It’s surprisingly common for people in the entertainment industry to face money problems, and many talented Black actors have struggled with debt, legal issues, and even bankruptcy. Despite working in Hollywood, these actors have publicly dealt with financial difficulties. This list details some of those who have experienced reported money troubles over the years.

Wesley Snipes

Wesley Snipes rose to fame as an action star in movies like ‘New Jack City’ and the ‘Blade’ films. However, his life changed dramatically when he was found guilty of not filing his taxes. He spent three years in prison and accumulated a huge debt to the IRS, reportedly owing millions in back taxes. Since then, he’s been working to revive his career with a range of film projects.

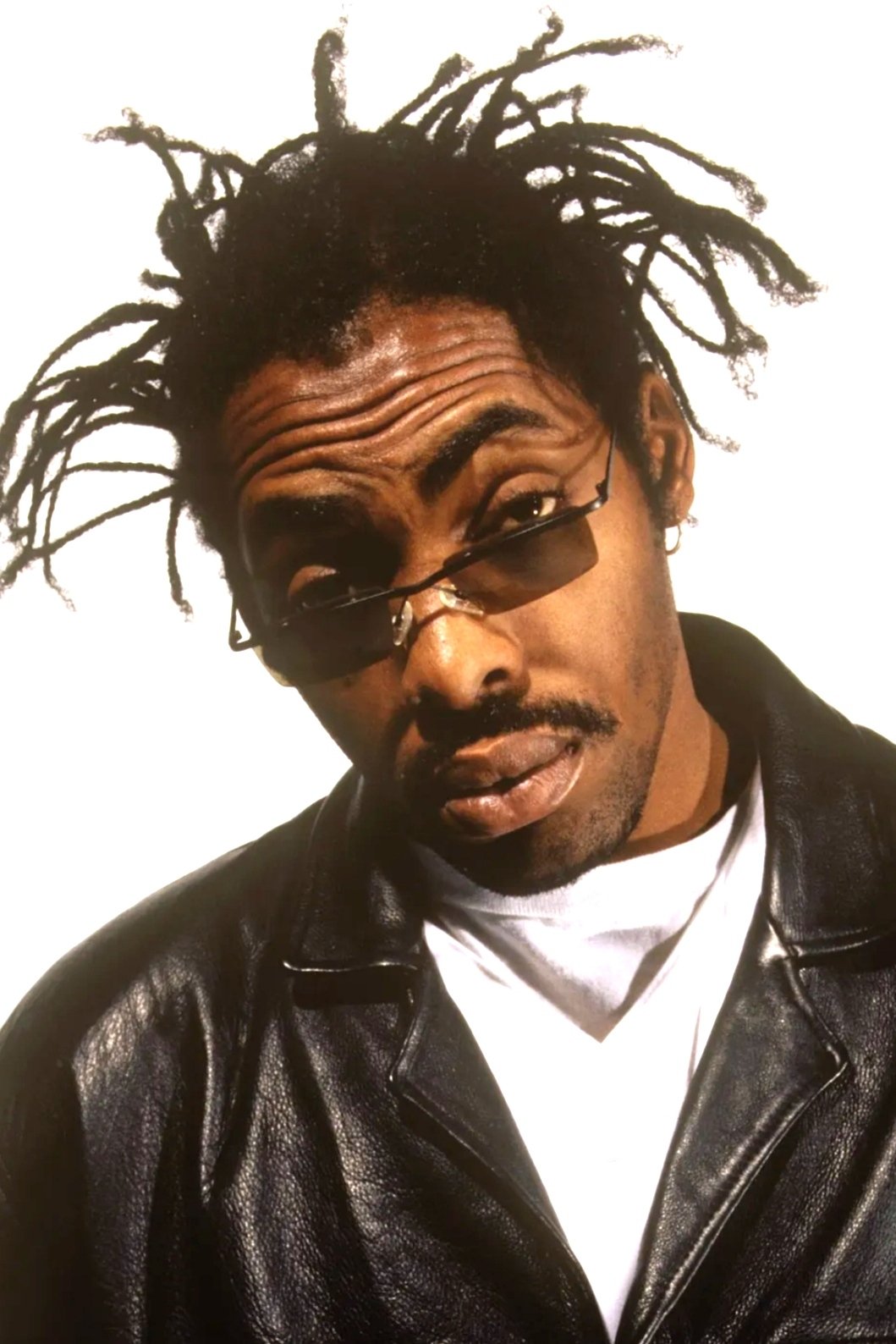

Chris Tucker

Chris Tucker became incredibly successful and earned huge paychecks for the ‘Rush Hour’ movies. However, despite making tens of millions of dollars per film, he faced serious financial problems with his taxes. For years, the IRS placed several liens against him for millions of dollars in unpaid taxes. Tucker has sometimes gone back to stand-up comedy and acting to help resolve these debts. Even with these private financial difficulties, he remains a well-known and popular comedic actor.

Terrence Howard

Terrence Howard is a well-known actor, famous for his roles in movies like ‘Hustle and Flow’ and the TV show ‘Empire’. He’s been in the public eye due to financial issues, including unpaid taxes and disagreements over alimony payments. Howard has often stated he wasn’t fairly compensated for some of his biggest projects. Recently, he’s also been investigated for possible tax avoidance. These personal and legal challenges have had a considerable effect on his wealth.

