Right. So, Starbucks. It’s been fifteen years since they started paying a dividend. Fifteen years of steadily increasing payouts. Which, let’s be honest, is a bit like being told you’re ‘doing well’ at a gym class when all you’ve managed is to not actively fall over. Still, it’s income. And income is… good. Theoretically. I remember back in 2010, pre-everything-being-expensive, investing a grand in Starbucks. It felt… optimistic. Now, the yield on cost is 28%. Which sounds impressive, until you remember inflation and the general feeling that everything is slightly falling apart.

But here’s the thing. I have a bad feeling. A sort of low-level, persistent anxiety that usually manifests as an urge to alphabetize the spice rack. And it’s telling me this dividend growth is… unsustainable. I’m almost certain they’ll announce a halt to the increases later this year, probably in October. It’s just… a hunch. A very financially-informed hunch, obviously. (I’ve read a lot of charts. It’s not healthy.)

Here’s my list of worries, because a list always makes things feel more manageable. Even if the list is deeply depressing.

The Slowing Momentum

From 2010 to 2020, they hiked the dividend by an average of 24.5% a year. That was… almost cheerful. But since 2021, it’s been… less so. A definite deceleration. See for yourself:

| Year | Quarterly Payout | Annual Dividend Increase |

|---|---|---|

| 2021 | $0.49 per share | 8.9% |

| 2022 | $0.53 per share | 8.2% |

| 2023 | $0.57 per share | 7.5% |

| 2024 | $0.61 per share | 7% |

| 2025 | $0.62 per share | 1.6% |

A slowdown isn’t necessarily a disaster, I suppose. I recently argued Coca-Cola’s dividend would pick up again after a similar lull. But with Starbucks, it’s not just the slowing growth, it’s… everything else. The underlying numbers are starting to look a bit… precarious.

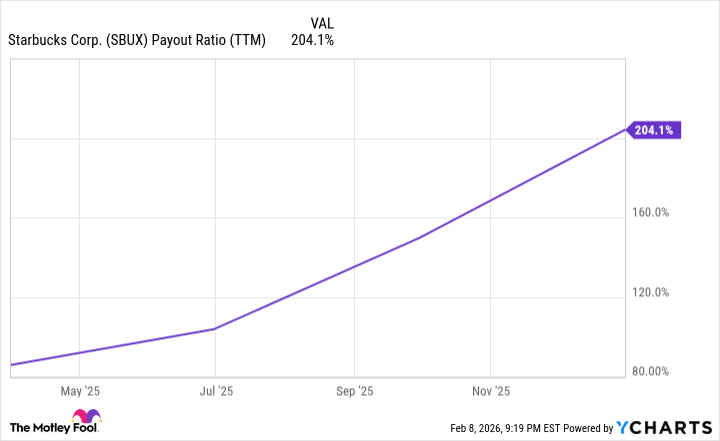

The Payout Ratio: A Warning Sign

The payout ratio. That’s the percentage of net income they’re spending on the dividend. It’s gone up. A lot. It’s now over 200%. Which means they’re spending more than twice as much on the dividend as they’re actually earning. It’s like… trying to fund a lavish lifestyle on an overdraft. It can’t end well.

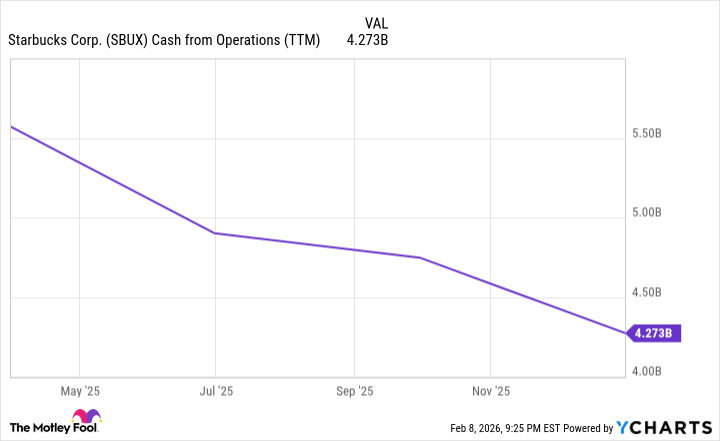

Okay, cash flow from operations is a better metric, everyone says so. It shows what’s left after the basics are covered. But even that’s… declining.

Plummeting Cash Flow

Starbucks’ cash flow from operations has fallen from roughly $5.6 billion a year ago to just under $4.3 billion. It’s not a gentle slope downwards, it’s more of a… precipitous drop. Like a badly-made soufflé. I keep hoping for a turnaround, honestly. But the numbers are… unhelpful.

And they haven’t repurchased shares since 2024. Which, I suppose, is sensible. But their employee stock investment plan is increasing the number of shares outstanding. Diluting the share price. It’s like trying to bail out a sinking boat with a sieve.

Remember when Howard Schultz suspended the share buyback program in 2022, saying cash was needed for investment? That was… a moment. Buybacks don’t have the same prestige as a rising dividend. There are no ‘Buyback Aristocrats,’ are there? So a dividend cut would likely hit the share price much harder. It’s just… basic psychology, really.

I’m not saying Starbucks is doomed. Brian Niccol might succeed in his turnaround mission. But shares are likely in for some short-term pain before that happens. And for investors who prioritize income… well, this is one stock to avoid. Honestly, I’m off to alphabetize my spices. It’s more predictable.

Read More

- 21 Movies Filmed in Real Abandoned Locations

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- 10 Hulu Originals You’re Missing Out On

- The 11 Elden Ring: Nightreign DLC features that would surprise and delight the biggest FromSoftware fans

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- 10 Underrated Films by Ben Mendelsohn You Must See

- ICP: $1 Crash or Moon Mission? 🚀💸

- 20 Films Where the Opening Credits Play Over a Single Continuous Shot

- Crypto’s Comeback? $5.5B Sell-Off Fails to Dampen Enthusiasm!

- 20 Games Where the Canon Romance Option Is a Black Woman

2026-02-11 04:32