Markets

What to know:

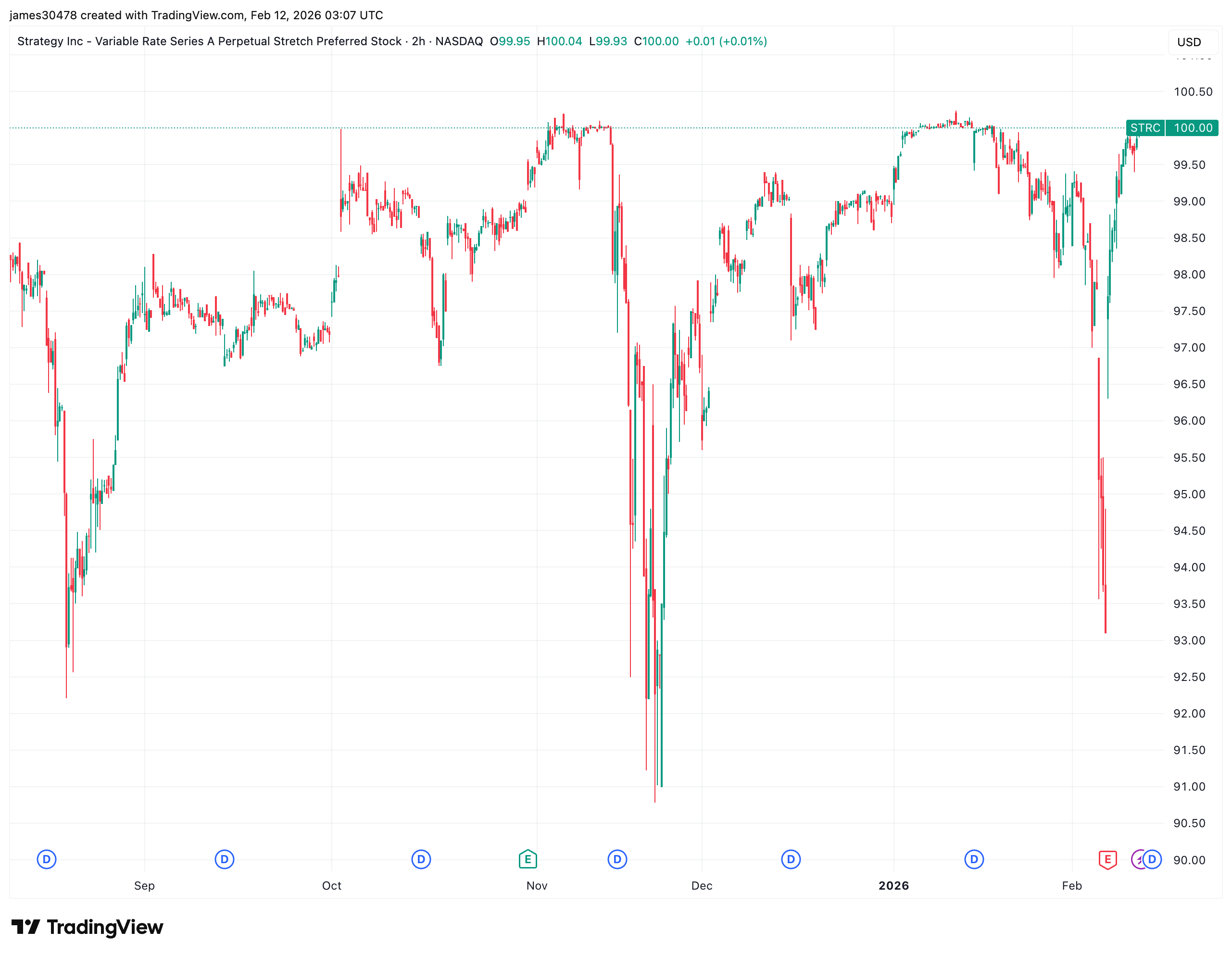

- Stretch (STRC) reclaimed its $100 par value for the first time since mid-January, a sunbeam slipping through a window, enabling Strategy (MSTR) to resume at-the-market offerings for additional bitcoin purchases.

- The preferred equity stabilized near par despite recent bitcoin volatility, supported by a monthly dividend rate that Strategy recently increased to 11.25%.

Stretch (STRC), the perpetual preferred equity issued by Strategy (MSTR), the world’s largest corporate bitcoin holder, reclaimed its $100 par value during Wednesday’s U.S. session for the first time since mid-January.

STRC trading at or above par enables the company to resume at-the-market (ATM) offerings to fund further bitcoin acquisitions. STRC last hit the $100 level on Jan. 16 when bitcoin hovered near $97,000; however, as the largest cryptocurrency by market capitalization retreated to as low as $60,000 by Feb. 5, STRC dipped to a low of $93 before its recent rebound.

Positioned as a short-duration, high-yield credit instrument, STRC currently offers an 11.25% annual dividend distributed monthly. To mitigate volatility and incentivize trading near par, Strategy resets this rate monthly, recently hiking it to the current 11.25% yield.

MSTR common stock faced pressure, sliding 5% on Wednesday to close at $126, as bitcoin hovers around $67,500.

Markets, that stubborn chorus, applaud and sigh in the same breath; a par value becomes a little sunbeam, and ATM offerings wear a wry smile at the prospect of more bitcoin on the table.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Monster Hunter Stories 3: Twisted Reflection launches on March 13, 2026 for PS5, Xbox Series, Switch 2, and PC

- Here Are the Best TV Shows to Stream this Weekend on Paramount+, Including ‘48 Hours’

- 🚨 Kiyosaki’s Doomsday Dance: Bitcoin, Bubbles, and the End of Fake Money? 🚨

- 20 Films Where the Opening Credits Play Over a Single Continuous Shot

- 39th Developer Notes: 2.5th Anniversary Update

- 10 Hulu Originals You’re Missing Out On

- 10 Underrated Films by Ben Mendelsohn You Must See

- Target’s Dividend: A Redemption Amidst Chaos

- First Details of the ‘Avengers: Doomsday’ Teaser Leak Online

2026-02-12 07:14