The chronicles of commerce often present curious spectacles, and the recent performance of Alphabet – a name now echoing through the halls of finance – is no exception. A rise of sixty-five percent in the value of its shares over the past year is a figure that compels attention, a testament to the currents of speculation and innovation that drive these markets. It is a gain, one might observe, that breeds a certain apprehension amongst those who seek to partake in such prosperity, for the higher a tower is built, the greater the risk of its eventual descent. The valuation, thirty times the projected earnings, is a matter for sober consideration, a weight upon the scales of potential reward.

Yet, to dismiss Alphabet’s trajectory as mere exuberance would be a simplification. The company, like a seasoned strategist, appears to be maneuvering with a purpose, a calculated intent that extends beyond the immediate allure of profit. The recent quarterly reports, a balm in a landscape often marred by disappointment, reveal a revenue of one hundred and thirteen point eight billion dollars, a per-share profit of two dollars and eighty-two cents – figures that surpass the expectations of even the most discerning observers. The increase in capital expenditure, directed towards the infrastructure of artificial intelligence, is a bold gamble, a wager on the future of computation. One hears whispers of concern – that certain companies, Microsoft and Oracle amongst them – are expending vast sums on this same pursuit with diminishing returns. But Alphabet, it seems, is different. Each dollar invested appears to bear fruit, a testament to the efficiency of its endeavors.

