The relentless pursuit of yield—a peculiar obsession of the financially timid—often overlooks a rather elementary truth: that capital, like a particularly stubborn lepidopteron, rarely alights where it is most earnestly desired. Yet, the arithmetic of dividends, those periodic disbursements of corporate largesse, does possess a certain seductive simplicity. S&P Global, in its meticulous charting of market vagaries, calculates that fully 31% of total returns since 1926 have sprung from these cash droplets. A substantial fraction, certainly, though one suspects the remaining 69% involved considerably more… drama. To cling to dividends is to attempt to anchor oneself to something tangible in a world of shimmering, illusory wealth. A futile gesture, perhaps, but a comforting one for those who prefer the scent of predictability to the bracing chill of speculation.

It is not, of course, the mere payout that matters—any fool can distribute cash—but the sustainability of the flow. A dividend, divorced from genuine profitability, is merely a temporary reprieve, a gilded postponement of inevitable reckoning. The truly astute investor seeks not just income, but a narrative—a story of enduring brand loyalty, of subtle market dominance, of a management team that understands the delicate art of extracting value without entirely alienating its customer base. And so, we turn our gaze, with a mixture of weary expectation and cynical amusement, toward two titans of their respective domains: The Coca-Cola Company and Phillip Morris International.

The Coca-Cola Company

Blue chips. A rather pedestrian moniker for shares in enterprises that have, through decades of relentless marketing and shrewd maneuvering, insinuated themselves into the very fabric of global culture. Coca-Cola, with its syrupy elixir and ubiquitous branding, is a prime example. A triumph, if one is inclined to view such things triumphantly, of consumer conditioning. The company’s resilience—its ability to maintain margins even in the face of economic headwinds—is not, however, a matter of mere luck. It is the result of a calculated willingness to raise prices, a talent for persuading consumers that a slightly more expensive sugary beverage is not a deprivation, but an affirmation of their lifestyle. FinanceBuzz notes an 89% price hike on a twelve-pack between 2020 and 2025. A feat of audacious pricing power, and a testament to the human capacity for self-deception.

The beverage, let us be clear, is fundamentally discretionary. A pleasant, fizzy indulgence, but hardly a necessity. Yet, Coca-Cola has managed to transcend the realm of mere product and become something akin to a cultural touchstone. A symbol, if you will, of a certain carefree, American optimism. And consumers, even in times of austerity, are loath to relinquish their symbols. Revenue grew 5% year-over-year in the third quarter, reaching $12.5 billion. A respectable figure, though one suspects the true measure of Coca-Cola’s success lies not in its financial statements, but in its ability to perpetuate a carefully constructed illusion of happiness. A 32% operating margin further solidifies the company’s position, demonstrating a mastery of cost control and a willingness to pass those costs on to the thirsty masses. The dividend yield of 2.71% is modest, perhaps, but coupled with a 58% share price appreciation over five years, it offers a reasonably palatable blend of income and capital growth.

Phillip Morris International

Tobacco. A product whose enduring popularity continues to confound the rational mind. A slow, deliberate indulgence, fraught with peril, yet stubbornly resistant to obsolescence. Nicotine, of course, is the culprit—a powerfully addictive substance that has fueled the tobacco industry for generations. Phillip Morris International, however, is not content to merely peddle traditional cigarettes. It has embarked on a bold—and arguably cynical—pivot toward alternative tobacco products. A shrewd move, perhaps, but one that raises uncomfortable questions about the ethics of corporate innovation.

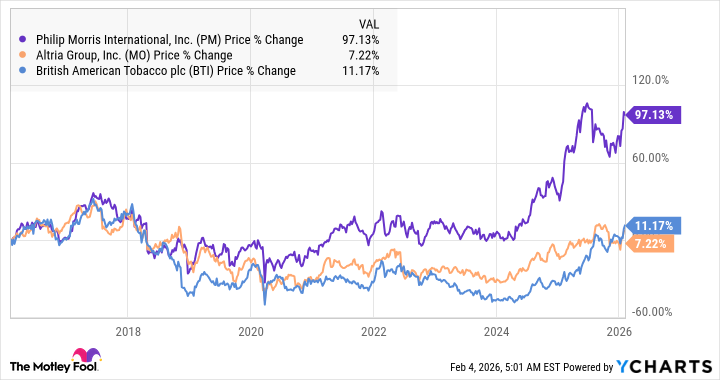

The long-term trajectory of traditional cigarettes is, inevitably, downward. Regulatory pressures, health concerns, and shifting consumer preferences all point toward a gradual decline. Phillip Morris, recognizing this reality, has positioned itself as a leader in the emerging market for smoke-free alternatives. Over the past decade, the company’s shares have risen 97%, while Altria and British American Tobacco have lagged behind with gains of only 7% and 11%, respectively. A clear indication that the market rewards those who adapt—or, at least, appear to adapt. Smoke-free products now account for 41% of Phillip Morris’ sales, available in 100 global markets. The $16 billion acquisition of Swedish Match in 2022 further expanded the company’s reach, particularly in the U.S., and diversified its product portfolio with offerings like Zyn oral tobacco pouches. A clever maneuver, though one cannot help but wonder if it is merely a rebranding of addiction.

While respectable stock price growth is certainly appealing, the main attraction of Phillip Morris remains its dividend. A yield of 3.3% far exceeds the S&P 500 average of 1.14%. Management has also demonstrated a commitment to returning cash to investors through buybacks, though these are currently on hold while the company absorbs the costs associated with the Swedish Match acquisition. A temporary pause, no doubt, but a reminder that even the most lucrative dividends are not guaranteed—they are merely a reflection of current profitability, and subject to the capricious whims of the market. A cynical observation, perhaps, but one that any seasoned investor—or, indeed, any student of human folly—would readily endorse.

Read More

- 21 Movies Filmed in Real Abandoned Locations

- The 11 Elden Ring: Nightreign DLC features that would surprise and delight the biggest FromSoftware fans

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- 10 Hulu Originals You’re Missing Out On

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- Gold Rate Forecast

- 39th Developer Notes: 2.5th Anniversary Update

- 15 Western TV Series That Flip the Genre on Its Head

- Tainted Grail: The Fall of Avalon Expansion Sanctuary of Sarras Revealed for Next Week

- Rewriting the Future: Removing Unwanted Knowledge from AI Models

2026-02-07 10:53