Author: Denis Avetisyan

New research reveals how intense market sentiment amplifies uncertainty in cryptocurrency trading, leading to wider price gaps and increased costs for investors.

This study demonstrates that extreme sentiment regimes significantly increase uncertainty and adverse selection in cryptocurrency markets, driven by inherent market noise rather than informational asymmetry.

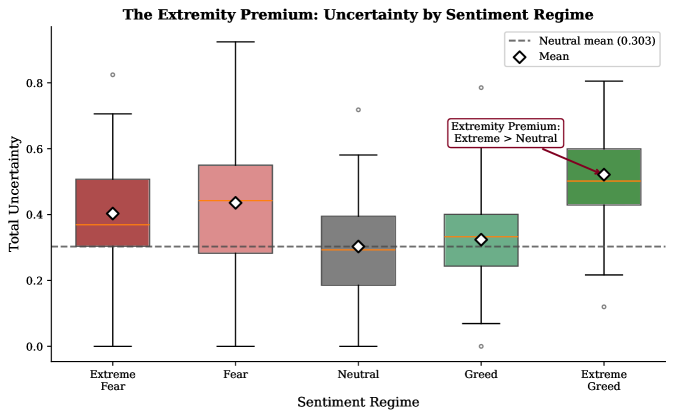

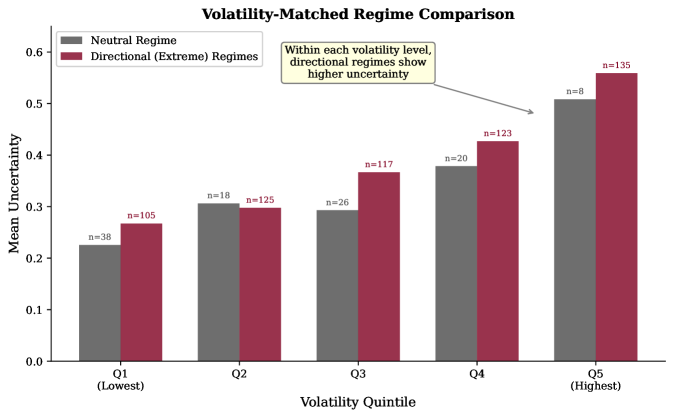

Despite growing interest in cryptocurrency markets, the drivers of liquidity provision under heightened uncertainty remain poorly understood. This paper, ‘The Extremity Premium: Sentiment Regimes and Adverse Selection in Cryptocurrency Markets’, investigates the relationship between market sentiment and bid-ask spreads in Bitcoin and Ethereum, revealing that extreme fear and greed regimes are associated with significantly higher spreads – an effect we term the “extremity premium”. Our analysis of \mathcal{N}=2,896 daily observations demonstrates this premium is not simply attributable to volatility, but reflects an intensity effect linked to sentiment itself. Can a more complete understanding of these sentiment-driven liquidity dynamics inform strategies for mitigating adverse selection and improving market efficiency in the rapidly evolving cryptocurrency landscape?

Decoding Market Signals: The Complexities of Digital Asset Valuation

Cryptocurrency markets present a unique challenge to conventional financial analysis due to their intricate internal dynamics and the sheer velocity of information flow. Traditional methods, built upon assumptions of rational actors and efficient price discovery, often falter when confronted with the high-frequency trading and rapid shifts in investor sentiment characteristic of these digital assets. The market microstructure – the mechanics of how orders are matched and prices are formed – is far more complex than in established markets, requiring analysis that moves beyond simple supply and demand. This complexity is further compounded by the prevalence of social media and online communities, which inject a constant stream of subjective information and emotional responses directly into price movements, rendering many established indicators less reliable and demanding novel approaches to data interpretation.

Market makers are essential to the functioning of cryptocurrency exchanges, continuously offering buy and sell orders to ensure assets can be traded without significant price slippage; however, accurately predicting their actions presents a considerable challenge. Conventional financial modeling, reliant on assumptions of rational behavior and readily available data, often falls short when applied to these actors in the crypto space. Their strategies are frequently complex, adapting rapidly to market conditions and incorporating private information unavailable to external observers. Furthermore, the motivations driving market makers – beyond simple profit maximization – can include factors like inventory management, order flow internalization, and even subtly influencing price discovery. This opacity necessitates novel analytical techniques, such as agent-based modeling and machine learning, to decipher their behavior and better understand the dynamics of liquidity provision in these rapidly evolving markets.

