Recent Netflix viewing numbers from the first week of February 2026 show people are watching a variety of content, including popular returning shows, competition series, and kids’ educational programs. The streaming service is still doing well with its established original series, and is also seeing success with live events and licensed movies and shows. These numbers show what American viewers like to watch during the winter months – everything from intense legal dramas to cheerful holiday specials.

‘Unfamiliar’ (2026)

The new mystery series centers around a main character who suddenly finds themselves in a completely unfamiliar life, with a family they have no recollection of. As they try to understand this strange new world where everyone knows them but they don’t know anyone, hidden truths about their past start to emerge. The first season is full of suspenseful episodes that explore questions of identity and memory, and keep viewers guessing about what’s real. People are drawn to the show’s fast-paced plot and the central mystery of how the main character ended up in this unknown situation.

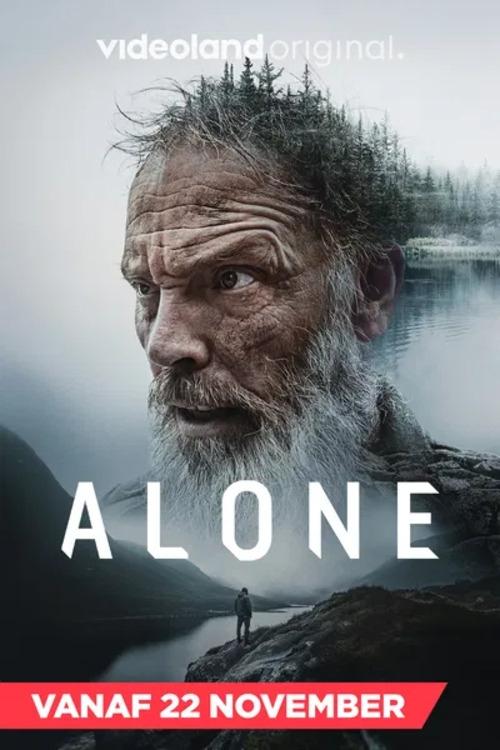

‘Alone’ (2024)

The latest season of this survival show drops contestants in incredibly remote wilderness areas around the globe. They have to film their own journeys as they try to survive with very little gear and no contact with other people. The last one left standing wins a large cash prize after battling tough weather, hunger, and complete solitude. Like previous seasons, this one pushes the limits of human strength and ingenuity against the power of nature.

