sword to slice through robots and giant machines with unbelievable accuracy. What I really love is ‘Blade Mode’ – it lets you slow down time and perfectly choose where to cut your enemies. The boss fights are completely over-the-top and the music is so energetic, it all adds up to an incredibly cinematic experience. Honestly, ‘Metal Gear Rising: Revengeance’ is still one of my favorites because of its crazy fast action and characters you just don’t forget.

‘Dead Cells’ (2018)

Dead Cells is a challenging action platformer where you explore a constantly shifting castle and battle through different environments. It’s a ‘rogue-lite,’ meaning each attempt is unique and death is permanent, but you can unlock upgrades to get further each time. The game is praised for its smooth controls, fast-paced combat, and the huge variety of weapons you can find. Plus, the developers consistently add new, free content!

‘The Witcher 3: Wild Hunt’ (2015)

In ‘The Witcher 3: Wild Hunt,’ you play as Geralt of Rivia, a monster hunter searching for his adopted daughter. The game takes place in a vast, war-torn world filled with dangerous creatures and compelling stories. Combat is dynamic, requiring players to use both swords and magical abilities to defeat a variety of enemies. With a huge open world and numerous engaging side quests, the game offers hundreds of hours of gameplay and a rich, detailed history. Many consider it to be one of the best action role-playing games ever made.

‘Armored Core VI: Fires of Rubicon’ (2023)

In ‘Armored Core VI Fires of Rubicon’, players control powerful, customizable mechs on a devastated planet, taking on challenging mercenary jobs. The game lets you experiment with different weapons and parts to build the perfect mech for any fight. You’ll need to master both ground and air combat to survive tough boss battles. This game is the latest installment in the long-running ‘Armored Core’ series, now with updated graphics and controls.

‘Warframe’ (2013)

In Warframe, you play as ancient warriors called Tenno, equipped with powerful, high-tech suits. They battle across the solar system in a game packed with content – there are hundreds of weapons and dozens of unique Warframes to learn and use. Players can also enjoy a robust crafting system and explore large, open areas, offering plenty to do. Warframe is well-known for its fluid movement and generous free-to-play approach.

‘Destiny 2’ (2019)

In Destiny 2, players become Guardians, defending the last city on Earth from alien enemies using incredible powers based on different elements. The game blends fast-paced shooting action with rich role-playing features and team-based raids. You can journey to various planets and enjoy a variety of game modes, including both competitive battles and cooperative missions. The game is constantly updated with new expansions that add exciting stories and powerful new equipment to discover.

‘Titanfall 2’ (2016)

Titanfall 2 tells the story of a soldier and an experienced Titan pilot who team up to face a difficult mission. The game’s single-player mode is celebrated for its clever level design and the strong connection between the two main characters. When playing with others, you’ll experience a thrilling mix of quick, agile movement as a pilot and powerful battles with massive Titans. Thanks to its refined controls and inventive gameplay, Titanfall 2 continues to be a highly regarded game in its genre.

‘Katana ZERO’ (2019)

In ‘Katana ZERO’, you play as an assassin who can control time, allowing for fast-paced, stylish combat in a side-scrolling world. Each level is a dangerous puzzle where a single hit is fatal, demanding careful planning and precise movements. The game boasts a striking dark neon look and a driving synthwave soundtrack, creating a unique and immersive atmosphere. The story is told through engaging conversations and intense action sequences.

