Many years later, as the scent of overripe mangoes clung to the humid air of Vancouver, old Manolo remembered the whispers of a coming silence, a loosening of the purse strings in Washington. It wasn’t the sound of gold changing hands, not precisely, but the echo of a promise made and broken, then tentatively remade, a rhythm as predictable as the tides in Cartagena. He’d seen it before, this loosening, this descent into the comfortable shadows of low interest, and he knew, with the certainty of a man who’d counted the rings of a thousand trees, that certain fortunes would bloom in the damp earth, while others would wither under the relentless sun. The air, thick with the memory of rain, carried the premonition of a shift, a subtle rearrangement of the world’s wealth, and it was in this atmosphere, steeped in the ghosts of rates past, that the true players began to stir.

The current President, a man accustomed to declarations delivered as pronouncements, had been insisting, with a volume that rattled the chandeliers of power, that the Federal Reserve ease its grip on the nation’s finances. His chosen successor, a figure named Warsh, seemed inclined to heed the call, a coincidence not lost on those who understood the delicate dance of influence. The markets, ever sensitive to the slightest tremor, began to anticipate the inevitable, pricing in an 81% probability of a rate cut by summer, a near certainty that hung over Wall Street like a persistent haze. After years of a monetary policy as rigid as a colonial fortress, the cracks were beginning to show, and the scent of change, like jasmine after a storm, was unmistakable.

This loosening of the financial reins, while presented as a boon to all, would inevitably favor certain sectors, those that thrived on borrowed time and the illusion of perpetual growth. Among these, the Real Estate Investment Trusts – REITs – stood out, their fortunes inextricably linked to the ebb and flow of interest rates. These entities, bound by arcane tax regulations that demanded they return 90% of their earnings to shareholders, offered a peculiar form of stability, a promise of income in a world increasingly defined by volatility. Their high yields, like a siren’s song, attracted investors seeking refuge from the dwindling returns of traditional bonds, while their valuations, tethered to the benchmark 10-year Treasury yield, would rise as rates fell, a simple equation in a world obsessed with complexity.

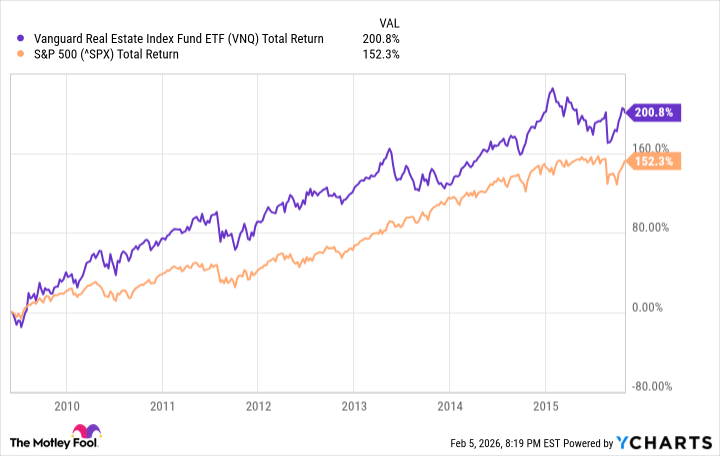

One could trace this pattern back to the years following the great tremor of 2008, to a period of prolonged low rates that stretched from 2009 to 2015. During those years, the Vanguard Real Estate Index Fund ETF – a vessel carrying a diverse collection of REIT stocks – had outperformed the broader S&P 500, a testament to the power of leverage and the enduring appeal of brick and mortar in a digital age. It was a period of quiet prosperity, a time when fortunes were built not on innovation, but on the simple act of borrowing cheaply and reinvesting wisely. But such periods, like the bloom of a rare orchid, are always fleeting, and the memory of those years served as a haunting reminder of what could be, and what might be lost.

Still, not all REITs were created equal. Some, like ancient galleons, were weighed down by debt and destined to sink, while others, sleek and agile, were poised to navigate the coming tide. Three, in particular, caught the eye of those who understood the subtle currents of the market, three opportunities to capitalize on the inevitable shift.

1. Realty Income

Founded in 1969, a year etched in the memory of those who remembered the scent of revolution in the air, Realty Income, headquartered in Vancouver, had grown into a behemoth, a global empire with properties spanning nine countries and a value exceeding $61 billion. Its tenants – Lowe’s, Chipotle, Sainsbury’s, Walmart – were the familiar landmarks of a changing world, the symbols of a consumer culture that knew no borders. But it was the company’s unwavering commitment to quarterly dividend increases – 112 consecutive increases, a feat almost biblical in its consistency – that truly set it apart. With earnings growing 17% year over year, the streak seemed destined to continue, a testament to the enduring power of predictable income in an unpredictable world. Its monthly dividend yield of 5.2%, well above the S&P 500 average of 1.16%, was a beacon to those seeking refuge from the storm.

2. Prologis

San Francisco-based Prologis, a name that evoked the vast warehouses and logistical networks that underpinned the modern world, operated in 20 countries, managing assets totaling $215 billion. Its dividend growth from 2019 to 2024 had outpaced the entire REIT sector by a factor of two, a testament to its efficient operations and strategic investments. The recent approval of another 5% dividend hike, announced on February 20th, 2025, was a clear signal of its confidence in the future, a promise of continued prosperity. With a current dividend yield of 3%, nearly triple the S&P 500 average, and earnings growing at a rate of 9.5% year over year, an imminent dividend increase seemed all but certain.

3. Vanguard Real Estate Index Fund ETF

The Vanguard Real Estate Index Fund ETF, a vessel carrying 152 REIT stocks, offered broad-based exposure to the industry, a diversified portfolio designed to provide high income and moderate long-term capital appreciation. Tracking the performance of the MSCI U.S. Investable Market Real Estate 25/50 Index, it represented a passive approach to investing, a bet on the collective strength of the sector. With a yield of 3.82%, over triple the S&P 500 average, and a low expense ratio of 0.13%, it offered a compelling value proposition. While year-to-date returns were modest, at just 2%, it was a clear indication that Wall Street had yet to fully embrace the potential of REITs. Yet, its history of outperformance during periods of low rates – a return of over 200% from June 2009 to November 2015 – suggested that a shift in sentiment was inevitable.

For investors seeking income and stability in a world bracing for a return to low rates, these three REIT opportunities represented more than just investments. They were a hedge against uncertainty, a bet on the enduring power of real estate, and a quiet acknowledgement that even in the most turbulent of times, the earth itself remained a solid foundation.

Read More

- 21 Movies Filmed in Real Abandoned Locations

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- The 11 Elden Ring: Nightreign DLC features that would surprise and delight the biggest FromSoftware fans

- 10 Hulu Originals You’re Missing Out On

- Gold Rate Forecast

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- 39th Developer Notes: 2.5th Anniversary Update

- 15 Western TV Series That Flip the Genre on Its Head

- Rewriting the Future: Removing Unwanted Knowledge from AI Models

- Doom creator John Romero’s canceled game is now a “much smaller game,” but it “will be new to people, the way that going through Elden Ring was a really new experience”

2026-02-09 00:54