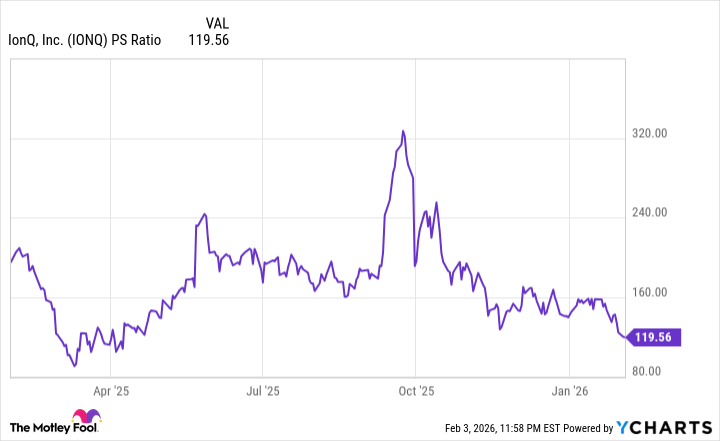

So, IonQ. Quantum computing. Everyone’s losing their minds. The stock went up, briefly, in ’25. A 52-week high. October. Fine. But now? February 2026? Down 14%. Down! And suddenly everyone’s all, “Buy opportunity!” It’s infuriating. Like they expect me to just ignore the trajectory. The sheer lack of consistency. It’s not about the money, it’s about the principle.

They claim they’re building a “full-stack quantum platform.” A “vertically integrated” solution. What does that even mean? It sounds like marketing jargon designed to distract you from the fact that nobody actually understands what’s going on. And now they’re just… acquiring companies left and right. Skyloom. Lightsynq. SkyWater Technology. It’s like they’re playing a game of corporate Monopoly. They’re buying up everything in sight, hoping something sticks. And the names! Skyloom? It sounds like a cleaning product.

The whole thing hinges on these “qubits,” apparently. Tiny little data units. Fragile, they say. Like a delicate flower. So, sending data across long distances is “difficult.” You don’t say. It’s like trying to transport a soufflé across the country. And then they expect you to invest? It’s a logistical nightmare, and they’re acting like it’s a minor inconvenience. They’re trying to solve a fundamental physics problem with… acquisitions? It’s absurd.

And Oxford Ionics. They bought a company to improve “accuracy.” Accuracy! Like quantum computers are prone to… typos? It’s a machine! It should be accurate by definition. It’s like buying a car and then having to purchase an “accuracy upgrade.” The whole premise is just… off. They’re bragging about achieving a “world record” for accuracy. A record! As if that means anything. It’s like being the fastest person to fold a fitted sheet. Impressive, maybe, but ultimately pointless.

They predict a million qubits by 2030. A million! What are they going to do with a million qubits? Run a slightly faster spreadsheet? The sheer scale of it is… unsettling. And then the sales numbers. Up 222% year-over-year. Okay, fine. But then the operating expenses. Up to $208.7 million. And a net loss of $1.1 billion. A billion! They’re spending more money than they’re making. It’s like setting your house on fire to stay warm. And they expect me to be excited about this?

They have $3.5 billion in cash, though. That’s… something. No debt. Which is good, I guess. But it just means they have more money to lose. They’re flush with cash, and they’re throwing it at a problem they don’t understand. It’s like giving a toddler a loaded credit card. What could possibly go wrong?

The price-to-sales ratio has come down. They’re calling it a “buying opportunity.” It’s still not “bargain territory,” they admit. But it’s… less expensive. Which is like saying a root canal is “less painful” than an amputation. It’s still not good! They expect me to be grateful for a slightly reduced level of financial distress? It’s outrageous.

They’re projecting sales of $106 to $110 million for 2025. Up from $43.1 million. Fine. More growth. More spending. More losses. It’s a vicious cycle. A never-ending spiral of quantum-fueled financial irresponsibility. And they’re calling it “innovation.” It’s just… infuriating. Seriously. Just infuriating.

Read More

- 21 Movies Filmed in Real Abandoned Locations

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- The 11 Elden Ring: Nightreign DLC features that would surprise and delight the biggest FromSoftware fans

- 10 Hulu Originals You’re Missing Out On

- 39th Developer Notes: 2.5th Anniversary Update

- Gold Rate Forecast

- Rewriting the Future: Removing Unwanted Knowledge from AI Models

- PLURIBUS’ Best Moments Are Also Its Smallest

- Leaked Set Footage Offers First Look at “Legend of Zelda” Live-Action Film

- Bitcoin, USDT, and Others: Which Cryptocurrencies Work Best for Online Casinos According to ArabTopCasino

2026-02-08 19:32