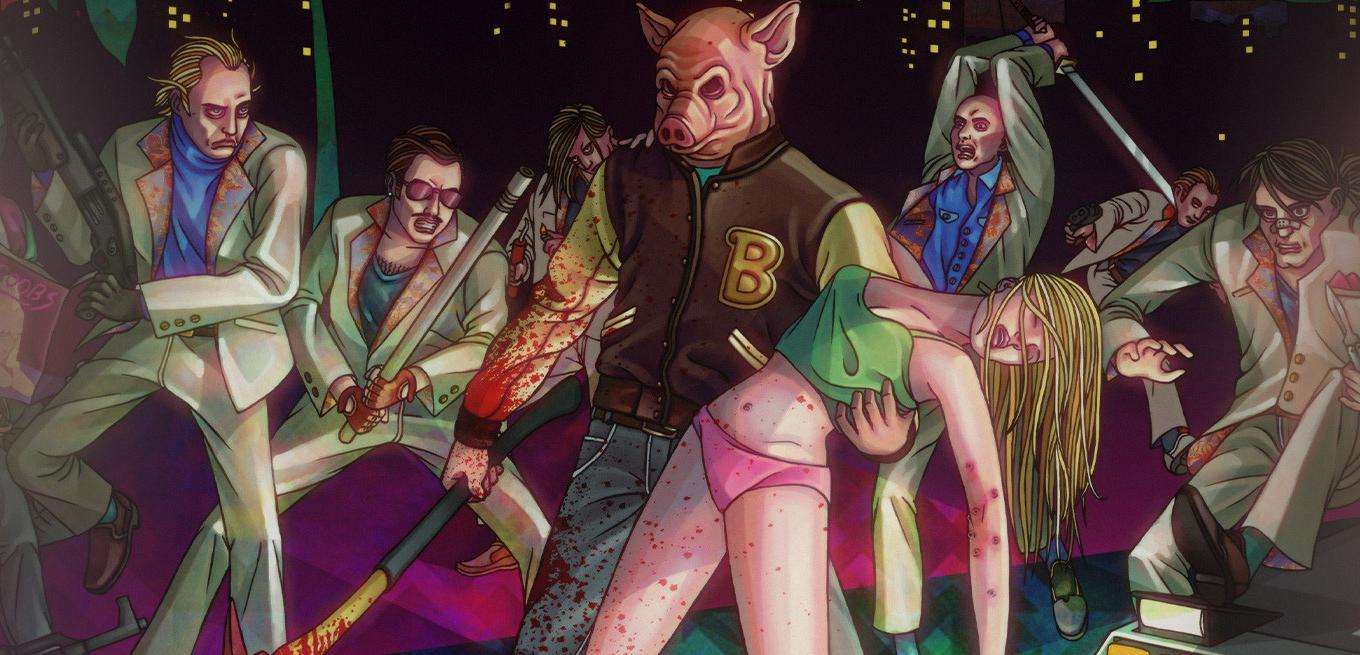

‘Hotline Miami’ (2012)

In ‘Hotline Miami,’ you play as a nameless character carrying out violent missions against the Russian mafia. The game is famous for being incredibly difficult and graphically violent, demanding fast reactions. Its strange, dreamlike visuals and eerie electronic music create a disturbing and unsettling atmosphere. ‘Hotline Miami’ stood out in the gaming world with its gritty style and unforgiving gameplay.

‘Batman: Arkham Knight’ (2015)

Okay, so in ‘Batman: Arkham Knight’, things are seriously bad. Scarecrow has teamed up with all of Batman’s worst enemies to completely wreck Gotham, and it’s up to me to stop them. The biggest new thing? I finally get to drive the Batmobile! It’s awesome for speeding around and getting into some intense tank battles. The fighting system is still amazing too – it’s super smooth and feels really impactful when you take down enemies. This game wraps up the whole Arkham trilogy, and honestly, the world is huge and the story keeps you on the edge of your seat. It’s a pretty epic conclusion.

‘Borderlands 2’ (2012)

In Borderlands 2, players become Vault Hunters on a mission to stop Handsome Jack from unleashing a powerful new vault on the planet Pandora. The game is known for its distinct visual style and a system that creates an almost endless supply of unique weapons. You can team up with up to three friends to complete quests and defeat challenging bosses. Players also praise Borderlands 2 for its funny writing and the many different ways you can customize each character.

‘Dishonored 2’ (2016)

In Dishonored 2, you can play as either Corvo Attano or Emily Kaldwin, both determined to take back the throne from a magical enemy. The game lets you decide how to complete objectives – you can sneak around enemies or fight them head-on. Levels are complex and full of hidden areas and secrets, and you’ll use special powers to explore them. Dishonored 2 encourages players to be inventive and try different approaches in its beautifully crafted steampunk setting.

‘Left 4 Dead 2’ (2009)

In ‘Left 4 Dead 2,’ four players team up to survive waves of zombies and find safe zones. The game cleverly changes the challenge and where you find supplies each time you play, making every experience unique. Players fight off both regular zombies and powerful, mutated creatures using a diverse arsenal of weapons. Its smooth gameplay and constant variety have made ‘Left 4 Dead 2’ a long-lasting favorite for cooperative gaming.

‘Helldivers 2’ (2024)

In Helldivers 2, players take on the role of soldiers fighting intense, third-person battles against overwhelming waves of alien bugs and robots. Success depends on teamwork and cleverly using powerful support abilities called stratagems. Be careful though – you can accidentally shoot your teammates, which adds to the game’s fast-paced and often funny chaos! The game features a constantly evolving galactic war, and the combined actions of all players will decide the fate of the universe.