The volatile nature of cryptocurrency markets necessitates analytical tools that move beyond purely quantitative data, recognizing the powerful influence of collective investor sentiment. Traditional financial modeling often prioritizes historical price action and trading volume, yet these metrics frequently fall short in capturing the rapid shifts driven by social media trends, news events, and overall market psychology. Advanced techniques, including natural language processing applied to online forums and news articles, are increasingly employed to gauge this subjective information, attempting to quantify the ‘mood’ of the market. By integrating sentiment analysis with conventional data, researchers and traders aim to develop more robust predictive models and navigate the complexities of this emerging asset class, acknowledging that perception often shapes reality within these digital ecosystems.

Uncertainty Deconstructed: Aleatoric and Epistemic Sources

The decomposition of total uncertainty into aleatoric and epistemic components is fundamental to robust modeling practices. Aleatoric uncertainty, also known as data uncertainty, represents inherent randomness in a system and cannot be reduced by gathering more information; it is a property of the phenomenon itself. Epistemic uncertainty, conversely, arises from a lack of knowledge – it reflects limitations in the model, errors in parameters, or insufficient data – and is therefore potentially reducible through improved data collection, model refinement, or the incorporation of expert knowledge. Accurately distinguishing between these two sources of uncertainty is crucial because different mitigation strategies apply to each; attempting to reduce aleatoric uncertainty with model improvements is futile, while ignoring epistemic uncertainty can lead to overconfidence in model predictions and inaccurate risk assessments.

Sentiment analysis utilizes natural language processing and machine learning techniques to quantify subjective opinions and attitudes expressed in text data, offering a measurable proxy for market psychology. Indicators like the Fear and Greed Index synthesize information from multiple sources – including market momentum, stock price strength, market volatility, and demand for safe haven assets – to generate a numerical score reflecting investor sentiment. A high score indicates excessive greed, potentially signaling an overbought market condition, while a low score suggests extreme fear, potentially indicating an oversold condition. These indices are not predictive in themselves, but provide a standardized metric for tracking and understanding the prevailing emotional state of market participants, which can then be incorporated into broader analytical frameworks.

Distinguishing between aleatoric and epistemic uncertainty allows researchers to strategically address limitations in predictive models. Focusing on epistemic uncertainty – that arising from a lack of knowledge – enables targeted improvements through model refinement and expanded data integration. This approach prioritizes reducing uncertainty stemming from model assumptions, parameter estimation, and incomplete datasets, rather than attempting to eliminate inherent randomness. Techniques include incorporating additional relevant variables, employing more complex or appropriate model architectures, and utilizing data augmentation or active learning strategies to enhance data quality and quantity, ultimately leading to more robust and reliable predictions.

The Extremity Premium: Quantifying Risk in Turbulent Markets

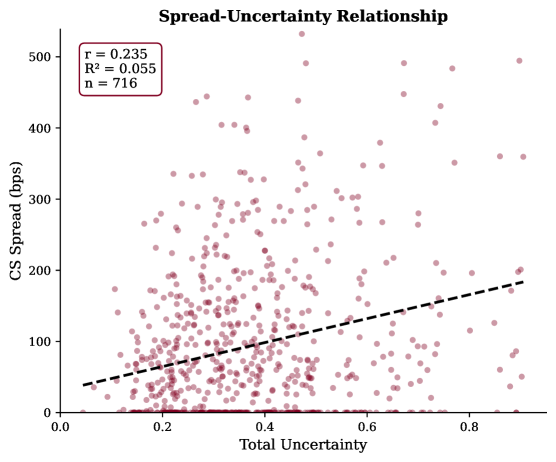

Analysis of market data demonstrates the existence of an ‘extremity premium’, characterized by a correlation between periods of extreme market sentiment and increased bid-ask spreads. Specifically, during these periods, spreads widen by an average of 62 basis points, a change determined to be statistically significant. This indicates that market participants require additional compensation to transact when sentiment is markedly positive or negative, reflecting a heightened perception of risk and uncertainty. The observed spread widening serves as a quantifiable measure of this risk premium demanded by traders under conditions of extreme sentiment.