Sinbad

Sinbad was a popular comedian in the 1990s, known for his sitcom and movies like ‘Jingle All the Way.’ Despite his success, he filed for bankruptcy twice, primarily due to business costs and unpaid taxes. Sinbad has publicly discussed the challenges of staying financially stable as a performer and continued to perform live shows for years to address his debts.

Gary Coleman

Gary Coleman became famous as a young actor on the television show ‘Diff’rent Strokes’. Unfortunately, he lost most of his money because of poor financial decisions made by those managing his earnings, and also due to high medical expenses. This led him to file for bankruptcy in 1999, and he even worked as a security guard to support himself. Throughout his life, Coleman struggled with legal and financial problems, and his experiences highlight the dangers child actors face with their money.

Todd Bridges

Like his ‘Diff’rent Strokes’ co-star Gary Coleman, Todd Bridges faced money troubles after the show ended. He battled personal problems and legal issues that used up the money he’d earned as a child actor, leaving him with few resources. Eventually, he rebuilt his career through writing and smaller acting jobs, including a role on ‘Everybody Hates Chris’. It was a difficult journey, but he overcame significant obstacles to support himself.

Orlando Brown

Orlando Brown first became well-known as a child actor on the Disney Channel show ‘That’s So Raven.’ More recently, he’s faced a number of legal and personal difficulties. These challenges have made it hard to find steady work and have led to financial problems. He’s been trying to get help with these issues since losing his income from acting, and his current financial situation is often linked to his ongoing struggles.

Katt Williams

As a comedy fan, I’ve always enjoyed Katt Williams – he’s hilarious in movies like ‘Friday After Next’ and his stand-up is top-notch. But it’s sad to see how much trouble he’s had with the law over the years. It seems like constant arrests and legal fights have really taken a toll on his finances. I’ve heard he’s dealt with some serious tax issues too, with the IRS filing multiple liens against him. He’s touched on his money problems in his act and interviews, and honestly, it sounds like those legal and tax bills are a huge weight on his career, despite all his success.

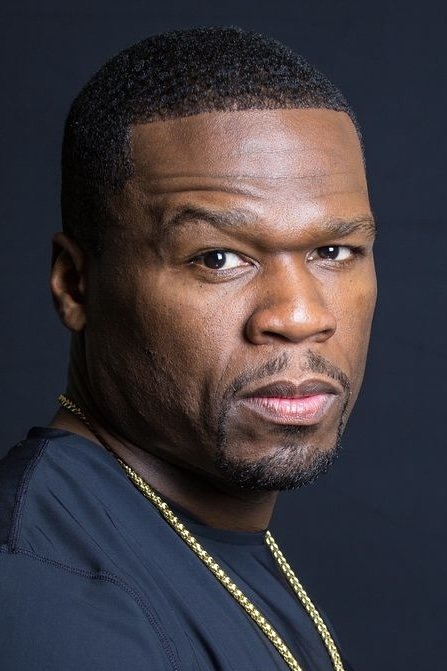

50 Cent

50 Cent first became famous as a musician, but he later expanded into acting with roles in shows like ‘Power’ and the movie ‘Get Rich or Die Tryin’. In 2015, he surprised many by filing for bankruptcy after losing several court cases. This wasn’t necessarily due to a lack of funds, but a calculated plan to restructure his debts and safeguard his possessions. Though he’s since rebuilt his fortune, the filing was unexpected given his image as a successful businessman. Today, he remains a prominent figure in both television production and acting.

MC Hammer

MC Hammer was a hugely popular star, appearing in movies and even his own cartoon, ‘Hammerman’. He’s well-known as a cautionary tale about celebrity finances, as he lost a fortune on extravagant expenses like a large home and numerous employees. While he once earned millions, he eventually accumulated over $13 million in debt. After losing his wealth, Hammer pursued business opportunities and religious work. Now, he shares his experiences to teach others about responsible financial planning.

Flavor Flav

Flavor Flav, best known as a founding member of the hip-hop group Public Enemy and for his reality TV show ‘Flavor of Love’, has struggled with money issues for many years. These problems, including owing money for child support and taxes, have led to arrests and fines. Despite his fame, he’s faced difficulties maintaining a stable financial life and continues to perform and make appearances to earn income.

