It is a truth universally acknowledged, that a company in possession of a novel technology must be in want of investment. D-Wave Quantum (QBTS +20.39%) has, with a degree of boldness that one might deem either admirable or imprudent, set itself forth as a leader in this most perplexing field of quantum computing. The month of January, however, witnessed a slight, though not entirely unexpected, diminution in the esteem of the market, the shares experiencing a decline of nearly one-fifth. A circumstance which invites, if not demands, a renewed assessment of its prospects.

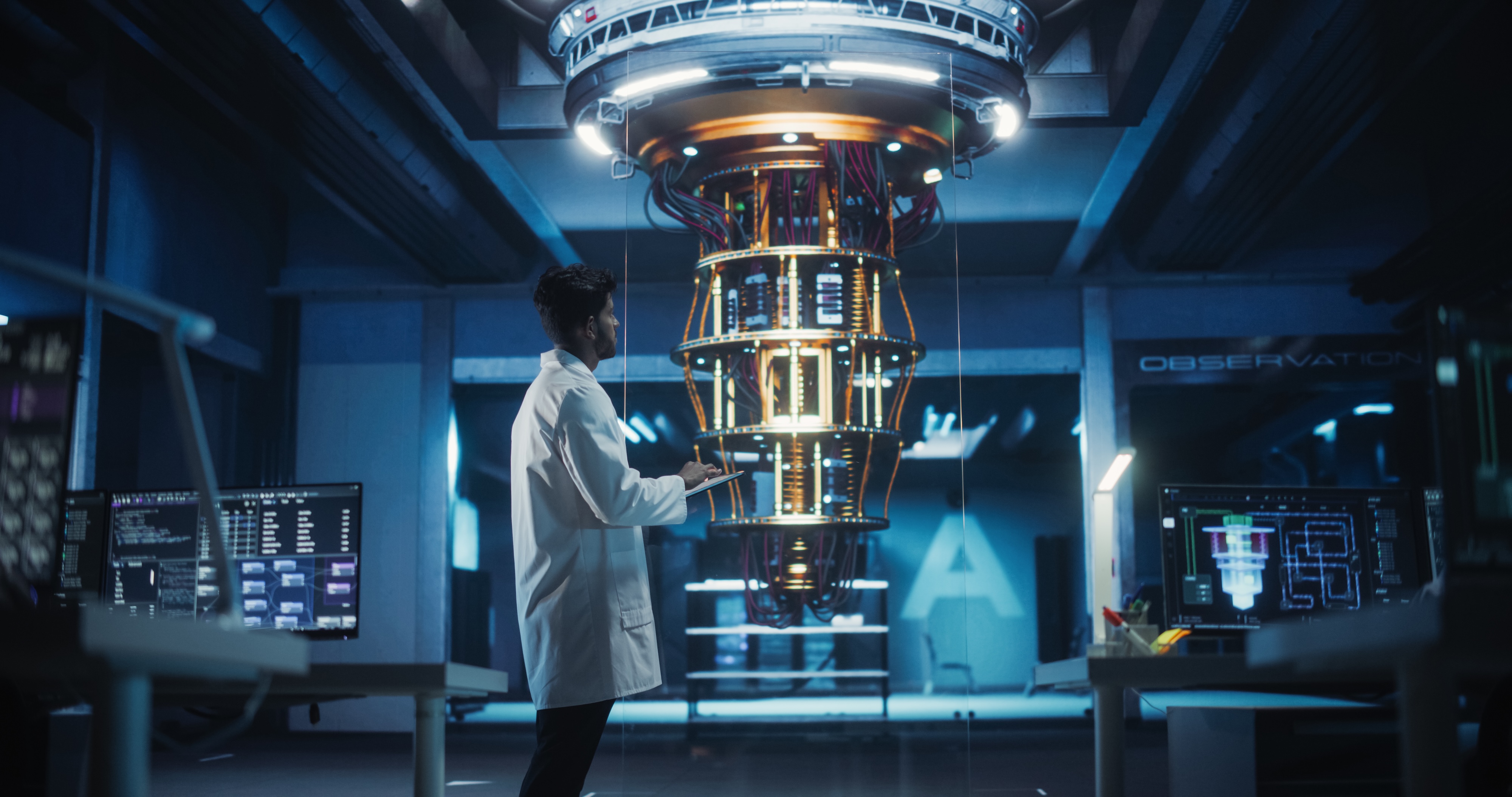

The potential for this new science is, of course, considerable. To harness the very principles of the universe to solve problems beyond the reach of conventional calculation is a prospect that captures the imagination. One observes a distinct enthusiasm amongst those acquainted with the intricacies of pharmaceuticals, materials science, finance, and even the safeguarding of information. The year 2025, it appears, saw the first stirrings of practical application, moving beyond mere theoretical contemplation. The emphasis has shifted, naturally, to the more substantial matter of production and deployment.

Several companies are presently engaged in this pursuit, each pursuing a different path, and leaving investors to determine which, if any, warrants a place within their portfolios. D-Wave has, until recently, been known principally for its quantum annealing systems – an energy-efficient approach, designed to expedite decision-making and optimise operations. However, the recent acquisition of Quantum Circuits Inc. (QCI) introduces a new complexity. It is a union that promises a balance between established practicality and the more ambitious, though as yet unproven, potential of gate-model quantum computing. One might liken it to a prudent marriage, combining existing assets with the promise of future advantage.

A Transaction of Some Magnitude

The price for this advantageous match, $550 million – a combination of stock and cash – is not inconsiderable. Indeed, it appears a substantial sum when viewed against D-Wave’s revenues for the preceding nine months, which amounted to a mere $22 million. However, one must acknowledge a threefold increase in revenue compared to the previous year, and a healthy cash reserve of $836.2 million as of September 30th. A comfortable position, though hardly a guarantee of future prosperity.

Nevertheless, a valuation exceeding $7 billion demands a degree of caution. The market, as always, is a fickle mistress, and a sustained period of success is required to justify such an ambitious price. Only those with a considerable appetite for risk, and a willingness to endure a degree of volatility – as demonstrated by January’s downturn – should consider an investment at this juncture. It is, after all, a speculative venture, and one must be prepared for the possibility of disappointment.

Should the sales of D-Wave’s annealing systems fail to gain sufficient momentum, or the development of its gate-model technology encounter unforeseen obstacles, a re-evaluation by the market is all but inevitable. A prudent investor will, therefore, remain keenly aware of these possibilities before committing capital to this most intriguing, and potentially rewarding, undertaking.

Read More

- 21 Movies Filmed in Real Abandoned Locations

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- The 11 Elden Ring: Nightreign DLC features that would surprise and delight the biggest FromSoftware fans

- 10 Hulu Originals You’re Missing Out On

- 39th Developer Notes: 2.5th Anniversary Update

- Gold Rate Forecast

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- Rewriting the Future: Removing Unwanted Knowledge from AI Models

- PLURIBUS’ Best Moments Are Also Its Smallest

- Leaked Set Footage Offers First Look at “Legend of Zelda” Live-Action Film

2026-02-08 20:22