It is a truth universally acknowledged, that a company in possession of rapid revenue growth, must be viewed with a degree of circumspection. While such an increase may command attention, a prudent investor will not be swayed by mere figures, but will seek a deeper understanding of the circumstances which produce them. A flourishing exterior may, alas, conceal deficiencies within, rendering the prospect a decidedly precarious one.

Super Micro Computer (SMCI 2.47%), a name now frequently upon the lips of those engaged in speculative ventures, has lately enjoyed a most remarkable ascent. The demand for its servers, fueled by the prevailing enthusiasm for all things related to Artificial Intelligence, has been, to say the least, considerable. The company’s recent reports confirm this prosperity, displaying a growth in sales which, at first glance, appears most gratifying. Yet, it is a matter of some concern that, despite these favourable indications, a hasty investment would be attended with a degree of risk.

The Matter of Profit

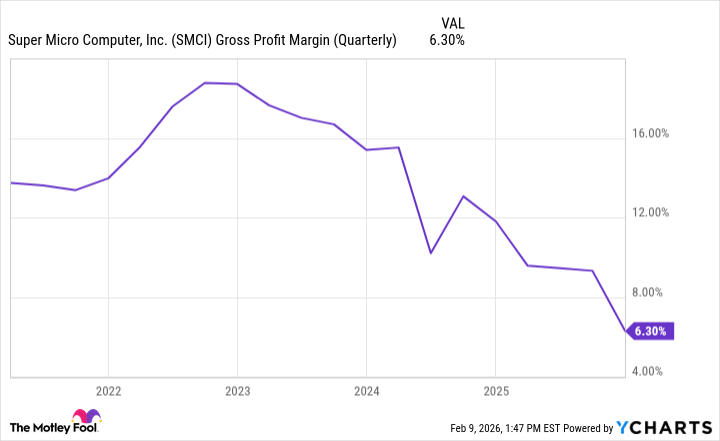

A discerning investor will always direct their attention to the matter of gross profit, that crucial measure which reveals the residue remaining after the costs of production have been accounted for. This, one might observe, is the true foundation upon which any lasting prosperity must be built. A slender margin, however, suggests a vulnerability, a dependence upon an unusually large volume of trade to maintain a comfortable position.

Supermicro’s margins are not merely low, but appear to be diminishing – a circumstance which does little to inspire confidence.

The company’s recent earnings, for the last quarter, reveal a net increase in sales of 123%, reaching $12.7 billion. However, the corresponding increase in gross profit was a more modest 19%, amounting to $798.6 million. Operating income saw a rise of 29%, to $474.3 million – a respectable advance, to be sure, but one which pales in comparison to the spectacular growth displayed on the top line. It is a disparity which warrants careful consideration.

A Question of Value

The current price of Supermicro stock, at 25 times trailing earnings, may appear attractively low, particularly given the company’s participation in the current enthusiasm for Artificial Intelligence. However, one must remember that this growth is predicated upon conditions which are unlikely to endure indefinitely. The present “arms race” in AI, with tech giants investing heavily in new models, cannot continue at its current pace forever. As this fervour subsides, Supermicro’s fortunes may well diminish. The rapid revenue growth which sustains the current bottom line is unlikely to persist during a period of reduced expenditure.

At its present valuation, the stock represents a somewhat risky proposition, given its slender margins and the uncertainties surrounding its future prospects. A prudent investor, one might suggest, would exercise caution before committing their funds.

Read More

- 21 Movies Filmed in Real Abandoned Locations

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- The 11 Elden Ring: Nightreign DLC features that would surprise and delight the biggest FromSoftware fans

- 10 Hulu Originals You’re Missing Out On

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- 39th Developer Notes: 2.5th Anniversary Update

- 17 Black Voice Actors Who Saved Games With One Line Delivery

- Rewriting the Future: Removing Unwanted Knowledge from AI Models

- Bitcoin’s Ballet: Will the Bull Pirouette or Stumble? 💃🐂

- Gold Rate Forecast

2026-02-10 01:02