Palantir Technologies. The name itself sounds like something conjured from a forgotten grimoire, doesn’t it?1 And the stock…well, it’s been on a run. A proper, headlong gallop, soaring upwards with the sort of enthusiasm usually reserved for pigeons escaping a particularly grumpy wizard. Over 1,660% in three years. That’s enough to make even the most seasoned gnome accountant raise an eyebrow.

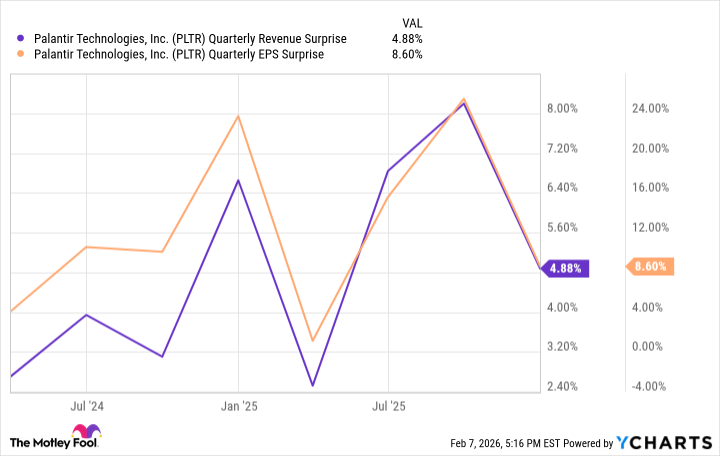

They’ve recently declared the end of their fiscal year 2025, and the numbers…they’re not bad, precisely. Revenue at $1.41 billion, a touch more than the prognosticators predicted. Earnings per share of $0.25, likewise exceeding expectations. It’s like they managed to sneak an extra shilling into every bag of gold. But let’s not mistake competence for sorcery.

And the forecast for 2026? A positively optimistic $7.182 to $7.198 billion. Up to 60.8% growth. A growth rate that would make even a mandrake blush. Their shareholders, naturally, are rather pleased. Their doubters, mostly left in the dust. But the question remains: is this a rocket worth boarding, or merely a brightly coloured firework?

The Hype Continues, and Palantir Continues to Deliver (Mostly)

Wall Street, as usual, is struggling to grasp the fundamentals. It’s like trying to herd cats with a feather duster. They keep topping quarterly estimates, which is…encouraging. But consistently exceeding lowered expectations isn’t quite the same as achieving greatness, is it?

Palantir finds itself in a fortunate position, riding the crest of this so-called “AI boom.” They specialize in crafting bespoke software, taking raw data and…well, divining meaning from it. Optimizing supply chains, distributing vaccines…it’s all rather clever, really. Although, one suspects a healthy dose of algorithmic smoke and mirrors is involved.

Their longstanding relationship with the U.S. government remains a significant source of income – $1.855 billion in 2025, to be precise. A relationship built on mutual benefit, and perhaps a shared understanding of the importance of keeping things…complicated. Their commercial business is also expanding, particularly since the launch of their AIP platform in 2023.

A staggering 137% growth in the fourth quarter for their commercial business. Impressive, certainly. But they still only have 571 commercial customers in the United States. Which means there’s still plenty of room for growth. Or, perhaps, plenty of potential for disappointment. The usefulness of their software across various industries is undeniable. But usefulness doesn’t automatically translate to sustained, exponential growth.

But the Stock is Not a Buy Right Now. Here’s Why.

Stocks rarely come cheap after appreciating by over 1,660%. It’s a simple truth, often overlooked in the frenzy of speculation. Ironically, Palantir isn’t even at its peak. Shares have fallen over 32% from their November 2025 high. Which, one might argue, is a healthy correction. Still, the stock trades at around 45 times its 2026 revenue guide. A valuation that suggests the market has already priced in a rather optimistic future.

They’re operating at a high level, undoubtedly. And they deserve a premium valuation. But a market capitalization exceeding $320 billion? That’s a hefty burden to carry. A large stock with such a steep valuation is vulnerable. A mere hint of slowing growth, a slight misstep, and the whole edifice could come tumbling down.

Palantir isn’t like most software companies. That much is true. But the broader technology landscape is becoming increasingly uncertain. Investors are grappling with the implications of AI’s improving capabilities. A nibble, perhaps, is permissible. But a clear buy? Not at this valuation. Those who hold onto some cash may find better opportunities down the road. After all, the market has a habit of offering second chances. And sometimes, the best investment is simply waiting for the dust to settle.

1 Derived from the ancient practice of ‘data divination’, where scribes would meticulously record and interpret patterns in celestial movements and market fluctuations. The original Palantír, a crystalline sphere used for scrying, was notoriously unreliable, often providing ambiguous or misleading visions. This modern iteration, while slightly more accurate, suffers from similar limitations.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Monster Hunter Stories 3: Twisted Reflection launches on March 13, 2026 for PS5, Xbox Series, Switch 2, and PC

- Here Are the Best TV Shows to Stream this Weekend on Paramount+, Including ‘48 Hours’

- 🚨 Kiyosaki’s Doomsday Dance: Bitcoin, Bubbles, and the End of Fake Money? 🚨

- 20 Films Where the Opening Credits Play Over a Single Continuous Shot

- 39th Developer Notes: 2.5th Anniversary Update

- 10 Hulu Originals You’re Missing Out On

- 10 Underrated Films by Ben Mendelsohn You Must See

- Target’s Dividend: A Redemption Amidst Chaos

- First Details of the ‘Avengers: Doomsday’ Teaser Leak Online

2026-02-11 23:42