The current obsession with artificial intelligence is, of course, rather vulgar. Everyone rushes to embrace the novel, as if originality were a virtue instead of a symptom. Still, even the most discerning eye must acknowledge that certain currents cannot be ignored, and certain enterprises, however lacking in aesthetic merit, offer a… compelling return. One must, after all, fund one’s extravagances. It is a truth universally acknowledged, that a single, well-placed investment can do more for one’s reputation than a lifetime spent cultivating good taste.

If one were compelled to allocate a modest £5,000—a sum barely sufficient for a decent wardrobe, admittedly—to this digital frenzy, two concerns present themselves with a certain… inevitability. Alphabet, and Taiwan Semiconductor Manufacturing. Not precisely inspiring names, but then, inspiration rarely translates to dividends.

Alphabet

Alphabet, that vast and somewhat amorphous entity, currently enjoys a market capitalization approaching four trillion dollars. A figure so large it rather strains the imagination—and one’s patience with accountants. It has, in the last five years, tripled in value. A pedestrian achievement, perhaps, but a profitable one nonetheless. The company’s expansion into the realm of artificial intelligence—Gemini, Waymo, and the ever-present Google Search—is less a stroke of genius, and more a logical extension of its existing ambition. To dominate, naturally.

The revenue generated in the last fiscal year—$402.8 billion—is, frankly, excessive. As is the net income of $132.2 billion. One suspects a great deal of it is wasted on frivolous endeavors. Still, a solid foundation upon which to build—or, more accurately, to expand. At a multiple of thirty times earnings, the stock is not entirely unreasonable, considering its potential for further, and likely relentless, growth.

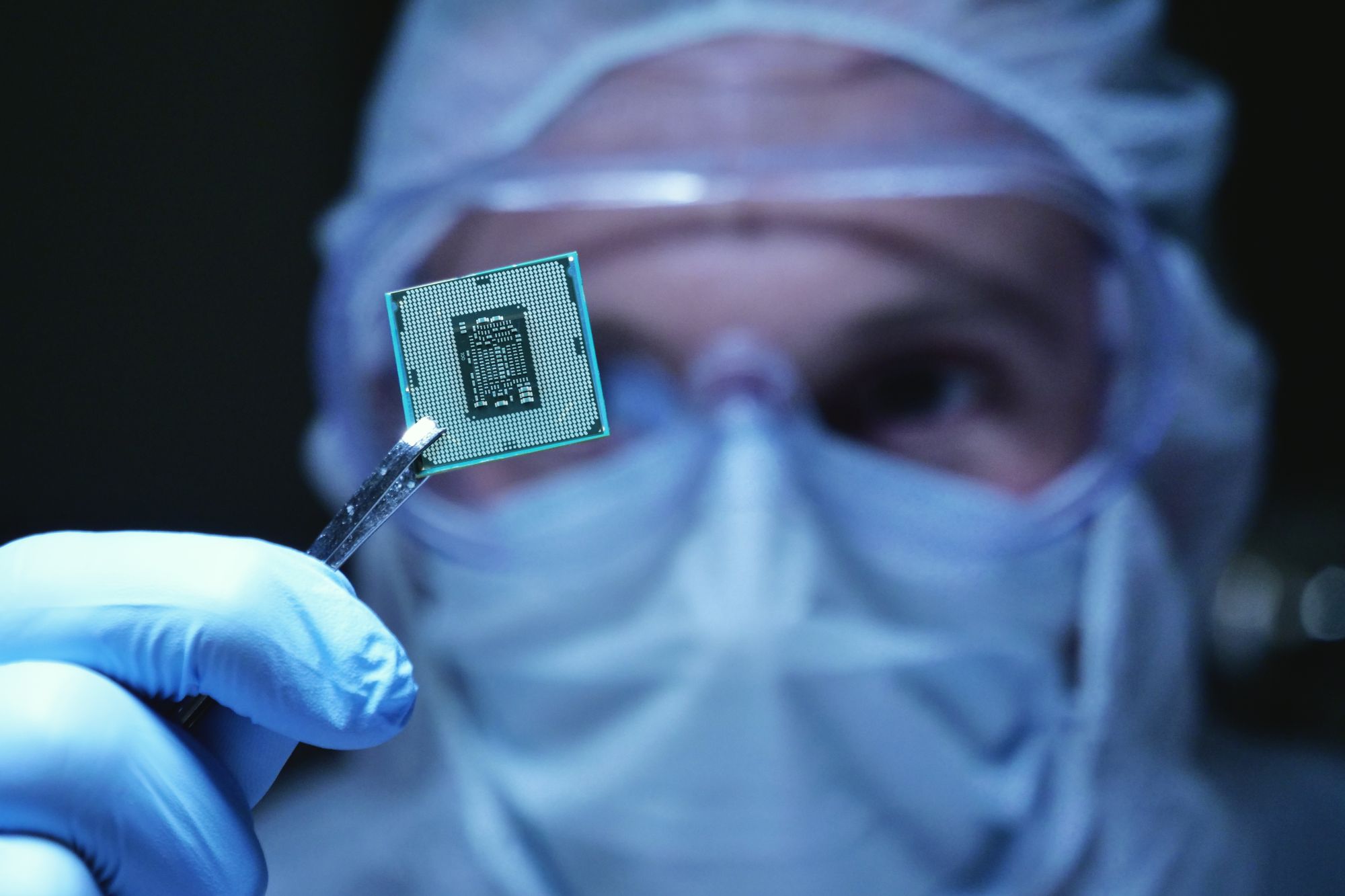

Taiwan Semiconductor Manufacturing

Taiwan Semiconductor Manufacturing, a name lacking all poetry, is the engine driving this artificial intelligence boom. They are the artisans, if you will, crafting the very chips that power these digital marvels. The tech giants, those titans of industry, turn to them when they require advanced chips at scale. An efficient, low-cost operation, it possesses a distinct advantage—and a rather predictable dominance—over its competitors. To be indispensable, naturally, is a most lucrative position.

The recent results—profits up 35% year over year—are, while not entirely surprising, certainly gratifying. The projection of 30% growth for the current year suggests a continuation of this fortunate trend. The expansion into the United States—a strategic move, if a rather obvious one—will undoubtedly open further avenues for growth. One suspects they are preparing for a future where silicon is more precious than gold.

With a market capitalization of $1.8 trillion, the stock, at 33 times earnings, is not inexpensive. But then, true value rarely is. The horizon is filled with the promise of further expansion, and a steady climb in valuation. It is a truth often overlooked: that the most reliable investments are those that simply… endure. And in this digital age, endurance is a quality increasingly difficult to find.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Monster Hunter Stories 3: Twisted Reflection launches on March 13, 2026 for PS5, Xbox Series, Switch 2, and PC

- Here Are the Best TV Shows to Stream this Weekend on Paramount+, Including ‘48 Hours’

- 20 Films Where the Opening Credits Play Over a Single Continuous Shot

- 39th Developer Notes: 2.5th Anniversary Update

- 10 Hulu Originals You’re Missing Out On

- 10 Underrated Films by Ben Mendelsohn You Must See

- Target’s Dividend: A Redemption Amidst Chaos

- The 11 Elden Ring: Nightreign DLC features that would surprise and delight the biggest FromSoftware fans

- 🚨 Kiyosaki’s Doomsday Dance: Bitcoin, Bubbles, and the End of Fake Money? 🚨

2026-02-11 20:02