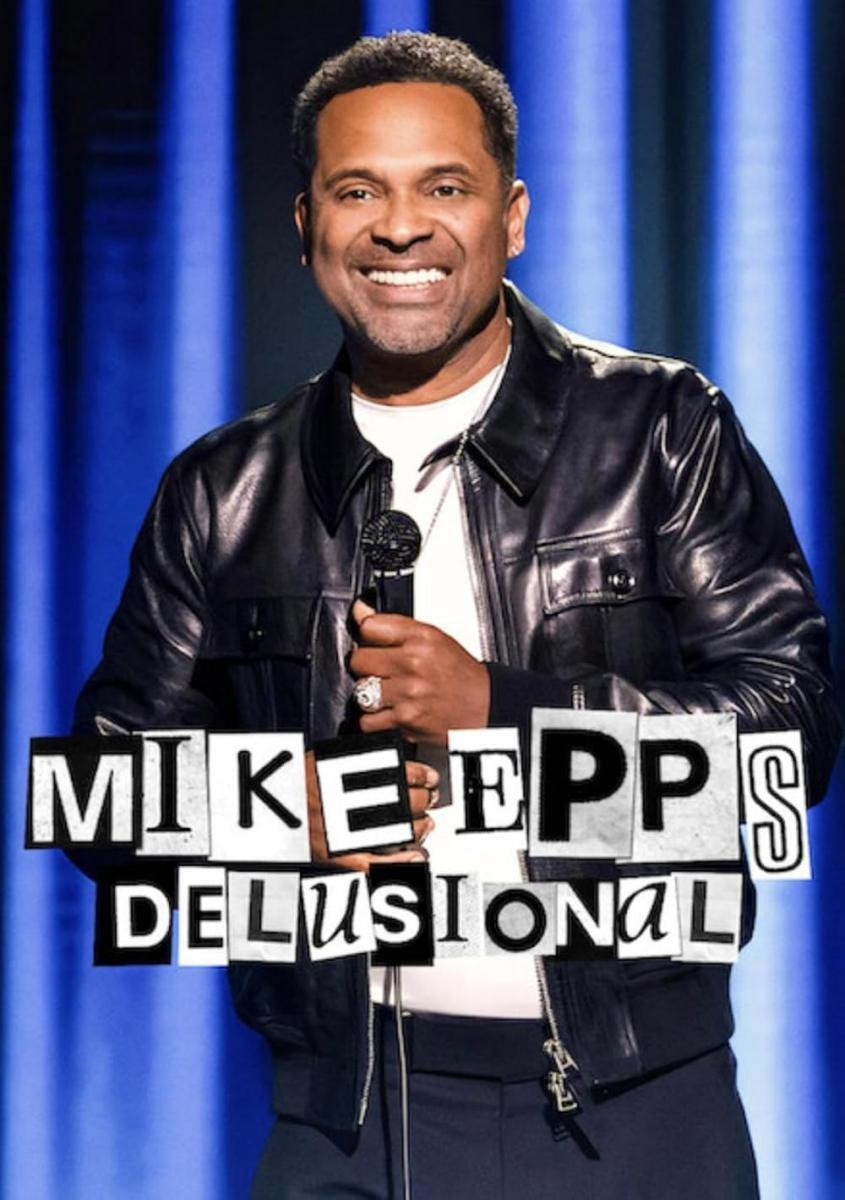

‘Mike Epps: Delusional’ (2026)

Mike Epps is back with a brand new hour-long stand-up special, filmed in early 2026. The seasoned comedian shares his hilarious takes on everything from family and getting older to what’s happening in the world and the latest technology. Known for his relatable jokes and energetic delivery, Epps is sure to entertain both longtime fans and new audiences. This special continues his successful partnership with the streaming service, adding to their growing collection of original comedy.

‘Ms. Rachel’ (2025–)

This educational show is back for a second season, continuing to help toddlers and young children learn and grow through fun, interactive lessons. Created by Rachel Griffin-Accurso, the series uses songs and repetition to build language skills and emotional intelligence. Each episode is designed with proven learning techniques to keep kids engaged and help them reach important developmental milestones. It’s a popular choice for parents who want their children to have valuable and educational screen time.

‘Ms. Rachel’ (2025–)

‘Ms. Rachel’ continues to be incredibly popular on the platform, proving that kids still love educational shows. The show uses bright, simple visuals and easy-to-understand language to help babies and toddlers learn to talk. It’s designed to get kids involved, encouraging them to sign and sing along with the host. Because it’s consistently watched each week, ‘Ms. Rachel’ has become a go-to resource for families nationwide.

