My uncle, bless his heart, cornered me at Thanksgiving. Not about politics, thankfully, but about “the chips.” Apparently, he’d been watching CNBC and decided he was now an expert in semiconductors. He asked, with the earnestness only a retired accountant can muster, whether I thought AMD or Nvidia would “make him a millionaire.” I mumbled something about diversification and excused myself to refill my wine. It got me thinking, though. Beyond my uncle’s retirement fund, there’s a genuine question here. Which of these companies, locked in this quiet, ruthless battle for computational dominance, will actually deliver in 2026?

Nvidia, for a long time, felt like the obvious answer. They’ve been on a run, haven’t they? A truly impressive, almost unsettling run. It’s like watching a particularly ambitious houseplant thrive while everything else withers. Since 2023, they’ve essentially lapped the field, rising over 1,100% while AMD managed a respectable, but comparatively modest, 209%. But lately? Things have…shifted. Since 2025, AMD has been nipping at their heels, gaining 65% to Nvidia’s 30%. It’s a bit like watching a determined dachshund trying to overtake a greyhound. Unlikely, perhaps, but not entirely impossible.

The GPU Game

Both companies are, at their core, selling the same thing: the ability to crunch numbers, and to do it fast. This is particularly crucial in the age of artificial intelligence, where complex algorithms demand ever-increasing processing power. Nvidia, initially, had a clear advantage. Their GPUs were simply better, more refined. It was like comparing a hand-built Italian sports car to a…well, a perfectly adequate American sedan. But AMD has been improving, and it’s not just about raw performance. It’s about price. My uncle, you see, isn’t looking to buy a Ferrari. He’s looking for something reliable, reasonably priced, and that won’t require a second mortgage.

And that brings us to the data center revenue. AMD’s Q4 saw a 39% increase year-over-year. Not bad. But Nvidia? They’re operating on another level. If Nvidia had only grown 39%, Wall Street would have had a collective coronary. They’re expected to report around 70% growth, and frankly, it wouldn’t surprise me. It’s the difference between a comfortable retirement and a yacht. They grew 62% companywide in Q3, and analysts are predicting 67% for Q4. It’s almost…taunting. Like a particularly smug athlete effortlessly clearing a hurdle.

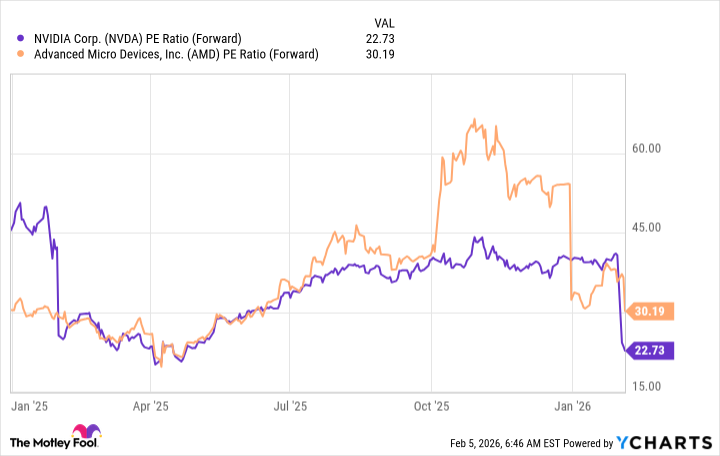

The Valuation Puzzle

You’d think, given its underdog status, AMD would be the cheaper option. You’d be wrong. It trades at 30 times forward earnings, while Nvidia is at a mere 23 times. It’s a peculiar disconnect. It’s like buying a fixer-upper for more than a fully renovated house. I keep waiting for the market to correct, for some rational investor to point out the obvious. But it hasn’t happened. Perhaps everyone is just caught up in the hype, blinded by the potential for future growth.

So, what’s the verdict? Will AMD make my uncle a millionaire? Probably not. Will Nvidia continue to dominate? I suspect so. It’s not a particularly exciting conclusion, I admit. But sometimes, the most likely outcome is also the most boring. And in the world of high-tech investing, boring can be surprisingly profitable. I’ll be sure to gently explain this to my uncle. Though, knowing him, he’ll probably just buy more shares of whatever CNBC is touting that day.

Read More

- 21 Movies Filmed in Real Abandoned Locations

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- The 11 Elden Ring: Nightreign DLC features that would surprise and delight the biggest FromSoftware fans

- 10 Hulu Originals You’re Missing Out On

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- 20 Films Where the Opening Credits Play Over a Single Continuous Shot

- Bitcoin’s Ballet: Will the Bull Pirouette or Stumble? 💃🐂

- Gold Rate Forecast

- 10 Underrated Films by Ben Mendelsohn You Must See

- Walmart: The Galactic Grocery Giant and Its Dividend Delights

2026-02-10 16:52