Applied Digital (APLD +25.50%). The very name sounds…efficient. As if souls themselves could be digitized and leased. And lease they do, it seems, these dedicated AI data centers. A quadrupling of the share price in a year. One almost expects a delegation from the Ministry of Statistics to appear, demanding an explanation for such…unnatural growth. The market, bless its fickle heart, has clearly decided that these silicon cathedrals are worth building. A perfectly reasonable madness, wouldn’t you agree?

Analysts, those oracles of the obvious, anticipate further ascent. One wonders if they’ve actually seen a data center, or merely consulted a spreadsheet. Still, they predict, and we, as cynical observers, are obliged to note their predictions. Let us examine, then, the potential for further…elevation.

A Price Target: A Fleeting Illusion?

A median price target of $43.50. A mere 18.5% upside. Such modesty! One expects fireworks, a declaration of a new golden age of computation, and they offer…18.5%. All fourteen analysts, naturally, rate it a ‘buy’. A chorus of affirmation. One imagines them huddled together, whispering reassurances that they haven’t missed the obvious. The obvious, of course, being that we are building the infrastructure for a future we scarcely understand.

Sixteen billion dollars worth of contracts. Six hundred megawatts. Enough power to illuminate a small nation, dedicated to the pursuit of…what exactly? More efficient advertising? More convincing disinformation? The mind reels. But the contracts are signed, the concrete is poured, and the revenue, ah, the revenue begins to flow. A slow trickle at first, then a torrent. The management anticipates a “ramp.” A most clinical term for the unleashing of a new force upon the world.

They’ve broken ground on a new campus, a 430 MW behemoth in the American South. Already courting a ‘hyperscaler.’ The term itself is chillingly impersonal. As if these data centers are not built to serve human needs, but to feed some insatiable digital god. Still, the potential for growth beyond 2026 is…significant. One can almost smell the money.

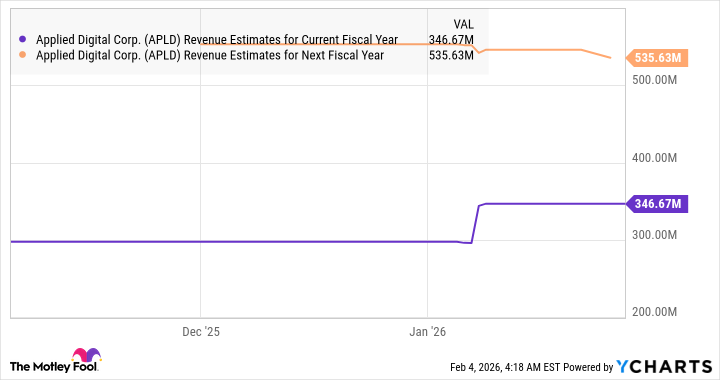

A projected 61% jump in revenue this fiscal year. A slowing to 55% next year. But the management, bless their optimistic hearts, forecasts an ‘acceleration.’ An acceleration towards…what? The singularity? The heat death of the universe? One can only speculate. And, of course, the possibility of higher ‘tenant fit-out’ revenue. A delightfully bureaucratic phrase. As if these data centers are merely empty shells, awaiting the whims of their tenants.

The Upside: A Glimpse into the Abyss?

A 65% jump in revenue next year. Based on the assumption that the lease revenue will finally materialize. And that the ‘tenant fit-out’ services will prove lucrative. A perfectly reasonable assumption, of course. As reasonable as believing in a benevolent dictator. A market capitalization of $18.3 billion. Nearly 80% above the current stock price. An impressive jump, indeed. One almost feels sorry for those who missed the boat. Almost.

The stock trades at 32 times sales. Justified, they say, by the ‘terrific revenue pipeline.’ A pipeline that, one suspects, is filled with more hope than actual data. Still, the multiple can be maintained, they argue, on the back of ‘accelerating growth.’ A growth that, if unchecked, could lead us all straight into the abyss. But who are we to judge? We are merely observers, after all. Cynical, perhaps, but observers nonetheless. And, as any good observer knows, the show must go on.

Read More

- 21 Movies Filmed in Real Abandoned Locations

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- 10 Hulu Originals You’re Missing Out On

- The 11 Elden Ring: Nightreign DLC features that would surprise and delight the biggest FromSoftware fans

- Gold Rate Forecast

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- 39th Developer Notes: 2.5th Anniversary Update

- Rewriting the Future: Removing Unwanted Knowledge from AI Models

- Tainted Grail: The Fall of Avalon Expansion Sanctuary of Sarras Revealed for Next Week

- PLURIBUS’ Best Moments Are Also Its Smallest

2026-02-07 15:23