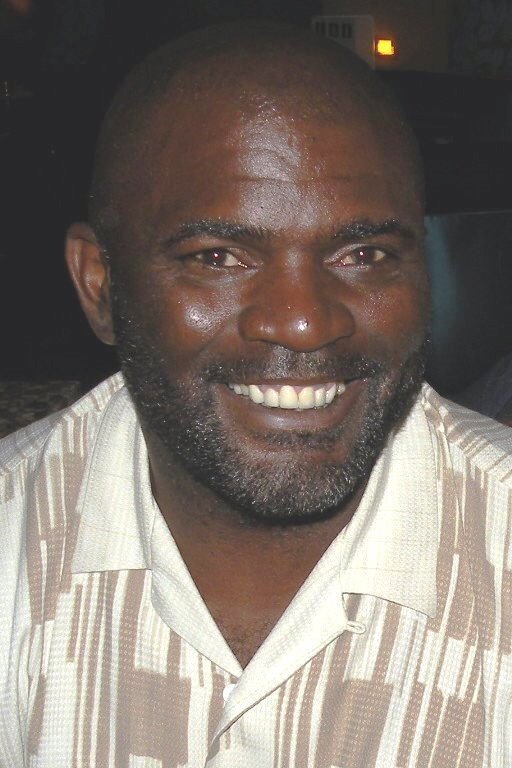

Lawrence Taylor

I’ve always been in awe of Lawrence Taylor, not just as a football giant, but as someone who tried to reinvent himself after the game. It was surprising to learn he faced serious financial difficulties, even filing for bankruptcy to save his home. From what I understand, some bad investments and legal issues really took a toll. It’s been tough watching him navigate those consequences over the years, even while he’s continued to work in TV and film. It just goes to show that even a successful career in sports, followed by a move into acting, doesn’t always guarantee long-term financial stability, and I really admire his resilience through it all.

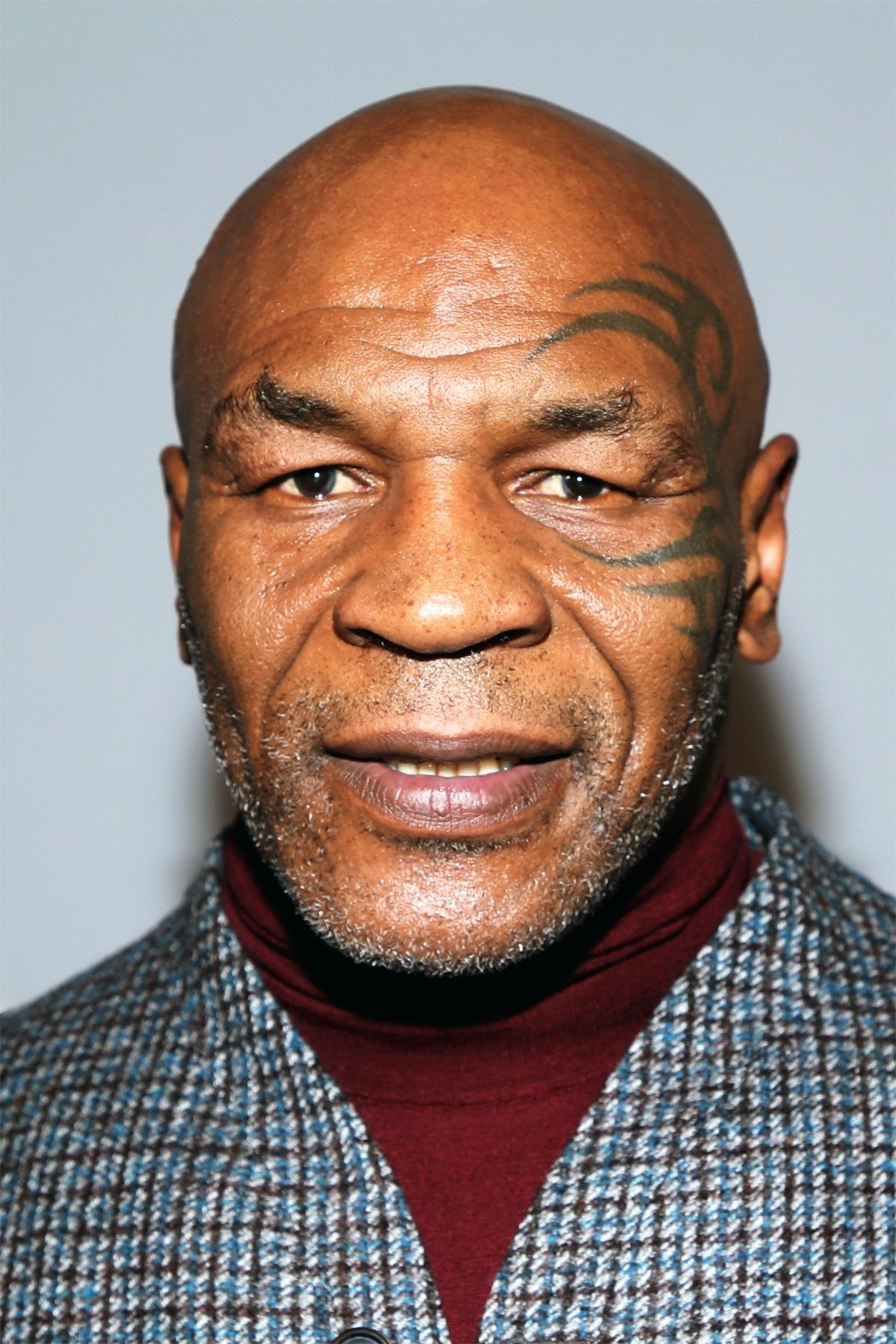

Mike Tyson

Mike Tyson is a globally recognized boxer who’s also appeared in movies like ‘The Hangover’. Although he earned a huge amount of money throughout his boxing career, he surprisingly filed for bankruptcy in 2003 due to significant debt. This was caused by a combination of lavish spending, legal problems, and poor financial decisions. Since then, Tyson has successfully turned things around, rebuilding his reputation and wealth through acting and business deals. His story serves as a reminder that even great fame and fortune can be unstable.

