The prophecies, as they often do, turned out to be… optimistic. Back in the Age of Optimism (circa 2018, a time when people genuinely believed that charging an electric carriage would be as simple as feeding the horses), the automotive guilds were confidently predicting the imminent demise of the internal combustion engine. They were, to put it mildly, a bit hasty. Now, in the somewhat less optimistic year of 2026, most have quietly reassessed, a process remarkably similar to a wizard attempting to recall a particularly embarrassing spell.

The electric current, it seems, hasn’t quite reached everywhere it was expected to. Sales have flagged in certain territories (the United States being a prime example, though the reasons are, as always, complex and involve a surprising amount of civic pride in large, inefficient vehicles), and the price of lithium – that essential alchemical ingredient for the energy-storing crystals – has decided to take a holiday on the far side of reasonable.1 But don’t write off the electric carriage just yet. The future, while delayed, hasn’t entirely forgotten its appointment.

And if, like a stubborn gnome convinced of the superiority of steam power, you remain bullish on the electric dream, then a closer look at Volkswagen (VWAGY 0.33%) might be in order. It’s a company that, shall we say, has experienced a… recalibration of its ambitions.

The People’s… Extended-Range Carriage

Volkswagen, in its initial fervor, possessed one of the most ambitious electrification schedules of any legacy automaker. A commendable, if slightly overzealous, undertaking. However, the company has since invested a substantial sum – 64 billion crowns, to be precise2 – back into the development of… well, the things that made them successful in the first place. And announced a delay in its next-generation electric architecture, pushing it into the late 2020s. A strategic retreat, if you will.