Market participants systematically require increased compensation when assuming risk during periods of heightened volatility and uncertainty. This behavior manifests as wider bid-ask spreads, effectively increasing transaction costs. The demand for this additional compensation is a direct response to the increased potential for adverse price movements and the difficulty in accurately assessing asset values under uncertain conditions. This risk premium is not static; it fluctuates with the level of perceived uncertainty, providing a quantifiable measure of risk aversion among market actors. Consequently, higher uncertainty correlates with a greater demand for risk compensation, reflected in observable market spreads.

A comprehensive framework for analyzing the extremity premium necessitates the integrated consideration of market sentiment, quantified uncertainty measures, and transaction costs as represented by bid-ask spreads. Specifically, the relationship is not merely correlational; accurately capturing the premium demands modeling how shifts in sentiment directly impact perceived uncertainty, and subsequently, how this amplified uncertainty translates into wider spreads demanded by market participants. This requires methodologies capable of isolating the influence of each component – sentiment, uncertainty, and spreads – and establishing a causal link demonstrating how increased uncertainty, driven by extreme sentiment, legitimately increases the cost of transacting as reflected in wider spreads. Such a framework allows for a more precise evaluation of risk compensation and a better understanding of market behavior during periods of heightened volatility.

Simulating Market Dynamics: An Agent-Based Modeling Approach

Agent-based models represent a significant advancement in simulating complex systems like financial markets by moving beyond traditional, equation-based approaches. These models function by creating a virtual world populated by autonomous ‘agents’ – representing traders, institutions, or market makers – each operating under defined rules and responding to market stimuli. The power of ABM lies in its ability to capture emergent behavior; that is, market-level phenomena, such as price fluctuations or liquidity crises, arising from the collective interactions of these individual agents, rather than being explicitly programmed into the model. This bottom-up approach allows researchers to explore how seemingly simple agent behaviors can lead to complex and often unpredictable market dynamics, offering insights that are difficult, if not impossible, to obtain through analytical methods alone. By focusing on individual decision-making and interaction, ABMs provide a flexible and realistic framework for understanding the intricate web of forces that shape financial markets.

Agent-based models excel at recreating the complexities of financial markets by moving beyond traditional assumptions of rational actors. These simulations don’t simply predict; they generate market behavior from the bottom up, by explicitly representing individual traders – some driven by sentiment, others reacting to uncertainty, and still others functioning as market makers providing liquidity. This approach allows for the observation of emergent phenomena, such as volatility clustering – the tendency for large price changes to be followed by further large changes, and small changes by small changes – a characteristic frequently observed in real-world financial data. By incorporating these behavioral nuances and the interplay between different agent types, the models move closer to mirroring the dynamic and often unpredictable nature of actual markets.

Rigorous validation is paramount when employing agent-based models to understand complex systems like financial markets. To assess the model’s fidelity, researchers utilized the Simulated Method of Moments (SMM) to calibrate the agent behaviors, effectively tuning the model to replicate key characteristics of real-world market microstructure. The resulting calibration was then subjected to a J-test, a statistical measure of model consistency. A p-value of 0.70 from this J-test provides strong evidence that the agent-based model is not rejected by the observed data; in other words, the simulated market dynamics align well with empirical observations, bolstering confidence in the model’s ability to realistically represent the underlying mechanisms driving market behavior and potentially forecast future trends.

Forecasting with Confidence: Granger Causality and Beyond

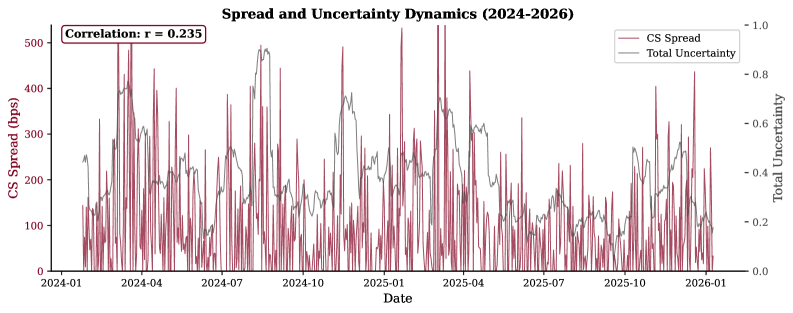

Investigations utilizing Granger Causality have demonstrated a compelling link between market sentiment and fluctuations in cryptocurrency price spreads. This statistical method assesses whether past values of one time series can predict future values of another, and recent analyses reveal a substantial predictive capability of sentiment data. The findings are reinforced by a highly significant F-statistic of 211, indicating a very low probability that the observed relationship occurred by chance. This suggests that shifts in market sentiment aren’t merely correlated with spread changes, but actually precede and potentially influence them, offering a valuable tool for forecasting and potentially capitalizing on short-term price movements.