‘Dying Light’ (2015)

In ‘Dying Light,’ you play as a secret agent trapped in a city overrun by zombies. To survive, you’ll need to become skilled at parkour and hand-to-hand combat. The game changes dramatically between day and night, with more powerful and dangerous zombies appearing after dark. You can create your own weapons and team up with up to three other players for cooperative missions throughout the city. ‘Dying Light’ is known for its fluid movement and the incredibly suspenseful feeling of being in its open world.

‘Middle-earth: Shadow of War’ (2017)

In Middle-earth: Shadow of War, Talion and Celebrimbor raise an army of orcs to fight against Sauron across a vast version of Middle-earth. The game features the returning Nemesis System, which creates personalized stories based on your interactions with memorable enemy leaders who recall past battles. Players will lead massive sieges on enemy fortresses and govern the territories they conquer. Overall, Middle-earth: Shadow of War delivers a rich and immersive experience for fans of the fantasy world.

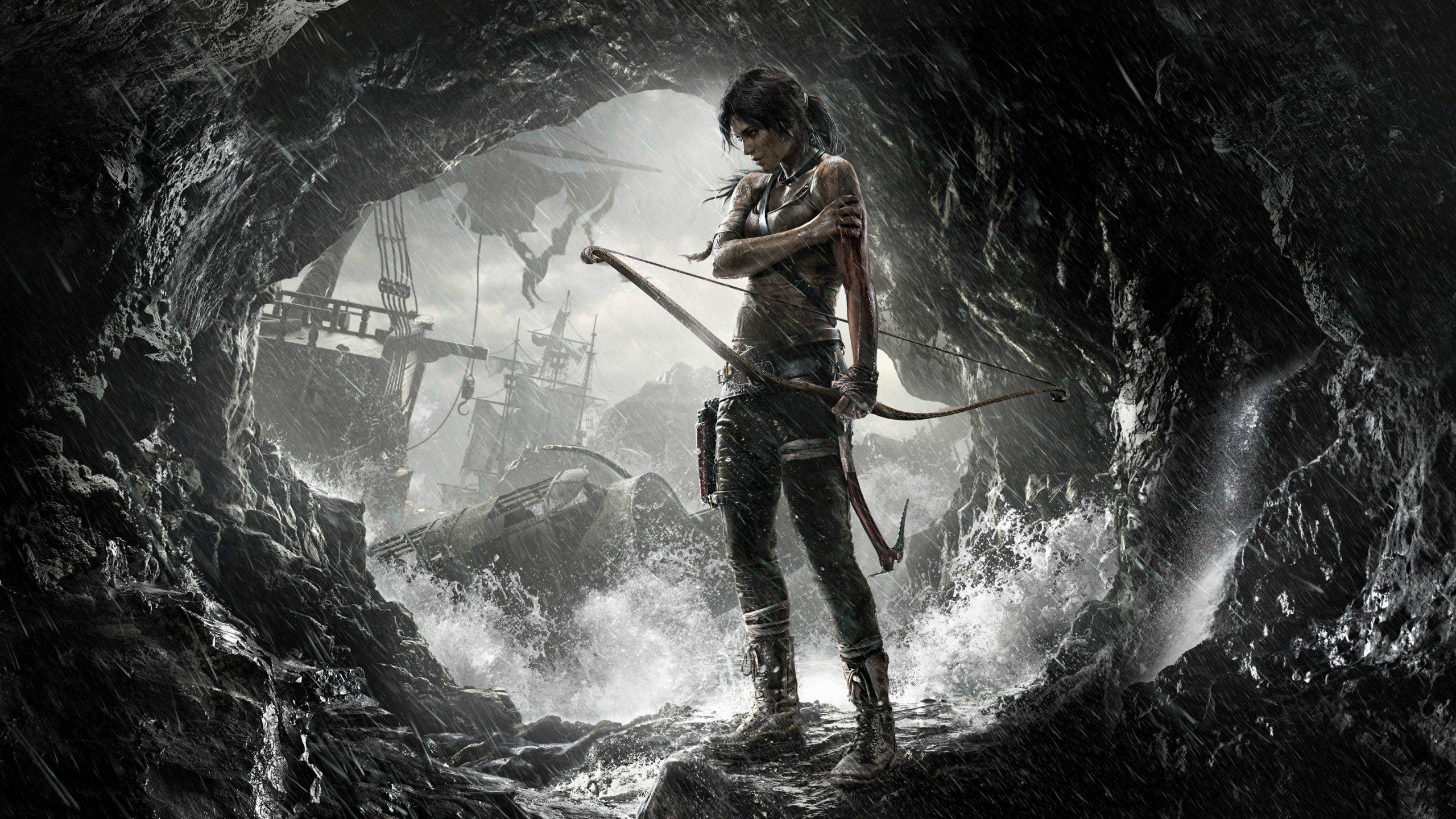

‘Tomb Raider’ (2013)

After a shipwreck leaves her stranded on a strange island, a young Lara Croft has to quickly learn how to survive. The game combines sneaking around, shooting from cover, solving puzzles using the environment, and exploring the island. As players progress, they improve Lara’s abilities and gear, watching her grow from a helpless survivor into a skilled adventurer. This new version of the classic character feels fresh and realistic, with a more immersive and cinematic style.

‘Just Cause 3’ (2015)

In ‘Just Cause 3,’ Rico Rodriguez goes back to his home country with a mission: to take down a ruthless dictator. Players have access to tons of weapons and vehicles, and the game is all about causing massive destruction in a huge open world. You can even connect objects together to create wild chain reactions! With a wingsuit and parachute, you’re free to explore a large Mediterranean island and experience over-the-top action and explosive fun. It’s a game where you truly feel powerful and can use the environment to create chaos.

‘Streets of Rage 4’ (2020)

Get ready for a fresh take on a classic! ‘Streets of Rage 4’ brings back the heroes you remember to restore order to Wood Oak City. This modern update features stunning hand-drawn graphics and a soundtrack inspired by the original games. Team up with friends – either in person or online – to battle through hordes of enemies and challenging bosses. The game keeps the classic ‘Streets of Rage’ gameplay while adding new features for today’s gamers.

‘Max Payne 3’ (2012)

