Steam offers a huge variety of horror games to satisfy any fear. You can find everything from mind-bending thrillers to action-packed survival games. These games often use clever gameplay and create spooky atmospheres to really pull you into terrifying worlds. Both independent developers and major studios are constantly creating new and exciting horror experiences. This list showcases some of the most memorable and highly-rated horror games you can download right now.

‘Amnesia: The Dark Descent’ (2010)

I’m really into this game where you play as Daniel, and it’s seriously creepy! You’re stuck in this dark, old Prussian castle, and you have to sneak around monsters because you can’t fight them at all. It’s all about figuring out puzzles and using the environment to your advantage. The biggest challenge is keeping your sanity – you have to keep a light on, or Daniel starts to lose it in the darkness. A lot of people say this game brought survival horror back to life by making you feel totally vulnerable and really messing with your head.

‘Outlast’ (2013)

In this game, you play as investigative journalist Miles Upshur, exploring a run-down asylum filled with dangerous patients. You’ll focus on sneaking around and avoiding enemies, using a camcorder to see in the dark. Managing the camcorder’s battery is key to survival, as it’s your only source of light. The game builds tension through constant, intense chases.

‘Resident Evil 7: Biohazard’ (2017)

In this game, Ethan Winters journeys to an abandoned plantation in Louisiana to find his wife. The game switched to a first-person view to make the experience more terrifying and create a sense of being trapped. Players have to carefully manage their supplies while facing off against the dangerous, mutated Baker family. It’s a return to the series’ origins, emphasizing exploration and item management within a tight, enclosed environment.

‘Alien: Isolation’ (2014)

In this game, you play as Amanda Ripley, investigating the fate of her mother aboard a rundown space station. A relentless Xenomorph stalks you, adapting its behavior based on your actions. While tools like the motion tracker help locate the creature, they also reveal your own position. The game’s visuals are carefully crafted to match the look and feel of the original 1979 movie.

‘Phasmophobia’ (2020)

Players team up as ghost hunters, exploring spooky locations to find proof of ghosts. The game listens to what players say and lets ghosts respond, making the experience more realistic. Players use tools like thermometers and spirit boxes to figure out what kind of ghost is haunting a place. It’s become very popular because it’s a fun, cooperative game that mixes investigation with jump scares.

‘Dead Space’ (2023)

In this survival horror game, engineer Isaac Clarke battles terrifying creatures called Necromorphs aboard a mining ship. Instead of simply shooting for headshots, players are encouraged to strategically cut off enemy limbs to survive. This updated version of the 2008 classic features improved graphics and a fully voiced main character. The game’s chilling lighting and sound effects create a truly isolating experience in the vastness of space.

‘The Forest’ (2018)

A man struggles to survive on a deserted island after a plane crash, facing the danger of cannibalistic creatures. He must build shelter, craft tools, and venture into a huge network of caves to find his missing son. The enemies are frighteningly unpredictable, behaving in complex ways as a group. Players need to manage basic needs like hunger and thirst while also defending against relentless nighttime attacks.

‘SOMA’ (2015)

Okay, so I’m playing this game set in this totally creepy underwater base. Basically, humanity’s minds have been uploaded into computers, and you’re wandering around the place which is falling apart. There are these hostile robots everywhere trying to kill you, and you have to avoid them. But it’s not just about action; the story really messes with your head, making you think about what it means to be human and if a digital copy of your brain is actually you. It’s super atmospheric and unsettling, more about a constant feeling of dread than cheap jump scares, which I really appreciate.

‘Resident Evil 2’ (2019)

In the zombie-filled city of Raccoon City, new police officer Leon Kennedy and college student Claire Redfield struggle to survive and escape. This updated version of the classic game uses a modern third-person perspective and controls, but keeps the challenging inventory system. A powerful enemy, the Tyrant, relentlessly pursues you through the police station, creating constant tension. With a variety of puzzles and different paths to explore, the game offers a lot of replayability for survival horror fans.

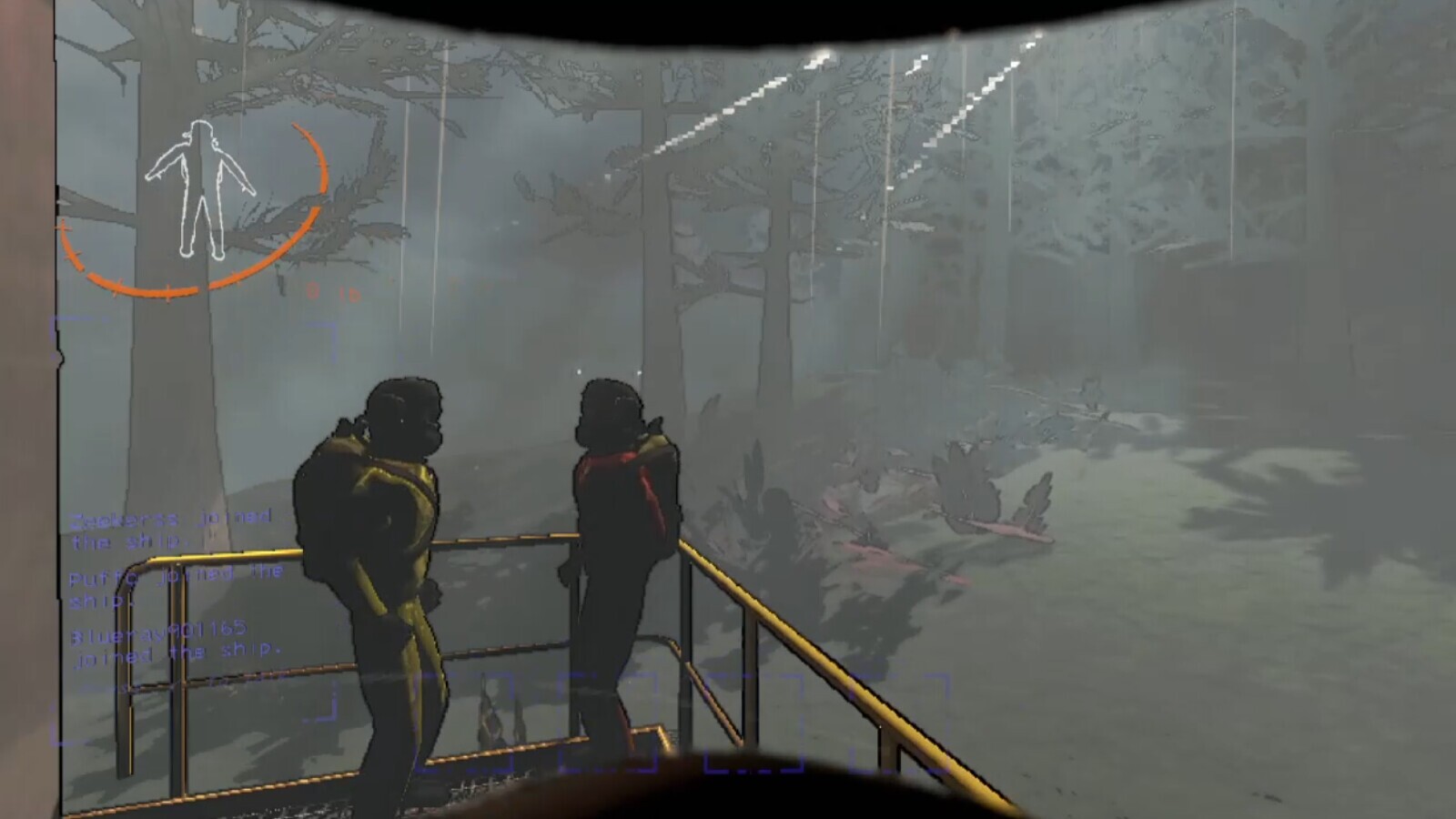

‘Lethal Company’ (2023)

Players take on the role of freelance workers scavenging for materials on deserted industrial moons for a shadowy company. The game is designed for teamwork, where players must hit their profit goals while dodging dangerous monsters and hazardous environments. Using voice chat, you’ll hear your teammates’ reactions – whether it’s a shout of alarm or a chilling silence. It’s a funny and scary experience thanks to its wacky physics and surprising monster attacks.

