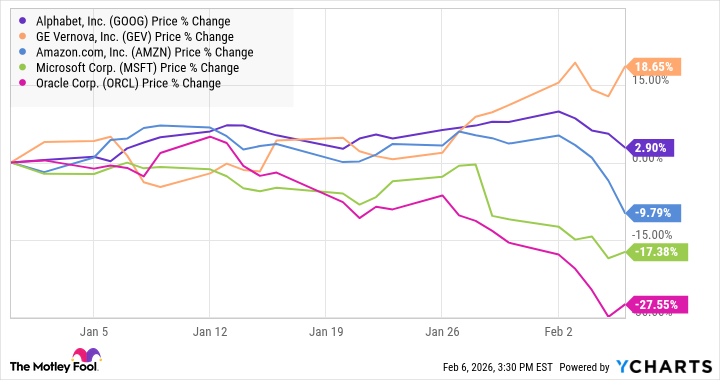

The figures arrive, announced with the bluntness of a winter frost: Amazon and Alphabet, together pledging some $385 billion toward the future. A sum that dwarfs the previous year’s commitments, a veritable shifting of tectonic plates beneath the market’s feet. Both stocks, predictably, yielded a little ground – a momentary hesitation before the inevitable surge. But within this broader movement, a different current stirs. GE Vernova, rising more than 5% in the late trading hours, a subtle bloom amidst the chill. It is not merely a stock; it is a measure of something deeper.

The Thaw and the Infrastructure

There is a skepticism, a cautiousness, surrounding Oracle’s entanglement with OpenAI. A $300 billion wager on the provision of computational power, a grand design shadowed by the sheer cost of sustaining such ambition. Reports suggest a potential cash burn of $115 billion by 2030 – a vast expenditure, a landscape consumed by fire. Microsoft, too, feels the strain, 45% of its Azure backlog tethered to OpenAI’s demands. Yet, through this uncertainty, Vernova persists, a steady climb, a quiet resilience.

The Hunger of the Machine

The reason, as with all things, is elemental. It is the insatiable hunger for power, the demand radiating from the data centers, those modern cathedrals of information. A thirst that feeds directly into Vernova’s turbines, its electrification equipment. A shift, a turning of the tide. Previously reliant on the cautious currents of utility companies, Vernova now finds itself buoyed by the rapid flow of hyperscalers – those voracious engines of the digital age. They are even, I hear, offering reservation agreements, a preemptive securing of future capacity. A strange thing, to pre-order the very breath of the machine.

Management anticipates a robust mid-teens revenue growth from 2025 to 2028, earnings more than doubling in the period. These are not merely projections; they are the echoes of a fundamental realignment. The commitments of Amazon and Alphabet, those pronouncements of intent, have lent a certain confidence to these expectations. It is as if the market, finally, recognizes the quiet strength of Vernova, the steady rhythm of its ascent. The stock continues to perform well, not because of speculation, but because it is a reflection of a deeper, more enduring force. It is, in its own way, a small victory against the prevailing winds.

Read More

- 21 Movies Filmed in Real Abandoned Locations

- The 11 Elden Ring: Nightreign DLC features that would surprise and delight the biggest FromSoftware fans

- 10 Hulu Originals You’re Missing Out On

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- PLURIBUS’ Best Moments Are Also Its Smallest

- 39th Developer Notes: 2.5th Anniversary Update

- 15 Western TV Series That Flip the Genre on Its Head

- Crypto’s Comeback? $5.5B Sell-Off Fails to Dampen Enthusiasm!

- Top ETFs for Now: A Portfolio Manager’s Wry Take

2026-02-07 00:03