In ‘Max Payne 3,’ Max relocates to Brazil to protect a rich family, but quickly gets tangled up in a dangerous plot. The game is known for its realistic physics and the iconic ‘bullet time’ effect, making gunfights look spectacular. Players will experience brutal and challenging combat as they fight for survival across a diverse city landscape. This installment brings Max Payne’s story to a dark and impactful end.

‘Wolfenstein II: The New Colossus’ (2017)

Okay, so I’m playing as BJ Blazkowicz, and it’s a wild ride! Basically, the Nazis won World War II, and now they’ve taken over America. I’m leading a group trying to take our country back. It’s non-stop, over-the-top action, and I’m fighting alongside a really interesting crew of characters. The coolest part? I can wield two weapons at once, and there are tons of gadgets to help me take down the enemy’s crazy tech. ‘Wolfenstein II: The New Colossus’ isn’t just about shooting things, though – it’s got a surprisingly emotional story that really pulls you in.

‘Metal Gear Solid V: The Phantom Pain’ (2015)

As a huge fan, I’ve been completely hooked by ‘Metal Gear Solid V: The Phantom Pain’! You play as Venom Snake, and it’s all about building up your own mercenary army while tracking down the people who ruined everything. What’s amazing is the freedom – you can tackle missions however you want, going in quiet and stealthy or all-out with guns blazing. There’s also a really detailed base you manage, and you team up with a bunch of different characters, which adds a ton of strategic depth to the gameplay. Honestly, the stealth mechanics are some of the best I’ve ever seen in any game – it’s just so polished and satisfying.

‘Black Myth: Wukong’ (2024)

Players take on the role of a chosen hero traveling through a world steeped in Chinese mythology, seeking to unravel the secrets of an age-old story. They’ll wield a powerful staff and unlock magical transformations to battle challenging enemies and epic bosses. The game features quick, action-packed combat that demands precise timing and skillful use of special abilities, all set within a beautiful and immersive world inspired by the beloved tale, Journey to the West.

‘Ghostrunner’ (2020)

Ghostrunner is a fast-paced action game where you play as a cybernetic warrior scaling a giant city to challenge a cruel leader. It’s incredibly challenging – one hit kills both you and your enemies – so quick reflexes and accuracy are key. You’ll use a katana and powerful cybernetic skills to overcome dangerous obstacles and defeat enemies. The game is tough, but mastering its fluid movement and relentless action is incredibly satisfying.

