It began, as these things invariably do, with a subtraction. Approximately five years prior, a decision was made – a severing of ties with Microsoft (MSFT +2.96%) stock. A profit was realized, naturally, a temporary alleviation of the constant accounting that defines existence. The shares were relinquished at approximately $150, a figure now hauntingly distant. The current valuation, exceeding $400, is not a triumph, but a persistent reminder of a calculation gone awry – a phantom limb of the portfolio. The recent decline, following the fiscal year 2026 Q2 earnings announcement (December 31st concluded), offers not opportunity, but the unsettling sensation of being granted a reprieve from a previously committed error, a chance to repeat the mistake with full awareness.

The acquisition of shares, therefore, is not an act of investment, but a compulsion – a bureaucratic necessity. One finds oneself, against all rational judgment, re-engaging with a system previously deemed flawed. There are, ostensibly, four justifications for this recurrence, though the true reasons likely reside in the impenetrable logic of the market itself, a logic one can only observe, never comprehend.

1. Azure: The Perpetual Motion Machine

The primary, and perhaps most illusory, reason for this re-engagement is Azure, the cloud computing division. It functions, one observes, as a kind of perpetual motion machine, endlessly consuming and generating resources. The current demand for computational power, driven by the relentless advance of artificial intelligence, ensures a continuous flow of revenue. Microsoft, predictably, is expanding its data center infrastructure to accommodate this demand, constructing vast, anonymous facilities that resemble nothing so much as holding pens for data. The reported 39% year-over-year revenue growth is not a sign of health, but of an accelerating cycle, a system spiraling towards an unknown endpoint. Should Azure falter, one anticipates a corresponding adjustment in the overall position, though the likelihood of such a disruption appears, at present, statistically improbable.

2. OpenAI: A Proxy for the Unreachable

MSFT”>

3. The Broadening of the Bureaucracy

Azure, while prominent, is not the sole driver of Microsoft’s performance. The company, as a whole, exhibits a disconcerting degree of stability. The Productivity and Business Processes division, encompassing the software utilized by countless organizations, experienced 16% growth. Multiple business units within that division reported positive results. Consumer cloud revenue rose 29%, and Dynamics 365 increased by 19%. These figures, while impressive, suggest not innovation, but the relentless expansion of a bureaucratic system, a widening of the net. The integration of artificial intelligence features is merely a catalyst, accelerating an already established trajectory. Overall revenue increased by 17% year-over-year to $81.3 billion – a figure that evokes not celebration, but a sense of inevitable progression.

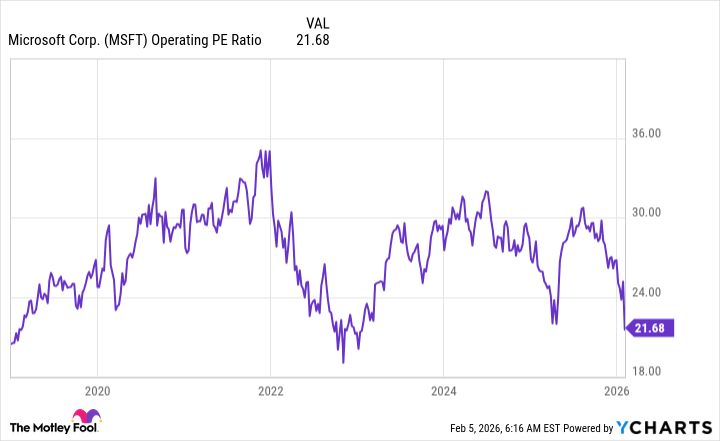

4. The Illusion of Value

The primary impediment to re-engaging with Microsoft shares was, historically, their inflated valuation. The stock consistently traded at a premium, reflecting an unwarranted optimism. The current decline, therefore, presents not an opportunity, but a correction – a temporary alignment with a more realistic assessment of the company’s worth. The operating price-to-earnings (P/E) ratio is near its lowest levels since 2020, and the market sell-offs of 2023 and April 2025. This metric, however, excludes the gains derived from the rising valuation of Microsoft’s OpenAI investment, providing a skewed perspective. It is, nonetheless, sufficient justification for the transaction – a signal, however faint, that the shares are, at least temporarily, undervalued.

One anticipates, of course, continued volatility. The market, like any complex system, is subject to unpredictable forces. Nevertheless, the potential for upside remains. The acquisition of Microsoft shares is not an act of optimism, but a calculated acceptance of the inevitable – a participation in a system that, despite its inherent flaws, continues to operate with a disturbing degree of efficiency.

Read More

- 21 Movies Filmed in Real Abandoned Locations

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- The 11 Elden Ring: Nightreign DLC features that would surprise and delight the biggest FromSoftware fans

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- 10 Hulu Originals You’re Missing Out On

- Rewriting the Future: Removing Unwanted Knowledge from AI Models

- Bitcoin’s Ballet: Will the Bull Pirouette or Stumble? 💃🐂

- 39th Developer Notes: 2.5th Anniversary Update

- Gold Rate Forecast

- 10 Underrated Films by Ben Mendelsohn You Must See

2026-02-09 22:02