‘Silent Hill 2’ (2024)

James Sunderland journeys to the eerie, fog-filled town of Silent Hill after receiving a letter seemingly from his late wife. This updated version of the beloved psychological horror game features stunning new graphics and more refined combat. The terrifying creatures and unsettling locations represent James’s own hidden guilt and past traumas. Players will need to solve challenging puzzles and explore a constantly changing world to piece together the truth about what happened.

‘Alan Wake 2’ (2023)

The game tells two interwoven stories: FBI agent Saga Anderson investigates disturbing ritualistic murders, while writer Alan Wake tries to escape a terrifying, otherworldly realm by writing his way out. It features a striking visual style, combining realistic live-action footage with stylized graphics. Throughout the game, light is your main defense against the dangerous shadows that pursue the characters.

‘Resident Evil 4’ (2023)

In this game, Leon Kennedy is sent to a remote European village to save the President’s daughter. Players will experience exciting, fast-paced combat where they can block attacks and use their surroundings strategically. The enemies, villagers transformed into creatures called Los Ganados, are smarter and more dangerous than typical zombies. This updated version keeps the fun, over-the-top spirit of the original game while also offering a richer story and more developed characters.

‘Outlast 2’ (2017)

After a helicopter crash in the Arizona desert, a cameraman named Blake Langermann desperately searches for his missing wife. The search leads him to a remote village caught in a bitter conflict between two extreme religious groups. Players experience the world through Blake’s camera, using it to find their way through shadowy cornfields and abandoned buildings while being hunted. The game builds on the ideas from the original, offering larger, more open areas to explore and adding disturbing psychological illusions.

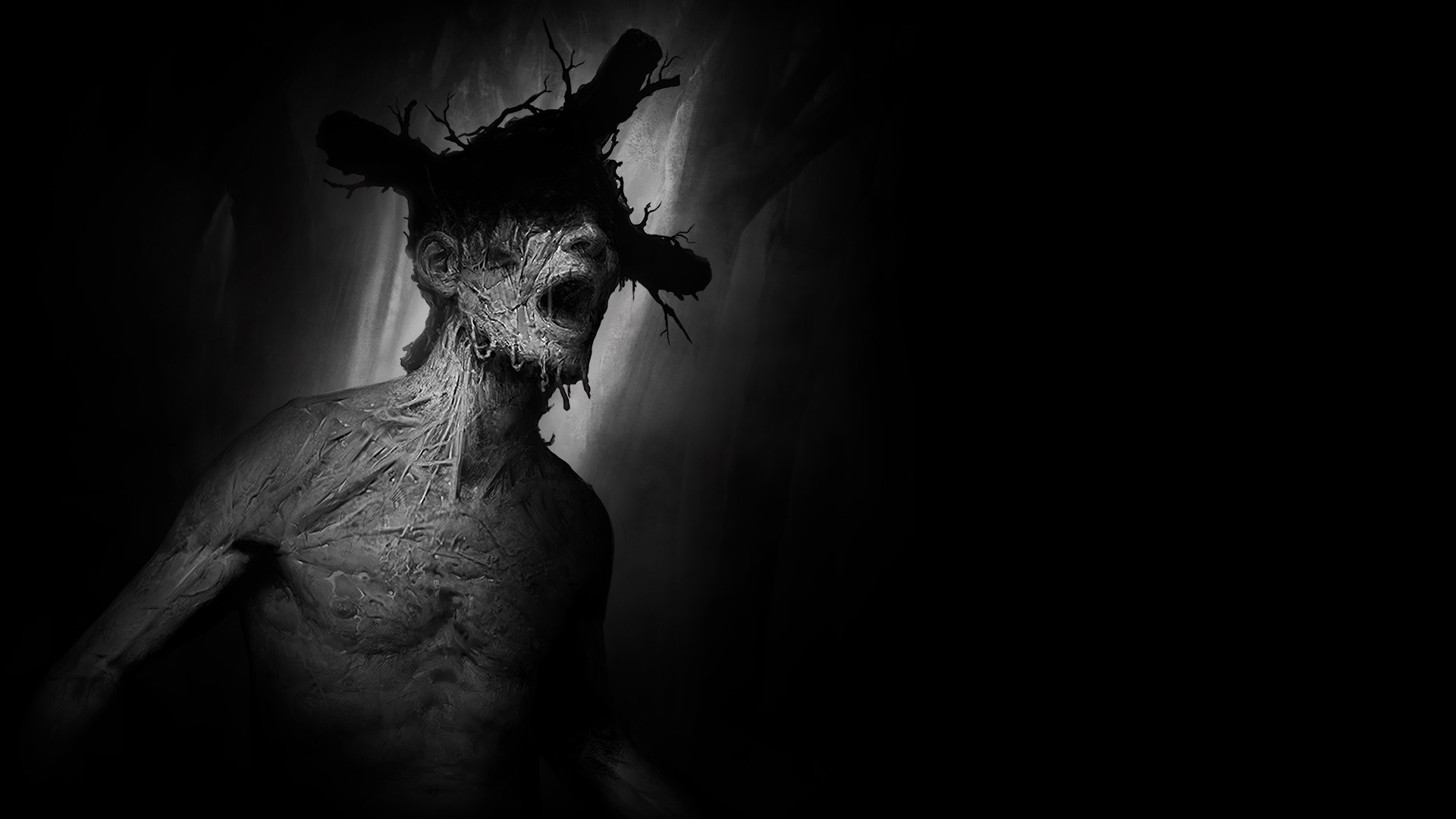

‘The Evil Within’ (2014)

Detective Sebastian Castellanos finds himself trapped in a bizarre and terrifying world filled with monstrous creatures and ever-changing environments. The game blends sneaking and careful planning with challenging boss fights. A unique feature is the ability to use matches to destroy defeated enemies permanently, preventing their return. Created by Shinji Mikami, the game is a modern take on classic survival horror, enhanced with strikingly surreal visuals.

