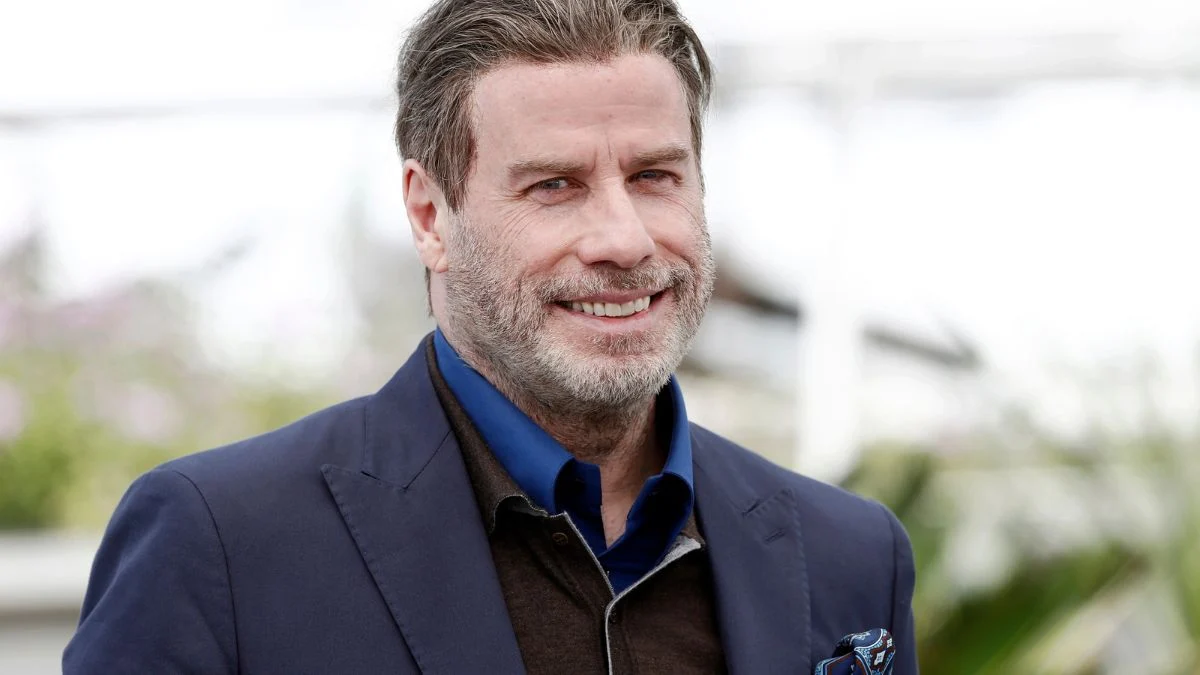

John Travolta recently shared a sweet family photo with his 5.6 million Instagram followers, showing that being a dad is his most important role. He posted what he called a late Christmas card from 2025, featuring a rare glimpse of his children, Ella Bleu, 25, and Benjamin, 15. The photo, taken on a city street at night, quickly became popular online, with fans commenting on how much Benjamin has grown.

In a recent photo, John Travolta posed with his children, Ben and Ella. He had his arm around 15-year-old Ben, who has grown significantly taller than his 71-year-old dad, surprising many fans. Ella sweetly rested her head on her father’s shoulder, highlighting the close and loving relationship the three of them share, even after facing difficult times together.

Olivia Newton-John’s daughter, Ella, responded with love to a sweet Christmas card photo her father, John Travolta, shared online. He captioned the picture, “My beautiful babies in my belated Christmas card 2025. Hope all is going well.” Ella showed her support with three red heart emojis. This kind of warm interaction on social media has become common for the pair, particularly as they continue to remember Travolta’s late wife, Kelly Preston, who sadly passed away from breast cancer in 2020.

View this post on InstagramA post shared by John Travolta (@johntravolta)

John Travolta is having a busy and fulfilling year, balancing personal remembrance with new work. He continues to honor his late wife, Kelly Preston, and son, Jett, but is also dedicated to his upcoming films. He recently celebrated the New Year with his daughter, Ella, sharing a video of fireworks with his fans.

One of his most exciting projects is the upcoming thriller, Black Tides, directed by Renny Harlin, who also directed Die Hard 2. In the film, Travolta plays Bill Pierce, a father trying to reconnect with his daughter on a sailing trip off the coast of Spain. Their trip turns dangerous when their boat is attacked by killer orcas, and they must fight for their lives in a desperate struggle for survival at sea.

Notably, Black Tides is the latest film to bring John Travolta and his daughter, Ella Bleu, together on screen. While Ella has appeared in a few of her father’s movies before, including Old Dogs and The Poison Rose, this thriller gives her a significant role alongside Melissa Barrera, known for her work in Scream.

Filming took place in Gran Canaria, Spain, where director Renny Harlin focused on practical effects – using real water and in-camera techniques – to make the movie feel incredibly realistic.

Whether he’s facing danger at sea or enjoying personal moments, Travolta continues to be a captivating figure in Hollywood, skillfully blending his established career with exciting new projects.

Read More

- 21 Movies Filmed in Real Abandoned Locations

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- 10 Hulu Originals You’re Missing Out On

- The 11 Elden Ring: Nightreign DLC features that would surprise and delight the biggest FromSoftware fans

- 10 Underrated Films by Ben Mendelsohn You Must See

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- 39th Developer Notes: 2.5th Anniversary Update

- ICP: $1 Crash or Moon Mission? 🚀💸

- 20 Films Where the Opening Credits Play Over a Single Continuous Shot

- Crypto’s Comeback? $5.5B Sell-Off Fails to Dampen Enthusiasm!

2026-02-11 13:45