Amazon’s (AMZN 5.49%) AWS unit continues to demonstrate robust, albeit moderating, growth within the cloud infrastructure market. Recent financial reporting indicates a deceleration in year-over-year expansion, coinciding with increased market share gains by both Alphabet’s (GOOG 2.42/GOOGL 2.46) Google Cloud and Microsoft (MSFT +2.00%) Azure. This necessitates a granular examination of AWS’s strategic positioning and capital allocation.

Competitive Landscape and Growth Rates

While AWS reported 20% growth, reaching an annualized run rate of $142 billion, this pales in comparison to Google Cloud’s 36% and Azure’s 39% growth during their respective reporting periods. This divergence, however, must be contextualized. AWS operates from a significantly larger revenue base, rendering percentage gains less indicative of absolute market dominance. Furthermore, the scale of AWS allows for greater revenue accretion from incremental growth.

Despite these considerations, the narrowing gap in growth rates warrants scrutiny. The competitive pressure exerted by Microsoft and Google is manifesting in increased pricing competition and a broader range of service offerings, potentially impacting AWS’s future pricing power.

Capital Expenditure and Strategic Investments

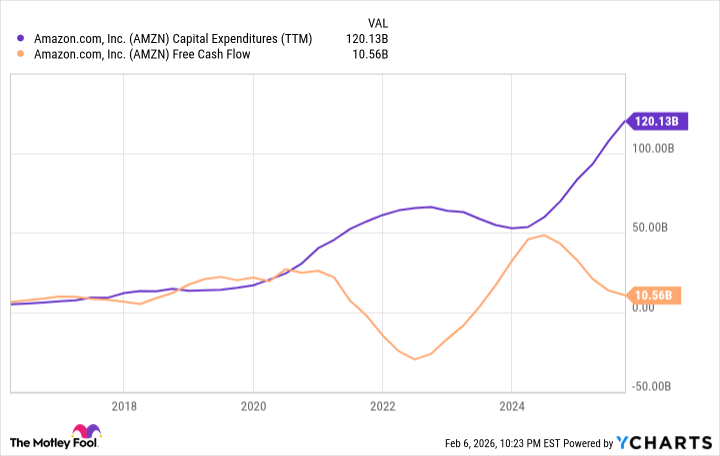

Amazon’s commitment to sustaining its cloud leadership is evidenced by its projected capital expenditure of $200 billion, primarily allocated to AWS and associated AI workloads. This aggressive investment strategy, while potentially suppressing free cash flow in the short term, aims to establish a defensible competitive moat through enhanced infrastructure capacity and technological innovation.

The company’s focus on internally developed silicon, specifically Graviton and Trainium processors, represents a strategic move towards vertical integration. These chips, achieving a $10 billion annual revenue run rate with triple-digit growth, offer potential cost advantages and performance improvements, enabling AWS to differentiate its service offerings. However, the success of this initiative remains contingent upon continued technological advancements and efficient supply chain management.

Financial Performance and Profitability

Despite moderating growth, AWS continues to exhibit superior profitability compared to its primary competitors. Operating income rose to $45.6 billion, substantially exceeding Google Cloud’s $13.9 billion. This margin advantage provides AWS with greater financial flexibility to pursue strategic investments and navigate periods of intensified competition. However, maintaining these margins will require ongoing cost optimization and efficient resource allocation.

Valuation and Investment Considerations

Amazon’s recent earnings report triggered a negative market reaction, primarily attributable to the announced capital expenditure plan. While the market’s aversion to short-term cash flow headwinds is understandable, it overlooks the long-term strategic rationale underpinning these investments. The historical precedent of similar capital expenditure cycles in both the cloud computing and e-commerce businesses suggests that these investments are likely to yield positive returns over the long term.

Currently, Amazon trades at a price-to-earnings ratio of less than 30. However, this metric is skewed by gains in equity holdings. A more conservative assessment reveals a fair valuation, limiting near-term upside potential. While a sustained period of robust growth is not immediately apparent, the company’s strong execution and defensible market position warrant continued monitoring.

In conclusion, while AWS faces intensifying competition and near-term headwinds, its sustained profitability, strategic investments in silicon and infrastructure, and established market leadership position suggest a reasonable long-term investment profile. However, investors should closely monitor the company’s ability to translate capital expenditure into tangible revenue growth and maintain its competitive advantage in a rapidly evolving cloud landscape.

Read More

- 21 Movies Filmed in Real Abandoned Locations

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- The 11 Elden Ring: Nightreign DLC features that would surprise and delight the biggest FromSoftware fans

- 39th Developer Notes: 2.5th Anniversary Update

- 10 Hulu Originals You’re Missing Out On

- Gold Rate Forecast

- Bitcoin, USDT, and Others: Which Cryptocurrencies Work Best for Online Casinos According to ArabTopCasino

- Rewriting the Future: Removing Unwanted Knowledge from AI Models

- PLURIBUS’ Best Moments Are Also Its Smallest

- Top ETFs for Now: A Portfolio Manager’s Wry Take

2026-02-08 07:32