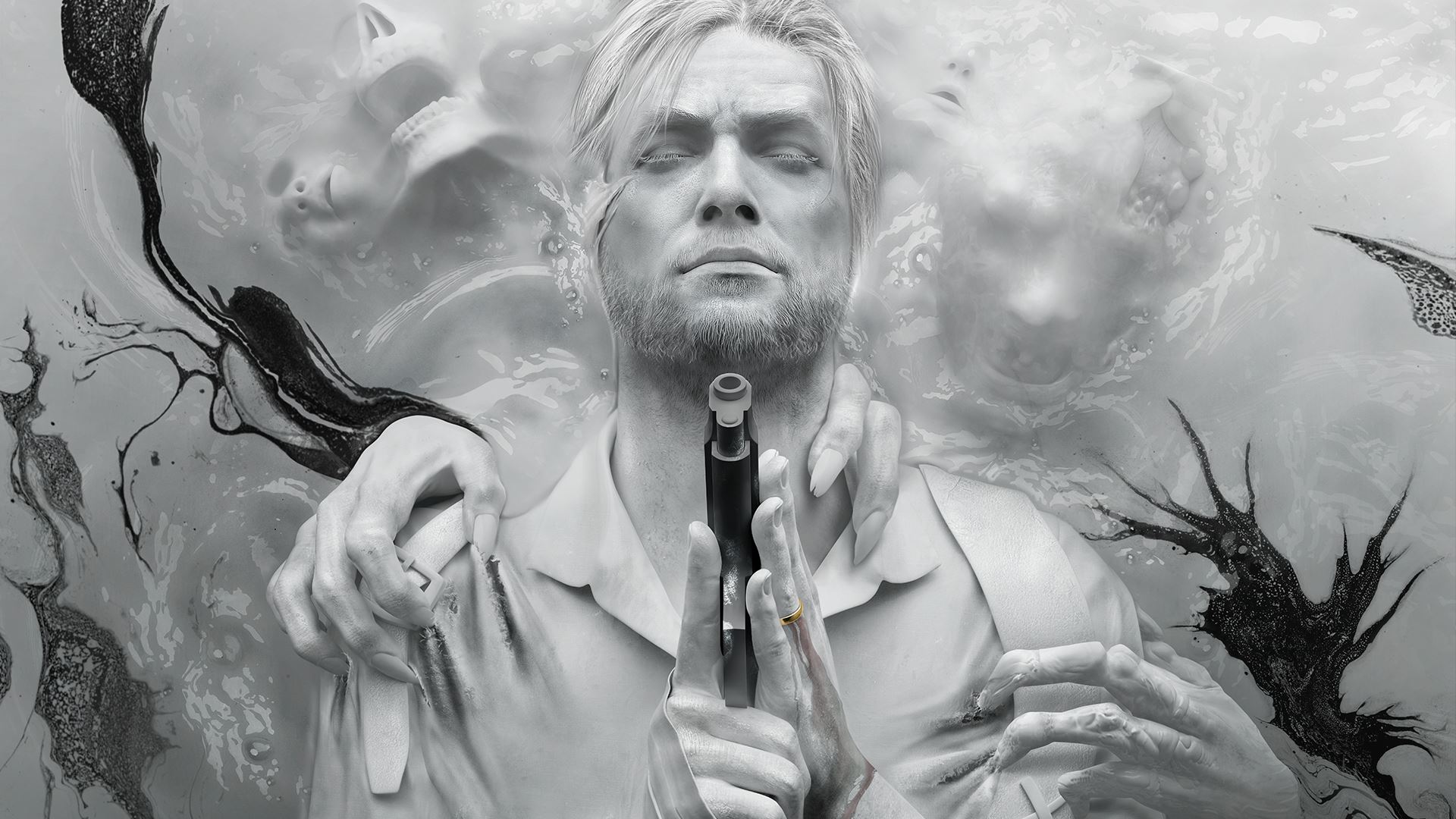

‘The Evil Within 2’ (2017)

Sebastian journeys into a virtual world called Union, hoping to find his daughter, who everyone believed was gone. This new installment offers larger, more explorable areas with plenty of side quests to complete. Players can also craft items and improve their character’s abilities, giving them more ways to survive the dangers they face. The game’s story centers around Sebastian’s quest for forgiveness and his own inner demons.

‘Little Nightmares’ (2017)

Little Six is on a desperate mission to escape The Maw, a huge and terrifying place filled with lost souls. The game makes you feel small and helpless as you navigate this enormous world. You’ll need to solve puzzles using physics and carefully sneak past the creepy creatures who want to catch you. The game’s visuals are a strange mix of cute characters and unsettling, dark imagery.

‘Little Nightmares II’ (2021)

Mono and Six journey through a strange and broken city, relying on each other to survive. They face dangerous obstacles and frightening creatures within the Signal Tower. This new installment adds some fighting and more challenging puzzles that require teamwork. It also reveals more about the world’s history, all while keeping the same unsettling and silent atmosphere as the first game.

‘Layers of Fear’ (2023)

This game offers a fresh take on the series’ lore, centering around a painter driven to complete his ultimate work. The world around the player is constantly changing, mirroring the unraveling of a fragile mind. You’ll explore a Victorian mansion haunted by the family’s sad past and the artist’s inner turmoil. Instead of relying on action, the game creates a chilling experience through its atmosphere and unsettling visuals.

‘Dying Light’ (2015)

In this game, you play as Kyle Crane, who ventures into a city overrun by zombies to recover important data. You’ll need to use fluid parkour moves – running across rooftops and scaling buildings – to get around. While the zombies are sluggish during the day, they become much faster and more dangerous when night falls. To survive, you’ll have to craft weapons and improve your skills, especially when facing the challenging nighttime hordes in the city of Harran.

‘Left 4 Dead 2’ (2009)

In this zombie apocalypse game, four players team up to reach safe zones across the southern US. An intelligent system adjusts the challenge on the fly, throwing obstacles and enemies at the team based on how well they’re doing. Players need to work together and plan carefully to defeat powerful, unique zombies like the Tank and the Witch. It’s a classic cooperative horror experience known for being endlessly replayable and easily customized with mods.

‘Dead by Daylight’ (2016)

In this multiplayer horror game, four players work together as survivors trying to escape, while one player takes on the role of a powerful killer. The survivors have to fix generators to open the exit gates, but the killer is trying to capture them. The game features both original characters and recognizable villains from popular horror movies. Players can personalize their characters with unique abilities and items to match how they like to play.

‘Five Nights at Freddy’s’ (2014)

In this scary game, you play as a night security guard trying to survive five nights at a children’s pizzeria. Animated characters come to life and hunt you, so you have to use security cameras and carefully manage the limited power to keep doors shut and lights on. The game builds suspense through frightening moments and sudden scares as the characters get closer to your office. Its simple gameplay combined with a surprisingly rich backstory led to a huge and popular series of games.

‘Resident Evil Village’ (2021)

In this game, Ethan Winters embarks on a desperate search for his daughter after she’s kidnapped, leading him to a strange village in Europe controlled by four powerful figures. It combines the fast-paced action of a previous game with the scary, first-person perspective of another. Players will face off against creatures like werewolves and vampires in dark, gothic settings. This adventure wraps up Ethan Winters’ story and ties into the broader lore of the series.