DMX

DMX was a highly successful rapper and actor, known for roles in movies like ‘Exit Wounds’ and ‘Belly’. Despite his fame, he repeatedly faced money problems and filed for bankruptcy on several occasions. A large part of his debt came from owing child support for his children and covering legal costs. Personal struggles also made it difficult for him to maintain consistent work. When he passed away in 2021, he didn’t have much cash or easily accessible savings.

Mekhi Phifer

Mekhi Phifer, known for his roles in movies like ‘8 Mile’ and the TV show ‘ER’, faced financial difficulties and filed for bankruptcy in 2014. He owed over a million dollars in debt and unpaid taxes. At the time, his monthly spending was higher than his income from acting. Since then, he’s continued to work in film and television to pay off his debts. His situation showed that even well-known actors can struggle with money.

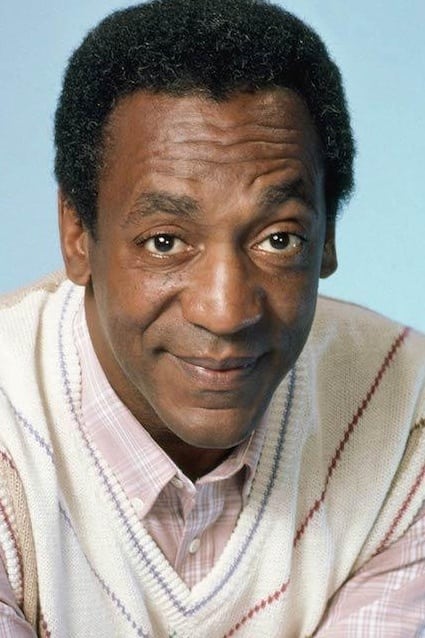

Bill Cosby

Bill Cosby was once incredibly wealthy, largely due to the success of ‘The Cosby Show.’ However, his financial situation changed dramatically after numerous lawsuits and criminal charges were filed against him. Legal costs and settlements have reportedly used up a significant amount of his fortune, and the controversies also affected his income from previous work. As a result, his current financial situation is very different from when he was at the height of his career.

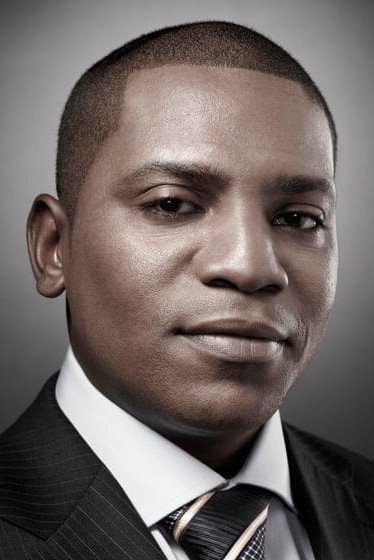

Darius McCrary

Darius McCrary is famous for his role as Eddie Winslow on the popular TV show ‘Family Matters’. Recently, he’s faced money problems, including legal issues related to child support payments. He’s spoken about how hard it’s been to find steady, well-paying acting jobs. These legal battles have made his financial situation even more challenging. He’s now looking for work in independent films and TV shows.

Redd Foxx

Redd Foxx was a hugely popular comedian, best known for his role in the TV show ‘Sanford and Son’. Although he was successful, he spent a lot of money and got into serious trouble with the IRS. Before he passed away, the government took his property and house because of unpaid taxes. Sadly, Foxx died on the set of ‘The Royal Family’ while still owing a large amount of money. His story is often used as a cautionary tale for entertainers, highlighting the need to manage finances and pay taxes properly.

Sammy Davis Jr.

Sammy Davis Jr. was a hugely talented performer and a famous member of the Rat Pack, appearing in many films. Despite earning a lot of money throughout his career, he sadly died in 1990 owing over five million dollars in back taxes. His estate couldn’t cover the debt, and his wife struggled financially for years. His excessive spending and poor financial management ultimately meant he lost all of his wealth. He’s remembered as one of the most famous performers to face financial ruin.

Cuba Gooding Jr.

Cuba Gooding Jr. is known for his Oscar-winning performance in ‘Jerry Maguire’ and for appearing in many popular, high-grossing films. However, his career has faced difficulties in recent years due to legal issues and court appearances. It’s been reported that he’s had to sell properties and other belongings to pay for his legal expenses, and he’s been unable to land significant roles in major films. These legal battles have reportedly caused him considerable financial hardship.

