February 2026 will be a great month for anime fans, with a mix of new TV series and exciting movies hitting screens. Expect to see continuations of beloved space adventures, the return of funny favorites, and fresh episodes of popular fantasy and romance shows. Big names like Toei Animation, Bandai Namco Pictures, and Shin-Ei Animation are behind these releases, with most of the new content arriving later in the month to appeal to a wide range of tastes.

‘Star Detective Precure!’ (2026)

The latest installment in the popular magical girl series will debut on February 1, 2026. Created by Toei Animation and directed by Kōji Kawasaki, the show features a team of detectives who investigate mysterious, supernatural events. It’s part of the series’ yearly tradition of new releases, designed to appeal to both new and existing fans.

‘Gintama: Yoshiwara in Flames’ (2026)

Bandai Namco Pictures will release this new movie in Japan on February 13, 2026. Directed by Naoya Ando, the film is based on the popular “Yoshiwara in Flames” storyline from the original manga by Hideaki Sorachi. It follows Gintoki Sakata and his Yorozuya crew as they go undercover in a hidden district to save a mother and her son. The movie is 124 minutes long and focuses on a fierce battle against the formidable Housen, known as the Night King.

‘The Dangers in My Heart: The Movie’ (2026)

Coming to theaters on February 13, 2026, this new movie continues the story of Kyotaro Ichikawa and Anna Yamada. Shin-Ei Animation is producing the film, with Hiroaki Akagi as chief director and Chen Dali directing. The 102-minute movie follows the middle school characters as they navigate changing friendships and relationships, building on the popular romantic comedy TV series.