‘Sons of the Forest’ (2024)

I was immediately hooked by the premise – you’re sent to this isolated island to find a vanished billionaire, but things quickly go south with these terrifying, cannibalistic mutants! What’s really cool is that this game builds on the base-building and crafting from the first one, making it even better. Plus, you’ve got this AI buddy named Kelvin who’s a huge help with collecting stuff and getting things done, which is awesome for surviving. And it’s not just about fighting – the seasons actually change, so you have to prepare for the brutal winter months. It adds a whole new layer to the gameplay!

‘Inside’ (2016)

I just finished playing this incredible game, and wow! You play as this kid trying to survive in a really bleak, messed-up world, constantly hiding from these shadowy figures. It’s a puzzle platformer, but it’s super stripped-down and focuses on atmosphere – it’s seriously hauntingly beautiful. As you go further in, you discover some really disturbing stuff, like weird experiments and devices that mess with your mind. What’s really cool is that the game doesn’t tell you much – it lets you figure things out for yourself, and honestly, the ending has stuck with me. It’s a really powerful experience.

‘Limbo’ (2010)

A young boy ventures into a shadowy, black-and-white world called Limbo to find his missing sister. The game challenges players with tricky puzzles and platforming sections, where mistakes often lead to instant failure. Players will encounter dangerous creatures like giant spiders and frightening enemies, including hostile children, while navigating dark forests and abandoned industrial areas. Its unique black and white visuals and unsettling quietness set a new benchmark for immersive indie game experiences.

‘Darkwood’ (2017)

This game challenges players to survive in a strange, shifting forest. During the day, you’ll explore and gather resources, but at night, you must defend your shelter from terrifying creatures. The overhead camera angle keeps you focused and creates a feeling of being trapped, even though the world is open. Your only hope for survival is to find materials and build traps. The story changes based on the decisions you make, ultimately determining the fate of the forest.