Researchers are increasingly combining the strengths of agent-based modeling (ABM) with traditional statistical forecasting techniques to create more resilient and precise predictive models. ABM allows for the simulation of complex, interacting agents within a market, capturing emergent behaviors that standard statistical methods might miss. When integrated with statistical forecasting-which leverages historical data to identify patterns and predict future trends-the resulting hybrid models offer a more comprehensive understanding of market dynamics. This synergy enhances the ability to account for both quantifiable data and the nuanced, often unpredictable, actions of market participants, leading to improved forecasts and a more robust assessment of risk compared to relying on either approach in isolation. The combination provides a powerful tool for navigating the complexities of financial markets and refining predictive capabilities.

The integration of advanced forecasting techniques with agent-based modeling offers substantial potential for refining cryptocurrency market analysis. Beyond simply predicting price movements, this methodology enables a more nuanced understanding of the underlying dynamics driving these assets. Statistical analysis reveals that incorporating regime dummies – variables representing distinct market states – significantly improves model accuracy, explaining an additional 1.3% of the variance in market behavior even after accounting for volatility. This improvement translates directly into more effective risk management strategies, allowing for proactive identification and mitigation of potential losses, and the development of more sophisticated trading algorithms capable of capitalizing on subtle shifts in market conditions. Ultimately, this approach promises not just improved financial outcomes, but a deeper, more comprehensive understanding of the complex forces shaping cryptocurrency markets.

The study reveals how sentiment regimes amplify uncertainty in cryptocurrency markets, manifesting as wider bid-ask spreads during periods of extreme greed or fear. This dynamic aligns with Thomas Kuhn’s observation that “the world does not speak only to passive receptors; instead, it is, in a sense, actively interrogated.” The research doesn’t merely observe market behavior; it actively investigates the influence of sentiment as a driving force behind volatility clustering. By decomposing uncertainty, the paper demonstrates that the extremity premium isn’t rooted in informational asymmetry, but rather in inherent market noise-a fundamental characteristic of how agents interact within these systems. This echoes Kuhn’s emphasis on paradigm shifts, where understanding requires a re-evaluation of established assumptions about market efficiency and information flow.

Beyond the Extremity Premium

The demonstrated link between extreme sentiment and increased market noise offers a curious paradox. While the paper isolates noise as the primary driver of wider spreads during sentiment peaks, the very act of measuring that noise introduces a boundary problem. What portion of observed spread variation remains truly random, and what is attributable to the limitations of sentiment proxies or the granularity of order book data? Future work must grapple with the irreducible uncertainty inherent in defining and quantifying ‘noise’ itself, potentially exploring high-frequency trading data to refine the signal-to-noise ratio.

Furthermore, the study focuses on price-based measures of adverse selection. A potentially fruitful extension lies in examining the behavior of informed traders during these sentiment regimes. Do they systematically alter their order placement strategies, exacerbating the observed effects, or do they remain largely unaffected, suggesting the noise is truly indiscriminate? Disentangling these behavioral responses could reveal whether the extremity premium represents a genuine inefficiency or simply a cost of doing business in a volatile asset class.

Finally, the reliance on sentiment analysis, while effective, raises questions about generalizability. Sentiment, as captured through textual data, is inherently subjective and culturally bound. Investigating the robustness of these findings across different cryptocurrencies, and even across different languages of sentiment expression, will be crucial for establishing the broader applicability of the extremity premium phenomenon.

Original article: https://arxiv.org/pdf/2602.07018.pdf

Contact the author: https://www.linkedin.com/in/avetisyan/

See also:

- 21 Movies Filmed in Real Abandoned Locations

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- 10 Hulu Originals You’re Missing Out On

- The 11 Elden Ring: Nightreign DLC features that would surprise and delight the biggest FromSoftware fans

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- 10 Underrated Films by Ben Mendelsohn You Must See

- ICP: $1 Crash or Moon Mission? 🚀💸

- 20 Films Where the Opening Credits Play Over a Single Continuous Shot

- Crypto’s Comeback? $5.5B Sell-Off Fails to Dampen Enthusiasm!

- 20 Games Where the Canon Romance Option Is a Black Woman

2026-02-11 02:13