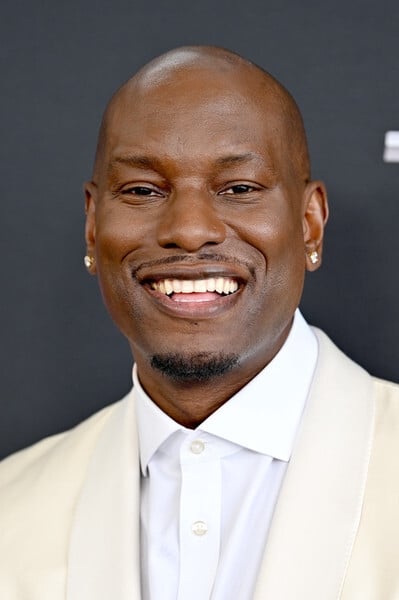

Tyrese Gibson

Tyrese Gibson, known for his roles in the ‘Fast and Furious’ and ‘Transformers’ movies, recently became the center of attention during a public disagreement over child support payments. He explained that high legal costs and inconsistent work were causing him financial hardship. Gibson has openly shared his difficulties and frustrations about these financial pressures and his career on social media. Although he appears in blockbuster films, his personal finances have been strained.

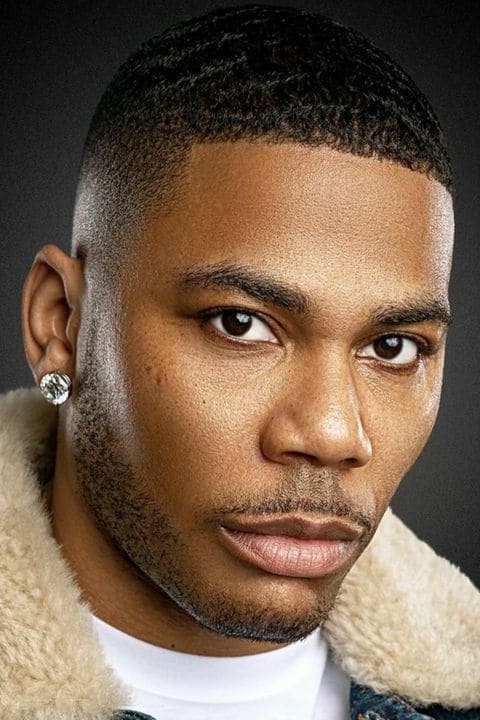

Nelly

Nelly, known as both a rapper and actor with roles in films like ‘The Longest Yard’ and the show ‘Real Husbands of Hollywood’, faced significant financial difficulties in 2016 when news broke that he owed over $2 million in back taxes. His fans rallied to support him, even starting a campaign to boost streams of his music in an effort to help him pay the debt. Nelly has continued to perform concerts and act in order to address these financial issues. While he remains a well-known and popular artist, his tax problems have presented a major challenge.

Ja Rule

Ja Rule was a major figure in the early 2000s, known for his music and acting, including a role in ‘The Fast and the Furious’. He later faced legal trouble and served time in prison for not paying his taxes, owing several million dollars. His involvement with the disastrous Fyre Festival also caused him financial and professional setbacks, significantly impacting his wealth and reputation. Since then, he’s been concentrating on new business projects and making occasional appearances in entertainment.

Method Man

Method Man, known for his music with the Wu-Tang Clan and acting roles in shows like ‘The Wire’ and ‘Power Book II: Ghost,’ publicly faced a financial issue when New York state took his Lincoln Navigator due to unpaid taxes. He explained this was a simple oversight caused by a hectic schedule. Although he’s currently addressing past tax problems, records show a history of non-compliance. In recent years, he’s made a conscious effort to manage his finances carefully and avoid further asset seizures.

Damon Dash

Damon Dash, a co-founder of Roc-A-Fella Records and a film producer and actor, has experienced significant financial difficulties in recent years. He’s faced foreclosures, lawsuits, and a substantial loss of wealth, which he often discusses as a result of issues within the traditional entertainment industry. Public records show he’s accumulated debts to various creditors and tax agencies over the last ten years. Despite these challenges, Dash remains committed to advocating for independent business ventures.

Xzibit

Xzibit, a musician and actor famous for hosting ‘Pimp My Ride’ and appearing in ‘Empire’, experienced financial difficulties after his TV show ended. He filed for bankruptcy twice when his income decreased and he faced significant tax debts, struggling to maintain his previous lifestyle. Xzibit has spoken about how quickly financial stability can disappear after a hit show ends. Since then, he’s focused on new ventures in the cannabis industry and independent media.

Pras Michel

Pras Michel, known as a member of the Fugees and for his roles in films like ‘Mystery Men’ and ‘Turn It Up’, is currently facing serious legal challenges. These cases involve international political issues and campaign finance, and have reportedly cost him a lot of money, leading to frozen assets. He’s dealing with substantial legal bills and possible fines, which put what’s left of his wealth at risk. These legal battles have largely taken over his career.

Kel Mitchell

Kel Mitchell became famous on Nickelodeon shows like ‘All That’ and ‘Kenan and Kel’. However, after that initial success, he went through a difficult time with work and money. He’s talked about how hard it was to find roles after being a child star and the impact it had on his finances. Eventually, Kel found success again doing voiceover work and returning to Nickelodeon. His experience is similar to what many actors go through – periods of high earnings followed by financial challenges between big projects.

