MP Materials (MP 0.65%). Now, that’s a name that sounds like a particularly obscure British engineering firm from the 1950s, doesn’t it? In fact, it’s a company attempting something rather ambitious: wresting control of rare earth magnets away from, well, pretty much everyone else. Last year, 2025, was quite the ride for shareholders, a rollercoaster climb peaking with a 440% surge before gravity, in the form of a broader market correction, reasserted itself. Currently, the stock is showing a respectable, if not dazzling, 10.5% gain year-to-date. But, as with most things involving geology, geopolitics, and government contracts, it’s a bit more complicated than a simple upward trajectory.

America’s Homegrown Magnet Maker

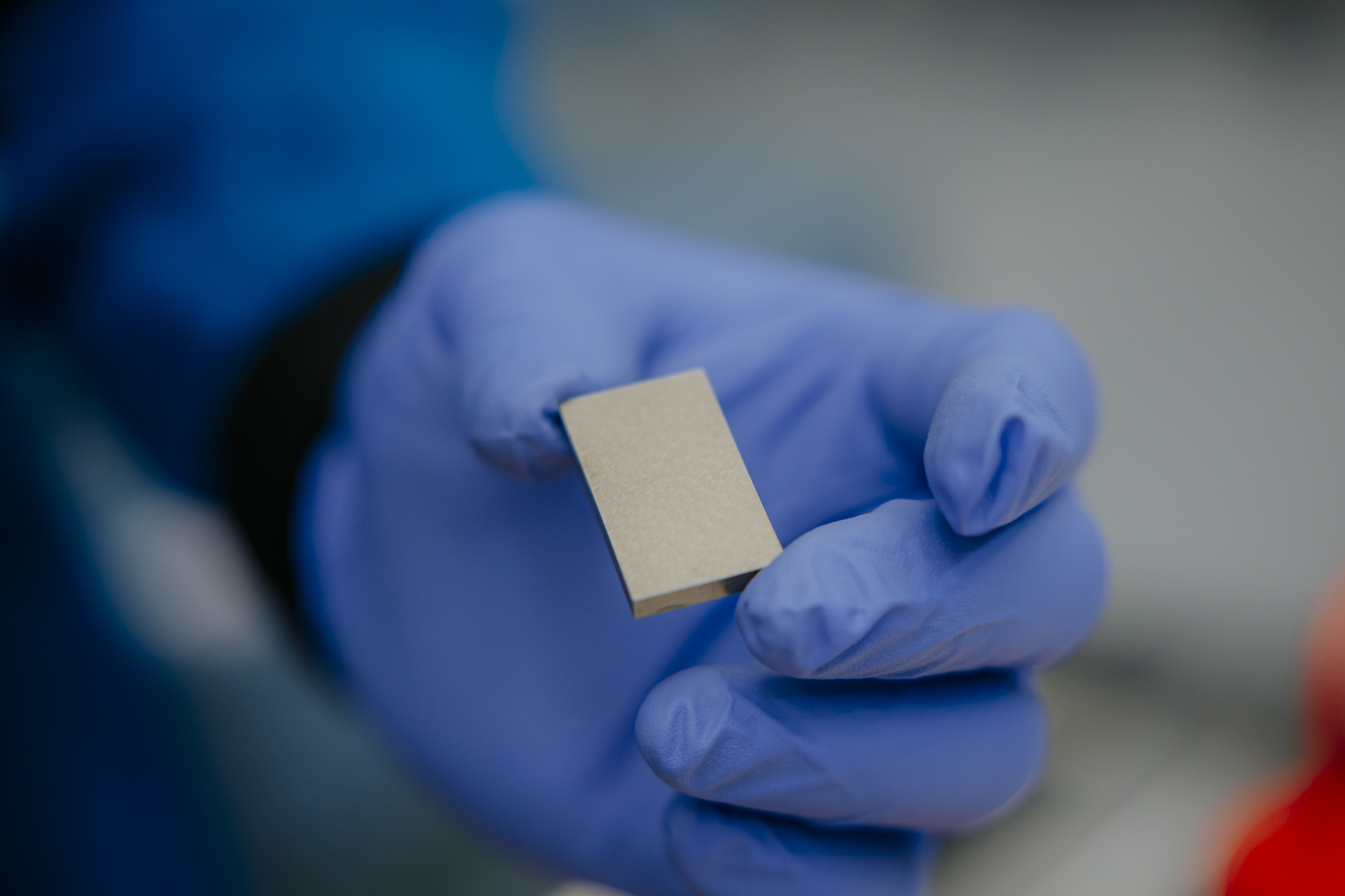

MP Materials, based in the United States, operates the Mountain Pass mine in California. It’s one of the few large-scale rare earth mines in the country, which is rather surprising when you consider that the periodic table is full of elements we barely knew existed fifty years ago. They don’t just dig stuff up, though. They also have a facility in Fort Worth, Texas, called Independence, where they turn those raw materials into permanent magnets. Permanent magnets! It’s like alchemy, only with more paperwork and slightly less turning lead into gold.

The company finds itself at a rather interesting intersection of global trends. Rare earth magnets are, as the name suggests, not exactly common. They’re vital for everything from smartphones and electric vehicles to wind turbines and, rather crucially, defense applications. For years, the U.S. has been heavily reliant on China for magnet supply. This isn’t necessarily malicious on anyone’s part, it’s just how things shook out, but it does create a situation where a single country holds a considerable amount of leverage. It’s a bit like being the only person in town with umbrellas during a monsoon.

Last July, the Department of Defense stepped in with a rather substantial $400 million investment, becoming MP’s biggest shareholder. They’ve entered into a public-private partnership, agreeing to purchase 100% of the magnets produced at MP’s second U.S. factory for the next decade. And, crucially, they’ve guaranteed a price floor of $110 per kilogram for MP’s neodymium-praseodymium product. That’s a rather specific number, isn’t it? It’s enough to make you wonder what goes into pricing rare earth minerals. Probably a lot of spreadsheets. That news gave the stock a considerable boost, finishing July up over 100%. It’s a good thing for shareholders, of course, but it also raises the question: can this momentum be sustained?