‘Enter the Gungeon’ (2016)

Enter the Gungeon is a fast-paced, challenging game where a group of unlikely heroes explores a dungeon in search of a gun with the power to erase the past. It’s a ‘bullet hell’ rogue-like, meaning you’ll face tons of projectiles and each playthrough is different. The game offers hundreds of unique weapons and items that combine in unexpected ways, and skillful dodging and using the environment are essential for survival. It’s famous for its cute pixel art and a huge number of hidden secrets and difficult challenges.

‘Remnant II’ (2023)

In Remnant II, players venture through dangerous worlds to prevent a powerful evil from unraveling reality. The game combines exciting third-person shooting with tough boss battles reminiscent of the Souls-like genre. Each playthrough is different thanks to randomly generated levels and enemies, offering a fresh challenge every time. Players can also deeply customize their characters and team up with others to tackle the adventure together.

‘Hollow Knight’ (2017)

‘Hollow Knight’ is an exciting action platformer where you play as a silent knight venturing through the haunting remains of a fallen kingdom. The game is full of tough enemies, mysterious secrets, and a huge world to explore in any order you choose. You can find and equip charms to unlock new skills and tailor how you play, which is essential for winning the challenging boss battles. Players love ‘Hollow Knight’ for its immersive atmosphere and incredibly precise controls.

‘Nioh 2’ (2021)

In Nioh 2, you create your own character and battle through a dark, demon-filled take on Japan’s Sengoku period, using the help of supernatural creatures called Yokai. The game’s combat is fast-paced and strategic, with three fighting styles and a system that encourages constant attacking. When facing tough enemies, you can even transform into a powerful demon yourself to unleash incredibly strong attacks. With tons of loot to collect and a complex character progression system, Nioh 2 is perfect for players who enjoy a challenging action experience.

‘Control Ultimate Edition’ (2020)

In Control, you play as Jesse Faden, the new Director of a hidden government bureau that investigates and combats supernatural events. Set within a constantly changing office building, you’ll use powerful telekinetic abilities and a unique, shape-shifting weapon to defend against a hostile force known as the Hiss. The game features exciting, physics-driven combat and a destructible environment, making each encounter unpredictable. This version includes both the original game and all of its expansions, offering a deeper dive into the game’s intriguing world.

‘Nier: Automata’ (2017)

In the stunning but ruined world of Earth, androids 2B and 9S battle machine invaders in a desperate conflict. The game offers thrilling combat that shifts between action-packed third-person views and different shooting styles. With a thought-provoking story and multiple endings, ‘Nier Automata’ delivers a deeply emotional experience and is celebrated for its originality.

‘Dark Souls III’ (2016)

In Dark Souls III, players explore the kingdom of Lothric on a quest to rekindle the fire and save the world from eternal darkness. The game is renowned for its challenging and memorable boss battles, and its carefully crafted levels. Combat is strategic, demanding careful stamina management and precise timing to overcome enemy defenses. As the final installment in the Dark Souls trilogy, this game delivers polished gameplay and a strikingly beautiful, yet melancholic, world.

‘Deep Rock Galactic’ (2020)

In Deep Rock Galactic, you play as a team of space dwarves who mine valuable resources while fighting off hordes of alien spiders. The game lets you destroy almost anything in the environment, and features four different classes, each with their own special equipment. Working together is key to surviving the randomly generated caves and completing challenging missions. It’s become popular thanks to its enjoyable gameplay and regular free updates, fostering a dedicated community.

Share your favorite action games from this list or tell us what we missed in the comments.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Monster Hunter Stories 3: Twisted Reflection launches on March 13, 2026 for PS5, Xbox Series, Switch 2, and PC

- Here Are the Best TV Shows to Stream this Weekend on Paramount+, Including ‘48 Hours’

- 🚨 Kiyosaki’s Doomsday Dance: Bitcoin, Bubbles, and the End of Fake Money? 🚨

- 20 Films Where the Opening Credits Play Over a Single Continuous Shot

- 39th Developer Notes: 2.5th Anniversary Update

- 10 Hulu Originals You’re Missing Out On

- 10 Underrated Films by Ben Mendelsohn You Must See

- Target’s Dividend: A Redemption Amidst Chaos

- ‘The Substance’ Is HBO Max’s Most-Watched Movie of the Week: Here Are the Remaining Top 10 Movies

2026-02-12 08:20