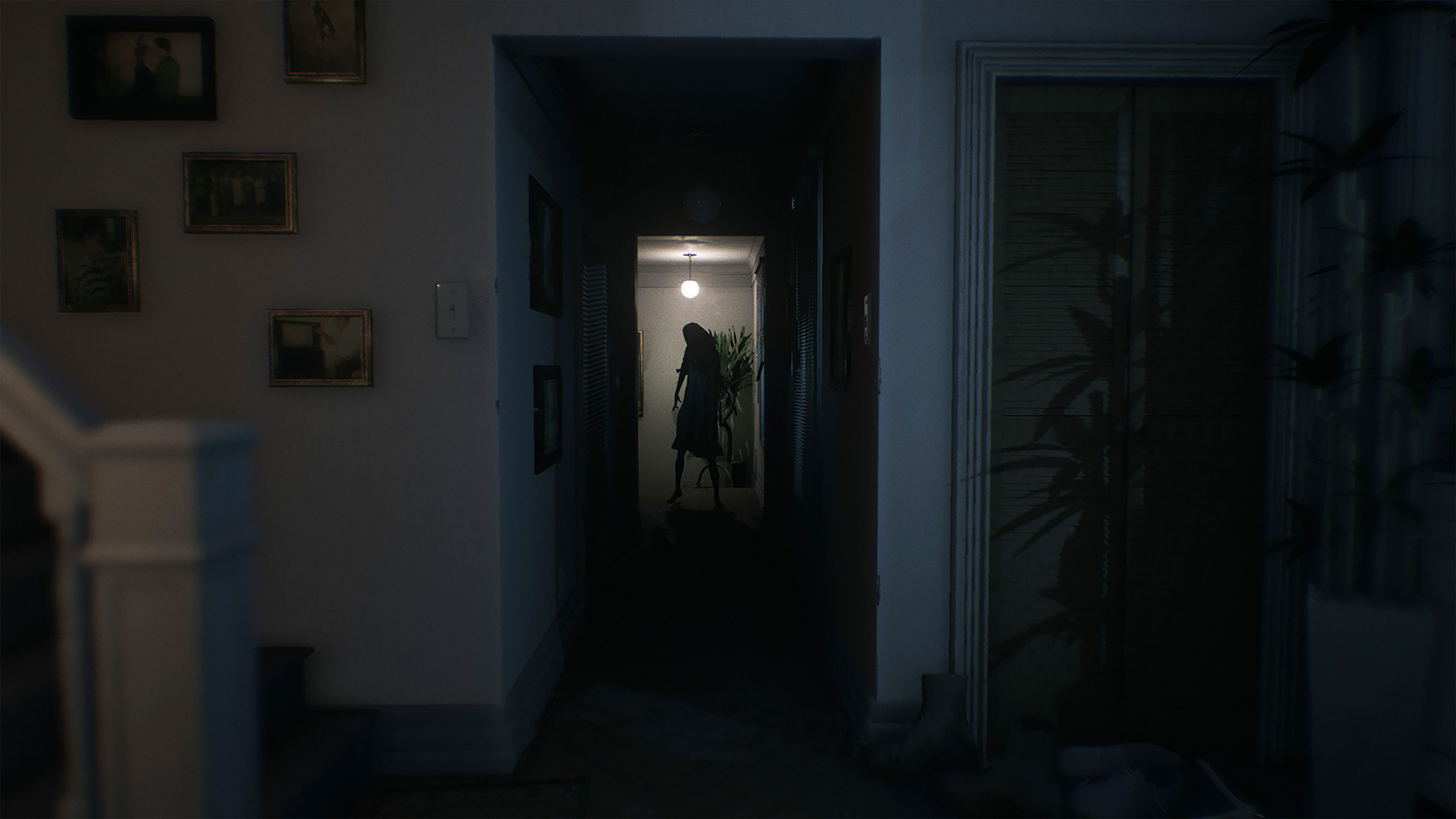

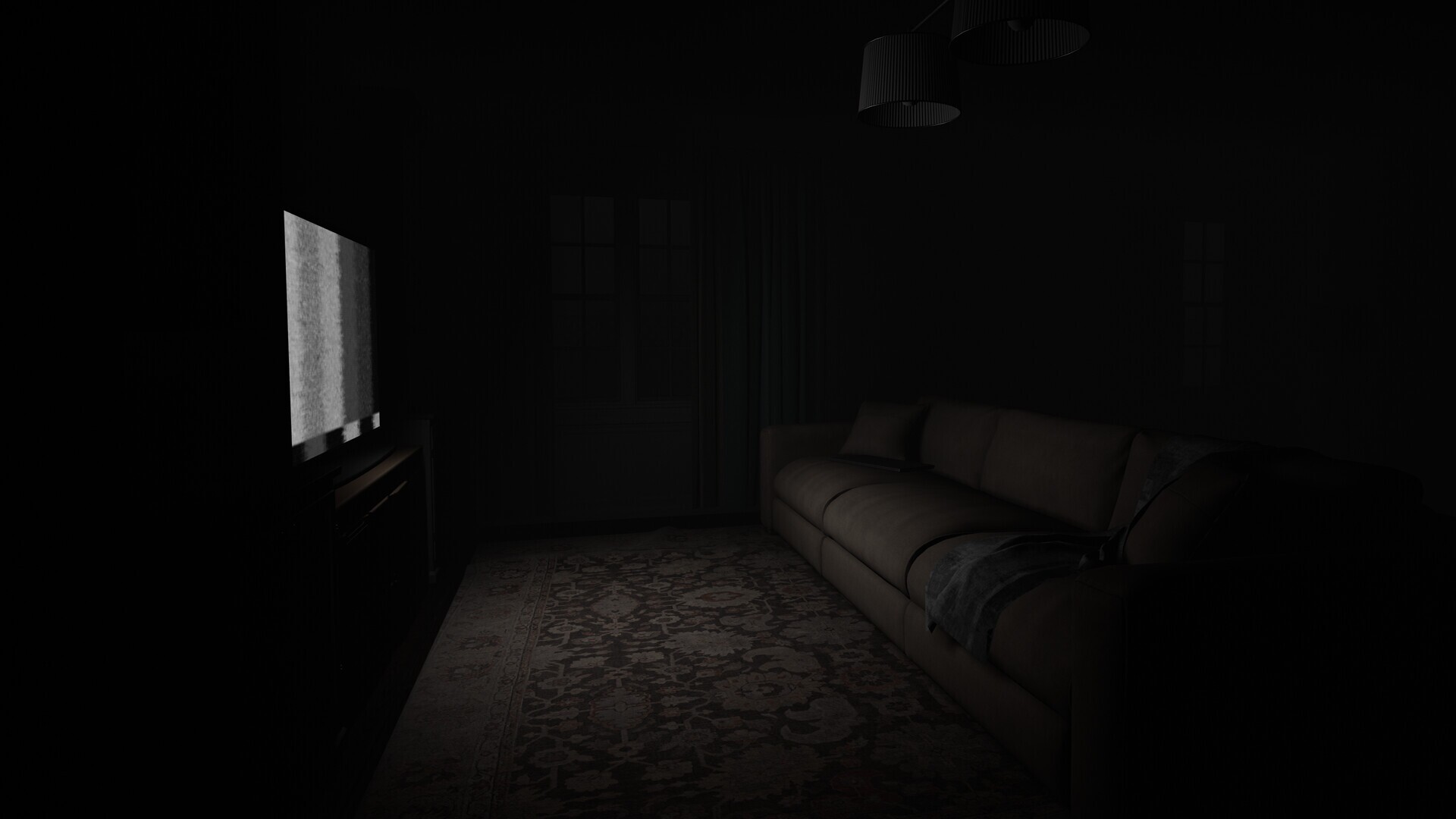

‘Visage’ (2020)

This game takes place in a large house with a dark past, where you uncover the stories of those who lived there before. It’s inspired by the cancelled demo P.T., and emphasizes building tension through psychological horror. Unexpected events and a ‘sanity’ system will keep you constantly anxious, as the house itself seems to respond to your actions. To survive encounters with the supernatural, you’ll need to carefully manage your light sources, like candles and lighters.

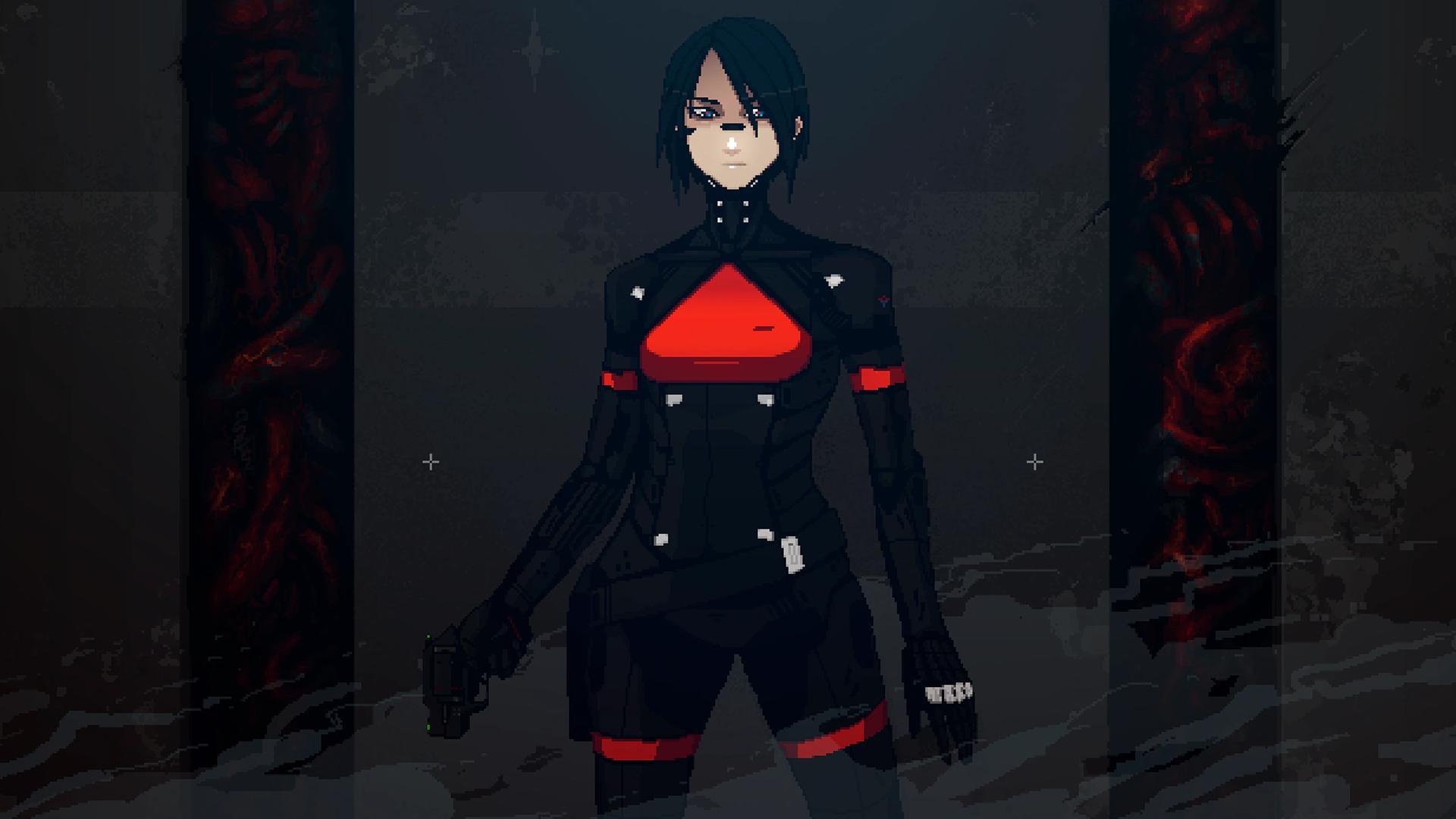

‘Signalis’ (2022)

In this game, you play as Elster, a technician searching for her missing partner within a crumbling, alien facility overrun by terrifying, bio-mechanical creatures. Visually inspired by classic survival horror games, it uses a distinctive low-poly art style and fixed camera perspectives. You’ll need to carefully manage limited resources and solve challenging puzzles to advance the story, which is a strange and unsettling tale blending cosmic horror with a retro-futuristic setting.

‘F.E.A.R.’ (2005)

This game follows an elite soldier with incredibly fast reflexes as they investigate a strange supernatural event connected to a young girl. It blends fast-paced, action-packed first-person shooting with the unsettling atmosphere of Japanese horror, creating a truly frightening experience. Enemies are smart and work together, using the environment to their advantage – and the world around you can be destroyed in the heat of battle. The game masterfully switches between intense combat and quiet, creepy moments, offering a unique and gripping rhythm.

