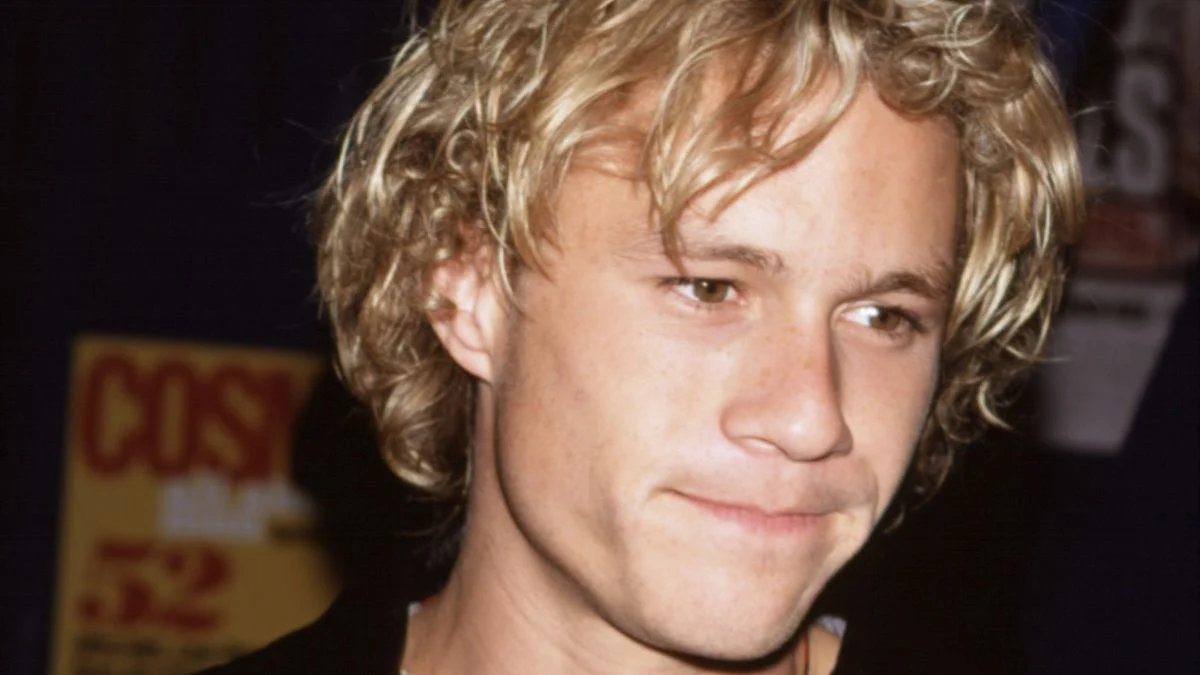

I remember hearing about how seriously Heath Ledger took the role of the Joker in The Dark Knight. It was incredible! He apparently locked himself in a hotel room for days before filming even started. He’d just sit there, staring at the walls, and worked on this really creepy, quiet laugh. He was completely trying to become the Joker, to understand what made that character tick.

The character’s voice and behavior were inspired by musicians like Sid Vicious and Tom Waits. But the on-screen energy really escalated when Heath Ledger acted opposite Christian Bale as Batman. Bale had spent months getting into incredible physical shape and was a skilled fighter, and Ledger intentionally used that to fuel his performance.

While filming the iconic interrogation scene, Heath Ledger actually asked Christian Bale to hit him for real, not hold back at all. Bale remembered Ledger playfully encouraging him to go all out. Even though Bale argued that a pretend punch would look just as good on camera, Ledger insisted on genuine contact. He was so committed that he repeatedly threw himself against the set’s tiled walls, leaving visible dents and cracks.

Ledger’s intense dedication is strikingly apparent in his performance, especially as the fight takes a physical toll on him. Seeing the Joker laugh even while being hurt makes the character truly frightening. This emphasizes that although Batman might be stronger physically, the Joker is the one truly in control, manipulating Batman by turning his own pain into a weapon. Ledger’s commitment to the role earned him a posthumous Academy Award, but sadly came at a great personal cost. He passed away just months after filming ended, due to an accidental overdose. Christian Bale, a longtime admirer of Ledger’s work, felt that Ledger’s incredible performance actually enhanced the movie, never overshadowing his own.

Christian Bale is getting a lot of attention for his dramatic physical change for his new movie, The Bride!, which comes out on March 6th. The film is a fresh take on the classic Bride of Frankenstein and is directed by Maggie Gyllenhaal. Bale plays Frankenstein’s monster – nicknamed “Frank” – alongside Jessie Buckley, and he recently shared that it took six hours of makeup each day to create his character’s undead appearance.

The movie boasts an impressive cast, including Annette Bening, Penélope Cruz, and Peter Sarsgaard, and even includes musical numbers where Christian Bale and Jesse Buckley perform a unique blend of tap and modern dance.

Beyond his acting, Bale is also gaining attention for his significant charitable work. His organization, Together California, is set to finish building a $22 million foster care village in Palmdale this year.

This project focuses on keeping brothers and sisters together while they are in foster care, demonstrating that Bale is as dedicated to his humanitarian efforts as he is to his acting career.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Monster Hunter Stories 3: Twisted Reflection launches on March 13, 2026 for PS5, Xbox Series, Switch 2, and PC

- Here Are the Best TV Shows to Stream this Weekend on Paramount+, Including ‘48 Hours’

- 🚨 Kiyosaki’s Doomsday Dance: Bitcoin, Bubbles, and the End of Fake Money? 🚨

- 20 Films Where the Opening Credits Play Over a Single Continuous Shot

- 39th Developer Notes: 2.5th Anniversary Update

- 10 Hulu Originals You’re Missing Out On

- 10 Underrated Films by Ben Mendelsohn You Must See

- Target’s Dividend: A Redemption Amidst Chaos

- First Details of the ‘Avengers: Doomsday’ Teaser Leak Online

2026-02-11 19:15