Uber, a name now echoing in the chambers of commerce and the quiet streets alike, operates not merely a platform for conveyance, but a vast, restless network. It is a choreography of motion, a river of needs fulfilled – or, more precisely, temporarily abated. Yet, beneath the surface of bustling routes and delivered meals, lies a dependence, a weight: the nine and seven million hands guiding those vehicles, a human tide consuming the greater part of the yield. A curious arrangement, isn’t it? To build a future on the backs of the present.

The company, under the direction of Khosrowshahi, now turns its gaze towards the horizon, towards the promise of autonomy. Not as a simple replacement of labor, but as a reshaping of the very landscape of value. The prospect is not merely financial, though a multitrillion-dollar opportunity is, of course, a compelling vista. It is a fundamental alteration of the cost structure, a severing of the tether to the most substantial expense. To imagine the possibilities… it is like watching a seed swell with the promise of spring.

This pursuit, however, is not a solitary venture. It requires an understanding of flows, of currents, of the delicate balance between supply and demand. Uber, having spent years navigating the labyrinthine streets and the capricious desires of its patrons, possesses a knowledge that few can match. It is a seasoned cartographer of movement, and in this new era, that skill will be more valuable than ever. The challenge is not merely to build a self-driving vehicle, but to orchestrate a fleet, to anticipate the ebb and flow of need, to ensure that the promise of efficiency does not devolve into a chaotic surplus or a frustrating scarcity.

A Harvest of Potential

The figures themselves are… substantial. In 2025, gross bookings reached $193.4 billion, a torrent of transactions flowing through the network. Yet, a significant portion – $85.4 billion – was immediately redirected to the drivers, a necessary expenditure, certainly, but one that limits the ultimate yield. The remaining revenue, $52 billion, represents a modest harvest from a vast field. And after accounting for operating expenses, the adjusted profit dwindles to $5.2 billion – a fragile bloom, easily withered by unforeseen circumstances.

The true potential, however, lies in the liberation from that primary cost. To imagine a future where those billions remain within the company, fueling innovation and expansion… it is a compelling vision. And Uber, with its existing infrastructure and its established network, is uniquely positioned to capitalize on this shift. Over twenty companies, developing their own autonomous technologies, are already plugging into its platform – a testament to its central role in this emerging ecosystem. Even Alphabet’s Waymo, a formidable competitor in its own right, finds value in collaboration, completing over 450,000 autonomous trips weekly through Uber’s network. It is a strange alliance, this dance between rivals, but a pragmatic one, born of necessity and opportunity.

Currently, autonomous vehicles account for a mere fraction – 0.1% – of all ride-sharing trips. The transition will be gradual, incremental. But Uber intends to expand its autonomous offerings to fifteen cities globally by 2026, with a stated ambition to become the dominant player in this space by 2029. Khosrowshahi’s projection of a multitrillion-dollar opportunity may seem ambitious, but it is grounded in a realistic assessment of the potential rewards.

A Dividend Hunter’s Perspective

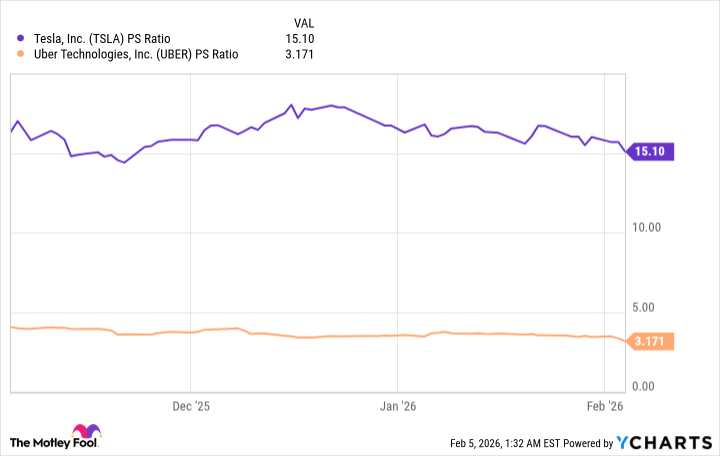

The pursuit of autonomy will not be a winner-take-all scenario. The opportunity is simply too vast, the demand too pervasive. Tesla, with its own ambitions in the autonomous space and its Cybercab robotaxi, will undoubtedly be a significant competitor. But Uber’s existing infrastructure, its established network, and its attractive valuation make it a particularly compelling investment. The stock currently trades at a price-to-sales ratio of just 3.1 – a fraction of Tesla’s valuation.

Furthermore, with adjusted earnings of $2.45 per share in 2025, the stock trades at a price-to-earnings ratio of just 30.1 – a discount to the Nasdaq-100 index. In a market often characterized by exuberance and speculation, Uber appears to be undervalued, a rare find indeed. Tesla, with its sky-high P/E ratio of 377, seems… precarious, even with its foray into autonomous ride-hailing.

For the long-term investor seeking exposure to the autonomous driving revolution, Uber presents a compelling opportunity. It is not merely a technological play, but a fundamental shift in the economics of transportation, a reshaping of the landscape of value. And in that transformation, a patient investor may find a fertile ground for growth, a bloom in the automated fields.

Read More

- 21 Movies Filmed in Real Abandoned Locations

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- The 11 Elden Ring: Nightreign DLC features that would surprise and delight the biggest FromSoftware fans

- 10 Hulu Originals You’re Missing Out On

- Gold Rate Forecast

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- 39th Developer Notes: 2.5th Anniversary Update

- 15 Western TV Series That Flip the Genre on Its Head

- Rewriting the Future: Removing Unwanted Knowledge from AI Models

- Doom creator John Romero’s canceled game is now a “much smaller game,” but it “will be new to people, the way that going through Elden Ring was a really new experience”

2026-02-08 22:52