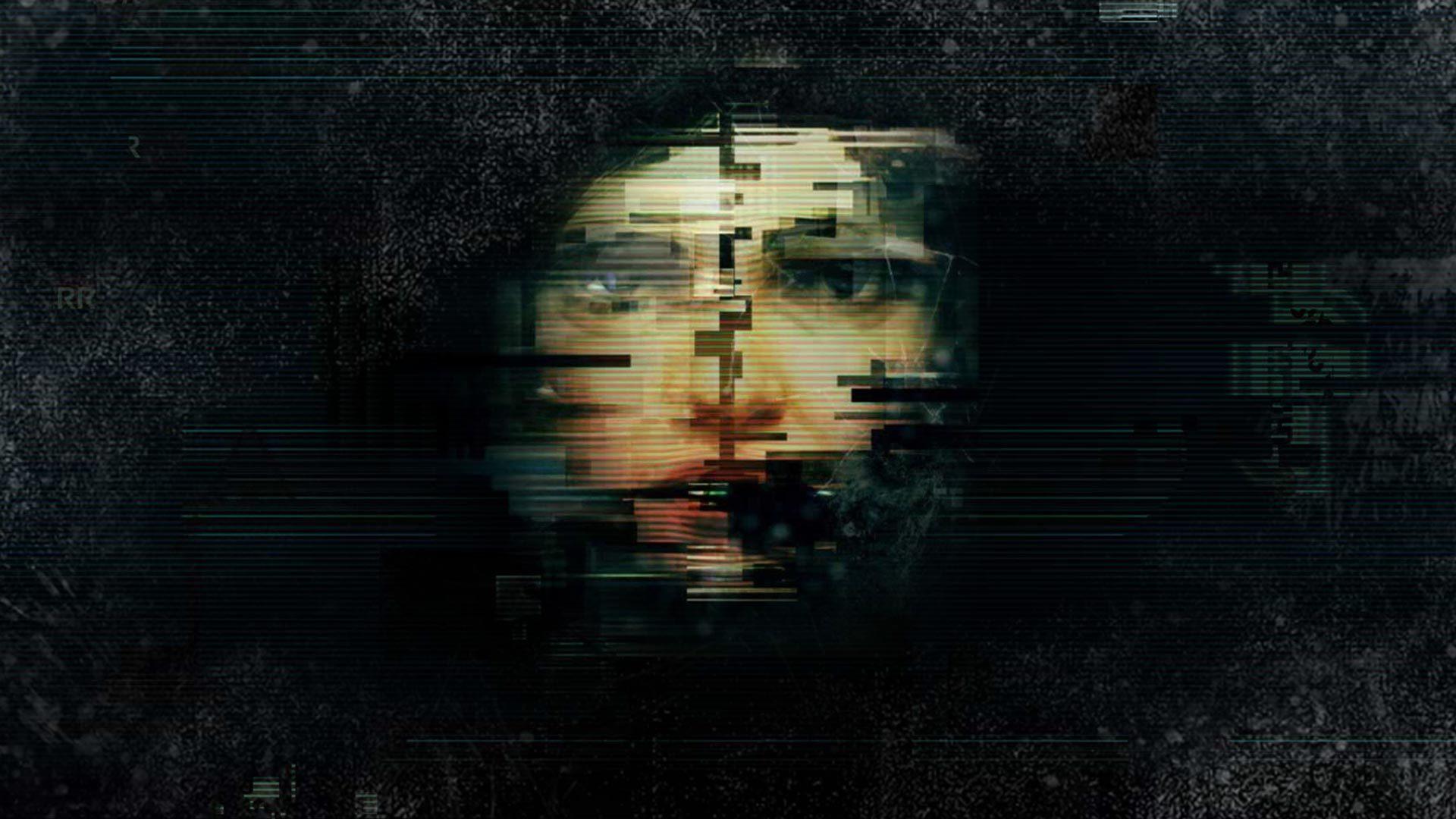

‘Observer: System Redux’ (2020)

Set in a futuristic, gritty world, this game puts you in the role of a detective who can dive into people’s minds to solve a murder. When interrogating suspects, you’ll experience their broken memories and deepest fears through striking visual effects and strange imagery. This updated edition expands on the original story with new content and improved graphics, and notably features the voice and appearance of the late, iconic actor Rutger Hauer.

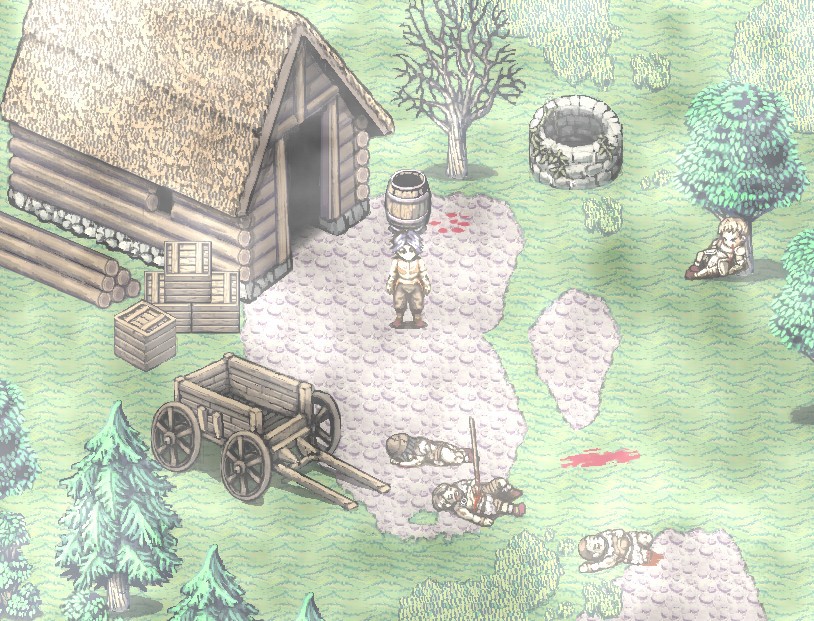

‘Pathologic 2’ (2019)

I’m really excited about this game! You play as a doctor who goes back to their hometown just as a terrible plague breaks out. You’ve only got twelve days to try and save everyone you can, but it’s hard. It’s not just about curing people; you’re constantly worried about being hungry, tired, and the fact that you can’t be in two places at once. Time keeps moving, even when you’re not doing anything, so you’re forced to make some really tough decisions about who to help. It’s a fresh take on an old favorite, and it really focuses on how hopeless things can feel when facing a disaster you know you probably can’t win.

‘SCP: Secret Laboratory’ (2017)

Okay, so I’ve been playing this new game based on the SCP Foundation, and it’s seriously intense. Basically, the facility’s had a containment breach, and you pick a side – are you a scientist trying to fix things, a prisoner trying to escape, or even one of the monsters? It’s super unpredictable because each monster has its own crazy powers that can totally mess up everyone else’s plans. The best part is how much it relies on actually talking to other players – it’s all done through proximity chat, which makes for a really chaotic, but fun, mix of cooperation and competition. You never know what’s going to happen!