Jaleel White

Okay, so everyone remembers Jaleel White as the unforgettable Steve Urkel, right? But what’s fascinating is how his career unfolded after ‘Family Matters.’ Like a lot of kids who find early fame, he really had to hustle to find consistent work as an adult. I was surprised to learn he wasn’t nearly as rich as people think after the show wrapped! He’s been taking on all sorts of roles – guest appearances, hosting gigs, you name it – just to keep things going. He’s still working steadily, which is great, but it hasn’t always been easy, and he’s definitely faced some tough financial times. It’s a good reminder that childhood stardom doesn’t guarantee a lifetime of wealth.

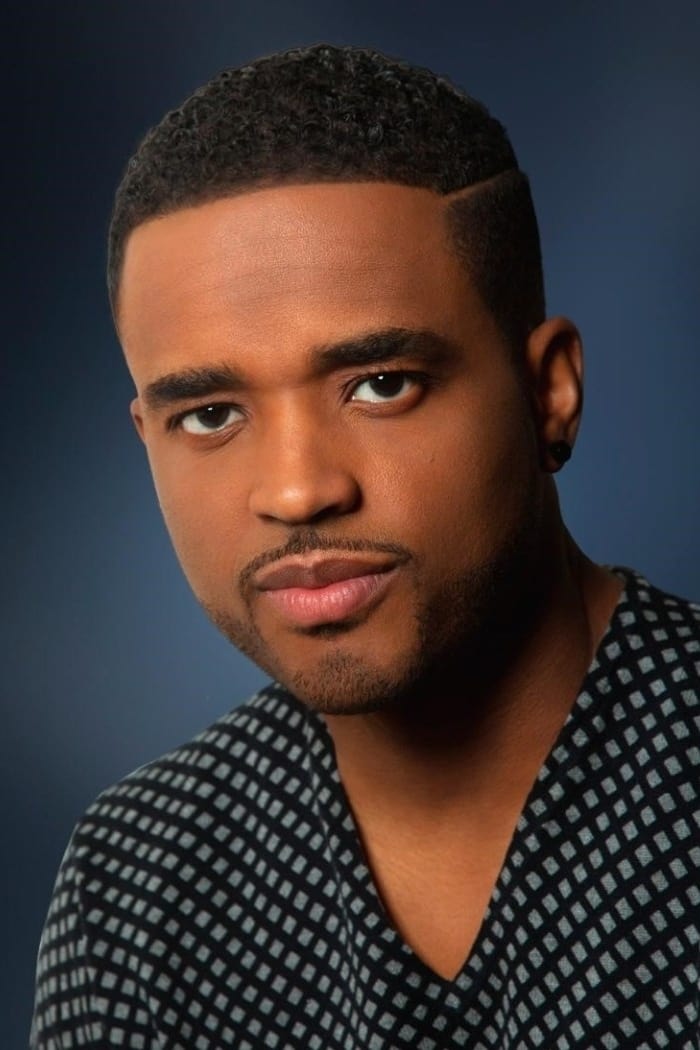

Larenz Tate

Larenz Tate is a well-known actor, famous for his roles in films like ‘Menace II Society’ and ‘Love Jones’. While he’s had a successful career, there have been ongoing rumors about his finances. He generally keeps his personal life private, and continues to work on popular shows like ‘Power’. He’s included on this list due to industry reports suggesting he’s experienced financial ups and downs throughout his long career in Hollywood.