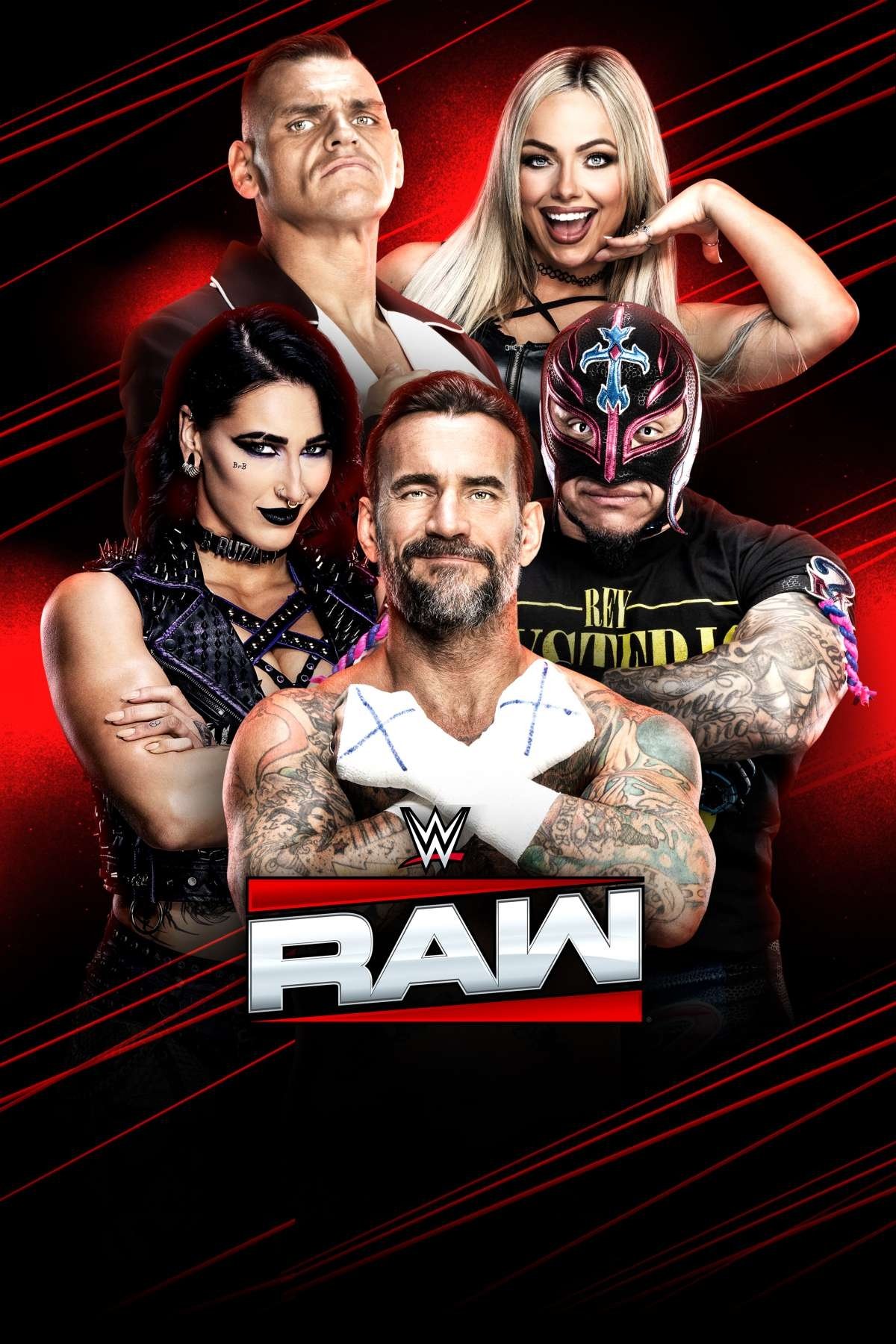

‘Raw’ (1993)

This episode of ‘Raw’ shows how the wrestling show is moving to a new home on the streaming service. The show, which aired on February 2, 2026, includes important matches and continues key storylines leading up to big events. Fans can enjoy the exciting action and dramatic entertainment that make the show popular worldwide, all filmed live. This weekly program marks a big change in how professional wrestling is shared with and watched by viewers today.