‘Devour’ (2021)

Okay, so picture this: you and your team are trying to stop a bunch of creepy cultists from being pulled into hell – seriously, it’s intense! We’re running around these really haunted maps, grabbing ritual stuff while this demon is constantly on our tail and getting more and more aggressive. The closer we get to finishing the ritual, the harder it gets, so everyone has to work together perfectly or we’re toast. The cool thing is, there are different characters you can play and outfits to unlock, so it’s super replayable. I can play it over and over again and still have a blast!

‘Demonologist’ (2023)

Like many ghost hunting games, players explore haunted places to find and remove dangerous spirits. The game boasts incredibly detailed settings and builds tension using scary visuals and sounds. You’ll use different tools to collect evidence and perform rituals to get rid of the ghosts. It really plays on the fear of what you can’t see, with each haunting being different and full of surprises.

‘Still Wakes the Deep’ (2024)

Okay, so I’m playing this game where I’m an oil rig worker way out in the North Sea, and things get seriously messed up. A huge storm hits, but it’s not just the weather – something else is out there, some creepy supernatural thing that’s taken over the rig. I can’t fight back, I don’t have any weapons, so I have to use my knowledge of the rig’s layout to try and escape. It’s super tense and isolating, and the whole industrial setting just adds to the feeling of dread. It’s all about figuring out where to go and avoiding whatever’s hunting me.

‘Madison’ (2022)

Luca finds himself trapped in a locked room, covered in blood, and compelled to finish a disturbing ritual. Players use an instant camera to link the real world with the supernatural, solving puzzles along the way. The story unravels a dark family past, filled with secrets of a serial killer and demonic forces. The game is praised for its incredibly tense and unsettling atmosphere, building psychological dread throughout.

‘The Mortuary Assistant’ (2022)

Okay, so I’m playing this game where I’m a mortician’s apprentice, and it’s seriously creepy. I have to actually embalm bodies, which is way more detailed than I expected, but then things get really weird. Turns out some of these corpses… aren’t exactly human. I have to figure out what kind of demon each body is, using clues I find on them and around the mortuary. If I get it wrong, bad things happen! The goal is to burn the right body, and honestly, there’s a lot to uncover about the funeral home itself. It’s got multiple endings, so I’m really trying to dig deep and figure out everything that’s going on.

‘Doki Doki Literature Club Plus!’ (2021)

This game starts like a normal high school dating sim, but quickly becomes a terrifying psychological horror experience. It messes with your expectations using clever tricks and a disturbing story. This updated version includes extra stories and improved graphics, but still delivers the same shocking impact as the original. It’s well-known for how effectively it plays with your mind and changes how you see the game.

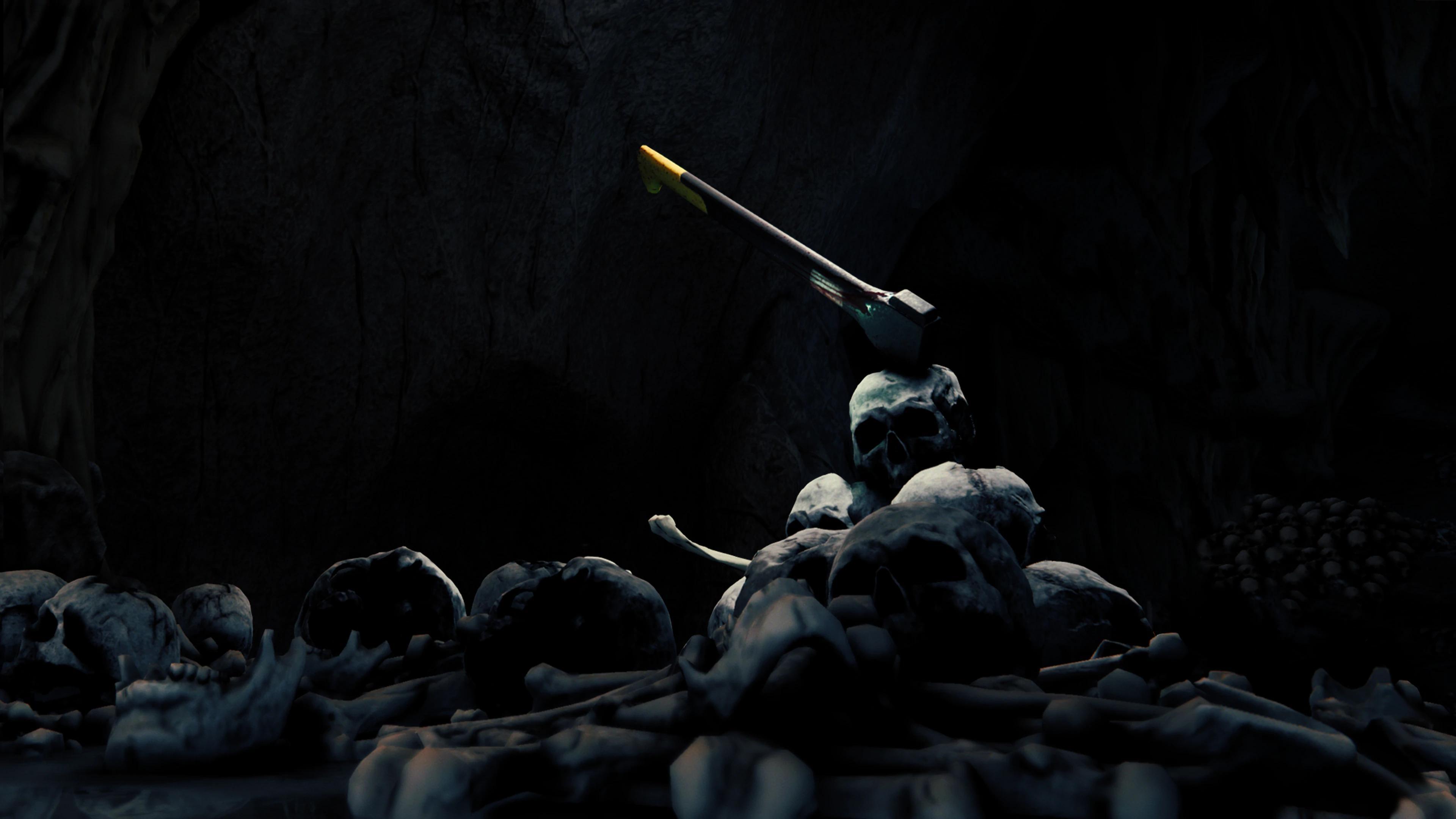

‘Fear & Hunger’ (2018)

Four adventurers delve into the dangerous dungeons of Fear and Hunger, searching for a lost captain. They’ll encounter terrifying monsters and deadly traps along the way. The game is known for being incredibly challenging and dealing with very dark subject matter. Battles require careful planning, as you must target specific enemy body parts to take them down. This independent game has become popular with a dedicated fanbase thanks to its rich backstory and brutal survival elements.

‘Iron Lung’ (2022)

You play as a prisoner piloting a tiny, decaying submarine through a terrifying ocean of blood on a lonely moon. Because you can’t see outside, you must rely on a map and a camera that provides pictures with a delay to navigate. The game creates intense claustrophobia and uses haunting sounds to deliver a short, but frightening horror experience, focusing on the terror of the unseen and the power of sound.