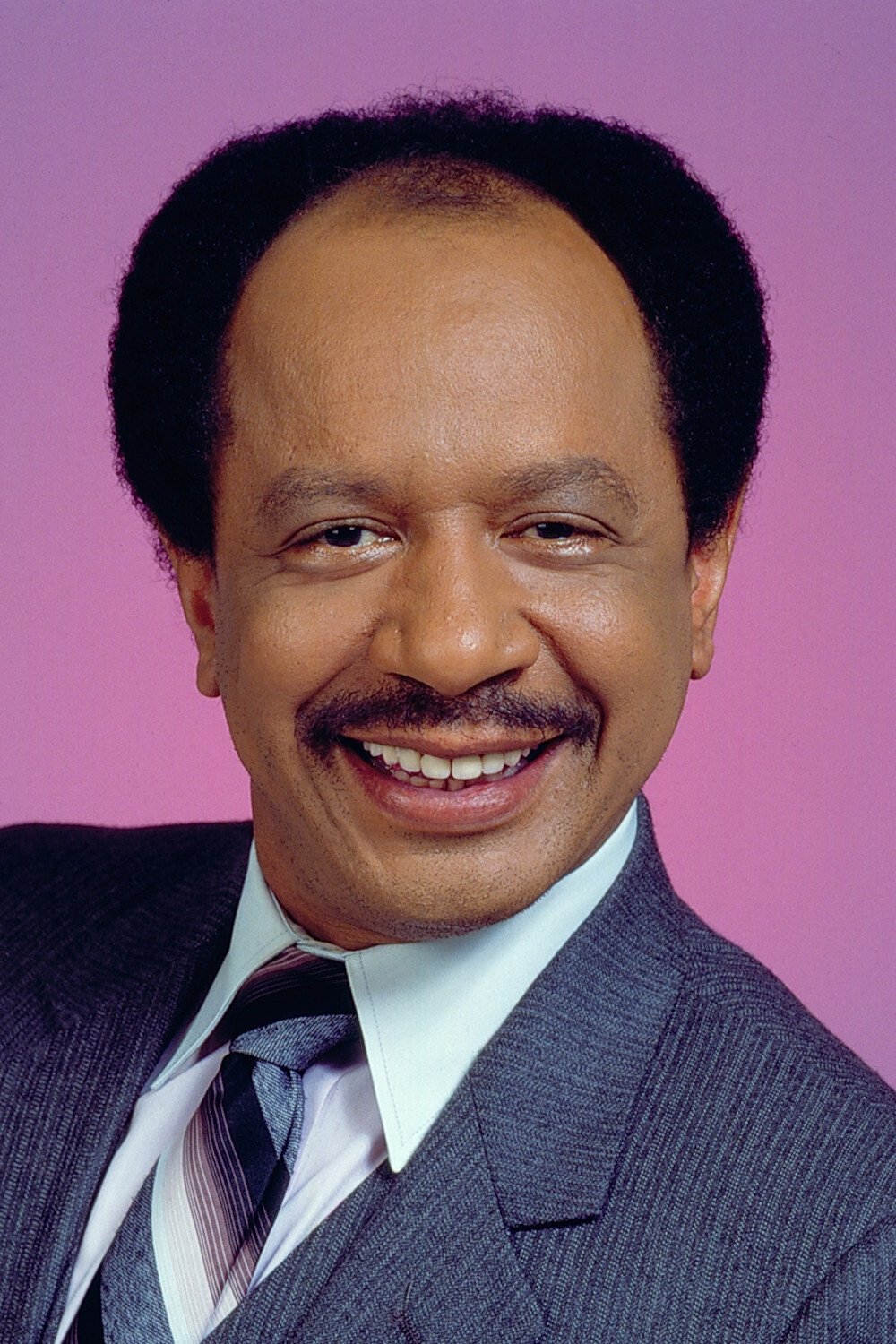

Sherman Hemsley

Sherman Hemsley, best known for playing George Jefferson on ‘The Jeffersons’, was a popular and talented actor. However, after his death in 2012, it became clear he hadn’t accumulated much wealth. He struggled with money towards the end of his life and actually lived quite simply. Even a dispute over his final arrangements revealed how limited his finances were, which was a surprising contrast to his fame as a TV star.