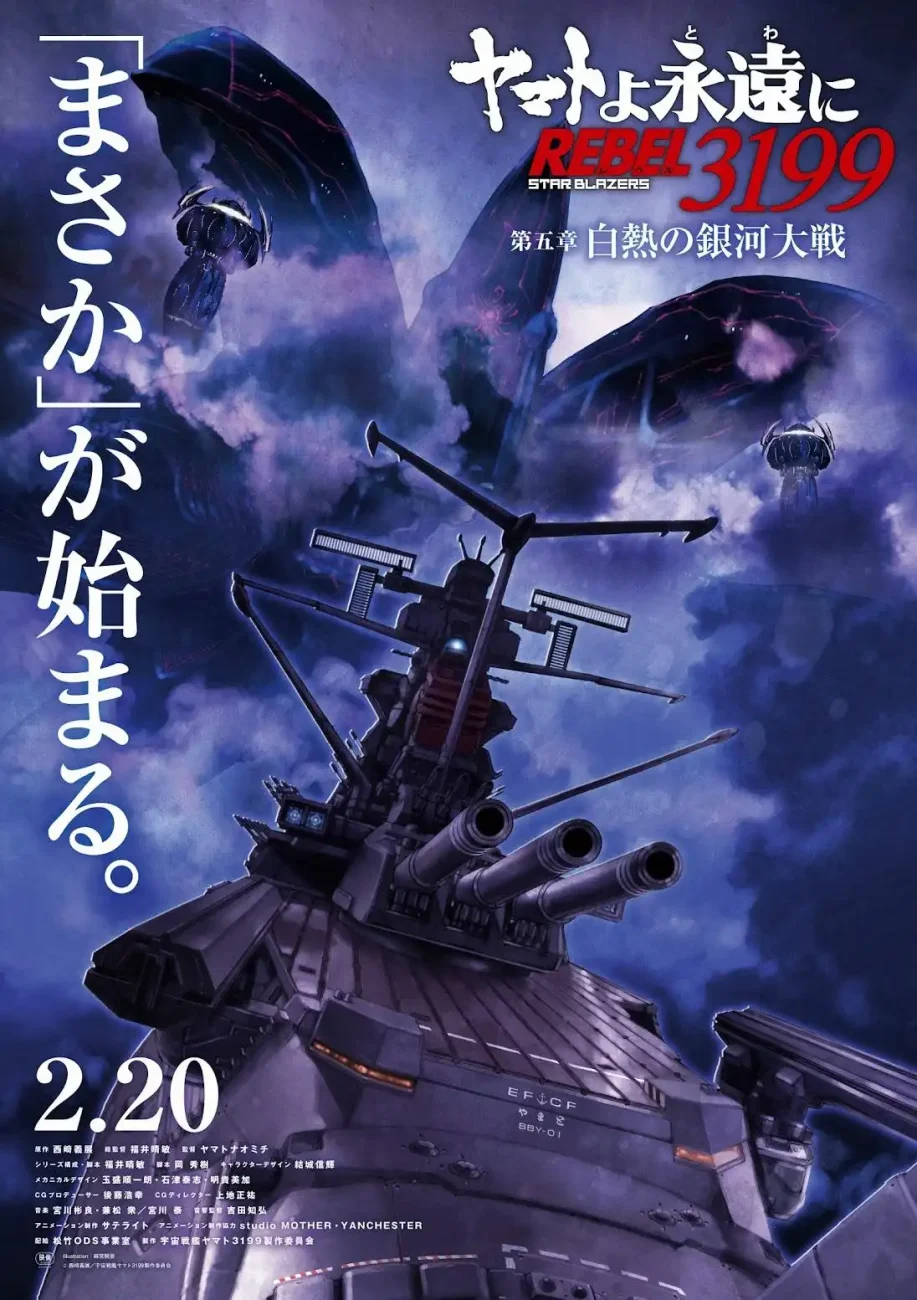

‘Be Forever Yamato: Rebel 3199: Part 5: The Incandescent Galactic War’ (2026)

The fifth movie in the ‘Be Forever Yamato: Rebel 3199’ series will come out on February 20, 2026. Created by Satelight, the film is directed by Harutoshi Fukui and Naomichi Yamato. It continues the story of the Yamato crew fighting in the ongoing Galactic War, and marks a key turning point in this new version of ‘Space Battleship Yamato’.

‘Doraemon the Movie: New Nobita and the Castle of the Undersea Devil’ (2026)

Coming to theaters on February 27, 2026, this new film reimagines a beloved adventure about Doraemon, the robotic cat, and his friends. Directed by Tetsuo Yajima and created by Shin-Ei Animation, the story centers on Nobita and his group as they go on a camping trip to the bottom of the ocean. There, they uncover a hidden, technologically advanced civilization and a dangerous threat to the world. The film uses modern animation to create a visually stunning underwater world for today’s viewers.

‘That Time I Got Reincarnated as a Slime: The Movie – Tears of the Azure Sea’ (2026)

The next movie in the ‘That Time I Got Reincarnated as a Slime’ series is coming out on February 27, 2026. Created by Eight Bit and directed by Yasuhito Kikuchi, the film tells a brand new story within the world of Rimuru Tempest. It focuses on adventure on the sea and uncovering ancient secrets, as Rimuru meets both friends and foes. This movie builds on the popularity of the TV show and the first film, adding even more depth to the Jura Tempest Federation’s story.

Tell us which of these February releases you are most excited to watch in the comments.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Monster Hunter Stories 3: Twisted Reflection launches on March 13, 2026 for PS5, Xbox Series, Switch 2, and PC

- Here Are the Best TV Shows to Stream this Weekend on Paramount+, Including ‘48 Hours’

- 🚨 Kiyosaki’s Doomsday Dance: Bitcoin, Bubbles, and the End of Fake Money? 🚨

- 20 Films Where the Opening Credits Play Over a Single Continuous Shot

- 39th Developer Notes: 2.5th Anniversary Update

- 10 Hulu Originals You’re Missing Out On

- 10 Underrated Films by Ben Mendelsohn You Must See

- Target’s Dividend: A Redemption Amidst Chaos

- First Details of the ‘Avengers: Doomsday’ Teaser Leak Online

2026-02-11 20:45