SoundHound AI (SOUN 7.51%) presents a case study in the peculiar logic of our age. The market, once effusive, now regards its shares with a discernible chill – a decline of sixty-five percent from former peaks. Such volatility, in a mere span of months, might tempt the heedless to speculate, to seize what appears a bargain. Yet, a prudent examination reveals a landscape fraught with peril, a structure built upon foundations of sand. The ephemeral enthusiasm that briefly buoyed this venture – mirroring the capricious winds of investor fancy – has dissipated, leaving behind a starker reality.

The prevailing sentiment, it is true, has shifted. The shadow of past anxieties – tariff pronouncements and market tremors – has receded. But to assume, on this basis alone, that SoundHound AI is now undervalued is to succumb to a dangerous simplification. The market, like a wounded beast, remembers. It recalls the pattern: initial promise, followed by unsustainable expenditure, and ultimately, the inevitable reckoning.

The Long Road to Self-Sufficiency

SoundHound AI occupies a rarefied position: a purportedly ‘pure-play’ artificial intelligence stock. Its core function – the synthesis of generative AI and audio recognition – is, in itself, not novel. The challenge lies in its application. Initial forays into restaurant and automotive assistance systems, while noteworthy, represent merely tributaries in a potentially larger stream. The true test will be its penetration into the realm of customer service – a domain where the potential for both profit and systemic dehumanization are immense.

Adoption within financial, insurance, and healthcare sectors offers a glimmer of hope, but hope, as any seasoned investor knows, is not a strategy. It is merely the precursor to disappointment if not grounded in demonstrable profitability. The market, however, seems willing to tolerate, even reward, prolonged losses, a symptom of our era’s relentless pursuit of growth at any cost.

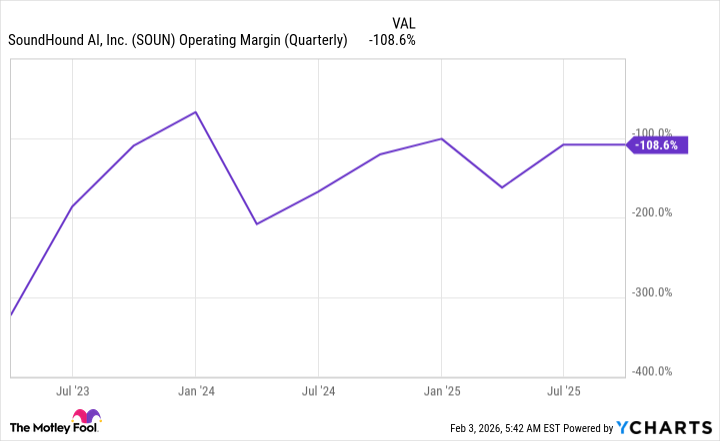

The sheer scale of those losses, however, is deeply troubling. SoundHound AI routinely expends twice its revenue, a financial hemorrhage disguised as ‘investment.’ This is not merely a matter of youthful exuberance; it is a fundamental imbalance, a structural defect that threatens the very viability of the enterprise. The market, despite the reported revenue growth of sixty-eight percent in the last quarter, is beginning to recognize this stark reality. Such growth, divorced from profitability, is a phantom limb – a sensation of progress that belies a deeper decay.

A Valuation Premised on Faith

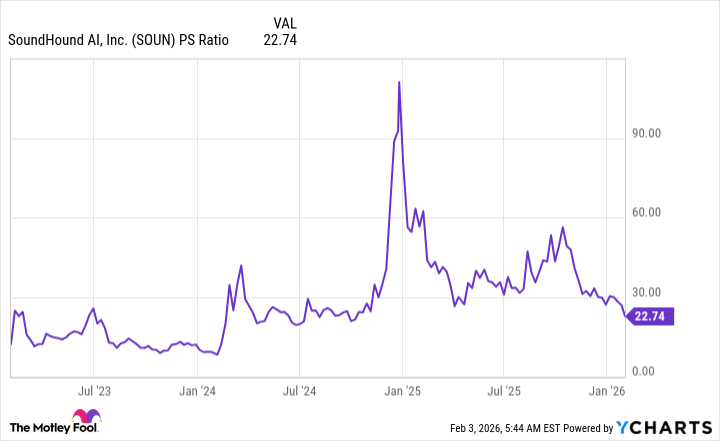

Even amidst this cooling of investor enthusiasm, SoundHound AI retains a premium valuation. The price-to-sales multiple, while not entirely exorbitant, exceeds that of most established software companies. This discrepancy is justified, ostensibly, by its rapid growth rate. But such justifications ring hollow when weighed against the backdrop of persistent losses. It is a valuation premised not on demonstrable value, but on faith – a dangerous commodity in the unforgiving realm of finance.

SoundHound AI, therefore, presents a speculative proposition. It is not an outright condemnation, but a sober assessment of risk. The path to profitability is arduous, the obstacles formidable. Should the company succeed in achieving self-sufficiency, the rewards could be substantial. But the likelihood of such success, given the prevailing circumstances, remains uncertain. The prudent investor will approach this venture with caution, recognizing that faith, however fervent, is a poor substitute for fundamental value. It is a venture, ultimately, built upon the shifting sands of technological promise, and the enduring human capacity for self-deception.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Monster Hunter Stories 3: Twisted Reflection launches on March 13, 2026 for PS5, Xbox Series, Switch 2, and PC

- Here Are the Best TV Shows to Stream this Weekend on Paramount+, Including ‘48 Hours’

- 🚨 Kiyosaki’s Doomsday Dance: Bitcoin, Bubbles, and the End of Fake Money? 🚨

- 20 Films Where the Opening Credits Play Over a Single Continuous Shot

- 39th Developer Notes: 2.5th Anniversary Update

- 10 Hulu Originals You’re Missing Out On

- 10 Underrated Films by Ben Mendelsohn You Must See

- Target’s Dividend: A Redemption Amidst Chaos

- First Details of the ‘Avengers: Doomsday’ Teaser Leak Online

2026-02-11 21:33