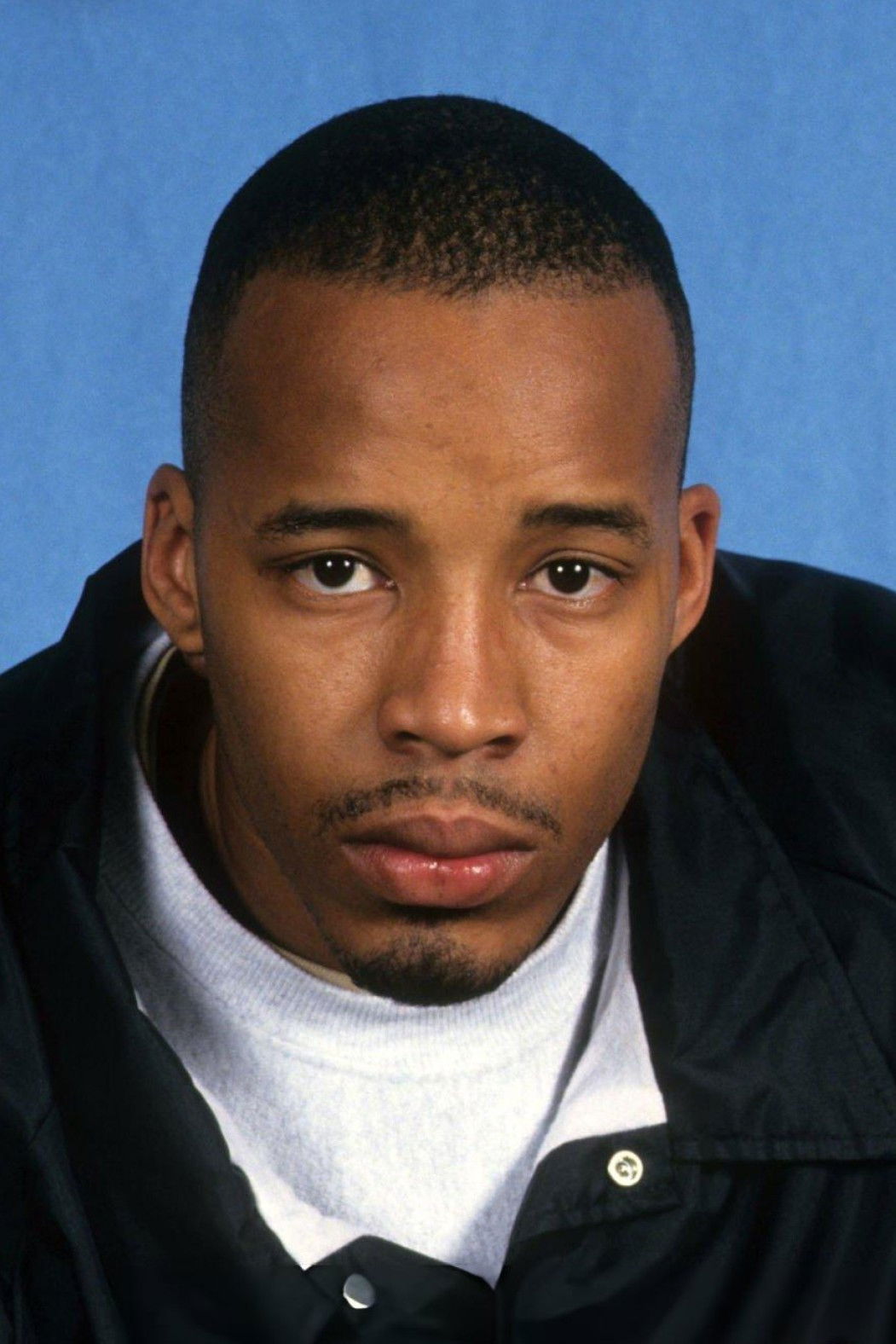

De’Angelo Wilson

I was really saddened to hear about De’Angelo Wilson. He was a fantastic actor – I remember him vividly in both ‘8 Mile’ and ‘Antwone Fisher’. It’s just heartbreaking to learn that, despite getting such a strong start in those big films, he had a tough time finding consistent work after that. From what I understand, this led to serious financial problems and a really difficult personal life. It’s incredibly tragic that he was reportedly facing homelessness and had very little money when he passed away. He’s remembered as someone with so much potential, but whose career sadly took a really devastating turn.

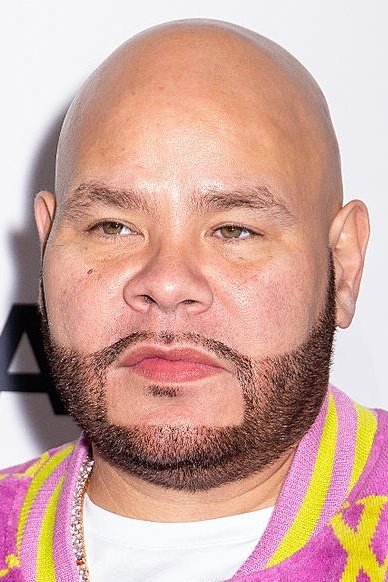

Fat Joe

Fat Joe is a rapper and actor known for roles in movies like ‘Scary Movie 3’ and ‘Happy Feet’. He went to federal prison because he hadn’t paid taxes on over three million dollars he earned. He admitted he was wrong and paid the taxes he owed as part of a legal agreement. Since being released, he’s found a lot of success in both music and other media projects. However, his time in prison and the fines he had to pay were a major financial setback in his career.

Master P

Master P is a successful entrepreneur and actor, known for roles in films like ‘Gone in 60 Seconds’ and his own productions. Though he was once incredibly wealthy, he’s been involved in several financial and legal issues. His divorce brought attention to changes in his finances and the worth of his businesses. Over time, he’s faced lawsuits from past colleagues and problems with taxes. While Master P continues to work in business, these legal battles have impacted his once-high financial standing.

Warren G

Warren G, known for his music and acting role in ‘The Show’, was a key figure in the development of West Coast hip-hop. While he initially found success in the 1990s, he later experienced financial struggles. He’s openly discussed the difficulties of handling money and the realities of the music industry, and continues to work through touring and smaller projects to maintain his career. His story illustrates how challenging it can be to stay wealthy over a long period of time.

Coolio

Coolio rose to fame in the 1990s with roles in the film ‘Dangerous Minds’ and his own TV shows. Later in life, he struggled with legal problems that affected his money and financial security. Reports often mentioned unpaid taxes and child support payments as contributing factors. He kept working by performing concerts around the world and appearing on reality TV. Despite his international popularity, his estate wasn’t as substantial as many might expect when he passed away.

Tony Cox

Tony Cox, known for his appearances in films like ‘Bad Santa’ and ‘Me, Myself & Irene’, previously filed for bankruptcy. This was due to inconsistent work as an actor and growing debts. Like many character actors in Hollywood who aren‘t major stars, he’s faced financial challenges and continued to work in comedies and independent films to make ends meet. His situation highlights a common struggle for seasoned actors in the industry.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Monster Hunter Stories 3: Twisted Reflection launches on March 13, 2026 for PS5, Xbox Series, Switch 2, and PC

- Here Are the Best TV Shows to Stream this Weekend on Paramount+, Including ‘48 Hours’

- 🚨 Kiyosaki’s Doomsday Dance: Bitcoin, Bubbles, and the End of Fake Money? 🚨

- 20 Films Where the Opening Credits Play Over a Single Continuous Shot

- 39th Developer Notes: 2.5th Anniversary Update

- 10 Hulu Originals You’re Missing Out On

- 10 Underrated Films by Ben Mendelsohn You Must See

- Target’s Dividend: A Redemption Amidst Chaos

- ‘The Substance’ Is HBO Max’s Most-Watched Movie of the Week: Here Are the Remaining Top 10 Movies

2026-02-12 05:53