The current enthusiasm for artificial intelligence, as an investment prospect, bears a troubling resemblance to past manias. While genuine innovation exists, the market’s reaction often outpaces demonstrable value. Recent earnings reports from Advanced Micro Devices (AMD) and Alphabet (GOOGL/GOOG) offer a case study in this disconnect. Both companies experienced share price declines, not because of inherent weakness, but because Wall Street’s expectations – inflated, as always – remained unmet.

This volatility, however, presents a predictable opportunity. The discerning investor, one unswayed by the prevailing hysteria, might consider these dips as entry points. The question is not whether these companies will succeed in the long term – that seems reasonably assured – but which offers a more stable and ultimately rewarding prospect.

AMD: A Promising, Yet Fragile, Position

AMD concluded 2025 with a record revenue of $10.3 billion, a figure that, on the surface, appears impressive. Growth was reported across all divisions, driven by the burgeoning demand for AI-capable hardware. Customers, predictably, are eager to acquire the necessary computing power, and AMD is currently well-positioned to supply it.

The company forecasts continued growth, projecting revenue of $9.8 billion for the first quarter of 2026, a substantial increase over the previous year. Yet, this prediction proved insufficient to satisfy Wall Street’s insatiable appetite. The market, it seems, demands not merely progress, but exponential, uninterrupted ascent. This is a demand no rational enterprise can consistently meet.

Alphabet: Entrenchment and Expenditure

Alphabet’s performance was, as one might expect, robust. Fourth-quarter sales reached $113.8 billion, pushing the company’s annual revenue beyond $400 billion for the first time. The enduring dominance of Google search remains the primary driver, with the division generating $63.1 billion in sales.

The company attributes this continued success, rightly or wrongly, to the integration of AI into its search algorithms. CEO Sundar Pichai claims increased usage, but it is difficult to ascertain whether this represents genuine improvement or merely a more effective means of data collection.

However, the market reacted negatively to Alphabet’s substantial increase in capital expenditure. Capex soared 95% year-over-year to $27.9 billion, culminating in over $91 billion in total expenditure for 2025. The company plans to spend even more in 2026 – an estimated $175 to $185 billion – ostensibly to further develop its AI capabilities. This commitment, while strategically sound, has understandably unnerved investors accustomed to immediate returns.

A Choice Between Potential and Power

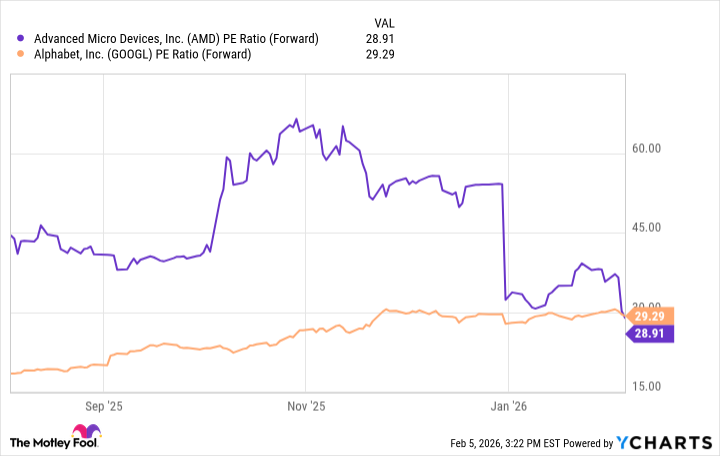

AMD’s valuation, prior to its recent earnings release, was undeniably elevated. The subsequent share price decline has brought its forward price-to-earnings ratio in line with Alphabet’s. This, superficially, suggests a comparable investment opportunity.

However, a closer examination reveals a critical distinction. Alphabet, while not immune to the pressures of market expectations, possesses a degree of financial stability and market dominance that AMD currently lacks. The company offers a modest dividend yield of 0.25%, a small but tangible return for income-oriented investors. AMD, predictably, pays no dividend.

More importantly, Alphabet maintains a commanding 91% market share in search. This entrenched position, combined with the increasing integration of AI into its core services, provides a significant competitive advantage. While the company’s capital expenditure is substantial, it is a necessary investment to maintain its dominance and drive future growth.

Therefore, while AMD represents a promising, albeit riskier, investment opportunity, Alphabet remains the superior choice for the discerning investor. It is a company built on solid foundations, capable of weathering market fluctuations and continuing to deliver long-term value. The current dip, therefore, should be viewed not as a cause for concern, but as a rational opportunity.

Read More

- 21 Movies Filmed in Real Abandoned Locations

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- 10 Hulu Originals You’re Missing Out On

- The 11 Elden Ring: Nightreign DLC features that would surprise and delight the biggest FromSoftware fans

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- ICP: $1 Crash or Moon Mission? 🚀💸

- 20 Games Where the Canon Romance Option Is a Black Woman

- 17 Black Voice Actors Who Saved Games With One Line Delivery

- Bitcoin’s Ballet: Will the Bull Pirouette or Stumble? 💃🐂

- 39th Developer Notes: 2.5th Anniversary Update

2026-02-10 22:52