Right. Let’s talk about money. Specifically, the kind of money that makes you slightly uncomfortable, the sort that requires a spreadsheet and a very strong drink. Nvidia, Apple, Alphabet, Microsoft – they’re all playing in the $3 trillion club. It’s exclusive, obviously. And frankly, a little bit boring. Everyone’s chasing the same shiny objects. But there’s one company, quietly building the infrastructure behind all the hype, that I’m convinced is about to crash the party. Broadcom. Don’t look so surprised. I have sources. And a very healthy sense of where the real leverage lies.

Now, I’m not usually one for predictions, because let’s be honest, the future is mostly just a series of increasingly panicked improvisations. But the numbers on Broadcom…they’re almost indecent. A $1.6 trillion market cap as of today. That means, if they manage to hit that magical $3 trillion mark, anyone who buys in now could see an 86% return. It’s not a guarantee, obviously. Nothing is. But it’s a significantly better gamble than my last attempt at competitive ferret breeding.

More Than Just AI (Honestly)

Everyone’s obsessed with AI. It’s the new oxygen. And yes, Broadcom benefits from it. But to reduce them to ‘just an AI chip supplier’ is… insulting. It’s like calling a perfectly crafted martini ‘just a drink.’ They do so much more. Broadband, networking, security, mainframe software… it’s a sprawling empire, really. And frankly, a bit intimidating. They’re everywhere, quietly powering everything. Which, if you ask me, is the most dangerous kind of power.

They’re industry leaders in Application-Specific Integrated Circuits – ASICs. Fancy name, basically means they make chips that are incredibly efficient for specific tasks. GPUs are all the rage for AI, sure, but ASICs are the smart money. Alphabet, bless their data-hungry souls, already knows this – they rely on Broadcom for their Tensor Processing Units. See? I told you they were smart.

Stellar Financial Results (Or, How They’re Counting Their Money)

Let’s talk numbers again, because that’s what we’re all here for, aren’t we? Record revenue of $18 billion in the last quarter, up 28% year over year. Adjusted earnings per share up 37%. It’s… robust. And here’s the kicker: AI-related revenue, while impressive, only made up about a third of their total revenue. They’re not reliant on one shiny trend. They’re diversified. They’re… responsible. It’s almost unsettling.

Management is forecasting even more growth. They’re predicting a nearly 29% increase in revenue for the next quarter, and a 30% jump in EBITDA. It’s all very…positive. I’m starting to suspect they’re deliberately trying to make me feel inadequate.

Broadcom’s Path to $3 Trillion (And My Portfolio)

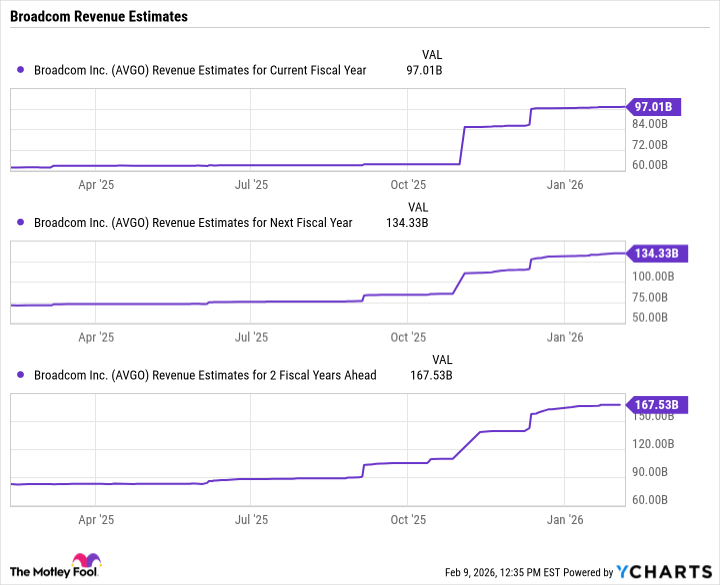

Okay, let’s break this down. Wall Street expects Broadcom to generate $97 billion in revenue by 2026. That gives them a price-to-sales ratio of 16. If that ratio stays constant, they’ll need $180 billion in revenue to hit that $3 trillion market cap. Simple, right? It’s just… a lot of money.

Analysts predict they’ll reach $167 billion by 2028, putting them within striking distance. But Broadcom has a habit of exceeding expectations. They’re annoyingly competent. And honestly, I’m counting on it. The data center boom is expected to attract nearly $7 trillion in capital expenditures by 2030, and Broadcom is perfectly positioned to benefit. Plus, as ASICs become a more economical alternative to GPUs, their opportunity will only expand.

Despite the recent surge in their stock price, Broadcom still sells for roughly 24 times next year’s expected earnings. That gives them a price/earnings-to-growth ratio of 0.25. Anything under 1 is considered undervalued. It’s practically giving money away. I’m starting to think they want me to buy more.

So, there you have it. The evidence is clear. Broadcom is a buy. And frankly, I’m not sharing this with anyone else. Don’t even think about it. This is my little secret. And my path to a significantly more comfortable future. Now, if you’ll excuse me, I have some buying to do.

Read More

- 21 Movies Filmed in Real Abandoned Locations

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- The 11 Elden Ring: Nightreign DLC features that would surprise and delight the biggest FromSoftware fans

- 10 Hulu Originals You’re Missing Out On

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- 20 Films Where the Opening Credits Play Over a Single Continuous Shot

- Gold Rate Forecast

- Top ETFs for Now: A Portfolio Manager’s Wry Take

- 🚨 Kiyosaki’s Doomsday Dance: Bitcoin, Bubbles, and the End of Fake Money? 🚨

- Crypto’s Comeback? $5.5B Sell-Off Fails to Dampen Enthusiasm!

2026-02-10 11:02