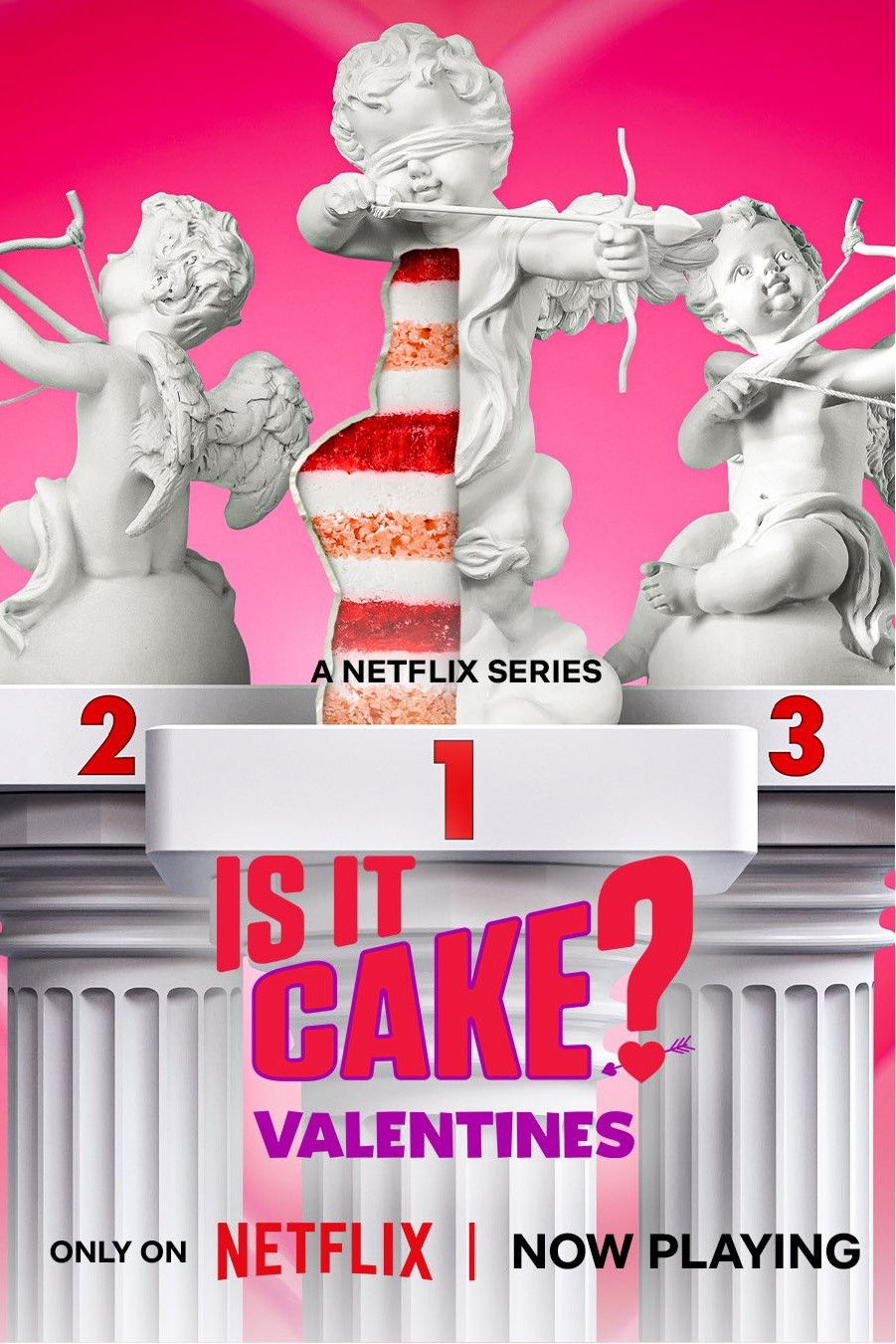

‘Is It Cake? Valentines’ (2026)

This special Valentine’s Day edition of the baking competition pits talented pastry chefs against each other to create incredibly realistic cakes. They’re tasked with making desserts that perfectly mimic Valentine’s Day items, hoping to trick a panel of celebrity judges. The show focuses on beautiful romantic designs, detailed sugar work, and the art of making cakes look like something else entirely. Each episode ends with a big reveal – can the judges tell what’s real and what’s a delicious illusion?

