ADBE”>

This year, the decline has become rather more pronounced – 23.5% down, if one is keeping score (and why wouldn’t one?). The press, naturally, is piling on. Forbes wondering if Adobe is a “falling knife.” How very melodramatic. And Wall Street, ever the pragmatists, dumping 4.8 million shares last quarter. One suspects they’ve found something shinier to play with.

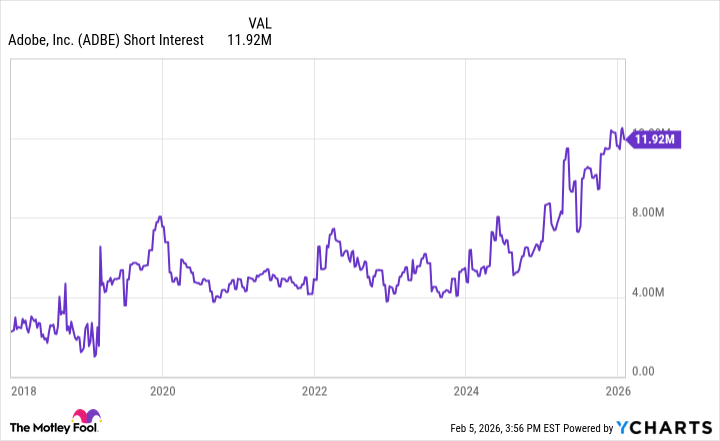

The short sellers, of course, are having a field day. Though, frankly, their optimism is rather predictable. It reminds one of a particularly tedious dinner party conversation. But, as the late Jim Rogers observed, when everyone “knows” something to be true, it’s time to consider the alternative. So, one asks oneself, what are the bears missing? And why might Adobe, despite all the gloom, not be quite the disaster everyone predicts?

If Adobe is doomed, why are the numbers so stubbornly cheerful?

The company reported record revenue of $19.41 billion last year, with earnings growth of 17%. Creative Cloud, Document Cloud, Experience Cloud… all doing rather well, thank you very much. One imagines the accountants are quietly pleased. And this year, another record – $23.77 billion in revenue, up 11%. Net income jumped to $7.13 billion. It’s all frightfully boring, really, but undeniably successful.

| Fiscal Year | Revenue | Net Income | EPS | Share Buybacks |

|---|---|---|---|---|

| 2022 | $17.61 billion | $4.76 billion | $10.10 | 15.7 million shares |

| 2023 | $19.41 billion | $5.43 billion | $11.82 | 11.5 million shares |

| 2024 | $21.51 billion | $5.56 billion | $12.36 | 17.5 million shares |

| 2025 | $23.77 billion | $7.13 billion | $16.70 | 30.8 million shares |

The numbers, as one can see, continue to climb. A slight dip in share buybacks in 2023, perhaps, but nothing to cause undue alarm. They don’t pay a dividend, so buying back shares is their way of returning value to shareholders. Over 70 million shares repurchased since 2022. Quite significant, for a stock with only 410.5 million shares outstanding.

Meanwhile, as Wall Street speculates about the $15.7 trillion AI revolution bulldozing Adobe, the company is rather cleverly embracing it.

“The biggest opportunity for Adobe in decades”

The CEO, Shantanu Narayen, called the AI revolution “the biggest opportunity for Adobe in decades.” Apparently, 70% of eligible customers are using the Adobe Experience Platform (AEP) AI Assistant. And they’ve been introducing innovative new AI-first products, integrating AI into their flagship applications. One gathers it’s all frightfully clever.

The latest earnings report expanded on Adobe’s adoption of AI. One statistic stood out: record bookings of deals valued at over $1 million. And the number of clients paying Adobe $10 million or more in annual recurring revenue grew by 25% year over year. A clear sign, one suspects, that their AI embrace is paying off.

Anything, of course, can happen. But, as Mark Twain might say, rumors of Adobe’s demise are greatly exaggerated. For investors with a moderate appetite for risk, it’s a worthy speculation. Though, frankly, one wouldn’t want to be caught dead admitting to being an optimist.

Read More

- 21 Movies Filmed in Real Abandoned Locations

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- The 11 Elden Ring: Nightreign DLC features that would surprise and delight the biggest FromSoftware fans

- 10 Hulu Originals You’re Missing Out On

- Top ETFs for Now: A Portfolio Manager’s Wry Take

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- 20 Films Where the Opening Credits Play Over a Single Continuous Shot

- Crypto’s Comeback? $5.5B Sell-Off Fails to Dampen Enthusiasm!

- Bitcoin’s Ballet: Will the Bull Pirouette or Stumble? 💃🐂

- Gold Rate Forecast

2026-02-10 20:22