Ah, the fickle embrace of the market! Behold, the LINK price languishes near $8.60, a pitiful wretch in the grand ballet of crypto. Yet, lo! The Chainlink Reserve, that stoic guardian of the network’s soul, has amassed a treasure trove of 125,000 LINK in a single, audacious swoop. While the broader crypto markets weep and wail like banished demons, on-chain accumulation and ETF flows whisper of a farce-a price divorced from its own demand, like a shadow mocking its master.

The Chainlink Reserve: A Monument to Stubborn Optimism

The Chainlink Reserve, that indefatigable juggernaut, marches onward, its coffers swelling to a princely 1.9 million LINK. Funded by the toil of off-chain enterprises and the whispers of on-chain usage, it stands as a monument to long-term sustainability-a beacon of hope in a sea of speculative despair. Yet, let us not forget its true nature: not a siren luring liquidity, but a silent architect of infrastructure.

RESERVE UPDATE

Today, the Chainlink Reserve has accumulated 125,454.48 LINK.

The Chainlink Reserve now holds a total of 1,899,670.39 LINK.

The Chainlink Reserve is designed to support the long-term growth and sustainability of the Chainlink Network by…

– Chainlink (@chainlink) February 5, 2026

And so it grows, unmoved by the tempest of LINK’s price fluctuations. A quiet accumulation, like a miser hoarding coins in a storm, while the market’s confidence lies shattered. Ah, the irony! Reserves thrive when the world doubts, and revenues hum softly, unconcerned with the cacophony of speculation.

Yet, let us not be deceived. This reserve is no inflationary siren; it is a monk, ascetic in its devotion to sustainability, spurning the fleeting allure of cyclical price appreciation.

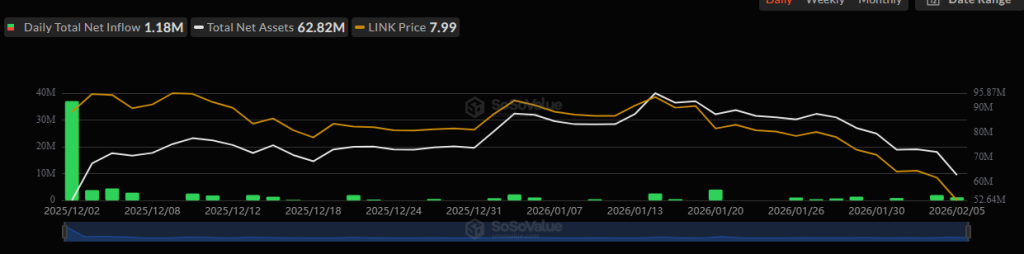

ETFs: The Bored Spectators of Crypto’s Tragedy

Turn your gaze now to the ETFs, those indifferent spectators of crypto’s grand tragedy. While Bitcoin and Ethereum ETFs flee like rats from a sinking ship, LINK’s ETF products remain unmoved, their inflows a steady $78.63 million. Institutional titans like Grayscale and Bitwise cling to their positions, their conviction unshaken by the market’s histrionics. Yet, their steadfastness is but a bandage on a gaping wound; the LINK price chart bleeds unabated.

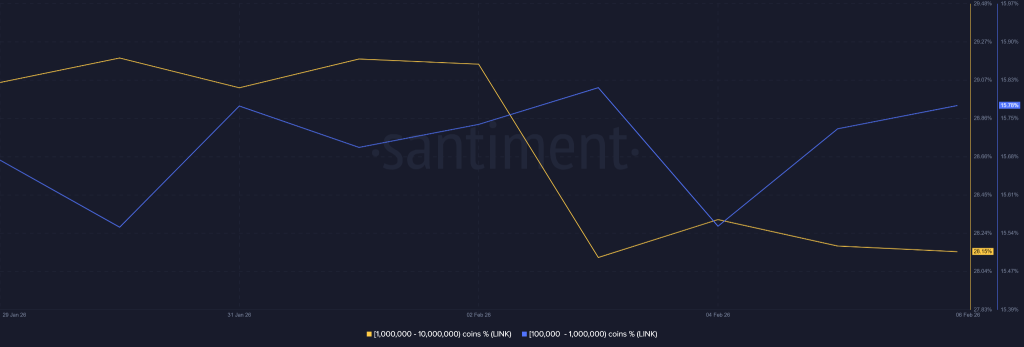

Whales: The Fickle Masters of the Deep

Ah, the whales! Those leviathans of the crypto seas, whose whims dictate the tides. Behold, the addresses holding 1 to 10 million LINK have turned their backs, selling like merchants fleeing a plague. Their liquidity, once a lifeline, now a noose around LINK’s neck. Yet, in the shadows, smaller wallets-those holding 100,000 to 1 million LINK-accumulate with quiet resolve. A transfer of power, perhaps, or merely a game of musical chairs? Until the whales tire of their tantrum, LINK’s descent may continue, a tragic farce played out in real-time.

Technical Whispers: The Market’s Ominous Murmur

And what of the technicals? Analysts, those modern-day soothsayers, peer into their charts with furrowed brows. $5, they whisper, a zone of historical refuge. $1.20, a precipice of despair, reserved for the most dire of scenarios. Yet, let us not be swayed by their incantations. These levels are but markers, stress tests for a market already battered and bruised. For LINK to fall further, the macro gods must align, and the whales must continue their lament.

$LINK chainlink prepare for an extended winter, the early snowfall in spring was a clue…

– master (@MASTERBTCLTC) February 4, 2026

And so, the dance continues. The Reserve laughs, the whales weep, and the ETFs yawn. LINK, ever the tragic hero, staggers onward, its fate uncertain. Will it rise again, or succumb to the market’s cruel embrace? Only time, that merciless judge, will tell.

Read More

- 21 Movies Filmed in Real Abandoned Locations

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- 10 Hulu Originals You’re Missing Out On

- The 11 Elden Ring: Nightreign DLC features that would surprise and delight the biggest FromSoftware fans

- 39th Developer Notes: 2.5th Anniversary Update

- Gold Rate Forecast

- PLURIBUS’ Best Moments Are Also Its Smallest

- 17 Black Voice Actors Who Saved Games With One Line Delivery

- Tainted Grail: The Fall of Avalon Expansion Sanctuary of Sarras Revealed for Next Week

- Bitcoin, USDT, and Others: Which Cryptocurrencies Work Best for Online Casinos According to ArabTopCasino

2026-02-06 20:52