Costco Wholesale (COST) has demonstrated a consistent commitment to shareholder returns, evidenced by a 1,200% dividend increase since 2004, significantly outpacing the inflationary environment of the period. Furthermore, the company has allocated $12.5 billion to share repurchases since 2000, including $903 million in the most recent fiscal year. Such capital allocation strategies, while common, warrant continued scrutiny to ascertain their efficacy in maximizing long-term shareholder value.

Evaluating the Prospect of a Special Dividend

Costco has historically implemented five special dividends since 2013. These distributions, while appreciated by shareholders, are characterized by their unpredictable timing. However, two discernible patterns emerge upon examination.

Firstly, the magnitude of these special dividends has been substantial. The January 2024 distribution of $15 per share represented a 1,370% premium over the concurrent regular dividend. Given a closing price of $607.92 the day prior, this yielded a one-time dividend yield of 2.4%, exceeding the two-year dividend yield of the average S&P 500 constituent. Such payouts, while generating immediate positive sentiment, require assessment within the context of the company’s broader capital structure and reinvestment opportunities.

Historical special dividends have consistently exceeded the regular quarterly distribution by a significant margin—ranging from 1,300% to 1,328% in recent years. This pattern suggests a deliberate strategy of periodically distributing excess capital rather than consistently increasing the regular dividend. The market’s reaction to these announcements—a 8% rally in the five trading sessions following the 2023 special dividend—highlights the potential for short-term price appreciation, though sustainability remains a key consideration.

Secondly, special dividends have typically coincided with periods of robust financial performance. The 17% year-over-year net sales growth reported in the month preceding the 2020 special dividend and the 15.2% growth in the quarter preceding the 2023 distribution indicate a correlation between financial strength and the willingness to distribute excess capital. This is not unexpected; prudent capital allocation dictates that dividends should be supported by sustainable earnings.

In the most recent fiscal first quarter of 2026 (ended November 23, 2025), Costco reported a 13.6% year-over-year increase in net income and a 7.3% increase in income from membership programs (excluding the impact of fee increases and foreign exchange rates). Membership totals—81.4 million paying members and 145.9 million cardholders—represent increases of 5.2% and 5.1%, respectively, over the prior year. These figures suggest continued strength in the company’s core business.

Factors Supporting a Potential 2026 Special Dividend

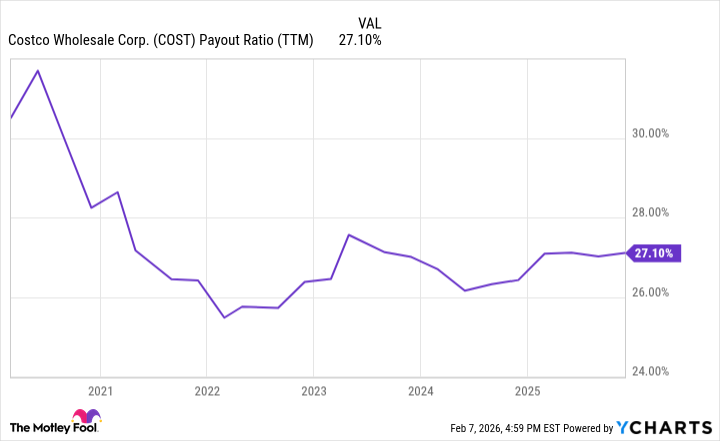

Costco’s recent share repurchase activity—nearly 2 million shares repurchased in 2024 and 2025—reduces the outstanding share count and, consequently, the total dividend obligation. This allows for a greater allocation of capital to dividends without impacting the per-share payout. Furthermore, the company’s payout ratio—the percentage of net income allocated to the regular dividend—has decreased, providing additional flexibility.

Net cash flow from operations has surged to $14.76 billion, approximately triple the level observed at the time of the 2020 special dividend and more than double the level in January 2023. This substantial cash reserve provides the company with the financial capacity to pursue a range of capital allocation strategies, including share repurchases, acquisitions, and dividends, without incurring significant debt.

Given these factors, a special dividend in 2026 appears plausible. However, investors should remain cognizant of the inherent uncertainties associated with future financial performance and capital allocation decisions. A proactive approach to risk management and a thorough understanding of the company’s long-term strategic objectives are essential for informed investment decisions.

Read More

- 21 Movies Filmed in Real Abandoned Locations

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- 10 Hulu Originals You’re Missing Out On

- The 11 Elden Ring: Nightreign DLC features that would surprise and delight the biggest FromSoftware fans

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- ICP: $1 Crash or Moon Mission? 🚀💸

- 20 Games Where the Canon Romance Option Is a Black Woman

- Bitcoin’s Ballet: Will the Bull Pirouette or Stumble? 💃🐂

- Gold Rate Forecast

- 10 Underrated Films by Ben Mendelsohn You Must See

2026-02-10 22:03