The House of Mouse, or Walt Disney (DIS), experienced a rather undignified tumble recently – a 7.4% decline following their quarterly pronouncements. One might say the market reacted as if presented with a counterfeit Mickey Mouse. A temporary affliction, we suspect, easily remedied with a closer inspection of the treasury.

The anxieties, as always, center around expenditures and projections. Higher spending, lower profitability… a familiar refrain in the world of commerce. But to dwell on deficits is to miss the subtle artistry of profit. Disney, you see, isn’t merely selling cartoons and theme park rides; it’s peddling dreams – and dreams, my friends, have a remarkably high margin.

Let us examine, then, why these concerns are, shall we say, a touch exaggerated, and why a patient investor might find themselves handsomely rewarded. Consider this not as a stock tip, but as a carefully considered assessment – a peek behind the velvet curtain of entertainment finance.

The Experience Economy: A Record-Breaking Spectacle

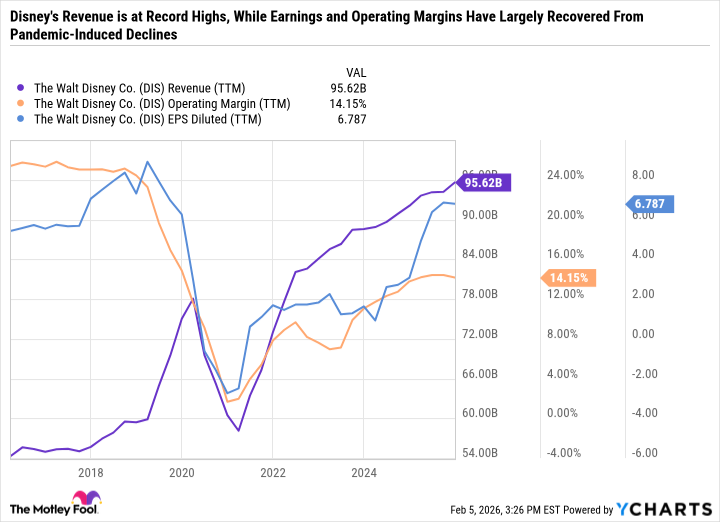

Disney’s parks and cruises, that engine of revenue, continue to perform with a vigor that would impress even the most seasoned carnival barker. The charts, of course, tell a story, but they lack the delightful nuance of lived experience. Yes, pre-pandemic highs remain elusive, but to fixate on the past is to ignore the present momentum.

Consider the numbers. Back in 2019, before the world decided to practice social distancing, the parks generated $7.4 billion in revenue with $2.34 billion in operating income. Fast forward to the most recent quarter: $10 billion in revenue and a robust $3.31 billion in operating income. A significant leap, wouldn’t you agree? And the operating margin? A respectable 33.1%. A clever operator knows when to raise the price of a churro.

The key, naturally, is expansion without saturation. New rides, new cruises, even a theme park in Abu Dhabi – these aren’t mere whims, but calculated risks. It’s a delicate dance, of course, but Disney appears to be leading with a sure foot. The demand, it seems, is insatiable. People will queue for hours to experience manufactured wonder. A truly remarkable phenomenon.

Streaming: From Red Ink to Respectable Profit

The streaming wars, as they’re called, have been a costly affair. Disney+, Hulu, and the various international iterations have required a substantial investment. But the tide, it seems, is turning. The latest quarter saw operating income more than double, reaching $450 million. A respectable sum, wouldn’t you say? And the operating margin? 8.4%. A modest start, perhaps, but with the potential for significant growth.

The focus, wisely, is shifting from subscriber acquisition to profitability. A clever maneuver, akin to a gambler realizing that quality, not quantity, is the path to long-term success.

The Box Office: A Resurgence of Magic

Before the pandemic, Disney dominated the box office, fueled by the Marvel and Star Wars franchises. The subsequent disruption, naturally, took its toll. But 2025 saw a remarkable resurgence, with $6.45 billion in global revenue – the third-highest year in the company’s history.

The usual suspects – Avatar: Fire and Ash, Zootopia 2, and the live-action Lilo & Stitch – led the charge. All exceeding $1 billion in revenue. A testament to the enduring power of well-crafted storytelling – and, let’s be honest, a carefully orchestrated marketing campaign.

The momentum is expected to continue in 2026, with highly anticipated releases like Avengers: Doomsday and Toy Story 5. A predictable strategy, perhaps, but one that consistently delivers results.

Buybacks: A Return of Capital, or a Clever Illusion?

Disney intends to repurchase $7 billion in stock in fiscal 2026, backed by $19 billion in anticipated cash flow. A substantial commitment, certainly. And a clever way to return capital to shareholders. A reduction in share count, naturally, accelerates earnings per share growth. A simple equation, really.

Whether this is a genuine expression of confidence or a calculated attempt to manipulate the stock price is, of course, open to debate. But the effect, regardless of intent, is undeniably positive.

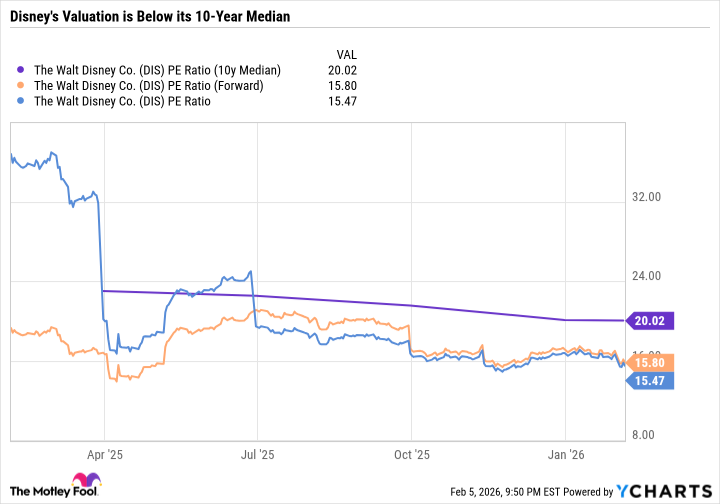

Valuation: A Kingdom Undervalued?

Disney’s valuation, compared to its historical average, is remarkably low. A puzzling anomaly, given the company’s strong performance and promising outlook.

The guidance is strong, with double-digit adjusted EPS growth expected in fiscal 2026. A compelling combination of factors, wouldn’t you agree? A shrewd investor might consider this an opportune moment to acquire a piece of the kingdom.

In conclusion, Walt Disney appears to be a top value stock to buy now. A kingdom of dreams, undervalued and ripe for investment. A proposition, we believe, worthy of careful consideration. Though, naturally, all investments carry risk. One should always remember that even the most meticulously crafted illusion can, eventually, be exposed.

Read More

- 21 Movies Filmed in Real Abandoned Locations

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- The 11 Elden Ring: Nightreign DLC features that would surprise and delight the biggest FromSoftware fans

- 10 Hulu Originals You’re Missing Out On

- Gold Rate Forecast

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- 39th Developer Notes: 2.5th Anniversary Update

- 15 Western TV Series That Flip the Genre on Its Head

- Rewriting the Future: Removing Unwanted Knowledge from AI Models

- Doom creator John Romero’s canceled game is now a “much smaller game,” but it “will be new to people, the way that going through Elden Ring was a really new experience”

2026-02-09 00:23