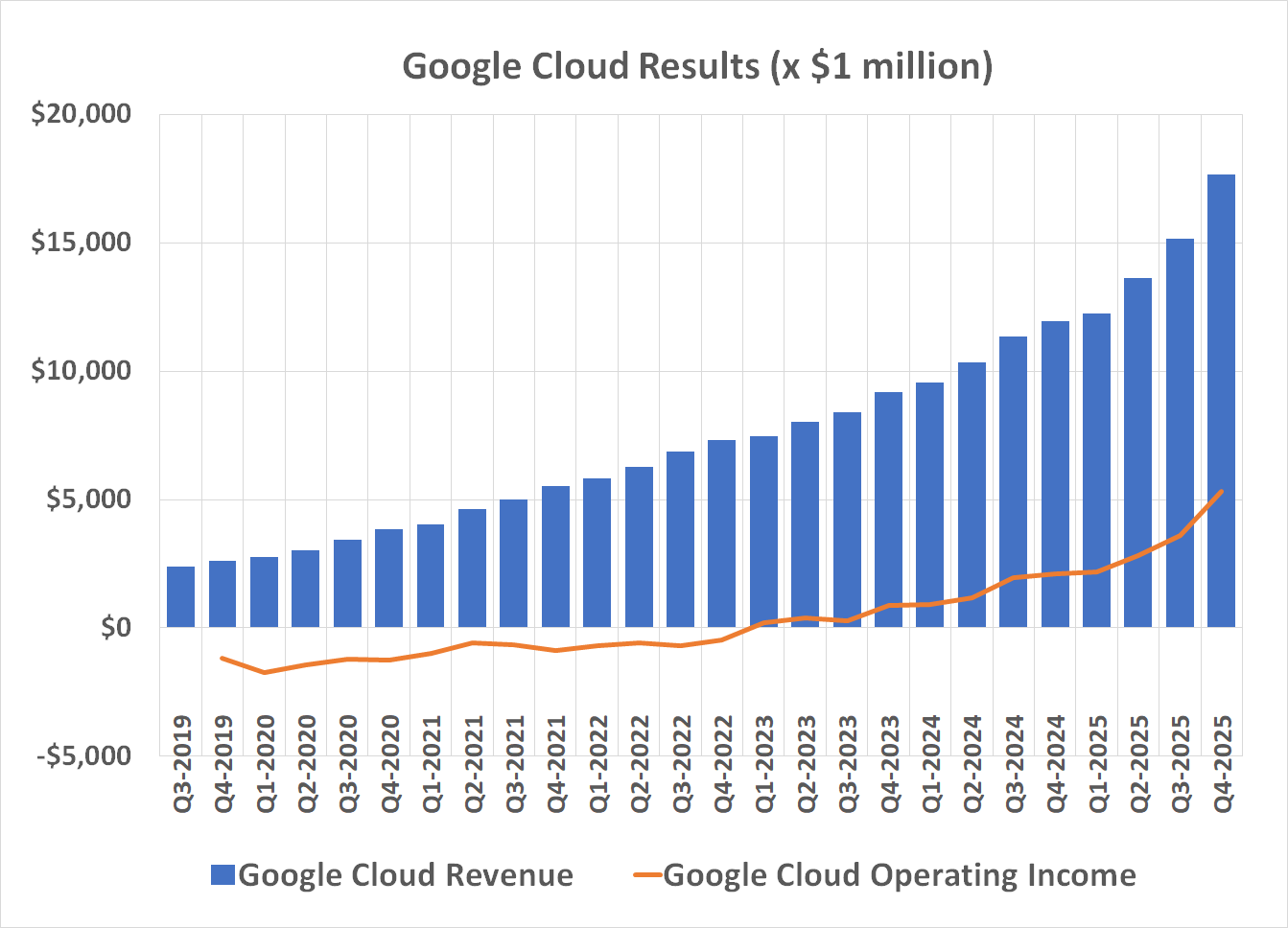

Consider the figures emanating from Google Cloud, the engine driving this expansion. Revenue is accelerating, reaching seventeen point seven billion dollars in the last quarter. More remarkable still is the growth of operating income, climbing to five point three billion dollars. This is not merely an increase in scale, but an improvement in efficiency, a refinement of the underlying mechanisms that generate wealth. It is as if the company has discovered a hidden spring, a source of energy that sustains its ascent. Whatever methods are employed, whatever secrets are guarded within its laboratories, they are proving remarkably effective.

To claim this growth is solely attributable to artificial intelligence would be a distortion. The search engine, the bedrock of Alphabet’s empire, and its associated offerings remain the primary source of income. However, the cloud division, now accounting for fifteen percent of both revenue and profit, is growing at a rate that demands attention. A forty-eight percent year-over-year improvement, coupled with a doubling of operating income, is a force that cannot be ignored. It is a ripple that will inevitably spread throughout the entire organization, reshaping its contours and altering its destiny. Investors, preoccupied with the immediate present, may fail to appreciate the magnitude of this shift. They will, in time, awaken to the reality unfolding before them.

And what of the future? The projections for the artificial intelligence data center industry suggest an average annual growth rate of twenty-five percent through 2031, a tripling of its current size. Alphabet, armed with its purpose-built Tensor Processing Units, appears well-positioned to capture a substantial share of this expanding market. But one must ask: is this relentless pursuit of technological advancement truly progress? Does it serve the greater good of humanity, or merely amplify our existing flaws and vulnerabilities? These are questions that haunt the discerning observer, questions that demand a deeper contemplation than mere financial analysis can provide. The market, driven by the ephemeral winds of speculation, rarely pauses to consider such matters. It is a relentless machine, grinding forward with an indifference to the consequences of its actions.

Thus, we observe Alphabet, a titan of the modern age, navigating the treacherous currents of commerce with a blend of ambition and calculation. Its ascent is a spectacle worthy of our attention, a story of innovation, growth, and the enduring human quest for prosperity. But let us not be blinded by the brilliance of its achievements. Let us remember that even the most formidable empires are ultimately subject to the laws of time and the vagaries of fate.

Read More

- 21 Movies Filmed in Real Abandoned Locations

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- The 11 Elden Ring: Nightreign DLC features that would surprise and delight the biggest FromSoftware fans

- 10 Hulu Originals You’re Missing Out On

- Gold Rate Forecast

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- 39th Developer Notes: 2.5th Anniversary Update

- 15 Western TV Series That Flip the Genre on Its Head

- Rewriting the Future: Removing Unwanted Knowledge from AI Models

- Doom creator John Romero’s canceled game is now a “much smaller game,” but it “will be new to people, the way that going through Elden Ring was a really new experience”

2026-02-08 23:53