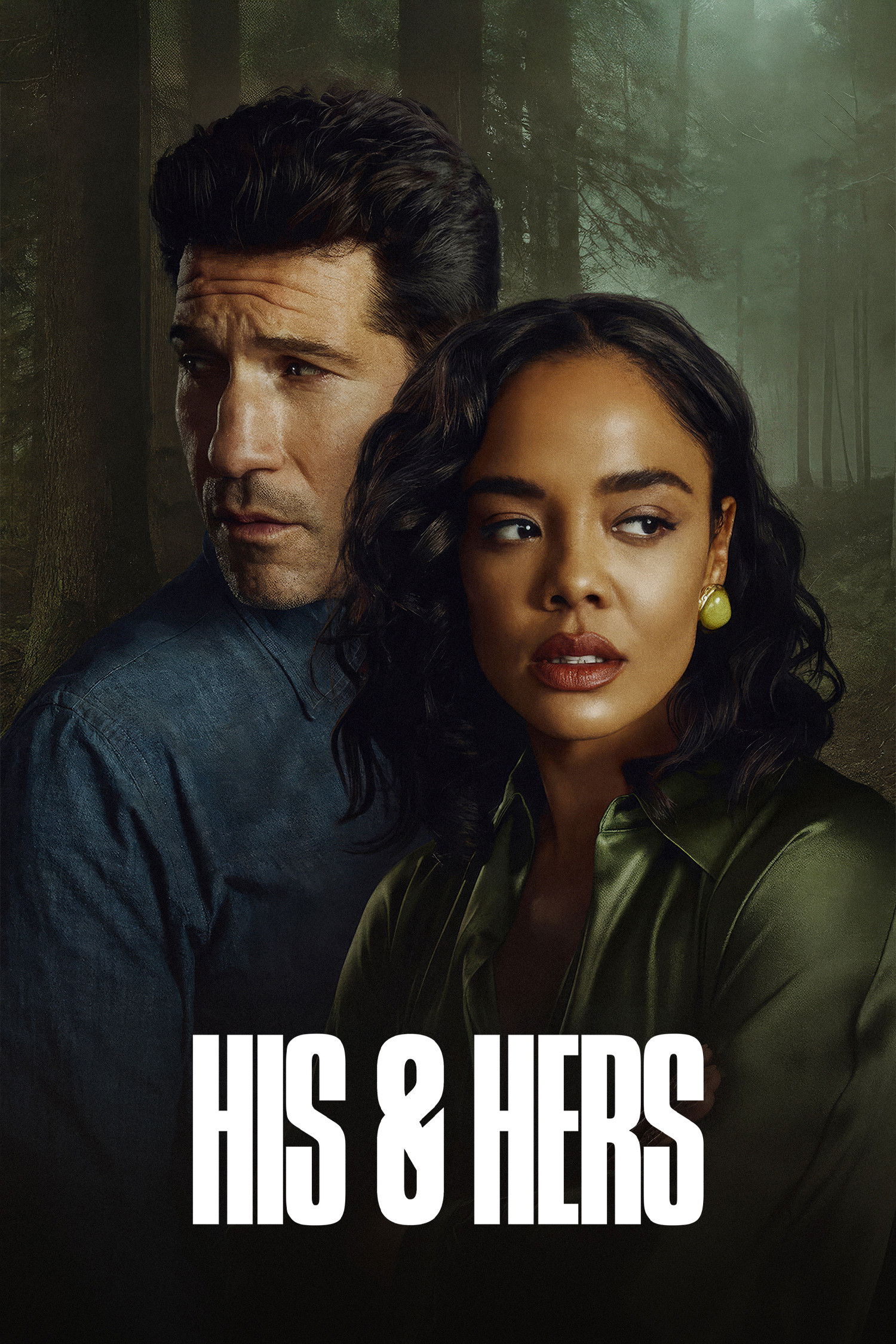

‘HIS & HERS’ (2026)

As a huge fan of thrillers, I’m really excited about this limited series! It’s based on an Alice Feeney novel and centers around a murder mystery, but it’s told in a really clever way. We see the story unfold through the eyes of both a journalist and a detective, and it turns out they both have connections to the victim and the town where it all happened. What’s fascinating is that their memories don’t quite line up, so you’re constantly questioning what really happened. It’s a real psychological ride that makes you think about how trustworthy our own memories can be, and how secrets can connect people in unexpected ways.