Is MP Materials a Buy Right Now?

If you believe that demand for rare earths will continue to climb and the U.S. will actively seek to reduce its dependence on China, MP Materials looks like a potentially good long-term investment. It’s not a slam dunk, of course. Nothing ever is. But the fundamental story is compelling. That said, the road ahead could be a bit bumpy. At its current price (around $61 per share), MP trades at a rather lofty 43 times sales. The average P/S ratio for metals and mining companies is closer to 3.8. That’s a significant premium, suggesting investors are paying for future growth that hasn’t yet materialized.

The DoD agreement is critical for helping MP become profitable in the near term, but it’s not entirely guaranteed. The agreement itself states that continued funding is subject to Congressional approval. It’s a reminder that government contracts are rarely set in stone. A change in political priorities or budget constraints could affect the deal. It’s a bit like building a castle on sand – you can hope for the best, but you should probably have a contingency plan.

The company also faces execution risks. Getting a new facility up and running is never easy, and MP is targeting 2028. So far, they haven’t even announced a location. It’s a bit like planning a party without a venue. You can have all the decorations and snacks in the world, but it won’t be much of a party without a place to hold it.

Overall, MP Materials appears to be a long-term buy, but it’s not for the faint of heart. If you can’t stomach volatility or are uncomfortable with a premium valuation, you might want to sit this one out for now. It’s a fascinating story, though. A company attempting to reshape a critical supply chain. It’s the kind of thing that makes you realize just how interconnected the world really is.

Read More

- 21 Movies Filmed in Real Abandoned Locations

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- 10 Hulu Originals You’re Missing Out On

- The 11 Elden Ring: Nightreign DLC features that would surprise and delight the biggest FromSoftware fans

- 10 Underrated Films by Ben Mendelsohn You Must See

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- 39th Developer Notes: 2.5th Anniversary Update

- ICP: $1 Crash or Moon Mission? 🚀💸

- 20 Films Where the Opening Credits Play Over a Single Continuous Shot

- Crypto’s Comeback? $5.5B Sell-Off Fails to Dampen Enthusiasm!

2026-02-11 16:02