Many years later, as the servers hummed with a digital melancholy born of endless calculations, old Mateo, the systems architect, would recall the quarter ending in 2025 as the moment the cloud began to cast a shadow longer than even the most optimistic projections dared to imagine. It wasn’t a shadow of failure, precisely, but one of expectation, a weight pressing down on the shoulders of Alphabet, the company that had, for so long, navigated the currents of innovation with a practiced, almost fatalistic grace. The numbers, of course, told a story of triumph – a 48% surge in Google Cloud revenue, reaching $17.7 billion, a sum large enough to momentarily silence the whispers of obsolescence that always cling to the edges of even the most powerful empires. But Mateo, a man who understood the language of machines, knew that such growth carried its own peculiar anxieties.

The reports spoke of a “revenue surprise,” a phrase that always struck him as faintly absurd. As if the market, that capricious and often irrational entity, could truly be surprised by anything. It merely reacted, like a startled iguana, to the shifting patterns of data, driven by forces as ancient and unpredictable as the monsoon rains. The cloud, it seemed, was not merely a repository of information, but a mirror reflecting the collective hopes and fears of a generation. And Alphabet, the company that had built this mirror, now found itself staring back at its own reflection, questioning the very foundations of its dominion. A 15.5% contribution to total revenues, the analysts chirped, a “beefy” figure. Mateo preferred to think of it as a tightening grip, a slow but inexorable ascent.

The stock, predictably, wobbled. A dip of 6.5% after the report, enough to briefly unsettle the legions of investors who had placed their faith in the company’s seemingly limitless potential. It was a small tremor, hardly a cataclysm, but Mateo had learned to pay attention to the subtle shifts in the market’s mood. The spending on AI infrastructure, a commitment to a future that remained stubbornly elusive, had triggered a wave of skepticism. The market, it seemed, preferred the tangible to the theoretical, the immediate to the distant. It wanted results now, not promises of future glory. A loss of $250 billion in market value over three days, the financial pages declared with a dramatic flourish. Mateo, however, saw it as a mere adjustment, a recalibration of expectations. The giants, after all, are always prone to stumbling.

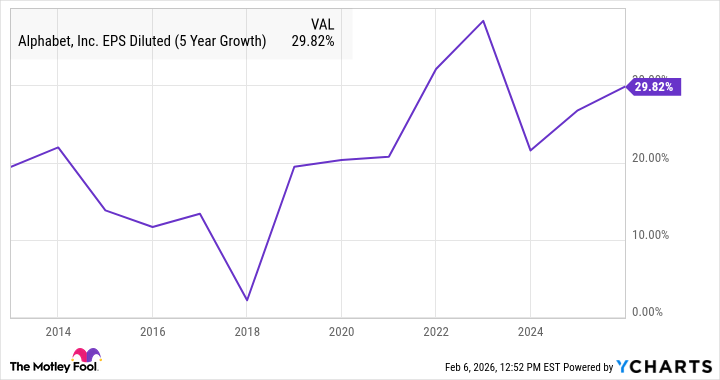

Still, to claim Alphabet the “best AI stock” felt like a premature coronation. Even amidst the “Magnificent Seven,” where it currently leads with a 68% gain, outpacing even Nvidia’s 47%, a certain weariness settled upon Mateo. The valuations, while not exorbitant – 30 times trailing earnings, 9.6 times sales – hinted at a precarious balance. The forward price-to-earnings ratio of 24x, the PEG ratio of 2.0… comfortable figures, perhaps, but lacking the reassuring solidity of a truly undervalued asset. The analyst consensus, predicting a mere 12.3% average annual growth over the next five years, felt particularly… restrained. A slowing of momentum, a settling into maturity. But Mateo knew that Alphabet, unlike most companies, possessed a peculiar talent for defying expectations. It had, after all, spent two decades turning data into dollars, a skill that few others could claim.

The doubling of the capital expense budget for 2026, the surge in operating margin for Google Cloud from 17.5% to 29.9%… these were not merely numbers, but signs of a deeper transformation. A willingness to invest in the future, even at the risk of short-term pain. Mateo knew that growth investors would welcome this, while long-term holders would appreciate the company’s adaptability. But he also knew that the future was never guaranteed. That even the most carefully laid plans could be derailed by unforeseen circumstances. The market, after all, was a fickle mistress, prone to sudden whims and irrational outbursts. To claim that Alphabet would outperform its peers in 2026 or beyond would be foolish. But to dismiss its potential would be even more so. It was a company that understood the art of evolution, a skill that few others possessed. And in a world of constant change, that was a quality worth cherishing, even if it meant accepting a little uncertainty along the way.

Mateo, sipping his lukewarm coffee, watched the rain fall against the windowpane. The servers hummed their endless song. And he knew, with a quiet certainty, that the story of Alphabet was far from over. It was a story of ambition, innovation, and the relentless pursuit of the future. A story that, like the rain, would continue to fall, washing away the old and making way for the new.

Read More

- 21 Movies Filmed in Real Abandoned Locations

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- The 11 Elden Ring: Nightreign DLC features that would surprise and delight the biggest FromSoftware fans

- 10 Hulu Originals You’re Missing Out On

- Gold Rate Forecast

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- 39th Developer Notes: 2.5th Anniversary Update

- 15 Western TV Series That Flip the Genre on Its Head

- Rewriting the Future: Removing Unwanted Knowledge from AI Models

- Doom creator John Romero’s canceled game is now a “much smaller game,” but it “will be new to people, the way that going through Elden Ring was a really new experience”

2026-02-08 21:43