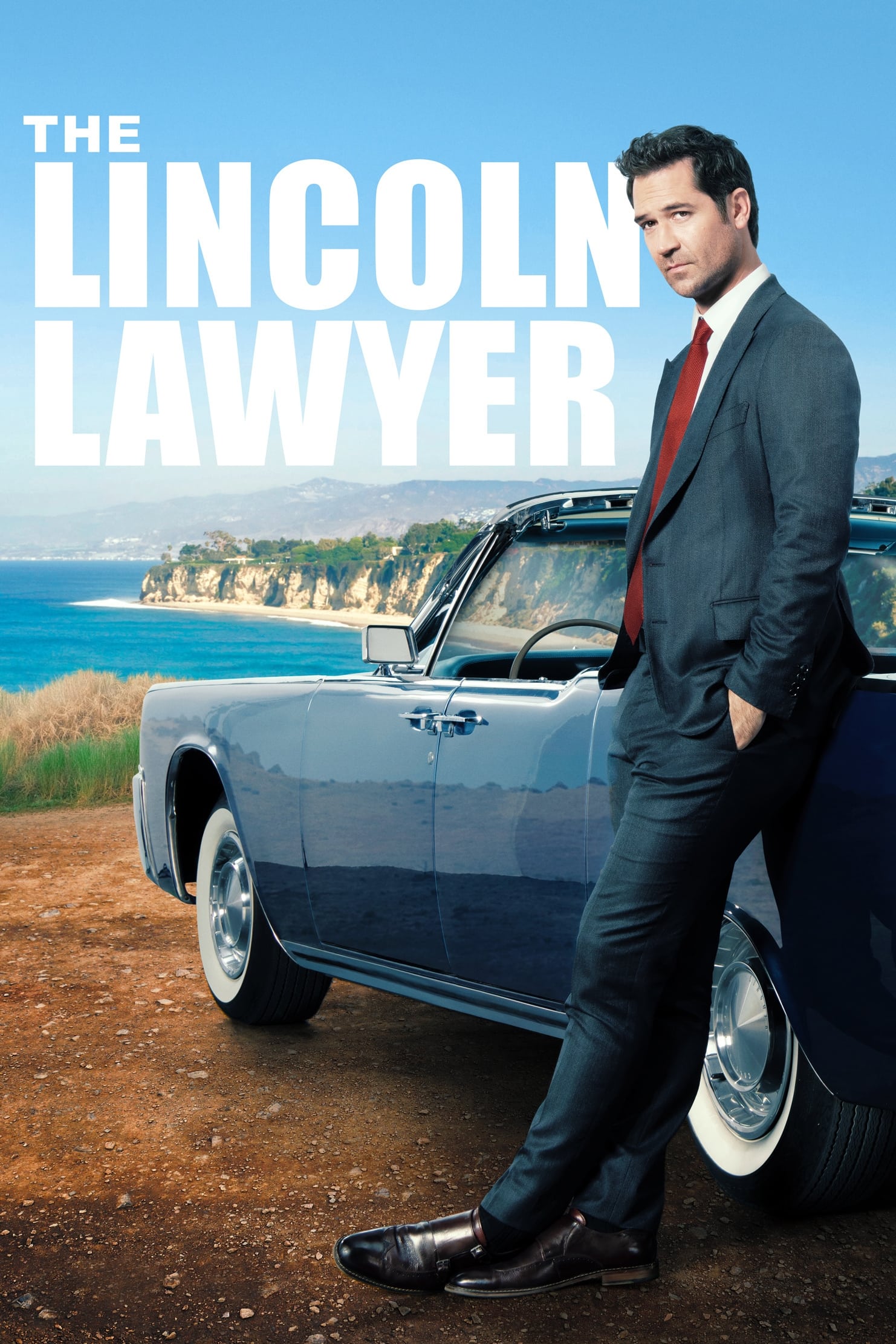

‘The Lincoln Lawyer’ (2022–)

Mickey Haller is back for a fourth season of legal battles and personal struggles in this popular series based on Michael Connelly’s books. The lawyer continues to work out of his car while taking on challenging cases all over Los Angeles. This season, he faces a complicated case that could ruin his career and put him in danger. The show continues to explore the complexities of the American legal system and Haller’s unique approach to winning.

‘Bridgerton’ (2020–)

Season four of this popular historical romance follows a new Bridgerton sibling as they navigate London’s social scene in search of love. Inspired by Julia Quinn’s novels, the show combines period drama with a modern feel, featuring classical arrangements of today’s hit songs. The story unfolds through beautiful costumes, scandalous secrets, and passionate romance, all set against the backdrop of London’s competitive marriage market. Like previous seasons, this installment delves into the challenges of family life and the characters’ individual quests for happiness.

Tell us which of these trending shows has captured your attention this week in the comments.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Monster Hunter Stories 3: Twisted Reflection launches on March 13, 2026 for PS5, Xbox Series, Switch 2, and PC

- Here Are the Best TV Shows to Stream this Weekend on Paramount+, Including ‘48 Hours’

- 🚨 Kiyosaki’s Doomsday Dance: Bitcoin, Bubbles, and the End of Fake Money? 🚨

- 20 Films Where the Opening Credits Play Over a Single Continuous Shot

- 39th Developer Notes: 2.5th Anniversary Update

- 10 Hulu Originals You’re Missing Out On

- 10 Underrated Films by Ben Mendelsohn You Must See

- Target’s Dividend: A Redemption Amidst Chaos

- First Details of the ‘Avengers: Doomsday’ Teaser Leak Online

2026-02-11 18:15