They call it Robinhood. HA! More like ROB-ME-HOOD. This whole thing…this digital casino disguised as a brokerage…it’s been circling the drain for months, and now the vultures are gathering. The stock, HOOD (because everything needs an acronym these days), is down 22% since January. Twenty-two percent! That’s enough to give a man the shakes, especially when you consider what this company promised. A revolution! Democratization of finance! Turns out, it’s just another feeding frenzy. They were posting some growth, sure, but growth fueled by…what exactly? Speculation? Daydreaming? The sheer, unadulterated gullibility of the masses?

The Bitcoin Hangover & The Digital Snake Oil

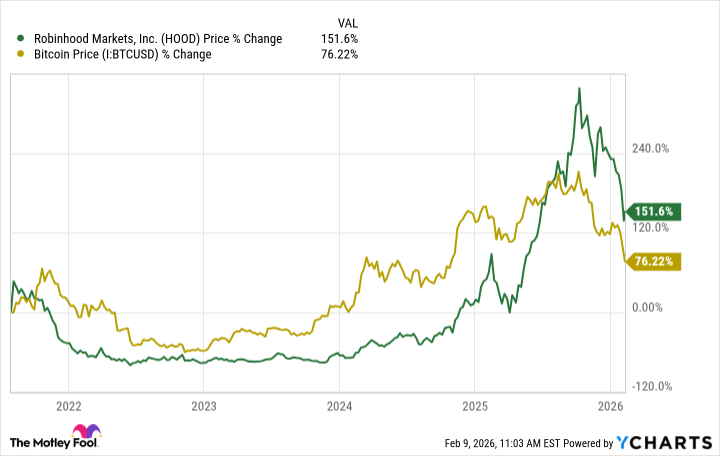

It all smelled wrong from the start. This platform, built on the backs of app-addicted millennials and Gen Z, peddling fractional shares and crypto…it was a recipe for disaster. And disaster, my friends, is now knocking on the door. Last quarter, they saw a 129% jump in transaction revenue, a staggering 300% increase in crypto-related earnings. Crypto! The wild west of finance! Of COURSE it was driving the bus. Now, Bitcoin is faceplanting, and Robinhood is right there with it, nose-diving into the abyss. Look at the charts – it’s a sickeningly obvious correlation. A straight line from digital tulip mania to financial wreckage. They were riding the wave, and now the wave has crashed. And who gets soaked? Not the guys in the penthouse offices, let me tell you.

The crypto bubble was always going to burst, and Robinhood was positioned perfectly to take the fall. They built an empire on volatility, and now volatility is biting back. Investors are waking up, realizing this isn’t some long-term investment strategy, it’s a high-stakes game of chance. And the house…well, the house always wins.

Cheap? Don’t Be Fooled. It’s Still Poison.

They’re calling it a “reasonable valuation” now. A price-to-earnings multiple of 37? Compared to 70? A bargain! HA! That’s what they want you to think. It’s a trap! A slick marketing campaign designed to lure in the unsuspecting. Sure, they’re growing fast, and they’re dabbling in prediction markets…but that doesn’t change the fundamental problem. This company is built on shaky ground, fueled by hype and speculation. A multiple under 40? It’s still wildly overvalued. It’s like offering a discount on a ticking time bomb.

If their next earnings report is “stellar,” it’ll just be a temporary reprieve. A sugar rush before the inevitable crash. They have a young user base, sure, but that’s a double-edged sword. These are the same people who chase meme stocks and fall for get-rich-quick schemes. Loyalty? Forget about it. They’ll jump ship at the first sign of trouble. And trouble, my friends, is coming.

Don’t be fooled by the recent slide. It’s not a buying opportunity, it’s a warning sign. A flashing red light screaming, “Get out while you still can!” There’s still risk here, a LOT of risk. Wait for the earnings report? Fine. But don’t expect a miracle. This isn’t a long-term investment, it’s a gamble. A dangerous, reckless, and ultimately doomed gamble. I expect another strong quarter of…well, of selling dreams. But dreams don’t pay the bills. And eventually, the music stops.

Read More

- 21 Movies Filmed in Real Abandoned Locations

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- The 11 Elden Ring: Nightreign DLC features that would surprise and delight the biggest FromSoftware fans

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- 10 Hulu Originals You’re Missing Out On

- Rewriting the Future: Removing Unwanted Knowledge from AI Models

- Bitcoin’s Ballet: Will the Bull Pirouette or Stumble? 💃🐂

- 39th Developer Notes: 2.5th Anniversary Update

- Gold Rate Forecast

- 10 Underrated Films by Ben Mendelsohn You Must See

2026-02-09 21:03