The matter of Costco Wholesale (COST 0.28%), you see, is not merely one of stock prices, but a peculiar dance of numbers and expectations. It has, as they say, been rallying. A most energetic rally, rising sixteen percent as of Monday’s close. One almost expects a small brass band to follow it through the trading halls. It flirts with the thousand-dollar mark, a sum that last graced its presence some months prior. Investor sentiment, a fickle beast at the best of times, seems to swell with each upward tick, approaching an all-time high of $1,078. A rather ambitious number, when one considers the price of a decent cabbage these days.

The upcoming earnings report, scheduled for March 5th, is being treated with a gravity usually reserved for pronouncements of impending doom. But should one, a humble seeker of consistent, reliable yield, rush headlong into this retail frenzy? A most pertinent question, indeed.

Is a Good Quarter Foretold?

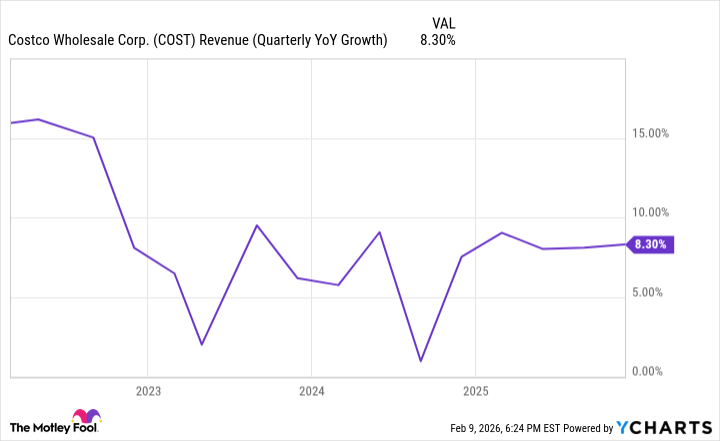

The last report, delivered on December 11th, 2025, revealed a revenue increase of approximately 8.3% for the period ending November 23rd. A respectable showing, certainly. Comparable growth, at 6.4%, was… adequate. Not spectacular, mind you, but not the sort of dismal performance that requires a commission of accountants to unravel. It was, one might say, a performance in keeping with recent periods. Predictable, like the changing of the seasons, or the complaints of a disgruntled shopkeeper.

There are, of course, occasional fluctuations. A sudden drop in demand for bulk mayonnaise, perhaps. Or a run on toilet paper fueled by irrational anxieties. But generally, the company manages to grow with a consistency that borders on the unnerving. They release monthly results as well, these little missives of commerce, offering glimpses into the inner workings of this retail behemoth. In December, a crucial month for any establishment peddling discounted goods, comparable sales grew by seven percent. Not a surge, no, but a steady, reliable climb. A sign, one assumes, that another strong quarter awaits. But whether it justifies the current valuation… that is a matter of some debate.

The Peculiar Problem of Valuation

Costco, it is true, exceeded expectations last time around. But the stock, alas, did not reward such diligence. It fell, you see, in the final weeks of the year. A most ungrateful response. Now, it is rising once more, in the early days of 2026. But at what price? It trades at a price-to-earnings multiple of 54. Fifty-four! More than double the S&P 500 average of 25. A most extravagant sum, when one considers that the company primarily sells… goods. Everyday, ordinary goods. It is as if each tin of peaches, each roll of paper towels, contains a fragment of the philosopher’s stone.

I would not, therefore, rush to purchase Costco’s stock before the earnings report. Whatever numbers they present will likely fail to alter the fundamental truth: this is a grossly overvalued stock. Investors, you see, have been flocking to ‘safe-haven’ assets, driving up the prices of everything in their path. It is a peculiar phenomenon, this collective desire for security. As if a stock certificate could shield one from the vagaries of fate. Costco, caught in this frenzy, has become… expensive. Even if the business performs admirably, I suspect there are better value stocks to be found. Stocks that offer a more sensible blend of yield, safety, and, dare I say, common sense. For a dividend hunter, after all, seeks not fleeting gains, but a steady, reliable income. A small, but consistent reward for enduring the absurdities of the modern world.

Read More

- 21 Movies Filmed in Real Abandoned Locations

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- The 11 Elden Ring: Nightreign DLC features that would surprise and delight the biggest FromSoftware fans

- 10 Hulu Originals You’re Missing Out On

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- 🚨 Kiyosaki’s Doomsday Dance: Bitcoin, Bubbles, and the End of Fake Money? 🚨

- Crypto’s Comeback? $5.5B Sell-Off Fails to Dampen Enthusiasm!

- 39th Developer Notes: 2.5th Anniversary Update

- Gold Rate Forecast

- Top ETFs for Now: A Portfolio Manager’s Wry Take

2026-02-10 04:32