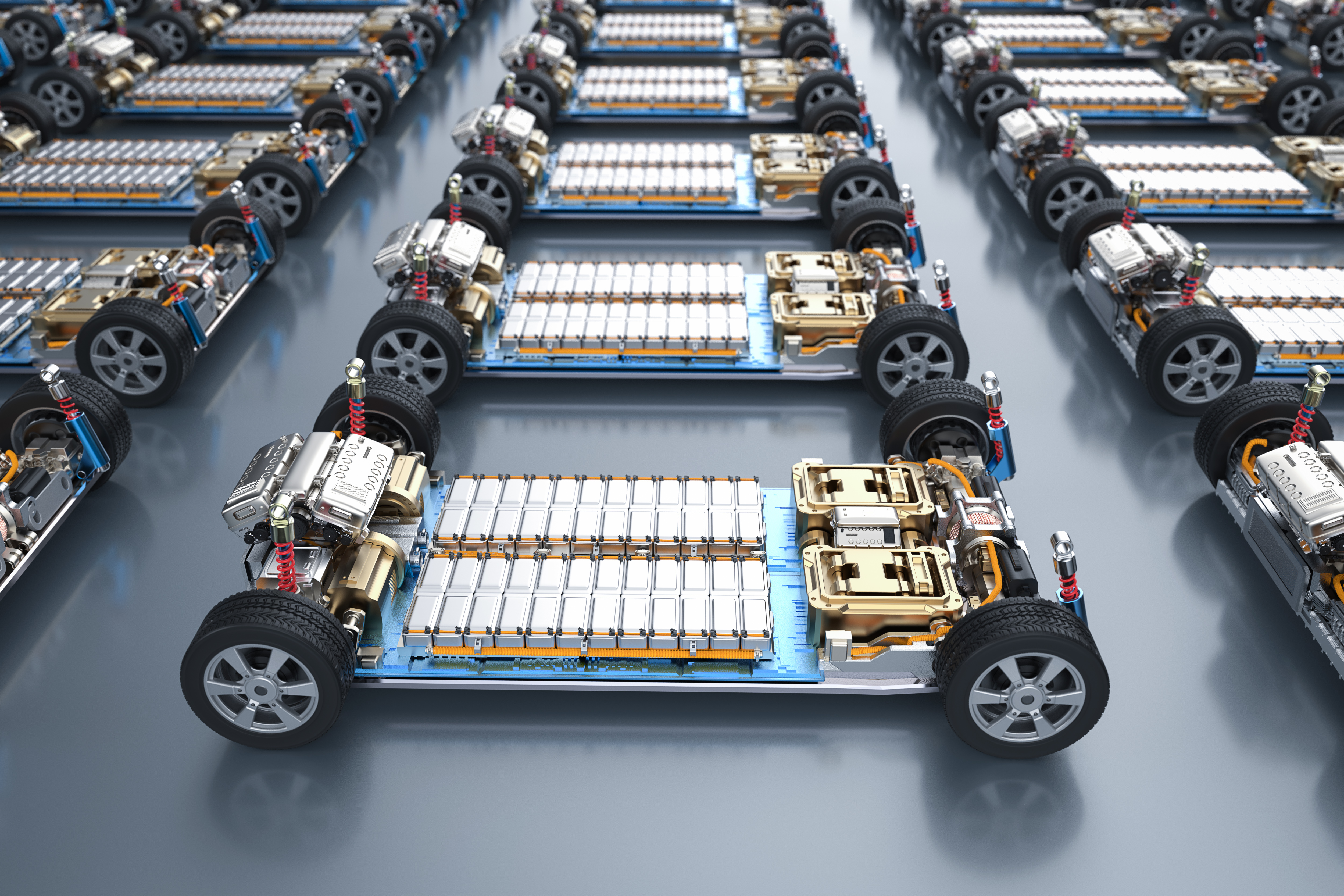

But don’t mistake this for surrender. Volkswagen hasn’t abandoned the electric path; it’s simply… rerouting. It appears they’ve realized that simply replacing horses with humming crystals isn’t quite enough. The problem, as any seasoned traveler knows, isn’t necessarily the destination, but the journey. And a journey that requires charging every hundred miles, or involves the unsettling possibility of being stranded in a particularly gloomy bog, isn’t going to appeal to many.

Range anxiety, as the marketing wizards have dubbed it, is a very real phenomenon. The number of potential carriage buyers considering a fully electric model has dwindled from 25% in 2022 to a mere 16% in 2025. Meanwhile, the number of those actively avoiding electric carriages has swelled from 51% to a rather alarming 63%.3 The reasons are depressingly predictable: range, the potential cost of replacing a depleted energy crystal (the most expensive component of an electric carriage, naturally), and the initial outlay required to acquire one.

Volkswagen, with a commendable degree of pragmatism, is exploring what they call “extended-range” carriages. Essentially, these operate on a principle not entirely dissimilar to a plug-in hybrid. They combine an electric drive train with a small combustion engine – a sort of miniature dragon, if you will – that acts as a generator. This solves the range problem and mitigates the cost issue somewhat. The engine allows for a smaller, less expensive energy crystal. It’s a compromise, certainly, but a sensible one.

If Volkswagen succeeds in this endeavor, they might just lure in those hesitant carriage buyers, easing them into the electric world. Once someone has experienced the quiet hum of an electric carriage, the argument goes, they’re far less likely to return to the noisy, fume-belching contraptions of the past.

As a long-term strategy for popularizing electric carriages, extended-range models sound… reasonably sound. And there’s little reason to worry about Volkswagen running out of funds while implementing its plans. The company is a slow, steady growth engine, boasting a compound annual growth rate (CAGR) of 4.25% over the past decade. And despite a recent 25% increase in share value, it currently appears undervalued.

Volkswagen’s trailing-12-month price-to-earnings ratio (P/E) sits at a modest 7.6, compared to 9.46 for BMW, 9.62 for Toyota Motor, and a rather extravagant 26.21 for General Motors. By my calculations, that makes Volkswagen worth a look for those bullish on the long-term prospects of electric carriages, but realistic about their short-term struggles.

It’s a long road ahead, to be sure. But Volkswagen, with a bit of luck and a healthy dose of pragmatism, might just navigate it successfully.

1

The alchemists, naturally, blame the gnomes. Apparently, they’ve been hoarding lithium for use in their particularly elaborate garden gnomes.

2

A sum roughly equivalent to the annual budget of a small kingdom.

3

The increase in those actively avoiding electric carriages is particularly alarming. Some speculate it’s due to the influence of the Society for the Preservation of Horse-Drawn Carriages, a surprisingly powerful organization.

Read More

- 21 Movies Filmed in Real Abandoned Locations

- The 11 Elden Ring: Nightreign DLC features that would surprise and delight the biggest FromSoftware fans

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- 10 Hulu Originals You’re Missing Out On

- 39th Developer Notes: 2.5th Anniversary Update

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- Gold Rate Forecast

- Rewriting the Future: Removing Unwanted Knowledge from AI Models

- 15 Western TV Series That Flip the Genre on Its Head

- PLURIBUS’ Best Moments Are Also Its Smallest

2026-02-07 12:42