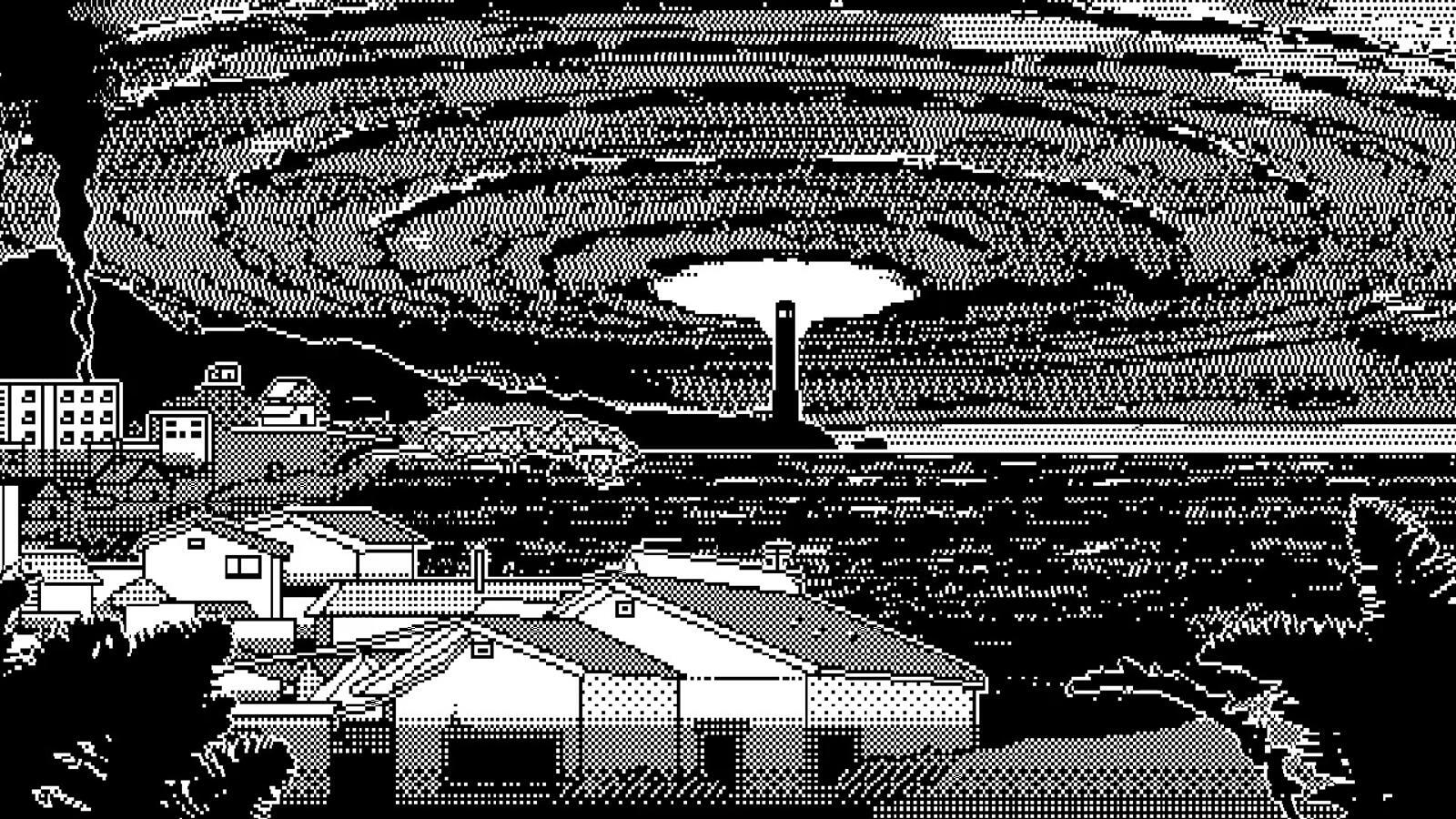

‘World of Horror’ (2023)

This game draws inspiration from the unsettling horror of Junji Ito and H.P. Lovecraft, setting its chilling mysteries in a Japanese town. It combines a distinctive pixel art style with classic turn-based combat, reminiscent of older adventure games. As you investigate local urban legends and perform rituals, you’ll need to carefully manage both your character’s stamina and sanity. The game offers a fresh experience each time you play, with different events and multiple endings determined by your choices.

‘Faith: The Unholy Trinity’ (2022)

A newly ordained priest revisits the scene of a failed exorcism, forced to face the demons he thought he’d escaped. The game features deliberately old-fashioned 8-bit graphics and computer-generated voices, creating a creepy and unique mood. Players defend themselves with a holy cross while investigating a sinister satanic cult. It’s a terrifying experience that combines religious imagery with the charm of classic retro games.

‘Barotrauma’ (2023)

In this game, you and your friends pilot a submarine through the icy waters of Europa, facing dangerous alien creatures and the threat of internal problems. Working together is key – each player takes on a critical role, like captain or engineer, to keep the sub running, fix damage, and fend off giant sea monsters. The crushing pressure and darkness create a constant, stressful fight for survival on every mission.

‘GTFO’ (2021)

Four prisoners are tasked with venturing into a large underground complex to find valuable artifacts. The game focuses on sneaking around and working together, because alerting the enemies almost always means instant failure. Players need to carefully manage limited resources like ammo and health. It’s a challenging game that really requires strong teamwork and communication to succeed.

‘Darkest Dungeon’ (2016)

In this game, you gather and guide a team of heroes with their own weaknesses as they explore dark forests and crumbling ruins. A key part of the game is keeping track of your heroes’ mental wellbeing, as well as their physical health. Because characters can die permanently, losing a strong hero can really set you back. The game’s dark artwork and narration create a gloomy and intense atmosphere for the strategic battles.

‘Buckshot Roulette’ (2024)

In this intense and gritty game, you’ll find yourself in a shadowy underground club facing off against a secretive dealer in a deadly game of Russian roulette. Played with a twelve-gauge shotgun, survival depends on both careful strategy and luck. You’ll have access to items that can give you an edge, like manipulating the odds or peeking at which shell is loaded. With its stark visuals and pulsing industrial music, the game creates a truly dangerous and gripping atmosphere.

Share your favorite scary gaming moments in the comments.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Monster Hunter Stories 3: Twisted Reflection launches on March 13, 2026 for PS5, Xbox Series, Switch 2, and PC

- Here Are the Best TV Shows to Stream this Weekend on Paramount+, Including ‘48 Hours’

- 🚨 Kiyosaki’s Doomsday Dance: Bitcoin, Bubbles, and the End of Fake Money? 🚨

- 20 Films Where the Opening Credits Play Over a Single Continuous Shot

- 39th Developer Notes: 2.5th Anniversary Update

- 10 Hulu Originals You’re Missing Out On

- 10 Underrated Films by Ben Mendelsohn You Must See

- Target’s Dividend: A Redemption Amidst Chaos

- First Details of the ‘Avengers: Doomsday’ Teaser Leak Online

2026-02-11 22:21